Grafner

Thesis

I shared my bull thesis on Adobe (NASDAQ:ADBE) earlier this year in this article. Since then, Adobe acquired Figma for what I believe was too steep a price, and growth has slowed a bit more than I expected. Despite these issues, I believe that the key components of my original thesis are still intact. Namely, Adobe is a strong buy because it scores well on many quality metrics including profitability, balance sheet strength, moat sources, and Rule of 40.

Did Adobe Beat Earnings?

Adobe reported Q3 2022 earnings on September 15th. The company beat expectations for EPS by 2% but missed on revenue by less than 0.5%. It was a similar story with forward guidance, with EPS guidance beating by 9% but revenue guidance missing by 2%. Thus, earnings were mixed, as Adobe beat on the bottom line but missed on the topline. Although the size of the topline miss was small, Adobe sold off by 17% after the results.

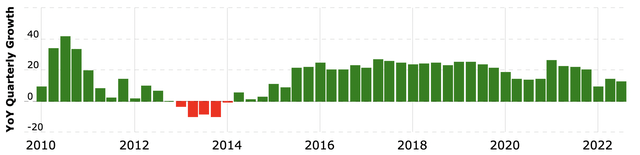

The harsh selloff could be partly blamed on investor concerns about slowing growth, as the 13% revenue growth rate the company reported matched its slowest growth since 2015. The provided outlook doesn’t indicate a major re-acceleration any time soon, due to a variety of factors including FX headwinds, a shorter fiscal year, and general macro concerns. However, Adobe has been predicting this slowdown since the start of the year, so it shouldn’t have come as a surprise to investors. If anything, investors should be happy that Adobe was able to more or less keep expectations unchanged, as many of its peers lowered or suspended guidance this quarter.

Instead, the elephant in the room was the Figma acquisition, which was announced alongside the earnings results. Adobe plans to acquire collaborative design software company Figma for $20B, a steep price at over 50 P/S. The fact that Adobe was willing to pay that price in the current market raises questions about whether Adobe’s moat in graphics software is impenetrable, whether Adobe is still able to innovate internally, and whether management can be trusted to create shareholder value in the future.

Fortunately, price is really the only concern with this acquisition. Investors don’t have to worry about whether Figma is a high-quality company; it’s cash flow positive, growing at nearly triple digits, and like Adobe it has best-in-class scores in SaaS metrics like net retention rate (>150%) and Rule of 40 (>>40). The acquisition also makes sense for Adobe strategically, as it will reinforce the firm’s nearly 87% share of the graphics software market even if Figma continues growing rapidly.

I can also personally attest to the quality of Figma’s products, as I regularly use their design tool at my day job. Figma makes it easy for engineers and designers to collaborate when developing features for apps and webpages. Designs can be shared easily via a URL, can be commented on, and can follow templates to make them easier to code. If Adobe’s Photoshop and Illustrator products are the Microsoft Word of the design world, then Figma is becoming the Google Docs of it. Great collaboration tools, lightweight web app, and all of the features that most designers need.

Although I love the Figma acquisition strategically, I do believe that Adobe overpaid for it and that the acquisition is unlikely to create shareholder value any time soon. Thus, like the rest of Adobe’s earnings, I view this acquisition as a mixed bag.

ADBE Stock Key Metrics

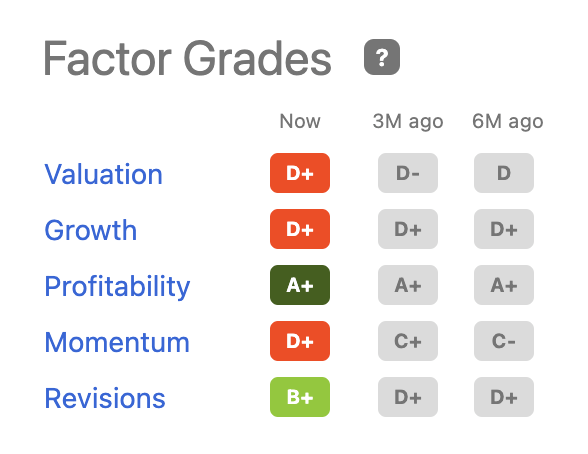

Seeking Alpha

Going forward, Adobe’s factor grades continue to look mixed. While the company remains highly profitable (28% GAAP profit margin) and has been able to maintain earnings expectations in a difficult macro environment, there are also some negative factors.

