Editor’s note: Seeking Alpha is proud to welcome Mohammed Saqib as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Olemedia

Investment Thesis

IonQ, Inc. (NYSE:IONQ) is the first pure-play quantum computing company to go public and has moved from strength to strength since its IPO. The company is a market leader in ion trap quantum computers, and its recent generation system exhibits unparalleled 2-Q gate fidelity and AQ scores. The company has sufficient cash balance on its balance sheet to fund its operations without having to raise additional capital in the medium term. The quantum computing industry has already started seeing adoption amongst big tech players, and in my view, IonQ is well-positioned to benefit from the rise of the industry and the potential influx of capital as it continues to execute its roadmap.

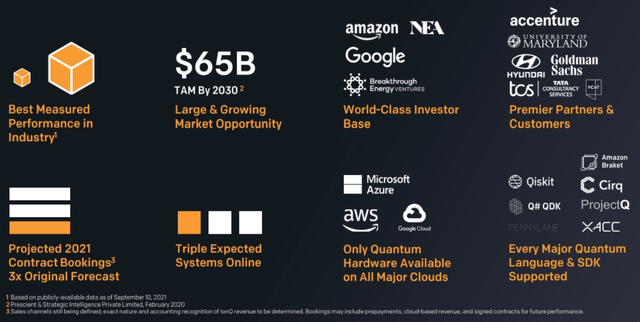

A Large Market Opportunity (IonQ)

Company Description

IonQ, Inc. was founded in 2015 with a mission to “build the world’s best quantum computers in order to solve the world’s most complex problems.” Its key differentiator is its ion trap technology, which is used to generate qubits that are identical, have a comparatively longer lifetime, and can operate at room temperature. This is coupled with an ability to attract top-tier talent that is led by two pioneers of the industry, and together these factors offer a considerable advantage in the race to build machines powerful enough to unlock a plethora of use cases.

A peek into the market opportunity

The development and commercialization of quantum computing is in the early innings of a long game. As an emerging technology with the potential to drastically improve the processing times of certain applications and solve computational problems beyond the reach of classical computers, quantum computing has captured the interests of some of the most powerful technology companies, governments, financial institutions, and top universities worldwide.

Today, access to quantum computing (QC) is commercially available through private and public quantum computing-as-a-service (QCaaS) offerings. Research firms estimate the QCaaS TAM alone is likely to reach billions of dollars by the end of the decade. As per BCG estimates, the total market size of quantum computing in the next 15 to 30 years could stand at $450 billion to $850 billion. While there is no consensus on the totality of applications that QCs may ultimately address, most experts believe QCs will likely provide the greatest benefits to the finance, logistics, chemistry/materials science, and healthcare industries by more efficiently solving optimization, simulation, machine learning, and cryptography problems.

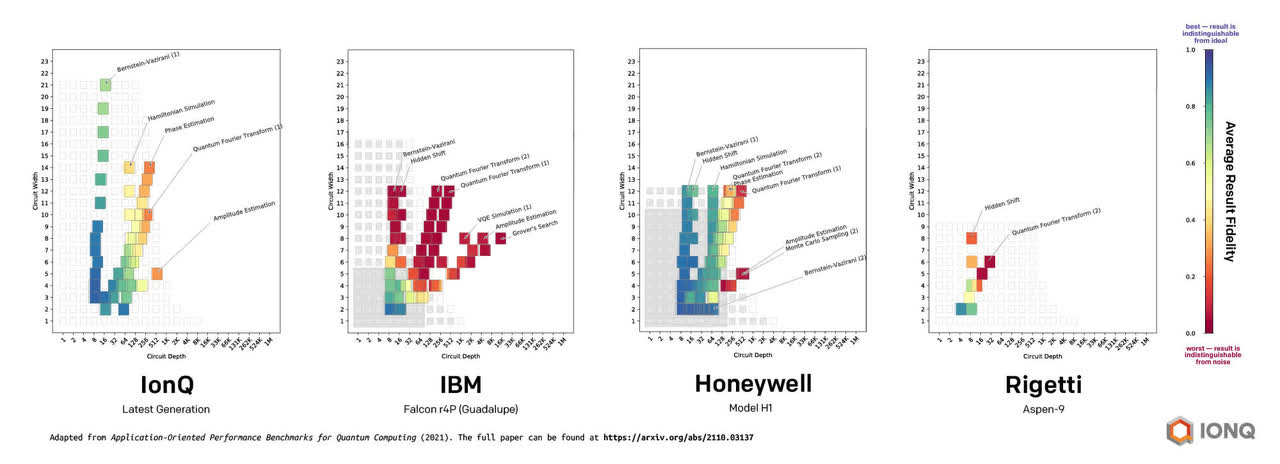

IonQ claims the industry’s highest-performance quantum computer

Though it may seem counterintuitive, using qubit count as the measure of the performance of a quantum computer is not a good benchmark as qubit count fails to consider important drivers of performance including fidelity, connectivity, gate speed and coherence times. In an attempt to better measure the real-world performance of quantum computers, IonQ introduced the Algorithmic Qubit benchmark (#AQ). IonQ’s Aria system posted an industry-leading #AQ score of 20, versus ~12 for Honeywell (HON), ~8 for International Business Machines (IBM), and 6 for Rigetti (RGTI).

