Drivers of the multi-year underperformance

US Healthcare is the 2nd largest equity sector, with a 14% index weight, and has been a perennial underperformer the last five years (see chart), and lagged by 10 points last year alone. This was even as the sector has continued to post robust growth, with the highest revenue and EPS growth of any US sector last year, as valuations continued to derate.

The valuation derating has been led by the Pharma component, which makes up 30% of the US universe, with Healthcare Equipment the only segment to buck the trend. The derating has been driven by drug pricing and regulatory concerns, and the rise of generics and biosimilars competition. This has been exacerbated by investor concerns on the US the electoral cycle, with Democrats Medicare for All amongst proposals to reverse perceptions of the high spending and poor outcomes of US healthcare system.

COVID crash causing a multi-year sector revaluation

This all changed in Q1 with the COVID pandemic and equity market collapse. The sector has begun to outperform (-17% vs -22% for S&P 500), and we believe this continues as:

- Investors refocus on the sector, given its defensive properties of low leverage and sustainable cash flows and dividends in a recession.

- The COVID pandemic relatively supports earnings, as governments and consumers ramp up spending in many healthcare segments.

- We see a reduction in the regulatory concern valuation discount, as the sector leads a multi-year global effort to combat the virus.

This is in addition to the pre-existing secular sector trends. Healthcare spending continues to benefit from accelerating middle class growth demand in Emerging Markets and ageing populations in Developed Markets.

Cheap valuation, defensive earnings, and unloved sector

We believe the sector is particularly sensitive to this potential change in sentiment given its cheap valuation, earnings resilience, balance sheet strength, and out-of-favour investor stance.

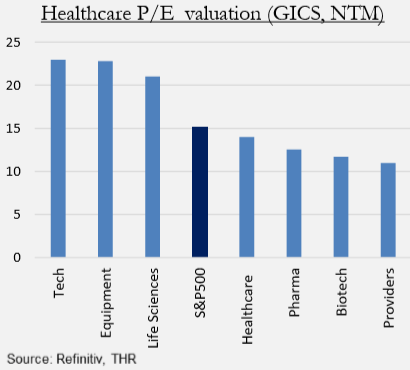

Cheaper valuations: The US Healthcare forward P/E has derated to a 32% discount versus its 10-yr average, compared to a 9% discount to history for US equities. Looking at intra-sector valuations Biotech (3rd largest sector weight) and Pharma (largest weight) both trade at a discount to the sector (chart below) and to the broader US market. Healthcare Tech, Equipment (2nd largest index weight), and Life Sciences all trade at a premium to the overall sector.

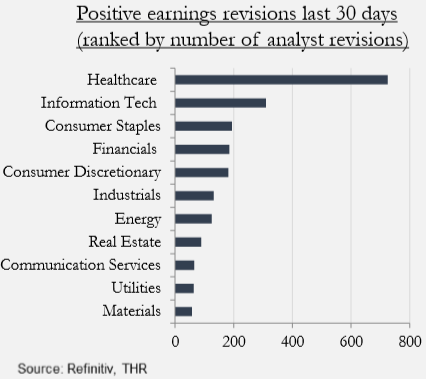

Defensive earnings: The sector not only has some of the best US earnings growth, but this is defensive in the current environment. Consensus forecasts for ‘trough’ Q2 2020 EPS are +3% for the sector vs -10% yoy for the market. The sector lags only IT in its full year earnings growth outlook, of +6%. The sector is also seeing twice the positive EPS revisions compared to other sectors – a rarity in this environment. The chart below shows the number of analysts whose current estimate is higher than 30 days ago.

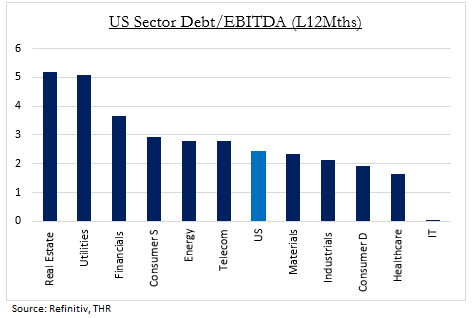

Strong balance sheets: The sector has the second lowest leverage of any US sector, only behind tech (Chart below). Sector debt/EBITDA stands at 1.66x compared to 2.50x for the overall market, and 5x for the most leveraged Real Estate and Utility sectors. This gives significant financial flexibility to maintain dividends, buybacks, or do M&A, unlike most other sectors:

- Healthcare saw a relative increase in M&A activity during the 2008-2010 global financial crisis, according to Refinitiv, with the Healthcare sector M&A market share increasing double-digit compared to before the crisis.

- Healthcare sector heavyweights Merck and J&J were amongst the 20 largest users of share buybacks last year.

- Healthcare is the fourth largest sector, with a 10.6% weight, in the S&P Dividend Aristocrats index, made up of stocks that have increased dividends every year for the last 25 consecutive years. AbbVie (NYSE:ABBV) and Cardinal Health (NYSE:CAH) are amongst the top ten largest weighted stocks.