The stock is down 50% year to date, raising questions about whether the positive momentum experienced over the 2010s decade is still intact. Part of this selloff is certainly attributed to slowing growth, as Adobe’s growth has slowed to levels not seen since 2015 when it was in the process of transitioning to a SaaS model.

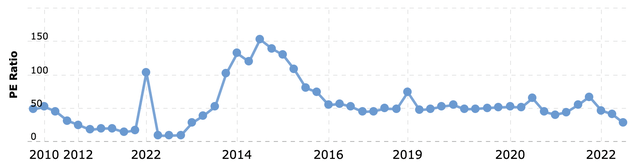

The good news is that because Adobe’s growth has remained positive amid this selloff, it’s condensed Adobe’s valuation to a level not seen since 2012 in the aftermath of the great financial crisis.

Adobe’s current P/E of 28 still doesn’t look that attractive against 13% growth, which perhaps explains Seeking Alpha’s D+ score for valuation. However, I believe that a comparison of ADBE stock’s P/E to peers isn’t a fully accurate measure of whether Adobe is fairly valued. In fact, I think it’s unrealistic to expect the valuation to contract much further, as evidenced by the historical valuation chart.

That’s because Adobe is an extremely high-quality company that generates massive recurring cash flow thanks to its SaaS business model and wide moat monopoly. Even relative to other high-quality peers like Microsoft (MSFT) and Apple (AAPL), Adobe is cheap on a P/FCF basis, valued at 20x FCF vs Microsoft’s 38x and Apple’s 26x. That’s despite Adobe’s defensive recurring revenue arguably being less at risk in an economic downturn and Adobe’s smaller size giving it more room to grow with less regulatory risk.

Is ADBE Stock A Buy, Sell, Or Hold?

Here’s a simple way of looking at the recent events. Adobe’s market cap was $186B on September 5th, shortly before earnings. Today’s market cap is $131B. That’s a difference of $55B, due to a selloff which is largely being attributed to a $20B acquisition. Of course, this is an oversimplification, since the acquisition introduces additional risks around integration and long-term strategy and earnings brought other issues to light. Not to mention that the overall market has continued to sell off. But at this point, I think it’s safe to say that the recent earnings results were more than priced in.

I shared my bull thesis for Adobe in January in this article. Although ADBE stock has struggled since that publication, I still believe that the thesis outlined in that article is intact. Adobe remains one of the widest moat and highest quality tech companies based on multiple metrics, and if anything the Figma acquisition only strengthens the moat by integrating one of the firm’s fastest growing and most modern competitors.

Thus, if I rated Adobe a strong buy at $491 in January, it probably goes without saying that I’ll make it a strong buy at $279 today. Admittedly, growth has slowed more than I expected when I wrote my previous article, and I’ve slightly revised my price target downward since then. The price target that I shared with Tech Investing Edge members today is $489, which implies 74% upside. That’s quite a bit of upside for what I believe is still a relatively low-risk blue chip at the end of the day.

Final Thoughts

For many years, Adobe has been an alpha-generating blue chip. It’s a wide moat company that’s highly profitable and highly defensive, and has a good track record of returning cash to shareholders. Although the Figma deal and slowing growth have made some investors question the strength of Adobe’s moat and management’s ability to create shareholder value, I don’t view the amount paid for the acquisition as being so extreme as to change the long-term bull thesis for Adobe. Overall, I believe that the bull thesis for Adobe is still intact. Thus, I rate Adobe as a strong buy today.

Be the first to comment