LilliDay

In 2021, the S&P 500 (SPY) hit 70 new highs and finished 27% higher. Likewise, both the Dow Jones (DJIA) and the Nasdaq advanced 19% and 21%, respectively. These gains added to the big gains netted in the previous two years, sending the major indexes to their best three-year performance since 1999. The rapid turn of events in 2022 couldn’t have been more extraordinary.

YTD, all indexes are in the negative, with the Nasdaq bearing the brunt of the selling pressure, down over 30%, driven in part by the significant declines logged by the investor favorite F.A.N.G stocks, comprised of Meta Platforms (META), Apple (AAPL), Netflix (NFLX), and Alphabet (GOOG), who are each down well into the double-digits. META, for example, is down nearly 70% YTD.

One of the most widely cited drivers of the market declines are rising interest rates due to the Federal Reserve’s efforts in reining in inflationary pressures that have risen to heights not seen since the 1970s. As rates have risen, investors have suddenly been provided a viable risk-free alternative to equities.

In addition, higher rates have raised risk premiums and altered valuation models. This has disproportionately affected tech and growth-related sectors with distant revenue streams that are inherently more sensitive to rate considerations.

Aside from U.S. equities, alternative investments, such as cryptocurrencies are also facing a reckoning reminiscent of the bursting of the dot-com bubble.

While there are other intricate factors driving the broad-based market declines during the year, monetary tightening could safely be argued as the leading culprit.

And as the Fed continues their tightening campaign heading into the new year, investors are increasingly on edge. For starters, inflation, though down from their highs, is still at uncomfortably elevated levels. This is stirring up chatter that rates are bound to stay higher for longer.

At the same time, however, bond investors appear to be calling the bluff via an inversion in the yield curve, which suggests the Fed is likely to reverse course sometime in 2023. While the multitude of concerns and considerations are valid, all may be overdone, given the current peculiarities in the current economic environment.

How Likely Is A Recession In 2023?

Economists are increasingly penciling in a recession into their forecasts. According to a recent survey of economists by The Wall Street Journal (“WSJ”), there is a 63% chance of a recession in the next 12 months. This is up from 49% in their survey from July.

Additionally, this is the first time the survey results came in above 50% since July 2020. At that time, the recession of 2020, which was the shortest on record, as assessed by The National Bureau of Economic Research, had just ended in April 2020, a mere two months after it had begun.

Presently, economists predict gross domestic product (“GDP”) will contract at an annualized 20 basis points (“bps”) in the first quarter and 10bps in the second quarter. This contrasts with their predictions in July of 80bps of growth in Q1FY23 and 100bps in Q2.

In addition, additional job cuts are expected in the middle of 2023 as employers respond to lower growth rates and weaker profits. Again, this diverges from prior predictions of job growth of about 65K a month over the same comparative period.

The apparent 360 turn in expectations come as both economists and the markets increasingly doubt that the Federal Reserve can engineer a soft landing, as initially hoped for.

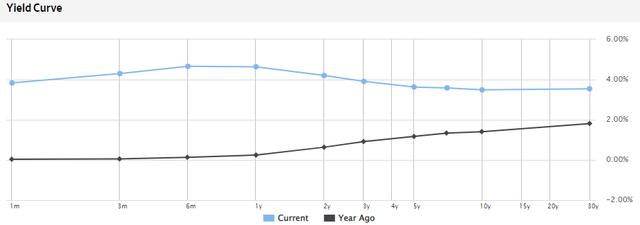

Evidence of this doubt is reflected in the yield curve, which has become more inverted in recent months. For perspective, every U.S. recession over the past 50 years was preceded by a yield curve inversion.

The Wall Street Journal – Current Yield Curve As Of 12/19/2022

Intuitively, the inverted curve suggests the Federal Reserve will have increased interest rates too high and too fast and will ultimately need to cut rates to respond to a recessionary environment.

And in anticipation of lower rates in the future, bond investors are bidding up long-range Treasury’s to lock in the higher rates offered in the current environment. Hence, the lower rates on longer term Treasury’s, which move in opposite direction of prices.

What Will Happen To The Economy In 2023?

