AlexSecret/iStock via Getty Images

Thesis

In a market environment where interest rates continue to rise and high-valuation stocks exhibit elevated volatility levels, more and more investors search for stable income-yielding investments to maximize cash flow generation and protect their assets from downside risk. Invesco’s S&P 500 High Dividend Low Volatility ETF (SPHD) claims to do just that. With monthly dividend payments and an allocation meant to reduce volatility, the fund’s attractiveness, examined in this analysis, initially seems strong.

Market Rotation

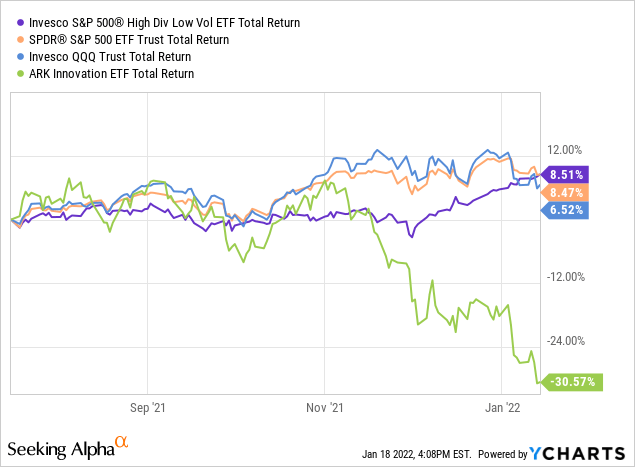

If the 12 months following the Covid-19 crash in March 2020 were the moment for stocks with strong growth potential and uncertain long-term profitability to shine, since the first half of 2021, investor sentiment has drastically shifted. The large-cap technology index Nasdaq 100, tracked by the widely popular Invesco QQQ ETF, has barely posted any gains over the trailing 6-month period, while the even more aggressive ARKK ETF has incurred significant losses. As rates are expected to rise and the Fed declares imminent balance sheet contraction, high multiple stocks are hurting, with investors turning to more traditional, income-yielding names. SPHD over this period has outperformed both the S&P 500 and the two other cornerstone ETFs mentioned above. Total return levels over the last 6 months are presented in the chart below.

Fund Structure

Invesco’s S&P 500 High Dividend Low Volatility ETF tracks the S&P 500 Low Volatility High Dividend Index, aiming to deliver monthly dividend payments while protecting portfolios from downside risk. The fund is rebalanced semi-annually, in January and July. Currently, SPHD offers a 3.40% yield and an expense ratio of 0.30%, somewhat higher than what the competition charges.

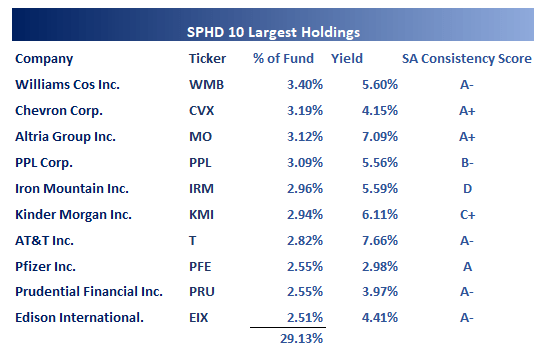

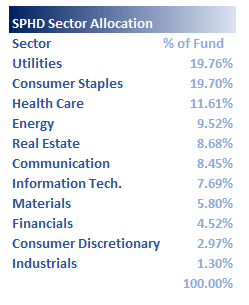

While in recent years broader market ETFs are becoming heavily weighted towards technology stocks, SPHD has adopted an allocation that remains much more diversified. The fund provides exposure to all sectors with the Industrials sector representing the fund’s smallest weighting at 1.30% and Utilities the largest (19.76%) followed by the Consumer Staples sector at 19.70%. Technology represents only 7.70% of total funds and while that seems logical since the fast-growing and expensively valued sector offers limited quality dividend choices, it offers nonetheless some portfolio diversification benefits for the average investor.

Mega cap stocks, especially in the technology sector are dominating the market. By recording accelerated growth, stocks like Apple (AAPL), Microsoft (MSFT) and a few others, have come to occupy a significant percentage of the market’s overall capitalization. While Apple, for example, as the largest holding of the SPDR S&P 500 ETF accounts for 6.8% of the fund’s assets, SPHD’s approach offers a less concentrated holdings mix. The fund’s 10 largest holdings offer dividend yields at least double the S&P 500’s yield, maintaining at the same time solid scores for payment consistency.

Author’s Research

Unlike most equities and ETFs SPHD pays income distributions monthly, increasing its appeal for investors with mature portfolios, that prioritize cash flow generation over growth potential. In that sense, the fund makes a good case for investors closing in on retirement, or for the ones that already have retired.

Performance and Volatility

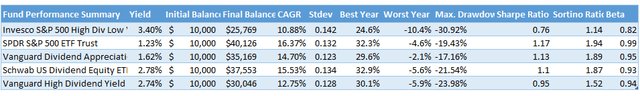

To examine performance and volatility metrics in an attempt to gauge SPHD’s relative attractiveness, I employed the tools offered by Portfolio Visualizer. Risk and return metrics were calculated for a group of ETFs consisting of SPHD, an S&P 500 ETF, and three more funds. Focusing on the relative performance between SPHD and SPDR S&P 500 ETF first, I backtested the performance of both funds. Going back to late 2012, when SPHD was incepted, a $10,000 beginning balance, dividend reinvestment, and annual rebalancing were assumed. The simulation is provided below.

As the gap between value and growth stocks became wider following the bull market that succeeded the Covid-19 market crash of 2020, SPHD has failed to keep up with broad-market performance. Over the past 10 years, SPHD’s CAGR of 10.88% lags SPY’s 16.27%. What appears more problematic, however, is the fact that despite the proclamation of lower volatility, SPHD has actually carried a higher risk profile than its S&P 500 counterpart. Standard deviation at 14.22% exceeded SPY’s 13.21%, while with a maximum drawdown of -30.5% the fund appears more vulnerable to large bearish market swings.

For peer-comparison purposes, three more ETFs were selected for a backtest. Vanguard’s Dividend Appreciation ETF (VIG) was selected for its dividend-growth style, Schwab’s U.S. Dividend Equity ETF (SCHD) for its high distributions yield, and Vanguard’s High Dividend Yield ETF (VYM) for similar reasons. While we should note that SPHD offers the highest yield in the group, as the data provided below points out, all alternatives perform considerably better in terms of risk-adjusted returns. SPHD carries the lowest Sharpe and Sortino ratio while having the higher Maximum drawdown. On top of that, SPHD has the highest negative returns during its worst year and the highest Standard Deviation in the group. It becomes apparent that the higher yield the fund offers comes at a price, as SPHD underperforms in terms of growth while bringing more volatility along.

Final Thoughts

While a 3%+ monthly dividend might seem initially attractive, SPHD’s reduced volatility claims do not seem to hold true, at least over its 10-year trading history. A peer comparison reveals that competitors might, in fact, present better choices, despite offering lower dividend yields. That said, in a shorter-term view, SPHD likely stands to benefit if the apparent transition away from high-valuation stocks persists. Currently, I would assign a neutral rating to the fund.

Be the first to comment