Andrew Burton

After a two-year period where shares declined roughly 80% from October 2020 to October 2022 to below its 2014 IPO price, American Depository Shares of Alibaba Group Holding Limited (NYSE:BABA) are presenting investors with the $230 billion question of whether now is the time to buy China’s e-commerce giant. In this article, I address the question “Is BABA a good buy for 2023?” by going through five factors: geopolitical backdrop, business model and segments, Seeking Alpha quant versus Morningstar ratings, estimated revenues and earnings, and catalysts and risk factors. Based on these, I explain an option strategy that I see as a safer way to capture the upside scenarios I see in BABA from these levels.

Geopolitical backdrop

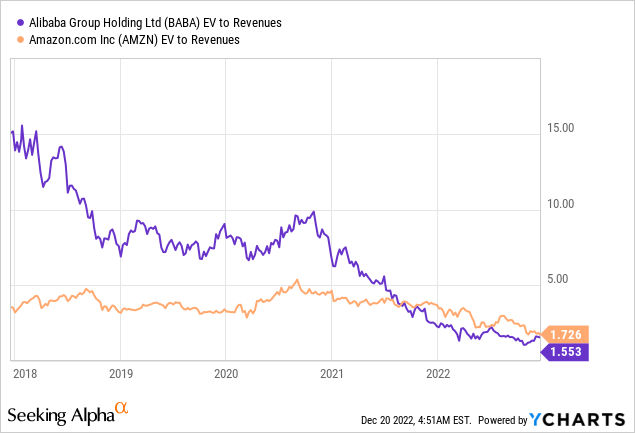

Alibaba is often referred to as “China’s Amazon”. Alibaba is very similar to Amazon.com Inc (AMZN) in that both are the largest and most dominant online e-commerce platforms in their respective home markets. For both BABA and AMZN, e-commerce in their domestic markets remains the largest share of their respective revenues, as we will see in the next section for BABA, and as AMZN’s 2021 Annual report shows, almost 70% of AMZN’s sales are in the US, and over 50% of that is online retail. Unlike AMZN, BABA’s home market is the People’s Republic of China, a market investors seemed very bullish on in the mid-2010s for its growth potential, but recently seem to have soured on for several reasons.

The “elephants in the room” of China’s geopolitical risk include government crackdowns on tech companies, continuing US-China tensions, and uncertainty about the future China after zero COVID. These three factors together likely explain why BABA has gone from trading at a significant EV/Sales premium to AMZN to now trading at a slight discount.

BABA arguably deserves a discount due to these risks and because of its business model (as described in the next section), so at these levels the question is whether BABA can sustain higher growth than AMZN which might justify less of a discount or even a premium.

Alibaba’s business model and segments

Alibaba reports its revenues and operating income by business segment in its annual and interim reports, which are available on the Alibaba investor relations website. I usually prefer to look at annual numbers, but this time am choosing to look at the latest interim report because it allows me to compare this most recent period of zero COVID year on year versus the six months ending a year earlier. Also, I find the annual reports are way too long and colorful, and I am one of those investors who tends to see too many color photos in an annual report as a negative.

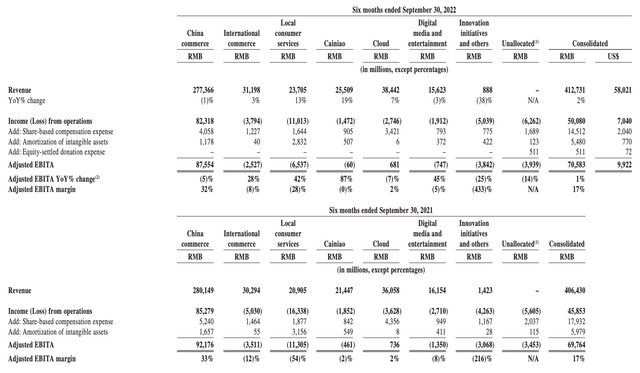

Alibaba FY 2023 Interim Report, page 4

My main takeaways from these tables are:

- Alibaba’s business is still primarily about Chinese e-commerce, which makes up about 65% of its revenues but 165% of its operating profits, because it seems to be losing money in every other business segment.

- The big difference here between Alibaba and Amazon is that Amazon makes more profit from its cloud business than from online retail business, while Alibaba is somehow still losing money on cloud. This could be read as Alibaba being about 10 years behind Amazon, or it could mean Alibaba is doing something different that makes its cloud business less profitable.