Though recent surveys indicate a recession is likely in 2023, the expected severity is more ambiguous. For example, of those economists surveyed by the WSJ who see a greater than 50% chance of recession next year, most expect the length of the recession to be about eight months. This is lower than the historical average of 10.2 months.

In addition, since 1968, the year in which the Federal Reserve Bank of Philadelphia began their own surveys of professional forecasters, there hasn’t been any recession that has been called a year in advance. With that in mind, why would this time be any different? Especially considering the peculiarity of the existing economic data.

For one, the job market remains resilient. Yes, certain industries, such as Tech, are making headlines regarding layoffs. But employers, overall, are still hiring at a rapid clip. In November, for example, employers added 263K jobs. While growth has indeed slowed from the first half of the year, the pace still far exceeds the average monthly gains in 2019, which were around 164K/month.

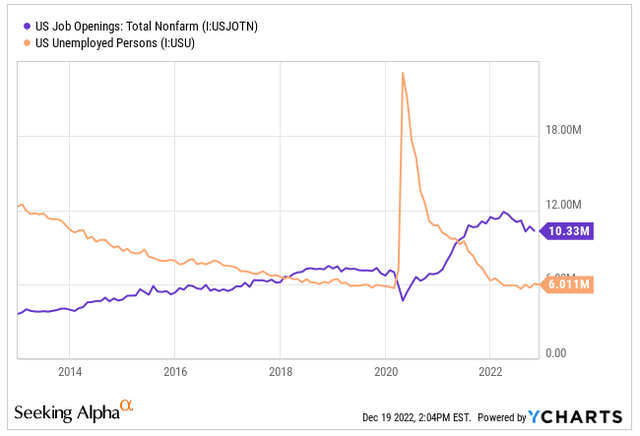

Furthermore, current job openings continue to track well ahead of historical averages, and, importantly, this exceeds the number of those unemployed by over 4M. Therefore, there is essentially an open job for anyone that wants one and has the necessary skills and qualifications.

YCharts – Chart Comparing The Total Number Of Job Openings To Total Number Unemployed

The robust job growth paired with an unemployment rate that has consistently remained below 4% has consequently translated to strong wage growth. Most recently, average hourly earnings grew 5.1% in November from a year earlier. This is about 2% above the pre-pandemic pace.

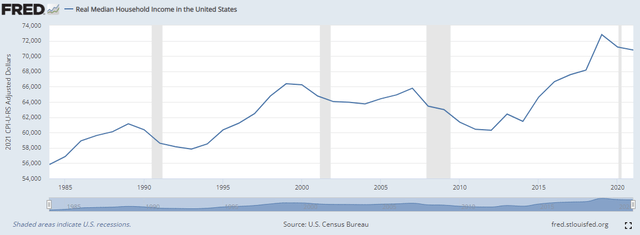

Wage growth is also trending in the opposite direction of overall inflation, which has been moderating since its recent peak of 9.1% in June of 2022. And compared to prior business cycles, inflation-adjusted household incomes have not declined as much as some would expect.

St. Louis Fed – Historical Chart Of Real Median Household Income

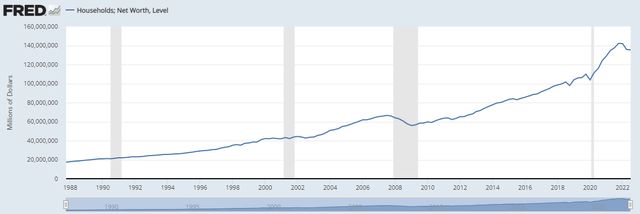

Households are also sitting on record equity due in part to the continued strength in the housing market, which has seen values hold at historically high levels despite declining demand from higher interest rates.

While some would argue that home values still have further to fall, which is entirely plausible, prices would have to fall between 40-45% from their peak to put the same number of mortgaged homes underwater as in the period between 2006 to 2009, according to the WSJ, citing recent analysis from CoreLogic. This seems unlikely, given current supply trends.

St. Louis Fed – Historical Chart Of Household Net Worth

On the opposite side of the coin is data pertaining to retail sales, which came in worse than expected for November, falling a seasonally-adjusted 0.6% from the prior month compared to consensus estimates of a 0.3% drop.

