10’000 Hours/DigitalVision via Getty Images

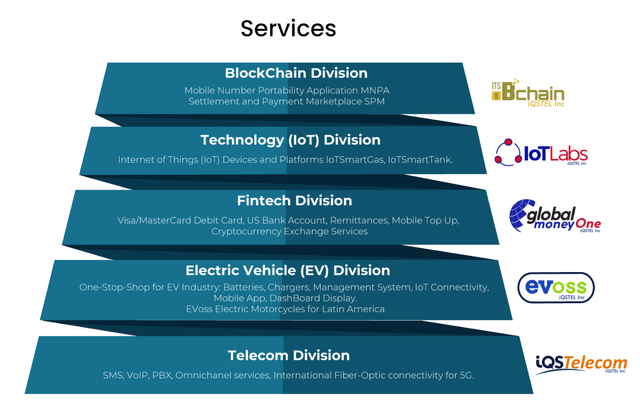

iQSTEL (OTCQX:IQST) is a microcap holding company that I have covered previously here at Seeking Alpha. Historically, the company’s primary revenue stream has been generated from its telecom operations. But iQSTEL also has, or is working on, several innovative technology products such as Blockchain, Electric Vehicle (EV), EV batteries, Fintech services, and Internet of Things [IOT] smart devices. According to iQSTEL, some of these operations, such as EV vehicle and Fintech, may begin to contribute revenue as early as the third quarter of this year.

In my most recent article, I saw a trend toward profitability, gross margin growth, and new products coming with higher margin potential as justification for a “Speculative Buy” opinion. However, the stock price has not increased since then and in fact has dropped substantially over the last few months. I believe this is partly because the first quarter results did not bring profitability, saw mediocre margin growth, and revenues from new products were not included in Q1. Also, I think it is reasonable to assume that the price drop is largely related to the current overall market conditions.

But still, I see iQSTEL as a speculative buy, when considering the company’s growth history and potential of new product offerings. It can take some time, and perhaps investors are holding back until certain milestones are reached, such as profitability. But I am writing this update to remind that this company is growing and looking strong in key metrics, while the stock is available at a current price of less than 1x sales. Perhaps even more compelling, I don’t think investors recognize that due to recent acquisitions some margin improvements appear to be likely as early as the next quarterly report, while even more likely in the Q3 report. This can put iQSTEL at, or very near profitability, and the company does expect profitability soon. I am maintaining my previous current fair market value of $1.07 but continue to consider adverse macro-economic conditions while also looking ahead for any potential upgrades.

Financial Update

Since my last writing the company filed its Q1 22 report and I see that cash at the end of the quarter was $4.2 million, representing a gain of about $.9 million. Since net income is yet to be positive the increase in cash flow may have come from an equity raise, although the amount raised would be negligible, I think, to the total. It may have even been fortuitous timing, as the market price was higher at the time. At any rate, $4.2 million appears to be enough cash to fund operations at least through FY 2022. In fact, the company stated that the cash position was enough to fund its M&A activity and leave enough left over to fund operation needs through the rest of this year and into 2023. I take that statement to indicate that no further dilution is needed anytime soon. But if any did occur, I would expect it to be used for a new unforeseen opportunity.

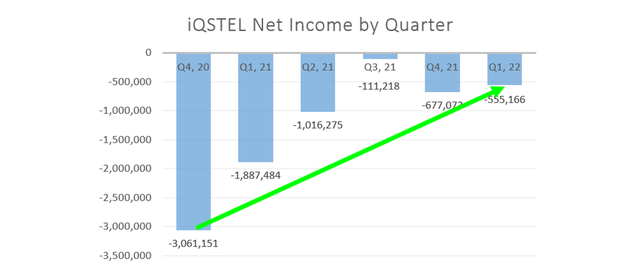

The first quarter net loss was just over a half million at about $555,000 as seen in the graph below. At that rate, you might say iQSTEL would need a little over $1.5 million more to finish out 2022 which could easily be covered under the $4.2 million in cash. But the long term trend is toward profitability, as shown in the graph, and iQSTEL’s guidance of profitability during 2022 may indicate that cash generated from net income may further decrease any need for share sales, for the purpose of funding operation.