- China commerce revenue is slightly down year on year, and international up only 3%, which can be seen as a dip in its long-term ~10% growth rate due to zero COVID policies this year.

- Alibaba’s fastest growing businesses are local consumer services, and its logistics business named “Cainiao”. These need to be watched to see if and when they round the “J-curve” and start making positive contributions to operating profits.

- Perhaps the most critical summary of what concerns me about this table is how it adds back three expenses to report EBITDA numbers as the bottom line for each business. I agree with Charlie Munger’s view that EBITDA is really just another way of saying “bull**** earnings”, and in my experience, companies that highlight EBITDA don’t look as good on other metrics I care more about.

BABA’s Seeking Alpha vs Morningstar ratings

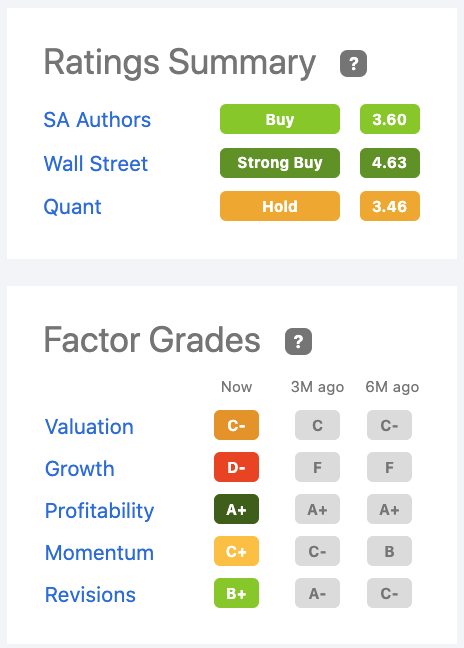

One reason BABA popped up on my screen of stocks to look at this year end is because it has a rare combination of Morningstar’s top rating on three metrics:

- 5-star Morningstar rating due to BABA shares being well below Morningstar analyst’s fair value estimate of $179.

- A “Wide” moat rating, meaning it is very difficult for other businesses to compete with it. I strongly agree with this part.

- “Exemplary” capital allocation due to its strong balance sheet and reinvestment into high returning businesses. This is a rating I’m more doubtful of.

By contrast, we see BABA’s ratings on Seeking Alpha are a little more mixed, with “Wall Street” being as bullish as Morningstar, SA Authors being a bit less bullish, and the Quant Factor Grades being only a “Hold” due to a poor growth grade and mediocre valuation and momentum scores. I would discount the growth and momentum scores, since those are heavily weighted down by the past year’s data which is weak for reasons we know, so I would probably be slightly more bullish than the quant score, but not much more bullish than most SA Authors. To the extent that I see BABA as a liquid way of trading China’s recovery, my views on it will ultimately come down to numerical projections I’ll discuss in the next section.

Seeking Alpha

BABA estimated revenues and earnings

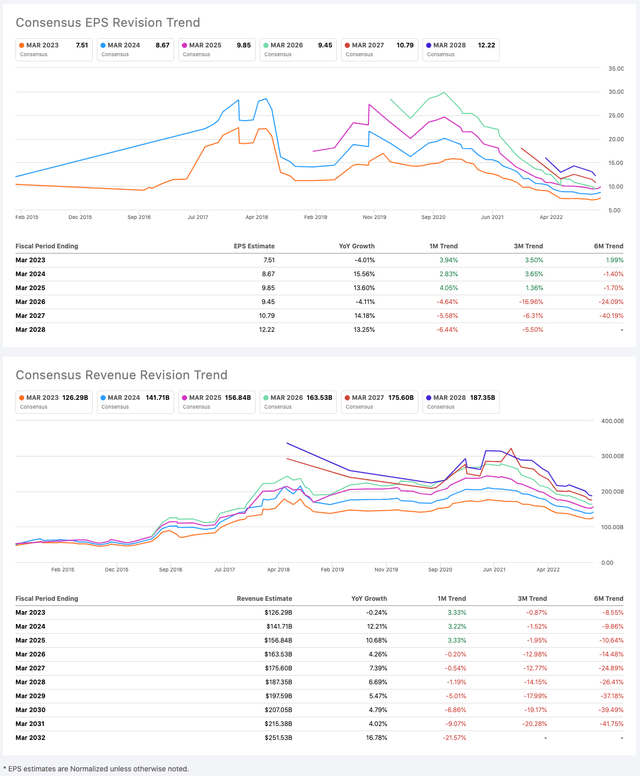

One advantage of looking at a mega-cap stock like BABA is that there are dozens of analysts who know much more than I do already looking at it and updating revenue and earnings estimates on a regular basis. The decline in BABA’s share price has been largely in line with declines in how much it is expected to earn per share in the fiscal year ending March 2025, which was expected to be almost $25/share back in late 2020 and has since been revised down to just under $10/share. While I would like to look longer term than that, the reason I currently have FY2025 on my dashboard is because that is the last year for which over 20 analysts currently submit estimates, versus only one analyst estimating earnings for 2026 and beyond. The main screen I go to see how these estimates are changing over time is the Seeking Alpha earnings and revenue revisions page, with a current screenshot below.