It’s worth noting, however, that consumer spending is still 35% higher than it was in 2019. Retail spending is also at odds with services demand, which continues to benefit from pent-up demand for travel and other activities that were missed over the past two years.

Rising demand for services could, indeed, fuel increased inflationary pressures, especially if wage growth doesn’t slow down. And this could be cause for further tightening by the Fed, which would ultimately feed into the overall economic environment.

But at any rate, any resulting downturn would likely be entered into from a position of strength, thereby resulting in a significantly less severe contraction than in prior years.

How To Prepare For A Recession In 2023

Heading into 2023, mutual funds are sitting on increased cash positions compared to prior periods. At present, total cash represents about 2.5% of their portfolios, according to Goldman Sachs (GS). This is up from 1.5% at the end of last year.

In addition, the number of bearish to bullish positions continues to sit at elevated levels, with most asset managers reluctant to make bullish wagers. This contrasts with individual investors, who generally have stayed on course through the year.

Inflows into U.S. equity mutual and exchange-traded funds, for example, have attracted over +$100B in net inflows in the current year, among the highest ever. This is notable since these are popular investment options among individual investors.

For those debating personal positioning ahead of the new year, increased holdings of cash would be one wise move. Holding cash has rarely been this attractive over the past decade. Rates on high-yielding savings accounts, for example, are currently averaging over 3% in many instances. And average rates are likely to head higher in future periods.

By storing cash in a high yielding savings account, investors will receive a reoccurring payout nearly double that offered by the average dividend yield of the S&P 500. It would also enable investors to readily capitalize on any market dislocations that may occur during the year.

Certain sectors will likely remain in favored status. These include Healthcare, Defense, and Energy, all of which have favorable outlooks and have performed strongly throughout 2022. Lockheed Martin (LMT) and Northrop Grumman (NOC), two defense giants, are each up over 30% YTD.

Huntington Ingalls (HII), the largest military shipbuilding company in the U.S., while not up to the same extent as LMT and NOC, is still up double-digits and is likely to be a prime beneficiary of any future expansion of the U.S. naval fleet in response to rising tensions between China and Taiwan.

As the market’s best performing sector in 2022, the run higher is likely to continue for the Energy sector. Favorable demand drivers, such as the inevitability of a restocking of the Strategic Petroleum Reserve (“SPR”), in addition to greater demand resulting from a reopened economy in China will also favor integrated oil giants, such as Exxon Mobil (XOM) and Chevron (CVX).

While the Healthcare sector hasn’t performed as strongly as Defense or Energy, the index is still down just 4.5% on the year, which is markedly better than the performance in the broader markets.

Other sectors, too, stand to benefit in 2023 on any prospects of either a slowdown in the pace of interest rate hikes or even a reduction in rates. Tech and Growth-related names, for one, will be among the first to rally.

Real estate investment trusts (“REITs”) are another that would likely rally higher due to their appeal to income investors. Presently, higher interest rates provide income investors a risk-free alternative to generating passive income. But that equation could shift if the direction of rates were to reverse course.

Bottom Line

Following a banner year in 2021, U.S. markets have stumbled through 2022. Heading into 2023, investors have much to consider. Aside from recessionary risks on the home front, one must also weigh the geopolitical environment, which has become increasingly more unstable in recent years. The ongoing war in Ukraine, rising tensions with China, and the ever-present contagion risks of regional conflict in the Middle East are a few geopolitical issues that investors should keep abreast on.

The key item, however, that will likely serve as the primary catalyst for equity markets is the impact of higher interest rates on the macroeconomic environment. If corporate earnings continue to fare less bad than feared, as they have through 2022, despite a higher rate environment, that may send markets on a sustained rally higher; even more so if household finances prove resilient in the face of tighter economic conditions.

As it is, the U.S. economy would already be heading into any recessionary environment in a position of strength, with numerous economic indicators still at or above levels in advance of prior recessions. While risks are certainly present, the foundation appears solid.

In the current environment, staying the course with time-tested companies with resilient balance sheets, albeit while also maintaining higher than normal cash balances, may prove to be the simplest yet most effective market strategy in 2023.

Be the first to comment