Dilok Klaisataporn

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Last November I gave the Invesco Variable Rate Preferred ETF (NYSEARCA:VRP) a Buy rating. With hints of inflation in the air, expectations were the FOMC would tighten, forcing other rates to follow them upward. Variable, or floating-rate assets should hold their value in such times, but that was too simplified.

The key to variable/floating-rate funds is understanding how the resets work. First a definition:

A floating-rate note (FRN) is a debt instrument with a variable interest rate. The interest rate for an FRN is tied to a benchmark rate. Benchmarks include the U.S. Treasury note rate, the Federal Reserve funds rate-known as the Fed funds rate-the London Interbank Offered Rate (LIBOR), or the prime rate.

Floating-rate notes usually pay a lower yield to investors than their fixed-rate counterparts because floaters are benchmarked to short-term rates. The investor gives up a portion of the yield for the security of having an investment that rises as its benchmark rate rises. However, if the rate of the short-term benchmark falls, so too does the rate on the FRN.

An FRN’s interest rate can change as often or as frequently as the issuer chooses, from once a day to once a year. The reset period, which is outlined in the bond’s prospectus tells the investor how often the rate adjusts. The issuer may pay interest monthly, quarterly, semiannually, or annually.

Source: Investopedia

As noted, the bonds/preferreds rate terms (fixed+floating, reset period. etc.) are defined in the assets’ prospectus, which sometimes are hard to track down unless you have the CUSIP or SEDOL. I did locate a few and they are covered under the Holdings review section of this article.

Invesco Variable Rate Preferred ETF review

Seeking Alpha describes this ETF as:

The investment seeks to track the investment results of the ICE Variable Rate Preferred & Hybrid Securities Index. The fund will invest at least 90% of its total assets in the components of the index, as well as ADRs that represent securities in the index. The index provider compiles and calculates the index, a market capitalization-weighted index designed to track the performance of floating and variable rate investment grade and below investment grade U.S. dollar denominated preferred stock, as well as certain types of hybrid securities. VRP started in 2014.

Source: Seeking Alpha

Index review

With VRP asset selection is based on an Index, understanding VRP will start there. ICE describes the Index; unfortunately one needs an ICE account to see this.

-

Index tracks the performance of floating and variable rate investment grade and below investment grade U.S. dollar denominated preferred stock and hybrid debt publicly issued by corporations in the U.S. domestic market.

-

Securities have at least one day remaining to maturity and at least 18 months to final maturity at time of issuance; issued in either $25 or $1000 par increments; and have a floating rate coupon or dividend. Fixed to floating rate securities are included in the index even while in their fixed rate period.

-

Qualifying constituents that are listed on the NYSE or NASDAQ exchanges, and must have at least $100 million face amount outstanding. All other constituents must have at least $350 million face amount outstanding.

-

The index includes debt securities, preference shares (perpetual preferred securities), American Depository Shares/Receipts (ADS/R) as well as domestic and Yankee trust preferreds.

-

The index includes $25 par securities that are rated investment grade or below investment grade, or that are unrated. Qualifying $1000 par securities must be rated by at least one of Moody’s, S&P or Fitch and those rated below investment grade based on an average of Moody’s, S&P and Fitch must also have a country of risk associated with a developed markets country.

Index constituents are market capitalization weighted subject to the following diversification constraints.

i) First, the index is divided into two groups: a small cap group comprised of issuers with weights less than 4.5% and a large cap group comprised of issuers with weights greater than or equal to 4.5%.

ii) A 4.25% cap is applied to issuers in the small cap group, with any excess weight redistributed within the small cap group to all issuers under the cap. If all issuers in the small cap group reach the 4.25% cap, then any remaining excess weight is redistributed.

iii) A 45% cap is applied to the combined weight of all issuers in the large cap group. If the weight of the large cap group is greater than 45%, the weight of all bonds in the group reduced on a pro rata basis, provided that no issuer weight is reduced below 4.5%.

iv) The excess weight from any reduction in the large cap group is redistributed to issuers in the small cap group with weights below the 4.25% cap.