Although the Quant Factor Grade for revisions on BABA is currently “B+”, my visual concern looking at these charts is whether “the knife has stopped falling yet”. Paying $87/share today does indeed look like an attractive price if 2025 earnings don’t fall much below $10/share, and there’s still growth beyond that, but another 50% downward revision in these numbers would be catastrophic.

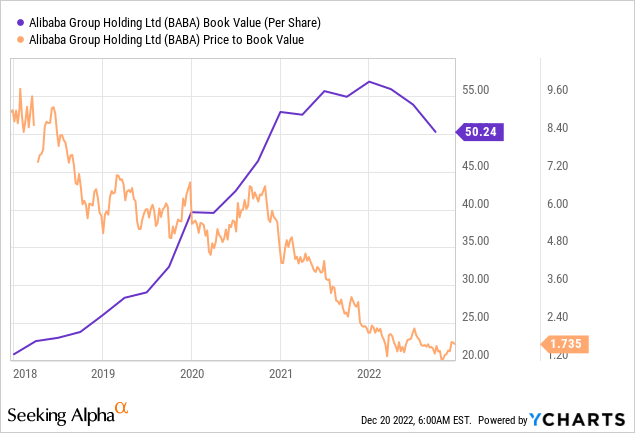

Although many disagree with me on this, my favorite metric for modeling the expected return on a non-dividend paying stock like BABA is through book value per share. Until this year, the fundamental growth in BABA’s fair value could be measured by its growth in book value from $20 at the start of 2018 to $55 at the start of this year. Book value has dipped this year despite net profitability because of buybacks, as buybacks at Price/Book multiples above one will reduce book value.

Two simple ways investors might expect BABA shares to rise by, for example, 10% over the next year could be:

- Book value per share grows back to $55, and the Price/Book remains around 1.7, or

- Book value per share remains around $50 and the Price/Book rises to 1.9

Either of these is quite reasonable to expect over the next year for someone considering a short to medium term trade, though before getting into that trade, I’d like to take a quick look at catalysts and risk factors.

Catalysts and risk factors for BABA in 2023

The end of zero COVID is the most obvious catalyst for BABA having a better 2023 than 2022, followed by any decrease in pessimism about government risk. A less obvious catalyst that I see as more significant for BABA’s longer-term future is increased traction in markets outside China, especially in emerging markets BABA may be more effective at penetrating than AMZN. This could take years to show up in BABA’s book value, but rising sentiment on China being open again and perhaps finding a profitable market in Africa could also boost the Price/Book multiple. Even though I have doubts about BABA’s financials and risks, I mostly consider having exposure to it because I am interested in its role in China’s growing online influence globally.

Conclusion and option strategy on BABA

BABA’s lack of a dividend, excessive use of color photos in its annual report, and use of EBITDA together disqualify BABA from my “A-list”, though I might consider a 1-2% position purely for exposure to its opportunities in China-allied markets. Overall, I see the risks in owning BABA shares as relatively “binary” over the next 1-3 years, meaning that I think it is more likely to either double to around $160 or fall to around $40 than it is to remain around $80. For that reason, I find it safer to capture BABA’s next upside move using options rather than outright putting 1-2% of my capital in BABA shares.

There are many, many option strategies I would consider on this name, but the one I choose to highlight here based on the “binary” assumption is a 70-120 call spread expiring on 19 January 2024. As of this writing, that call spread would cost a little less than $20 per share, and have a maximum payout of $50 per share (a 150% return) if BABA finishes at or above 120 around 13 months from now. On the downside, the most I could lose is the $20 premium ($2,000 per contract) if BABA falls below $70 over the next year. I size call spread positions based the notional value, not the premium, so one of these call spreads (based on lower strike of 70) per $350,000-$700,000 of portfolio value is how I would size this “1-2% position” for accounts ready to lose $2,000 to make $3,000 in a bullish BABA scenario.

Be the first to comment