JasonDoiy

What Is LeeWay Services?

Salt Lake City, Utah-based LeeWay Services, Inc. (LEWY) was founded to offer a variety of freight brokerage services in the U.S. and has expanded into e-commerce capabilities.

Management is headed by CEO and President, S. Whitfield Lee, who has been with the firm since inception of WLP in 1984 and has started a number of companies in various industry segments.

The company’s primary offerings include:

-

Freight brokerage

-

Dedicated contract carriage

-

Transportation management

-

Financing platform

LeeWay has booked fair market value investment of $2.9 million in debt as of June 30, 2022 from investors including W.L.P. Corporation.

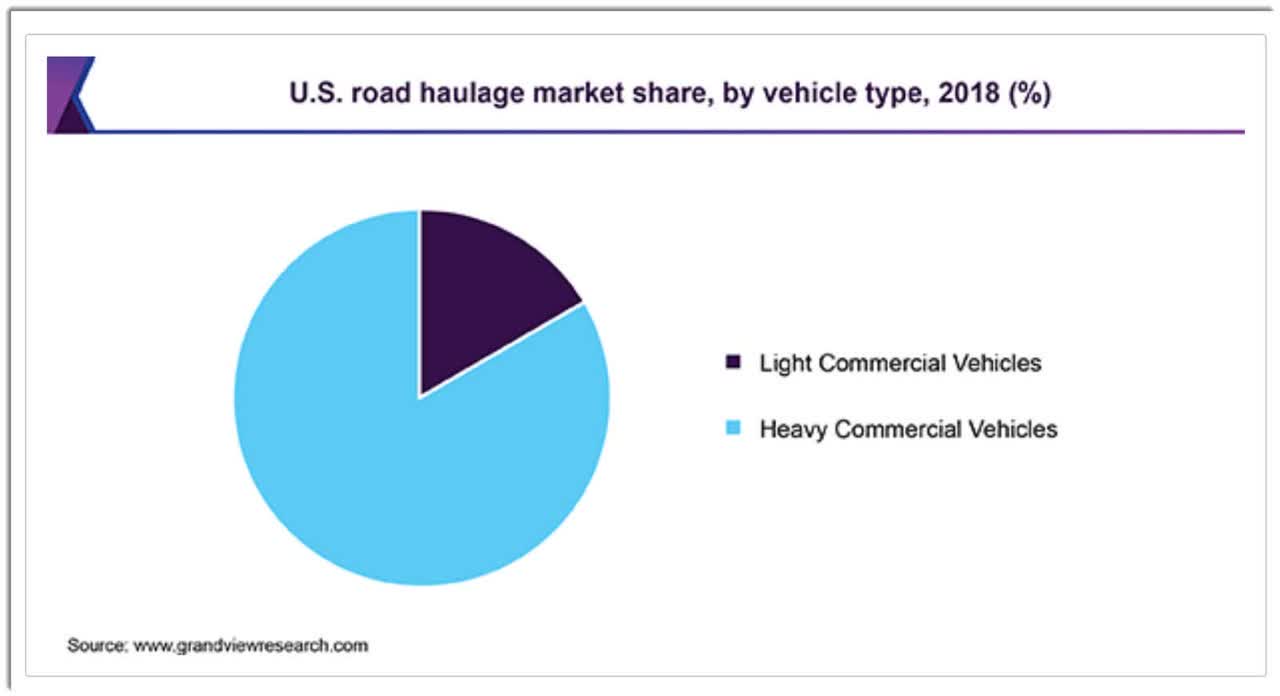

According to a 2019 market research report by Grand View Research, the global market for road haulage was an estimated $2.8 trillion in 2019 and is expected to exceed $4 trillion by 2025.

This represents a forecast CAGR of 5.5% from 2019 to 2025.

The main drivers for this expected growth are the growing need for good transportation due to the growth of the e-commerce industry and improved technologies resulting in more reliable vehicles, better fleet management and lower operating costs.

Also, the U.S. road haulage market breakdown by type is pictured below:

U.S. Road Haulage Market (Grand View Research)

Major competitive or other industry participants include:

-

XPO Logistics

-

C. H. Robinson

-

Uber Freight

-

Transfix

-

Other freight brokerages and financial services companies

LeeWay’s IPO Date & Details

The date for the initial public offering, or IPO, for LeeWay is still to be announced.

(Warning: Compared to stocks with more history, IPOs typically have less information for investors to review and analyze. For this reason, investors should use caution when thinking about investing in an IPO, or immediately post-IPO. Also, investors should keep in mind that many IPOs are heavily marketed, past company performance is not a guarantee of future results and potential risks may be understated.)

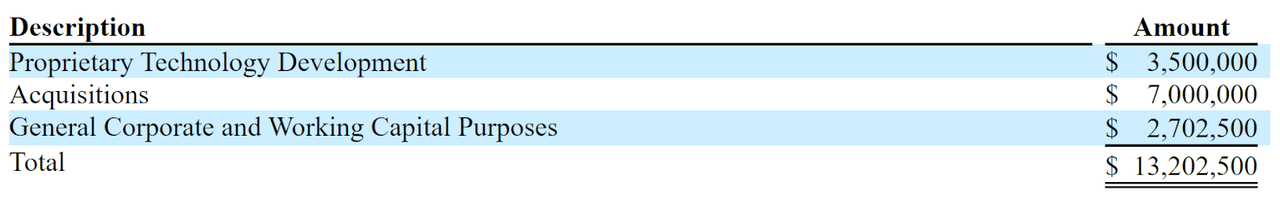

LEWY intends to sell 3.0 million shares of common stock at a proposed midpoint price of $5.00 per share for gross proceeds of approximately $15.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

W.L.P. Corporation will have voting control of the company immediately post-IPO.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $37.9 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 30.3%. A figure under 10% is generally considered a ‘low float’ stock, which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

Proposed Use Of IPO Proceeds (SEC EDGAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not a party to any legal proceedings that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is ThinkEquity.