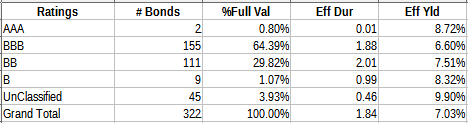

The following data was pulled from ICE Index Platform. Invesco did not provide this level of detail so any drift from the Index holdings is not available. Ratings allocations are such. Morningstar gives VRP an overall rating of “BBB-“.

PVAR09292022Distribution.xlsx

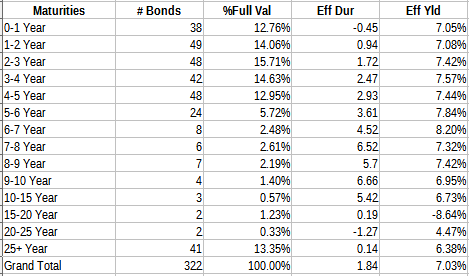

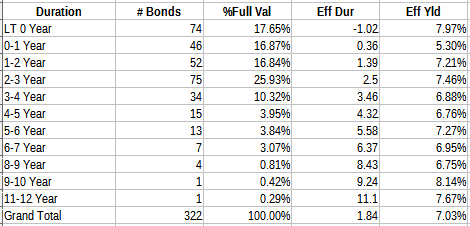

I estimate the WAM at just over 7 years.

PVAR09292022Distribution.xlsx

Morningstar shows Effective Duration at 2.85 years.

PVAR09292022Distribution.xlsx

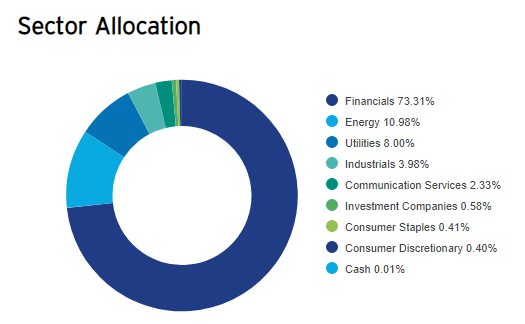

The Sector data does reflect VRP holdings.

invesco.com VRP holdings

VRP holdings review

I tried finding detailed data to answer the question on how the floating-rate resets work. It was a painful process and failed numerous times which is why some of the largest holdings are not presented.

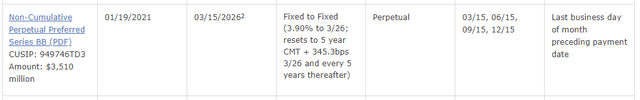

For the above Wells Fargo security, the reset happens every five years, starting in 2026. The “CMT rate” means, for any interest determination date, the rate published by the FRB, or its successor, on its website or in another recognized electronic source, as the yield is displayed for Treasury securities at “constant maturity” under the column for the Designated CMT Maturity Index. Despite the name, VRP holds securities that are still in the fixed-rate period and these securities are crashed the most when rates increase.

Another security held is the JPMorgan Chase & Co., 7.90% Fixed/Float Dep Shares Non-Cumul Preferred Stock I, for which I found the prospectus, and found this description of their floating-rate rules:

Dividends on shares of the Preferred Stock will not be mandatory. Holders of the Preferred Stock will be entitled to receive, when, as, and if declared by our board of directors or a duly authorized committee of our board, out of our assets legally available under Delaware law for payment, non-cumulative cash dividends based on the liquidation preference of the Preferred Stock at a rate equal to (1) 7.90% per annum for each semi-annual dividend period from the issue date of the depositary shares to, but excluding, April 30, 2018 (the “Fixed Rate Period”), and (2) three-month LIBOR plus a spread of 3.47% per annum, for each quarterly dividend period from April 30, 2018 through the redemption date of the Preferred Stock, if any (the “Floating Rate Period”).

