shironosov/iStock via Getty Images

IRadimed (NASDAQ:IRMD) develops, markets, and distributes non-magnetic Medical Resonance Imaging (“MRI”) compatible medical devices, accessories, and related services. IRMD is a profitable company that is enjoying increasing demand for its products and is exploiting the opportunity by adding new products. The company has a monopoly as there aren’t any direct competitors and it is unlikely that any will come about. No one else is marketing an FDA-approved non-magnetic, MRI-compatible medical device. The recent stock price decline is offering an excellent opportunity to initiate a position or to add shares for an investor interested in a growth stock.

My investment thesis: The company is reporting record revenues that exceed the pre-covid time period, but the share price is still 65% below the high. I believe the stock price will follow the strong fundamental picture.

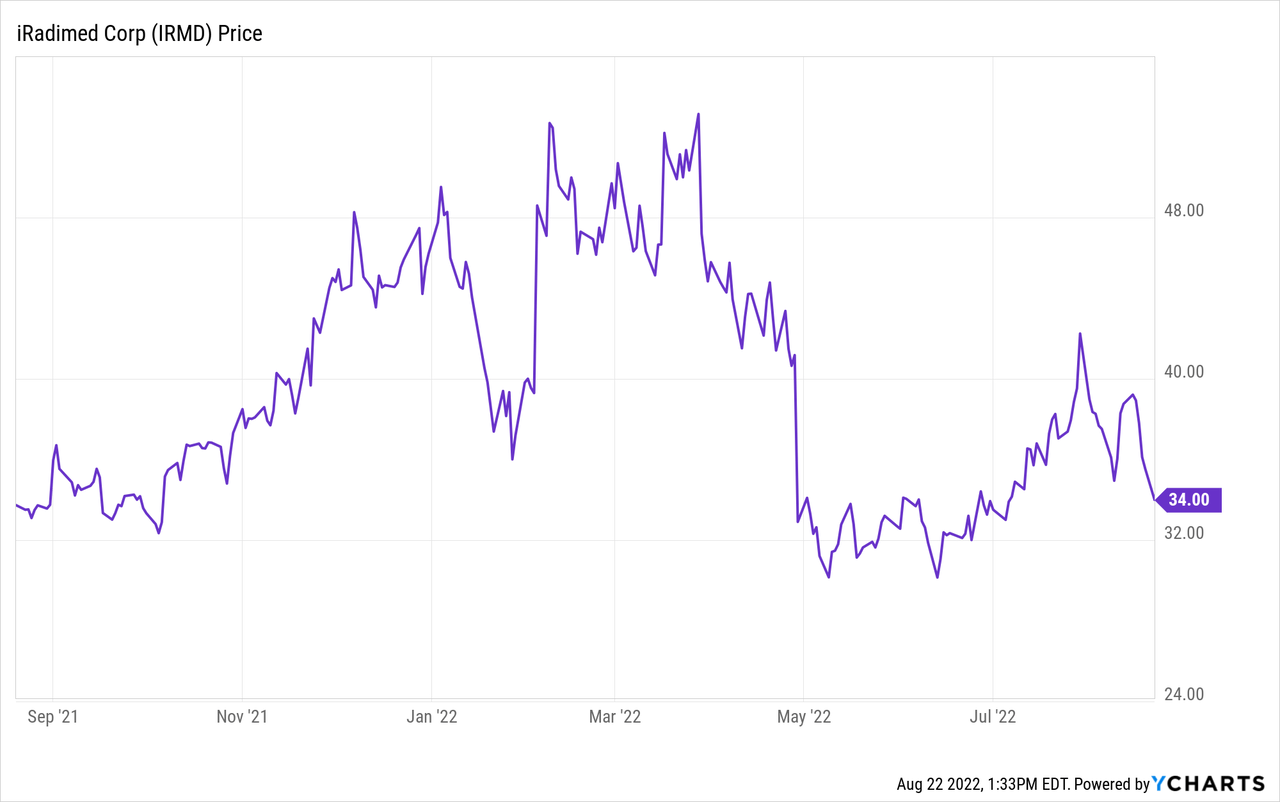

I first wrote about the company in 2019 as I saw a disconnect between the stock’s fundamentals and the technicals. IRMD was on its third consecutive quarter of record revenues but the stock price had declined about 50%. History is repeating itself for IRMD as the company has again recorded three consecutive quarters of record revenues but the stock price hasn’t responded in kind.

A comparison of the 2019 and the present charts illustrate similar technical pictures. Despite the reason sell-off the stock price is nearly double now from when my first article was published. I’ll follow the technical illustration with a look at the fundamentals which support the stock price resuming its pre-covid uptrend.

2019 chart

2019 chart (Y CHARTS)

Present chart

The stock is off 65% from its high of $56/share. The fundamentals point to the stock price climbing back up and reaching new highs.

Earnings

The company recently reported second-quarter revenue of $12.7 million, nearly a 30% increase over the second quarter of last year, and earnings of $0.26, 116% higher than for the same period in the prior year. It was also reported that bookings were at record levels, setting up continued revenue growth going forward. Management provided guidance of revenue of $13.1 million to $13.3 million for the third quarter and for the full 2022 revenue of $52.5 million to $53.2 million, about 27% higher than for the previous year and higher than pre-covid revenue.