How To Invest In The Company’s Stock: 7 Steps

Investors can buy shares of the stock in the same way they may buy stocks of other publicly traded companies, or as part of the pre-IPO allocation.

Note: This report is not a recommendation to purchase stock or any other security. For investors who are interested in pursuing a potential investment after the IPO is complete, the following steps for buying stocks will be helpful.

Step 1: Understand The Company’s Financial History

Although there is not much public financial information available about the company, investors can look at the company’s financial history on their form S-1 or F-1 SEC filing (Source).

Step 2: Assess The Company’s Financial Reports

The primary financial statements available for publicly-traded companies include the income statement, balance sheet, and statement of cash flows. These financial statements can help investors learn about a company’s cash capitalization structure, cash flow trends and financial position.

My summary of the firm’s recent financial results is below:

The firm’s financials have shown strong but decelerating growth in topline revenue, higher gross profit and gross margin, increasing operating profit and growing cash flow from operations.

Free cash flow for the twelve months ended June 30, 2022, was $106,638.

Sales and Marketing expenses as a percentage of total revenue have dropped as revenue has increased sharply and its Sales and Marketing efficiency multiple rose to 88.9x in the most recent reporting period.

The firm currently plans to pay no dividends on its shares and anticipates that it will use any earnings in the foreseeable future to reinvest back into its business expansion efforts.

LEWY’s CapEx Ratio is a low 1.2x, which indicates it is spending heavily on capital expenditures as a percentage of its operating cash flow.

Step 3: Evaluate The Company’s Potential Compared To Your Investment Horizon

When investors evaluate potential stocks to buy, it’s important to consider their time horizon and risk tolerance before buying shares. For example, a swing-trader may be interested in short-term growth potential, whereas a long-term investor may prioritize strong financials ahead of short-term price movements.

Step 4: Select A Brokerage

Investors who do not already have a trading account will begin with the selection of a brokerage firm. The account types commonly used for trading stocks include a standard brokerage account or a retirement account like an IRA.

Investors who prefer advice for a fee can open a trading account with a full-service broker or an independent investment advisor and those who want to manage their portfolio for a reduced cost may choose a discount brokerage company.

Step 5: Choose An Investment Size And Strategy

Investors who have decided to buy shares of company stock should consider how many shares to purchase and what investment strategy to adopt for their new position. The investment strategy will guide an investors’ holding period and exit strategy.

Many investors choose to buy and hold stocks for lengthy periods. Examples of basic investing strategies include swing trading, short-term trading or investing over a long-term holding period.

For investors wishing to gain a pre-IPO allocation of shares at the IPO price, they would “indicate interest” with their broker in advance of the IPO. Indicating an interest is not a guarantee that the investor will receive an allocation of pre-IPO shares.

Step 6: Choose An Order Type

Investors have many choices for placing orders to purchase stocks, including market orders, limit orders and stop orders.

-

Market order: This is the most common type of order made by retail traders. A market order executes a trade immediately at the best available transaction price.

-

Limit order: When an investor places a buy limit order, they specify a maximum price to be paid for the shares.

-

Stop order: A buy-stop order is an order to buy at a specified price, known as the stop price, which will be higher than the current market price. In the case of buy-stop, the stop price will be lower than the current market price.

Step 7: Submit The Trade

After investors have funded their account with cash, they may decide an investment size and order type, then submit the trade to place an order. If the trade is a market order, it will be filled immediately at the best available market price.

However, if investors submit a limit order or stop order, the investor may have to wait until the stock reaches their target price or stop-loss price for the trade to be completed.

The Bottom Line

LEWY is seeking to go public to fund its general, unspecified corporate growth plans.

The market opportunity for providing freight brokerage and related services in the U.S. is large but expected to grow moderately in the coming years and features significant, fragmented competition.

ThinkEquity is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (60.9%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is a slowing U.S. economy as the Federal Reserve raises interest rates to reduce inflation.

As for valuation, management is asking IPO investors to value the company on an EV/Sales multiple of approximately 1.08x.

This valuation expectation compares favorably to a basket of publicly-held Transportation companies as compiled by noted valuation expert Dr. Aswath Damodaran, which produced an average EV/Sales multiple of 1.52x in January 2022.

However, LeeWay has produced a net margin of 3.19% versus the basket’s 5.97%, so the IPO may be excessively valued.

While the low nominal price of the stock may attract day traders seeking volatility, as is so common in the current environment of low nominally-priced IPOs, I’m concerned about the likelihood of a recession in the U.S., which would negatively impact the firm’s growth trajectory.

I’m also cautious on many of the current crop of low nominal price stocks, as they have difficulty attracting stable institutional investors with longer-term time horizons.

I’m on Hold for the LeeWay Services IPO.

Be the first to comment