IonQ benchmark score vs Peers (IonQ)

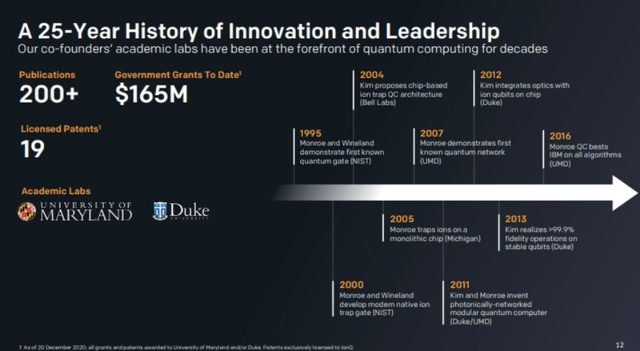

Founded by leading QC scientists, IonQ benefits from their research and funding

IonQ was co-founded in 2015 by Dr. Christopher Monroe and Dr. Jungsang Kim. The two are authors of more than 200 technical publications and hold 50+ patents and patent applications. Their work at the University of Maryland and Duke University forms the basis of IonQ’s technology. Dr. Monroe demonstrated the operation of the first quantum logic gate with Dr. David Wineland, whose 2012 Nobel Prize in Physics was partially credited to this work. Dr. Kim is a professor of ECE and physics at Duke University as well. While at Duke, Dr. Kim pioneered and invented multiple technologies critical to introducing trapped ions to the commercial setting. IonQ has a royalty-free licensing agreement with Duke through 2026 that provides the company a non-exclusive license to all IP developed by these professors’ labs.

A strong history of leadership (Company Presentation)

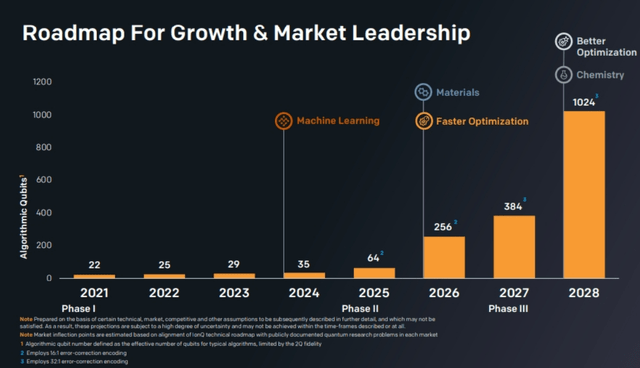

Roadmap for growth, fault-tolerant quantum computing

IonQ has already established the performance leadership of its quantum computers and has among the highest fidelities in the industry. To further improve its fidelities, IonQ will transition from Ytterbium ions to Barium ions in future systems. IonQ was the first to demonstrate an error-corrected qubit with a 13:1 overhead rate. IonQ’s superior fidelities allow the company to implement quantum error correction with a lower overhead rate than peers. IonQ is also developing photonic interconnect technology to connect multiple quantum processors together, thereby enhancing scalability.

IonQ roadmap (Company Presentation)

Revenue Model

IonQ currently sells access to its 11-qubit Harmony quantum computers through all three major quantum computing-as-a-service (QCaaS) cloud providers – Amazon Bracket, Microsoft Azure Quantum, and Google Cloud. IonQ expects to make its next-generation 32-qubit Aria quantum computer available on Azure Quantum in the near future. The company also sells access to its Harmony and Aria systems to select customers via IonQ’s own cloud service. Offering quantum computing as a service (QCaaS) eliminates the cost and complexity of manufacturing, shipping, and servicing on-premise customer systems and strengthens intellectual property security by lowering the risk that competitors might reverse engineer the company’s systems. Management believes the QCaaS service approach will accelerate the adoption of quantum computing.

What are the sources of revenue?

IonQ has four primary revenue streams: 1) public cloud revenue from calculations run through the major hyperscalers (Azure Quantum, Amazon Bracket, Google Cloud), 2) private cloud revenue for customers who do not want their calculations to get batched in with other jobs and instead choose to run them on the IonQ cloud, 3) joint application development/ professional services revenue that includes aiding in the development quantum algorithms, and 4) system sales where the company sells a complete ion trap quantum computer to a customer. Management does not believe it is meaningful to break out the revenue among these different streams yet since the business is still at an early stage.

Anticipating two stages of quantum algorithm deployment

The development stage will consist of IonQ experts assisting customers’ creation of algorithms geared toward solving their business challenges. Revenue in this stage will be a mix of computing usage and consulting service fees and will transition to a hardware usage-based model in the application stage once algorithms are fully developed. The application stage is expected to supply a steady stream of revenue and holds the potential for incremental growth as complexity and inputs scale.

Scorpion Capital Short Report Lacks Substance

On May 3, 2022, Scorpion Capital released a report outlining its reasoning for taking a large short position in IONQ shares. Based on interviews with former employees and other industry participants from which many comments were taken out of context, Scorpion essentially claimed IonQ as being a hoax. The report alleges that IonQ’s 32-Q Aria system is a toy, may not even exist, and is not capable of useful calculations, while also stating the co-founders treat IonQ as their side hustle. The Scorpion report makes several other outlandish claims, and it is quite clear that Scorpion’s main arguments are elementary in nature, false and misleading, and easily refutable.

Some of the key allegations made are as follows.

The claim: Aria is not real

Aria is already offered as part of IonQ’s private cloud, and IonQ is currently building a second Aria system. Also, the company recently announced Forte, its next-generation system following Aria, will be released privately in late 2022 to lead customers and partners and to a broader audience in 2023.

The claim: UMD’s $14 million contract with IonQ represents a conflict of interest

- On September 8, 2021, IonQ and UMD announced a $20 million partnership to form the National Quantum Lab (Q-Lab) at UMD. Q-Lab will be the nation’s first user facility that enables the scientific community to pursue world-leading research through hands-on access to a commercial-grade quantum computer. As part of the $20 million investment, UMD now has access to IonQ’s quantum hardware. Additionally, IonQ disclosed in its September 30, 2021, 10-Q a multi-year contract with UMD “to provide quantum computing services and facility access related to Q-Lab in exchange for payments totaling $14 million.”

- UMD is a leader in the field of computer science and sees quantum computing as an important part of the future of computer science. The contract with IonQ provides UMD students, researchers, and faculty access to the industry’s latest and highest-performance quantum computers. UMD aims to become a central location for undergraduate and Ph.D. students interested in studying quantum applications, where access to top systems will attract the best talent.

- Both of IonQ’s co-founders are now at Duke University, making it hard to imagine they had influence over the UMD committees and budget approval required for such a large contract to be signed.

- IonQ expects a total contract value of bookings of $23 million – $27 million in 2022, none of which is expected to come from UMD or Duke.

The claim: IonQ’s system can’t even properly calculate 1+1

- It is well understood by the industry that quantum computers are not intended to be used for solving simple problems that classical computers or calculators can easily solve. Scorpion attempted to show IonQ’s systems do not show technological superiority in this calculation, educated participants in the industry understand this is a laughable example and not an intended use case for quantum computers (especially given the amount of emphasis Scorpion placed on this claim).

- Quantum computers provide probability distributions as solutions, whereas classical computers provide deterministic solutions. The solution to a quantum algorithm includes a set of potential outcomes (basis states) each with an associated probability amplitude (the sum of the squares of the probability amplitudes is equal to 1 or 100%). After measurement, one of the possible outcomes (basis states) is obtained with a certain probability (the square of its probability amplitude). In order to determine the entire probability distribution of the possible outcomes, quantum calculations are typically run many times (e.g., 1000 times or shots is common). Knowing that quantum computers provide probability distributions, the evidence provided by Scorpion Capital with this claim actually disproves the claim. Scorpion ran the 1+1 calculation over 5 separate runs, each with 1000 shots, for a total of 5000 shots. On average, each run ended up calculating 1+1=2, ~656 times (for a probability of 65.6%). With the quantum computer providing “2” as the highest probability outcome (with a probability well over 50%), the quantum computer, in fact, did calculate the correct solution!

IONQ Valuation – At a compelling level after recent pull-back

Reflecting challenging equity market conditions, the rising interest rate environment, and the Scorpion Capital short report, IonQ shares have recently traded below $5.00 per share. I view the pullback in IONQ shares as an attractive entry point. As of September 30, 2022, IonQ had $405 million of cash and investments on its balance sheet, equivalent to net cash per share of $2.05. It is worth noting that, IonQ has the strongest balance sheet among the pure-play quantum computing companies. Based on the company’s November 18, 2022, closing price of $4.92, about 40% of the company’s current market capitalization is supported by cash on the balance sheet. Accordingly, the market is effectively valuing the company’s technology at less than $600 million. Despite forecasting negative free cash flow through 2026, I believe IonQ has enough cash on its balance sheet to fund operations through cash flow breakeven in 2027.

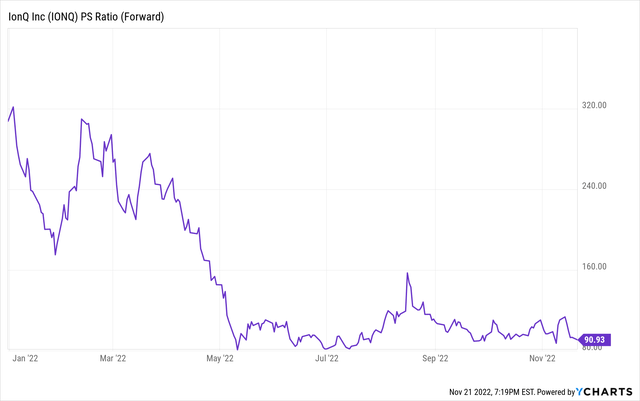

Valuing a company in its nascent stages can be tricky and highly subjective. IonQ is well on its way to achieving 2022 revenue between $10.2 million to $10.7 million. Based on the current year’s expected annual revenue and current market cap, IonQ is trading at a forward P/S ratio of about ∼90x. While this may seem high, it is significantly lower than ∼300x seen in the early part of 2022. Based on the strong booking momentum and the company’s roadmap, I expect the company to grow revenues to ∼$50 million by 2024, which essentially means that the company is currently trading at ∼20x 2024 P/S ratio, which is highly appealing in my opinion, given the company’s growth prospects.

IonQ PS ratio (forward) (Ycharts)

Record Bookings Growth in Q3 2022

IonQ reported $2.8 million in revenue for Q3 2022, in-line with the management’s guidance of 2022 revenue to be between $10.2 million and $10.7 million. It is worth noting that the company’s annual revenue in 2021 stood at $2.1 million. However, the main takeaway from the quarter’s result was the record bookings during the quarter.

IonQ reported new total contract value (TCV) bookings of $16.4 million in Q3 2022 which brings the total bookings during the year to $21.2 million. The company is well on its way to achieve annual bookings in the range of $23 million and $27 million for the full year 2022, a significant improvement from $16.7 million in 2021. I see the strong momentum in bookings to continue setting the base for a healthy revenue growth going forward in 2023 and 2024. I see TCV bookings increasing to $40 million in 2023 and $80 million in 2024. Should the company book an order for one of its ion trap quantum computers, cumulative TCV bookings from 2021-2023 may exceed $100 million and beat current estimates. The upside surprise to TCV bookings estimates and the achievement of technical milestones will serve as upside catalysts for IONQ shares going forward in the near term.

Major competitors

|

Company |

Qubit Type |

Metrics |

|

Microsoft (MSFT) |

Superconducting – Topological |

|

|

Intel (INTC) |

Superconducting |

|

|

PsiQuantum |

Photonic |

|

|

Rigetti |

Superconducting |

|

|

Xanadu |

Photonic |

|

Risks

The company is expected to post substantial losses for several years, opening up the possibility of shareholder dilution through secondary offerings or convertible debt. Losses may incur at an increasing rate if R&D increases (as IonQ forecasts) and sales growth is lower than expected. Delayed quantum adoption poses the risk that end-users will not be as accepting of the technology as the industry expects, leading to slower scaling and lower sales.

Larger competitors with significantly greater resources will be able to survive any potential “quantum winters” without the risk of raising additional capital or complete failure. The freedom of greater funding may accelerate the competition’s scaling progress. Additionally, these competitors have the capital to entice the best talent.

Conclusion

Although the quantum computing industry is in its nascent stage, the market opportunity is large. The viability of the technology and its commercial applications are proved, with technology giants such as Google (GOOG) (GOOGL), IBM, Amazon (AMZN), Intel, and Microsoft actively developing an ecosystem for quantum computing (QC). IonQ has laid out a clear pathway and has made notable advancements in a short period. As IonQ scales its ion trap devices over the next few years, I believe large organizations, likely universities or government labs, will start to see the value in running solutions on their own quantum computers and will turn to companies like IonQ to purchase leading-edge quantum computers. Accordingly, system sales may not be that far away for IonQ and represent a significant driver of incremental revenue on top of QCaaS sales.

Be the first to comment