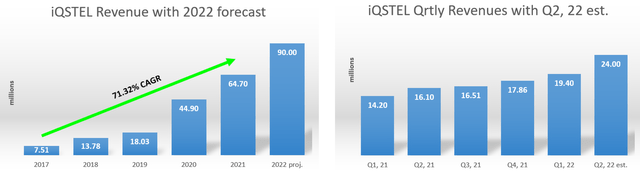

iQSTEL continues its aggressive revenue growth trajectory as Q1 22 brought a 37% year-over-year quarterly increase and an 8.6% increase over the prior quarter. The preliminary Q2 22 revenue data further shows a 49% year-over-year increase and a 24% sequential revenue increase with Q2 containing one month of new revenue from recent acquisitions. The charts below illustrate the progress including the current 71% CAGR growth since 2017, and the $90 million revenue forecast for 2022 which iQSTEL appears to be well on the way to meeting or exceeding.

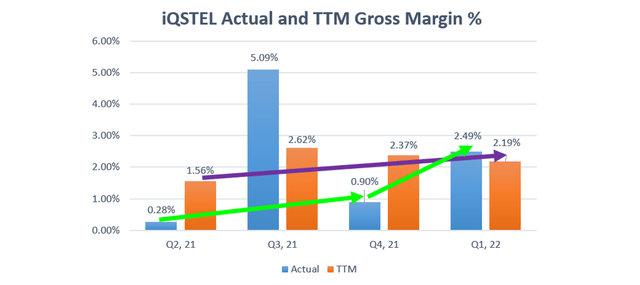

If there is one metric from Q1 that may have tempered some investor enthusiasm, it may be the size of the gross margin. iQSTEL is collecting millions in revenue, but the razor thin margins are slowing its progress to profitability. The gross margin for the quarter was 2.49%, which isn’t quite enough to cover other expenses such as general and administrative expenses. The $19.4 million revenue in Q1 at a 2.49% margin only provided a little less than half the other expenses. At around a 5% margin, profitability could have been in sight.

iQSTEL’s record includes some margin performances better than others. Q3 21 saw a 5.09% margin achieved, but the prior quarter was dismal at just .28%. In recent history the average TTM margin has stayed around a range of about 2.5% so the fair question becomes one of whether the company can improve on that. It’s a complicated issue, involving lots of moving parts, but I will try to look at several factors.

To start, we first must realize that most all company revenue to date has come from its telecom division. As you recall, they plan to have [IoT] device products, EV products, Fintech, and others. Several of these products have been in pre-revenue status for some time but, as mentioned, recent company statements are that they expect revenue from some of these divisions in Q3. iQSTEL’s new products such as Fintech and EV are expected to provide higher margins and the company believes they can achieve margins as high as 30% or higher on those products and services. I think the important takeaway for the investor is to consider that even if those margins were halved from their expectations, it can still add a lot to the bottom line since the company is very near profitable on its existing business at last report.

But back to telecom, I mentioned in prior articles that the typical telecom margin was much higher than what iQSTEL has averaged in the last several quarters. And in fact, some of iQSTEL’s existing operations such as Swisslink and the SMS division in Miami had strong gross margin results last quarter with each achieving over 17%. But iQSTEL’s largest and newest revenue center barely brought in more than cost. Past guidance from iQSTEL included a statement that newer business takes some time to optimize. I think we will have to see if that can be proven, but as I have noted in the past, the potential may be there, and if proven even small percentage gains in margins can add much to the bottom line. With iQSTEL nearing $100 million in annual revenue each % in margin approaches an extra $1 million that could be available, and at around 2.5% the bar appears to be set low at this point.

