piranka

Thesis

Iron Mountain Incorporated (NYSE:IRM) is a highly profitable REIT focusing on storage and information management services with a diversified global footprint. It’s exposed to digitization drivers and the growth of data centers globally. Therefore, it’s highly exposed to long-term secular drivers underpinning enterprise IT spending, driving its differentiation against other more traditional physical REITs.

As a result, the company focuses on driving EBITDA profitability that sustains its distribution. Therefore, IRM offers investors clear revenue and bottom-line visibility as it leverages the digitization growth drivers.

IRM has also been a solid performer over the past ten years, underpinned by its dividend yields. However, we gleaned that its rapid run from its COVID bottom may soon be peaking as the company laps more challenging comps from FY22. Therefore, we believe IRM may face considerable headwinds on its total return performance moving ahead, even though its AFFO per share growth is projected to remain stable.

Our relative valuation analysis suggests that IRM seems overvalued, as it continues to trade well above its 10Y mean. Coupled with ominously-looking price structures, we believe IRM could underperform from a total return perspective if investors decide to add at the current levels.

Hence, we urge investors to leverage the current levels to cut exposure. Accordingly, we rate IRM as a Sell.

Investors Should Expect Slower Growth Ahead

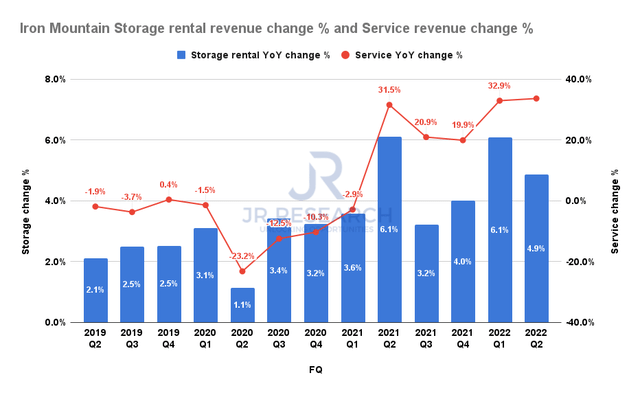

IRM storage rental revenue change % and service revenue change % (Company filings)

As seen above, Iron Mountain’s highly consistent storage business has underpinned the stability of its revenue growth over the years. Consequently, it offers investors tremendous visibility, helping the company to sustain reliable distribution payouts for investors.

However, its services business has been more volatile. Nevertheless, its elevated growth rates corroborate the company’s competitive moat as it expands its TAM. Furthermore, it also lapped less challenging comps from 2021, coupled with the contribution from its ITRenew acquisition. Moreover, the company also cited robust pricing gains, corroborating its competitive advantages and driving significant value for its customers.

Notwithstanding, we urge investors to consider whether Iron Mountain can sustain such elevated growth rates moving ahead as it laps more challenging comps in FY23.

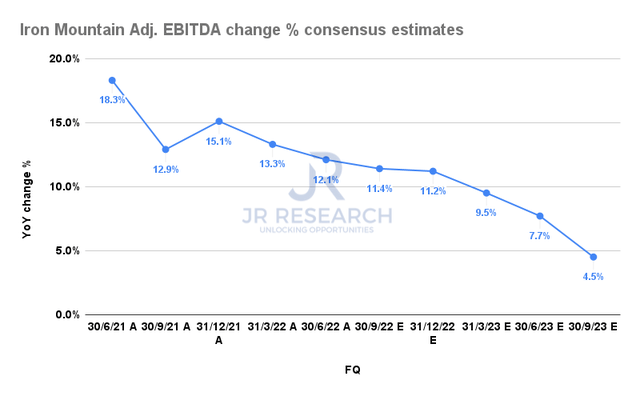

Iron Mountain adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) indicate that Iron Mountain’s adjusted EBITDA growth cadence could continue to slow moving ahead. The company’s Q3 guidance of $465M in adjusted EBITDA implies a YoY increase of 11.3%, lower than Q2’s growth of 12.1%.

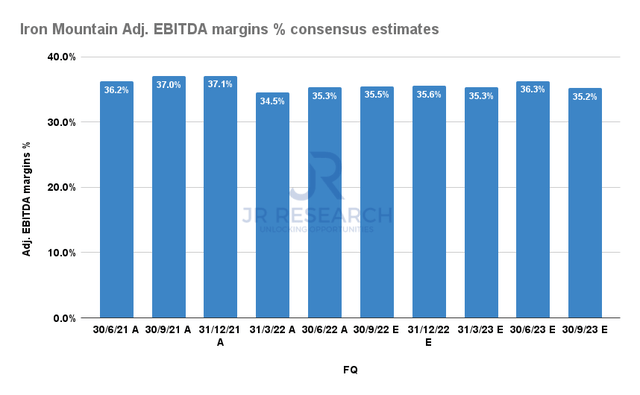

Iron Mountain adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Notwithstanding, Iron Mountain’s profitability margins remain robust, which should undergird its valuations. Therefore, despite a significant slowdown in its adjusted EBITDA growth momentum, we don’t expect its distribution to investors to be impacted.

We deduce that the Street’s expectations of slowing profitability growth are credible, as recessionary fears could likely hamper the growth in enterprise IT/data center spending. Coupled with its above-trend growth rates, it’s likely to be a significant headwind against IRM’s growth cadence moving forward, impacting its performance.

Is IRM Stock A Buy, Sell, Or Hold?

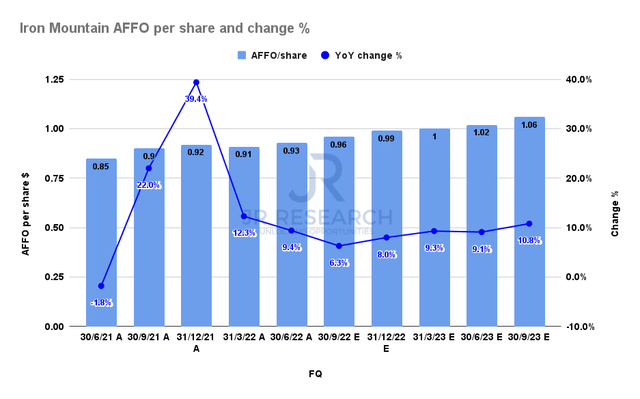

Iron Mountain AFFO per share metrics consensus estimates (S&P Cap IQ)

Iron Mountain’s AFFO per share is projected to increase through FY23, given its robust profitability. Therefore, it should continue to support buying sentiments. Furthermore, the company’s relatively low payout ratios should give investors confidence in its ability to continue growing its distribution over time.

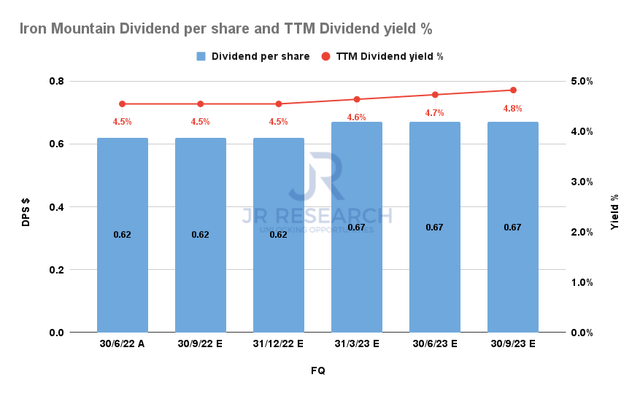

Iron Mountain Dividend per share and change % consensus estimates (S&P Cap IQ)

Consequently, we are confident that the Street’s estimates of a TTM dividend yield reaching 4.7% by FQ2’23 are credible. Despite that, we urge investors to be cautious, as its dividend yield remains well below its 10Y mean of 6.19%. It’s also important to note that IRM’s average dividend yield has significantly contributed to its 10Y total return CAGR of 15.15%.

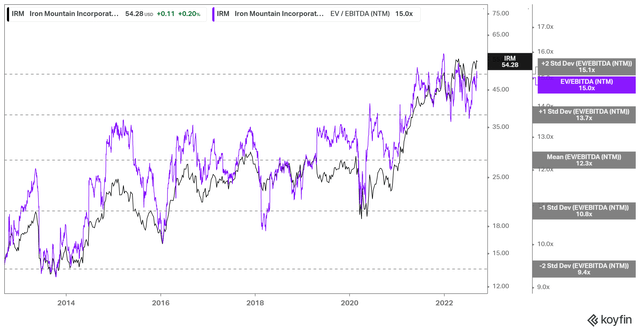

IRM NTM EBITDA multiples valuation trend (koyfin)

As seen above, IRM last traded close to the two standard deviation zone above its 10Y mean. Also, that zone has consistently denied further buying upside since 2021. Therefore, we believe IRM would face significant challenges in replicating its 10Y total return CAGR in the medium-term at the current levels.

As a result, we believe substantial digestion in its price is necessary to help improve its potential for IRM’s forward performance to mean-revert to its 10Y averages.

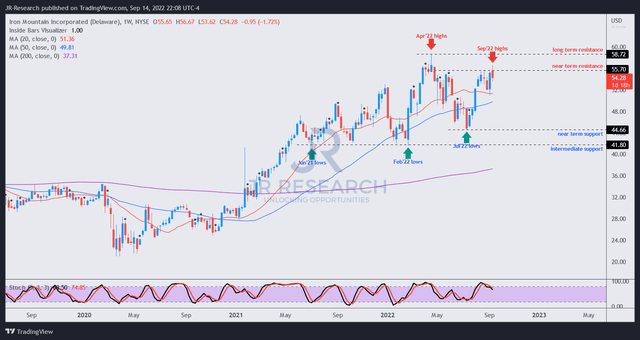

IRM price chart (weekly) (TradingView)

We gleaned that IRM’s buying upside has faced significant selling momentum at its near- and long-term resistance levels. Therefore, we deduce that the market has configured IRM for a steeper sell-off moving ahead.

Consequently, we believe investors need to be highly cautious in considering adding new positions at the current levels. Instead, we urge investors to use its recent highs to cut exposure and rotate away.

We rate IRM as a Sell and encourage investors to get down the mountain safely.

Be the first to comment