Source: SEC Filing

The current coupon pays only 6.28% but with the 3-mo LIBOR now at 3.64%, I would expect the next payment to be at 7.11%, scheduled for the end of October. While this security is floating, the 347bps fixed portion is not one of the better ones and that would hurt performance.

The JPMorgan Chase (48128BAG6) was issued with SOFR as the expected floating rate:

We will pay dividends on the Preferred Stock, when, as, and if declared by our board of directors or a duly authorized committee of our board, from the date of issuance to, but excluding February 1, 2025, at a rate of 4.60% per annum, payable semiannually in arrears, on February 1 and August 1 of each year, beginning on August 1, 2020. From and including February 1, 2025, we will pay dividends when, as, and if declared by our board or such committee at a floating rate equal to a benchmark rate (which is expected to be Three-Month Term SOFR) plus a spread of 3.125% per annum, payable quarterly in arrears, on February 1, May 1, August 1 and November 1 of each year, beginning on May 1, 2025. Dividends on the Preferred Stock will not be cumulative.

Source: JPMorgan

When it floats, its fixed component is even smaller than the previous JPMC preferred. As is the case with almost all bank/insurance company issued preferred, the dividends are non-cumulative, meaning missed payments do not need to be made up.

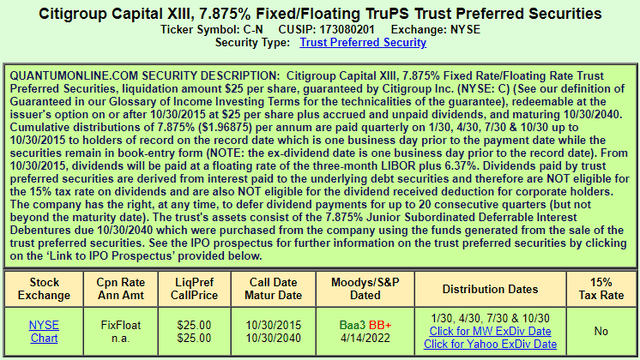

One of the site I regularly use for fixed income data is Quantumonline.

Unlike some other, this Preferred is floating and the add-on (6.37%) has the current payout above the old fixed rate (9.2% vs. 7.875%).

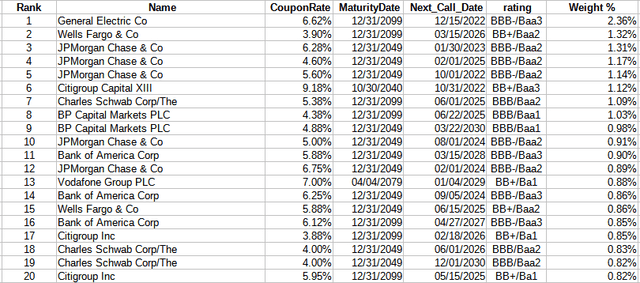

VRP top holdings

invesco.com; compiled by Author

VRP currently hold about 320 assets, of which the Top 20 comprise 21% of the portfolio weight. I could not find data on the largest holdings other than it appears to be a international issue with a 5% coupon, now floating.

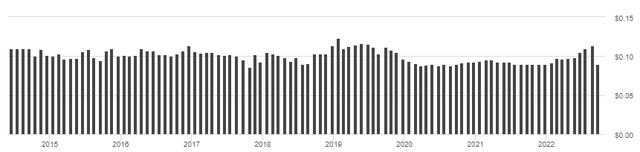

VRP distribution review

With the large reduction in the last payout, it brings into question what the going forward yield on VRP will be. I was unable to find any information on why the cut was made.

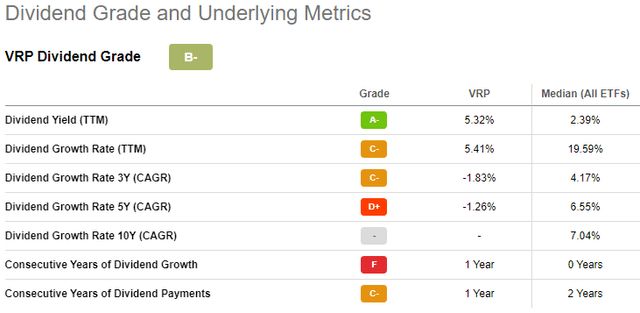

Seeking Alpha gives VRP a “B-” overall grade for their distribution history.

seekingalpha.com VRP scorecard

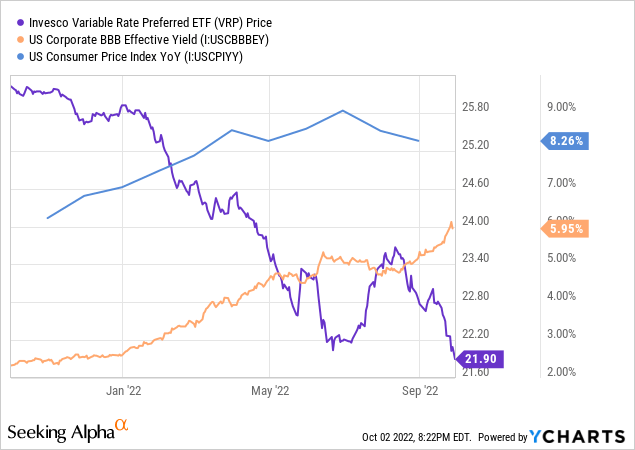

The past year: why?

Like many experts, 8+% inflation wasn’t in my analysis for VRP and thus how much interest rates on BBB-rate assets would climb. In a moment, I will compare VRP to other fixed income ETFs. Here I will suppose reasons, other than BBB rates rising 155%, for VRP’s dismal performance. Despite its name, there are several important unknowns about its holdings that could explain this.

- Portfolio weight where assets are still under a fixed rate.

- Portfolio weight where the floating rate changes slowly.

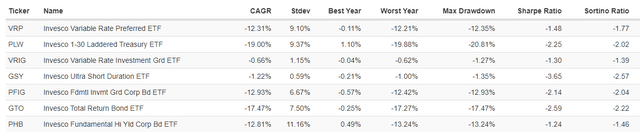

Besides these unknowns, there is one known that helps explains it. The next table includes other Invesco fixed income ETFs and we see that VRP falls in the middle for CAGR over the past year and indicates a key variable that is not rates: duration.

| Ticker | Duration | Wt Avg Cpn | Yield |

| VRP | 2.72 | 5.48% | 4.86% |

| PLW | 10.10 | 4.01% | 2.06% |

| VRIG | .08 | 3.84% | 3.47% |

| GSY | .64 | 1.55% | 2.28% |

| PFIG | 4.53 | 3.24% | 2.69% |

| GTO | 6.26 | 3.78% | 3.61% |

| PHB | 3.86 | 4.94% | 3.76% |

There is a 100% correlation between duration and returns, with Invesco Variable Rate Investment Grade ETF (VRIG) and Invesco Ultra Short Duration ETF (GSY) having the shortest durations and best returns: VRP places 3rd for both but way behind.

So it appears that my error last year was putting too much confidence in the fact “variable rate” in the name without doing enough due diligence to evaluate how the holdings would be positively affected by their floating-rate features to offset the 3-year duration VRP had at the time too. Based on that duration and 350bps rate movement, a 10.5% price hit might be predict, reality was much worse.

Portfolio strategy

Investors have an old reliable choice back that was gone for most of the past decade: brokered CDs. Just six months ago, 1-yr CDs were probably less than 50bps.

Now those CDs yield over 4%. The average yield on assets like those held by VRP are 5.76%. In other words, investors might gain 176bps in yield for taking on price risk and defaults risks. Changes the risk/reward decision from twelve months, or even six months ago.

Final thought

One thing I learned is sometimes it is hard to find all the data you need to make the “perfect” decision on some investments. Toss in that the future can throw you a curve ball (COVID, Ukraine, 40-yr inflation), and you could start suffering from “analysis paralysis”. Go with what you know, be ready to reverse the trade when new information becomes available.

Be the first to comment