So maybe the question for now is whether improvements are being made. You can see in the graph below some modest gains over the last year, and that includes disregarding the exceptional quarterly results from Q3, 21. The actual margin percent grew over the year from .28% in Q2, 21 to 2.49% in Q1, 22. Over the same period, the TTM grew from 1.56% in Q2, 21 to 2.19% in Q1, 22. Also, the Q1, 22 performance of 2.49% at least slightly surpasses the full year FY 21 margin of 2.37%. Overall, the gains are small, but clearly indicate movement in the right direction and Q3, 21 is an example of much better results being possible in any given quarter.

I think the margin performance is something we need to continue to focus on extensively in evaluating iQSTEL’s worth. And it may serve to keep in mind that the company plans to grow its telecom operation, as well as pursue other higher margin opportunities. Also, iQSTEL has combined its telecom operations to seek economies as well as to cross sell its products.

The latest two new acquisitions of two small telecom companies, Smartbiz and Whisl, may demonstrate some better planning as they are said to be both immediately accretive. iQSTEL sees the two new companies contributing net income from the start with a yearlong projection of $11.6 million revenue and $1.34 million net income. That implies a margin of at least 12% coming from those two companies, and that alone should contribute to an improved overall margin for iQSTEL.

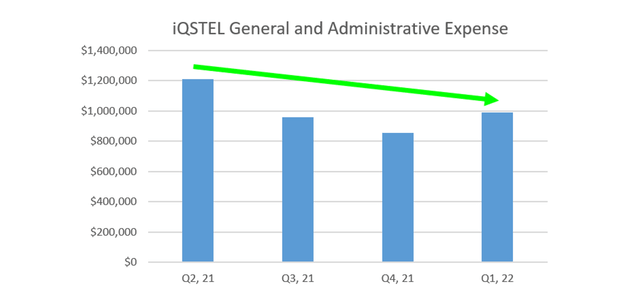

But margin is not the whole story, as iQSTEL is also making progress in overall operation. This graph shows a favorable trend in cost reduction even as the company grows its revenue. Holding these expenses allow more room for margins to contribute toward net income.

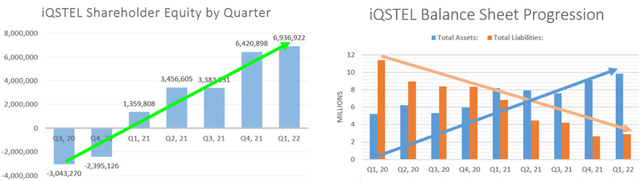

The company continues to grow shareholder equity although fueled by sales of stock. Total assets, less goodwill, was $8.3 million and almost 3 times total liabilities of $2.9 million. The charts below illustrate the gains in shareholder equity and the strengthening of the balance sheet.

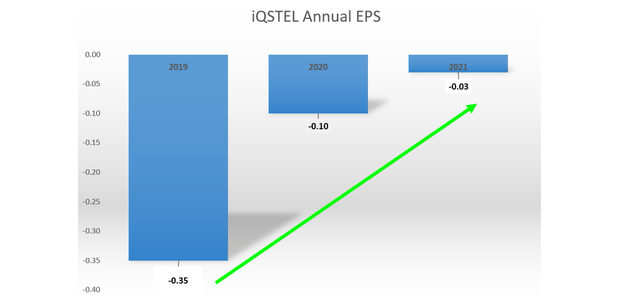

iQSTEL guidance is to expect profitability to begin in FY 2022. Again, history confirms the trend as shown in the graph below. While, as mentioned, some equity was raised from sell of stock, the graph demonstrates substantial progress toward profitability. I believe this shows some prudence by the company in managing the amount and timing of such issuances, and in gaining of value to shareholders in the use of funds received. To point, iQSTEL reported 147 million outstanding common shares at the end of FY 21, and recent current data reports 151 million shares, or only about a 2.7% increase for operational and M&A needs.

Recent Developments

I already mentioned the Smartbiz and Whisl acquisitions. Those began to show revenue in June, but the first full quarter showing the results of the new business will be Q3. Smartbiz was purchased with a 51% interest for $800,000 in cash and $1 million in 6-month restricted common stock. Smartbiz has a FY 22 net income forecast of $.5 million. I believe Smartbiz is a good deal as it should pay for itself in the first couple of years or so.

