TimArbaev

The Renaissance IPO ETF (NYSEARCA:IPO) gives investors a convenient way to invest in newly-listed IPOs. While investing in hot IPO stocks can be exciting and rewarding, investors need to be mindful of the macro environment. Typically, newly-listed companies need “buoyant” risk appetites to perform, as they generally lack large fund sponsorship and need individual investors to bid up their shares. IPOs also tend to be high growth / high valuation companies that perform poorly in rising interest rate environments. Currently, both macro drivers are headwinds. The IPO ETF should be avoided until the macro environment changes.

Fund Overview

The Renaissance IPO ETF gives investors exposure to a portfolio of the largest, most liquid, newly-listed U.S. IPOs. The fund has $156 million in assets.

Strategy

Who doesn’t want to buy the next Tesla, Inc. (TSLA) at its 2010 $17.00 IPO price ($1.13 split-adjusted) and watch it soar 19,000%? Although many retail investors love investing in newly-listed companies, they usually find that in practice, investing in IPOs is not as easy as it sounds.

First, newly-listed companies usually do not have research coverage until weeks or months after listing, so investors must do their own due diligence. This can be a very tedious and time-consuming process. Furthermore, while many IPOs do well initially, there are occasional duds such as the Pactiv Evergreen Inc IPO (PTVE) in September 2020 that quickly fell from its IPO price of $14 to a low of $9.82 in the days following the IPO. An investor buying individual IPOs may have difficulty separating the wheat from the chaff. Finally, for every success that turns into Tesla or Alphabet Inc. (GOOG, GOOGL), there are a dozen mediocre companies that do not pan out.

The IPO ETF aims to solve some of these issues by employing a portfolio approach to invest in newly-listed companies. The IPO ETF tracks the Renaissance IPO Index, an index designed to capture approximately 80% of the total market capitalization of companies that have gone public in the past 3 years that fit the index’s size, liquidity, and free float criteria. Each quarter, the index is rebalanced and companies that have been public for more than 3 years are removed from the index while new companies are added. Index constituents are weighted by their free float-adjusted market cap, and individual positions are capped at 10%.

Portfolio Holdings

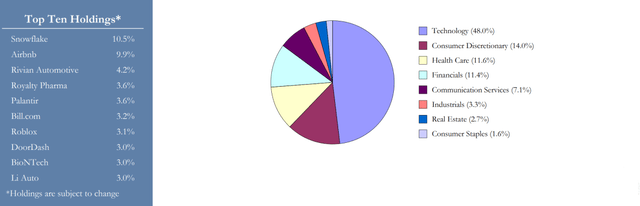

As of September 30, 2022, the fund’s top 10 holdings are shown in Figure 1. The IPO ETF is overweight technology (48%) and consumer discretionary (14%) companies relative to the market, as newly-listed companies tend to have some sort of technology or consumer angle.

Figure 1 – IPO ETF Portfolio Holdings (IPO ETF Factsheet)

Returns

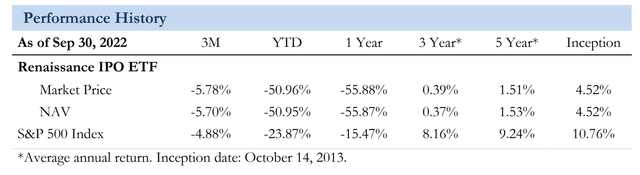

The IPO ETF has performed poorly, with YTD returns of -51.0%. On a 3 and 5 Yr basis, it has delivered average annual returns of 0.4% and 1.5%, respectively, compared to the S&P 500 Index which has delivered YTD/3/5 Yr average annual returns of -23.9%/8.2%/9.2%, respectively (Figure 2).

Figure 2 – IPO ETF Returns (IPO ETF Factsheet)

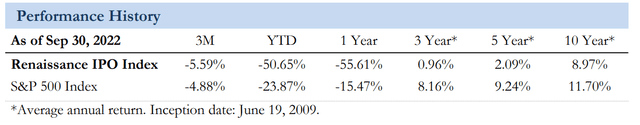

Interestingly, the underlying index, Renaissance IPO Index, has done “well” on a 10-year timeframe, with 9.0% average annual returns. Could this be a case of data fitting, where an index methodology is created using backward-looking rules that do not perform as well in practice?

Figure 3 – Renaissance IPO Index Performance (IPO Index Factsheet)

Distribution & Yield

The IPO ETF does not pay a distribution.

Fees

The IPO ETF charges a 0.60% expense ratio.

IPO Returns Correlated With Risk Appetite

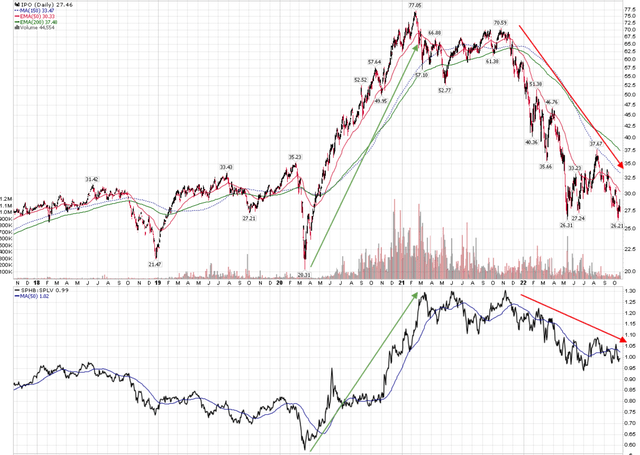

Similar to my argument on Bitcoin, which can be found in my recent article on MicroStrategy Incorporate (MSTR), the performance of IPO stocks are highly correlated to risk appetite, as measured by the ratio of the Invesco S&P 500 High Beta ETF to the Invesco S&P 500 Low Volatility ETF, as shown in Figure 4.

Figure 4 – IPO ETF Performance vs. SPHB/SPLV Ratio (Author created with price charts from stockcharts.com)

Intuitively, this makes sense as newly-listed companies generally do not have large fund sponsorship, so they require “buoyant” risk appetites in order to perform well. Currently, risk appetites remain in a downtrend, hampered by tightening financial conditions. Until the macro situation changes, newly-listed companies are unlikely to do well.

Risk

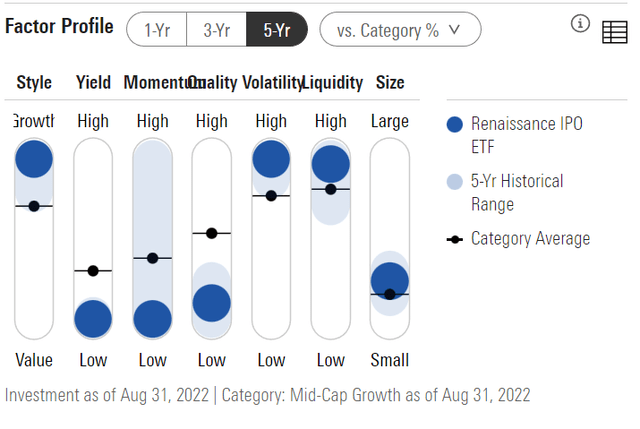

One problem with the strategy of the IPO ETF is that newly-listed companies tend to be high-growth, high-multiple companies such as Snowflake Inc. (SNOW) that trades at 30x trailing EV/Sales, or Airbnb Inc. (ABNB) that trades at 61x trailing P/E. Overall, IPO’s portfolio is overweight growth and underweight quality (Figure 5).

Figure 5 – IPO ETF Factor Profile (morningstar.com)

These “growth” companies tend to do poorly during bear markets, as there is no valuation support level (ABNB still trades at 60x trailing P/E when it has suffered a 30% YTD drawdown) where these stocks are “cheap.”

Furthermore, the valuation problem of growth stocks is compounded by interest rate increases. If we look at a DCF model of a growth company, we find that they tend to have the vast majority of their “value” derived from projected cash flows far out in the future. When interest rates rise, the discount rate used to discount these cash flows also rise, which can cause dramatic declines in NPV “value.”

Conclusion

While investing in hot IPO stocks can be exciting and rewarding, investors need to be mindful of the macro environment. Typically, newly-listed companies need “buoyant” risk appetites to outperform, as they generally lack large fund sponsorship and need individual investors to bid up their shares. IPOs also tend to be high growth / high valuation companies are susceptible to higher interest rates. Currently, interest rates are rising, and risk appetites are trending lower. The IPO ETF should be avoided until the macro environment changes.

Be the first to comment