Revenues for 2023 could top $70 million if the company continues growing at the same pace. It’s possible that the growth rate could accelerate as the company has increased its sales staff and introduced a new product.

Share info and valuation

There are about 12 million shares. Institutions own about half while insiders own about 43% of the shares. The market cap is $447 million. The company last reported $2.35 million in debt and $52.16 million in cash resulting in an EV of $397 million. The company has sufficient funds to maintain its operations and also make an acquisition if management so desires.

IRMD trades at high multiples at first glance but not so when compared to its peer group. IRMD enjoys better margins and therefore the higher P/S and P/B ratios are justified. There’s also a premium that IRMD stock can command as the company is a virtual monopoly.

| IRMD |

Med. Device Ind. |

|

| Gross Margin | 76% | 54% |

| Ebit Margin | 26% | 16% |

| Price to Sales | 6.25 | 4.04 |

| Price to Book | 6.77 | 4.37 |

| Price to Earnings | 35.0 | 55.39 |

Compiled by the author from data from CSI Markets

Moat

The stock price drop in 2019 was due to regulatory compliance issues in Europe and in the U.S. The European Union equivalent of the U.S. FDA found a technical non-conformity with the IRMD MRI compatible patient vital signs monitor. The company received a warning letter from the FDA in 2014 pursuant to a routine inspection that identified eight areas of concern. The warning letter had not been closed until October 2019 and the issue clouded IRMD’s future and cast doubt on investors.

A great indicator of IRMD’s dominance is that Bayer (OTCPK:BAYZF) now offers IRMD non-metallic, MRI-compatible products on its website after stopping production of its own non-magnetic, MRI-compatible devices due to many recalls and FDA warnings. The only other previous IRMD competitor that I could find was Nebion which was also unable to overcome FDA recalls. The Bayer and Nebion experiences and the regulatory hurdles that IRMD has had to clear, point out the difficulties in maintaining regulatory compliance and serve as a moat. A new company seeking to enter IRMD’s space would need at least three years to gain FDA clearance.

Products

The flagship product is a non-magnetic MRI-compatible MRI pump, the MRidium 3860, which serves patients too ill to be taken off intravenous medication and young children who require medication in order to remain still during a scan. The 3860 was FDA approved in 2009.

MRidium 3860 (IRadimed website)

The FDA approved the company’s second commercial device, a non-magnetic MRI-compliant patient monitor system in 2017, the IRadimed 3880. This device is the only portable MRI-compatible patient vital sign monitor allowing for patient monitoring as the patient is moved throughout the hospital.

Pumps are the bread and butter of IRMD’s business. The monitor is bundled with the pump and offered as a more complete solution.

IRadimed

The company also offers disposable components, various available upgrades to meet customer needs, and offers extended maintenance contracts. The disposable components and maintenance products provide recurring revenue. The company does not break out what percentage of revenue is recurring. I estimate it to be about 25% of total revenue.

A third product, a magnetic detection device has had a delayed introduction due to the pandemic, but sales began this quarter. This device is designed for placement at the entrance to MRI rooms to ensure that magnetic material is detected before it is allowed to enter the room. For anyone not familiar with what happens with magnetic material during an MRI scan please click here.

IRadimed

The company is working with the FDA to clear up questions and obtain 510(K) clearance for its next-generation IV pump, the MRidium 3870. Management expects to obtain clearance before the end of the year. In addition to its existing line of products, IRadimed plans on using its MRI-compatible technology to develop additional products such as ventilators, suction devices, robotic controls, and hydraulic controls.

Industry

MRI is a non-invasive procedure used to provide images of the structures inside a body, capturing bodily functions, and is commonly used for patients suffering from stroke, cirrhosis of the liver, hepatitis, brain injury, cancer, and more as it is finding new applications in a variety of surgeries and neurology.

IRMD’s sales growth is pegged to the increasing demand for MRI services and for safety inside the MRI room. With the increased usage of MRI, there has also been an increase in adverse events related to MRIs where magnetic objects were present in an MRI room. The company estimates that it has barely penetrated its total addressable market worth $3.1 billion and growing.

Absent IRMD’s pump system, options available include avoiding MRI, using long pipes to a pump system outside the MRI room, or protecting the pump system inside a box. IRMD eliminates the clumsiness as well as dangers from those procedures.

Risks

IRMD has to carefully monitor its supply chain as many parts it utilizes have single source exclusive supply agreements.

The cost of the IRadimed MRI-compatible infusion pump is roughly four to five times the cost of a conventional infusion pump which may make it prohibitive for some hospitals.

Most of IRMD’s patents are going to expire in the next two to ten years.

The third quarter is typically IRMD’s weakest quarter due to summer vacations.

Conclusion

IRMD is showing no signs of slowing down now that it is back on course after suffering pandemic-related delays. The company’s fundamentals are solid as demonstrated by record revenues, profitability, and a strong balance sheet. The stock price bounced back strongly from the uncertainties of regulatory review and should do the same on bouncing back from the effects of the pandemic. The company is recording revenue that is higher than pre-covid levels and the market might reward it with a commensurate share price. If that’s the case, then there is likely good reason to expect price appreciation of at least 65%.

Be the first to comment