Similarly, 51% interest of Whisl was acquired for $1.25 million in cash and 550,000 of 6-month restricted common stock, with Whisl expecting to bring $.83 million in net income over the next 12 months. Like Smartbiz, Whisl will pay for itself quickly. I like that iQSTEL is making accretive acquisitions, and each of these new companies should fit well into their existing business, with cross selling opportunities as a bonus. Also these two acquisitions alone are evidence that iQSTEL is bringing value to shareholders from the sales of equities. The ability to cross sell and find synergies to meld with their existing business should alleviate any concerns of just trying to “buy growth”. New and existing companies can each benefit from the additions.

A possible fiber deal that has been in the works for two years was mentioned recently. Details are few but this is said to be a 5G play and involves a more active role for iQSTEL in the U.S. market. The company is pursuing the purchase of 100% of 2,300 miles of fiber-optic network in America.

The EV division is still ongoing with dealer arrangements being negotiated. Orders for more production should follow. Also, iQSTEL advised that another company made an offer to purchase the EV division and it was said to be at a value higher than iQSTEL had considered in its internal valuation. The offer was declined, but the company is now considering a spin-off of the division to perhaps unlock the perceived hidden equity. The spin-off would be targeted for a Nasdaq listing from the onset.

Lastly, perhaps the most overlooked recent news by the market occurred as iQSTEL named the Fortune 500 company that they are working with to potentially deploy the company’s Smart Tank [IoT] devices. The company was identified as BASF, and BASF is the largest chemical producer in the world, currently ranked #134 on the Fortune 500 list. iQSTEL has stated that these devices, if deployed in a contract, are expected to involve monthly recurring revenues for the company. It’s hard to say what the potential is but BASF surely has an innumerable number of tanks worldwide.

Maybe the market would have reacted if an actual contract was announced, but it was not. Still, iQSTEL continues to field test the devices. They informed that they are on the third version of the product, as they continue to fine tune the devices to the customer’s needs. The guidance was that a deal may be close, as you might expect after the length of time that has occurred and after the product upgrades. A telling factor could be that the iQSTEL referenced a non-binding MOU, as opposed to the prior LOI. The MOU wording could be a clue that a contract is getting closer, and iQSTEL does appear to believe that to be true.

Tanks/IoT Opportunities (iQSTEL)

The Smart Tank device is an [IoT] award winning product from an organization which includes big name competitors. That may be what helped gain interest from BASF, but iQSTEL states they have several other potential large customers to pursue. And I assume that if they land a contract with BASF, a global leader, then it would help bring attention from many others, some of which are quite large on their own, including other Fortune 500 companies.

Valuation

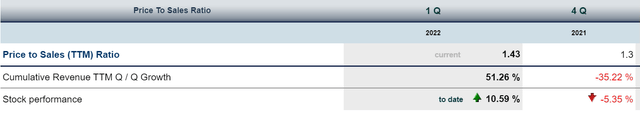

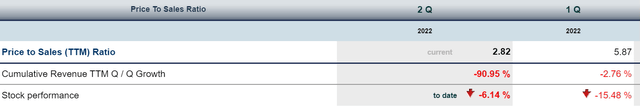

Despite the overall market, the telecom price to sales ratio I used for valuation has increased since my last report, although the technology price to sales ratio has dropped drastically. But since iQSTEL revenue has mostly been comprised of telecom up to this point I will maintain my fair valuation 0f $1.07 as provided in my last article.

Telecom CSI Market data:

Telecom Price to Sales (CSI Market)

Technology CSI Market data:

Technology Price to Sales (CSI Market)

Of course, I acknowledge that the overall market conditions have taken a toll, and the industry ratio for technology has declined, but little has changed with iQSTEL except that the company is stronger in many measures. As the next quarterly data is made available any major changes in margin performance or other available data including industry ratios may lead to adjustments in fair value. In addition, any major confirmation of the technology products, such as with a contract signed, could warrant adjustments to fair value as well.