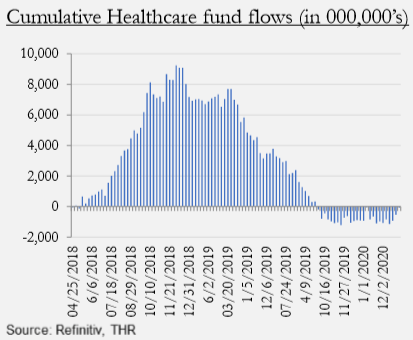

Out of favour: We think there is room for buy-side sentiment to improve on the sector in this environment, after seeing significant mutual and ETF fund outflows (see chart below) over the past year, and with only a modest flows reversal in recent months, despite the significantly changed sector outlook.

What to own and why

We recommend a broad healthcare sector exposure, to capture the turnaround in valuation, earnings, and sentiment.

The largest broad Healthcare sector ETF is the US$18bn Health Care Select Sect SPDR ETF (NYSEARCA:XLV). It has a trailing 1.8% dividend yield, and the five largest stocks are Johnson & Johnson (NYSE:JNJ), UnitedHealth (NYSE:UNH), Merck (NYSE:MRK), Pfizer (NYSE:PFE), and Abbott Laboratories (NYSE:ABT).

The US$8bn Vanguard Health Care ETF (NYSEARCA:VHT) has a similar dividend yield but is much more diversified, with 390 stocks, versus 60 for XLV, and with the top 10 stocks making up 42% of the ETF vs 51% for XLV. The top stock composition is broadly comparable, though with Bristol-Myers (NYSE:BMY) as its 5th largest position. Both are very diversified by sub-sector, with the VHT breakdown: Pharmaceuticals (29.2%), Healthcare Equipment (23.1%), Biotechnology (18.5%), Managed Health Care (9.7%) and Life Sciences (7.3%).

Whilst our preference is for the diversification of a broad sector position, more specific exposure is available for those with particular conviction. The 3rd largest sector ETF is the US$6bn iShares Nasdaq Biotechnology ETF (NASDAQ:IBB), and fourth largest is the US$4bn iShares U.S. Medical Devices ETF (NYSEARCA:IHI).

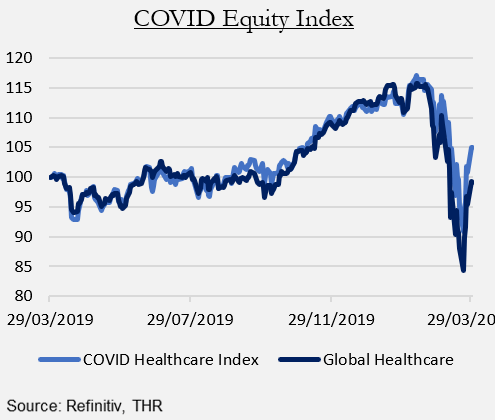

We have also looked at the specific companies at the forefront of the fight against COVID. We constructed a bespoke index out of 11 companies that are potential beneficiaries of the COVID outbreak. Namely AbbVie (ABBV), Gilead Sciences (NASDAQ:GILD), FUJIFILM Toyama Chemical (OTCPK:FUJIF), Regeneron (NASDAQ:REGN), Chugai (OTCPK:CHGCF), Moderna (NASDAQ:MRNA), Abbott (ABT), LabCorp (NYSE:LH), Quest Diagnostics (NYSE:DGX), Becton, Dickinson (NYSE:BDX), and Medtronic (NYSE:MDT).

AbbVie produces the anti-viral Kaletra, Gilead Remdesivir, and Toyama anti-influenza Favipiravir. Regeneron is working on the anti-inflammatory Kezvara, and Chugai on Actemra, which is already widely approved to treat Rheumatoid Arthritis. Moderna is one of the leaders in creating a vaccine and has a manufacturing relationship with Merck. Finally, Abbott, LabCorp, and Quest Diagnostics are heavily involved in diagnostic testing, and Becton, Dickinson and Medtronic amongst the leading ventilator makers.

Interestingly, as a group, shown by the index above, they have only moderately outperformed the healthcare sector so far, whilst trading at a lower overall valuation (14x vs 16x forward P/E) and having a similar low leverage level.

Risks: Recovery rally or government involvement

We believe the main risks to the broader sector are two-fold, and the opposite of each other:

That the COVID crisis passes quicker than perceived, and the traditionally defensive and low beta healthcare sector lags what could be a significant equity recovery rally, given the depth of the current recession and unprecedented amount of fiscal and monetary stimulus deployed. For comparison, in the 12 months from the March 2009 US market bottom the MSCI US healthcare index rose 47% vs the broader 69% rise of the US market.

The alternative risk is that the crisis drags on, becomes ever more serious and political frustrations with the sector become clearer, in terms of insurer coverage, pharma and biotech ability to develop therapies and vaccines, and equipment companies to provide sufficient support. Government intervention in the sector, mandating production and facilitating new entrants (see ventilators) could grow. This could end up boosting price competition, regulatory risk and derating sector valuations further.

Conclusion: Healthcare outperformance to continue

Healthcare, the 2nd largest US equity sector, has been a perennial underperformer, lagging the S&P 500 for five years, and underperforming 10% last year. This has changed with the COVID crisis, and we think outperformance has just begun. Investors will now focus on sectors defensive characteristics and financial flexibility, whilst COVID is relatively boosting earnings and may reduce regulatory overhang concerns. Valuations are derated, earnings resilience coming through, and sector relatively under-owned. Low leverage gives unique flexibility on dividends and M&A. Broad sector exposure is available through healthcare ETFs such as XLV and VHT. Our 11 stock COVID basket has only moderately outperformed, and trades at a sector discount.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment