da-kuk/E+ via Getty Images

This is my first take on Iovance (NASDAQ:IOVA), a 2007 start-up developing tumor-infiltrating lymphocyte [TIL] therapies against cancer. Entering its mid-teens, Iovance is prepping for its initial BLA.

Iovance is taking its first big steps towards becoming a commercial pharma

Iovance Biotherapeutics, formerly known as Lion Biotechnologies, announced the pricing at $6.50 of its ~$50 million IPO in 09/2017. Proceeds were to be used:

…to fund its current and future clinical trials for its product candidates, including its ongoing Phase 2 clinical trials of LN-144, TIL for treatment of metastatic melanoma, and LN-145, TIL for the treatment of cervical and head and neck cancers, to fund activities related to commercial scale-up of the Company’s TIL product manufacturing operations; and for working capital and other general corporate purposes.

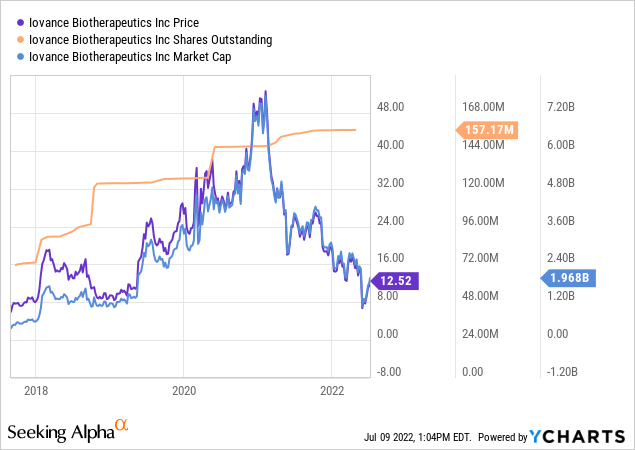

Since that time it has followed a path as shown below:

It peaked with a market cap exceeding $7 billion in early 2021 on enthusiasm over upcoming data reads. Its sharp pullback during late 02/2022 anticipated its Q4, 2021 earnings release with no other apparent trigger, suggesting that its previous share run-up was too far, too fast for the market to digest.

In 05/2021 Iovance suffered twin setbacks. Its data release on lifileucel, in treatment of melanoma disappointed and its CEO resigned unexpectedly. Iovance promptly began a search for a successor. It appointed its general counsel, Frederick G. Vogt, Ph.D., as interim CEO and president. Vogt remains in that role.

Iovance is getting set to launch lifileucel in treatment of melanoma, with BLA filing soon

Lifileucel (LN-144) in treatment of metastatic melanoma is Iovance’s lead therapy. It achieved an orphan therapy designation from the FDA in 2015. It subsequently opened its clinical trial (NCT02360579) titled “A Phase 2, Multicenter Study to Assess the Efficacy and Safety of Autologous Tumor Infiltrating Lymphocytes (LN-144) for Treatment of Patients With Metastatic Melanoma” in 09/2015.

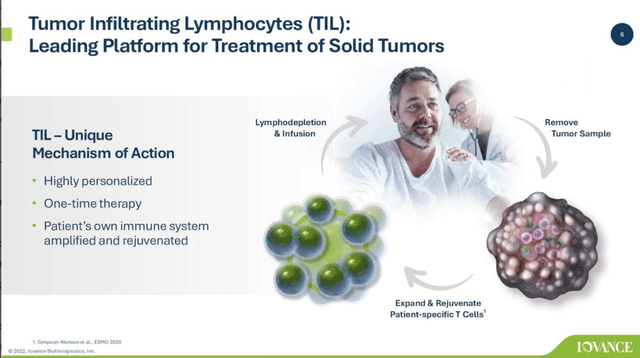

Iovance’s Q1, 2022 earnings presentation describes its tumor inducing lymphocyte (TIL) cancer therapy platform as follows:

Iovance Q1, 2022 earnings presentation (seekingalpha.com)

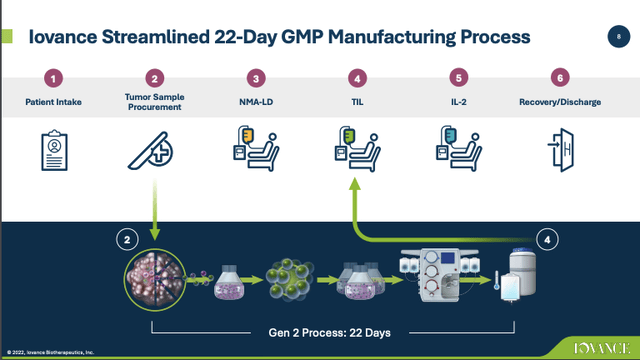

Its TIL therapy is one of several being evaluated for treatment of solid tumors in clinical trials. TIL therapy requires autologous cell harvesting and treatment. This is a complex process that Iovance has streamlined down to 22 days as described below:

Iovance Q1, 2022 earnings presentation (seekingalpha.com)

The process is reminiscent of Gilead (GILD) subsidiary Kite’s CAR T-cell therapy. Kite has winnowed its process down to a turnaround time of 16-19 days. Even if it is approved, the logistics of commercializing TIL therapy will be daunting. In order for it to succeed commercially it will have to show strong therapeutic effect.

As it prepares to file its BLA for lifileucel in treatment of melanoma, it is knee deep in preparations as it described in its Q1, 2022 earnings call (the “Call”) below:

We are performing numerous activities to support the BLA submission at iCTC in parallel with clinical manufacturing, which began at iCTC last year. In addition, we are on track in preparing the iCTC and our contract manufacturer facility for BLA, for FDA approval inspections, which we expect to occur as part of the BLA review process.

Iovance has a cash runway into 2024, but just barely

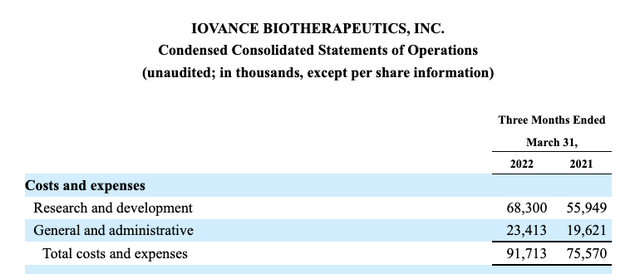

Not surprisingly, such a resource intensive therapy has proven expensive to develop. Iovance has generated an accumulated deficit of $1.264 billion in its 15 years of operation. Iovance has a hefty quarterly expense profile as shown by the excerpt from its Q1, 2022 10-Q below:

Iovance Q1, 2022 10-Q (seekingalpha.com)

It has not generated any revenues from its business and does not expect to in the next 12 months following its Q1 2022 report. It is developing its Iovance Cell Therapy Center (the “iCTC”) which will play a critical role in supporting its BLA application.

Iovance expects its near term expenses to continue to grow as it experiences:

- continued spending on its current and planned clinical trials,

- continued expansion of manufacturing activities,

- higher payroll expenses as the Company increases its professional and scientific staff and continuation of pre-commercial activities.

Despite its significant ongoing expenses, Iovance claims a comfortable financial position as it prepares for its key filing. CFO Bellemin summarized it as follows during the Call:

… As of March 31, 2022, Iovance held $516 million in cash, cash equivalents, investments and restricted cash compared to $602.1 million on December 31, 2021. Our cash usage from operations included certain annual payments totaling $16 million. We maintained prior guidance that our cash position is sufficient to advance our operating plan into 2024, including pipeline development and expansion, commercial manufacturing readiness and launch preparation.

As of the end of Q1, 2022, Iovance was 7 quarters shy of entering 2024. With $516 million in liquidity, that gives it resources of ~$ 71 million per quarter. Accordingly, from a back of envelope perspective it seems inadequate to take it through Q2 and Q3 2023 into 2024.

Conclusion

Iovance clearly has its supporters. If it can prove that its TIL therapy is therapeutically and logistically effective in treatment of solid tumors, it will likely take off into the stratosphere.

At this point I count myself as an onlooker. It still has significant upcoming hurdles which will likely provide better entry points.

Be the first to comment