Risks

The company provides a full list of risks in its annual filing. I recommend reading that in its entirety, but I will add a few notes.

The most obvious, and perhaps biggest risk for many companies today is the current geopolitical environment. All risks, including market or world events, can lead to depressed share values that do not reflect my view of fair value.

I don’t think the current geopolitical environment will have any major impact on iQSTEL’s business, and the CEO made a similar statement to validate that opinion. Telecommunications touches our lives in so many ways, and it only becomes more so with time. Also, iQSTEL’s new products such as [IoT] devices and EV are the trends of today and the future.

Investors are clearly not excited about iQSTEL stock, but as I mention the market environment has caused a correction, and OTC stocks are more likely to get caught up in the negative sentiment. Also, iQSTEL hints at profitability and a Nasdaq listing but their timelines appear to be behind. That seems to be typical, but with a statement giving direct guidance to expect revenue in Q3 from the new Fintech and EV products, and with new acquisitions already adding revenue, I think the case is very strong for iQSTEL to make the transition to sustainable profitability by the next quarter, or by Q3.

I would re-evaluate my bullish investment thesis for iQSTEL if there was significant loss of business, failure to achieve profitability in a reasonable timeframe, and failure to achieve better margins. I would also re-evaluate my thesis if I saw significant dilution occurring that does not bring in equal or better value to the company. For an investment in iQSTEL, I expect shareholder equity to continue to improve over time. At this point I believe the company has made steps in the right direction regarding these issues.

Final Thoughts

I continue to hold a substantial position in iQSTEL with shares bought at various levels above and below the current market price, but the average is well below. I hoped to see the company reach its goal of up listing to Nasdaq in the first half of 2022, but that did not happen. As I stated above, I think the overall market conditions was a key to holding this and other stocks down, but iQSTEL’s margin performance failed to impress too, I think.

If I was just looking at iQSTEL as a small growing telecom I might consider the stock more as a “Hold” and watch the margin to see if an upgrade was warranted. What we do now is that at least iQSTEL is a small telecom that is rapidly growing. It was not profitable at last report, but I believe it’s reasonable to assume that improvements could occur to its margins, towards industry standards. This is often a good reason to use a price to sales valuation as I have with iQSTEL. Since iQSTEL is rapidly adding new business and actively pursuing synergies, I believe that expectation of margin improvement is reasonable. Also, since the company is showing strength in many metrics, I think it is fair to apply a valuation that looks forward to profitability. I see this as further, and strongly, reinforced by the possibilities of several new product introductions that could bring new revenue streams. If validated, any one, or several of those products can bring considerable upgrades to fair market value. All considered I see iQSTEL about as good of a speculative buy as any to be found.

I hope to see some new revenue streams as of Q3, as the company projects, but I think you do have to consider some things take a little longer than expected. The Smartbiz acquisition was once thought to may be bringing in revenue by January of 2022, but ultimately it was in June. Maybe not all their plans will work out, and maybe some will open new doors. I do consider this as speculative, but despite the unknowns, I see a company growing revenue, (slowly) improving margins, managing expenses, and on a trend towards profitability. Some degree of share dilution has occurred but not greatly, so I think. If they can keep that near current levels, or even make share reduction efforts I think that could help a lot too.

The EV spin-off idea is interesting but if they can publicly demonstrate the value of the division enough to warrant a spin-off, I would think that alone could help get the current company stock as is, to be more ready for Nasdaq all on its own. If the real goal is just getting to Nasdaq there might be no need to spin-off, if iQSTEL were to meet all the listing requirements. In fact, I believe that any solid evidence that the company can and will bring in revenue outside of telecom could foster substantial new interest in the company.

iQSTEL has a lot of ambition and sometimes it seems odd to see all these things connected. But iQSTEL has found the ways. Maybe it’s odd, or maybe it’s visionary, but it’s interesting to me.

Be the first to comment