alfexe/iStock via Getty Images

This ETF review series aims at evaluating products regarding the relative past performance of their strategies and metrics of their current portfolios. As holdings and weights change over time, updated reviews are posted when necessary.

PFM strategy and portfolio

The Invesco Dividend Achievers ETF (NASDAQ:PFM) has been tracking the NASDAQ US Broad Dividend Achievers Index since 09/15/2005. It has 373 holdings, a 12-month distribution yield of 1.94% and a total expense ratio of 0.52%. Distributions are quarterly.

As described on Nasdaq website, the index “is comprised of US accepted securities with at least ten consecutive years of increasing annual regular dividend payments”. The index is reconstituted annually and rebalanced quarterly. It employs a modified market capitalization-weighted methodology so that the maximum weight of any security does not exceed 4% on rebalancing dates.

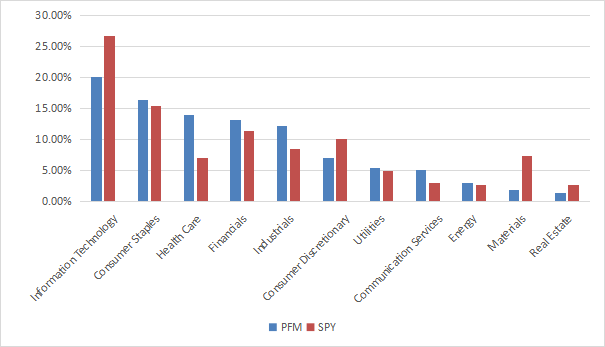

PFM invests almost exclusively in U.S.-based companies (99.5% of asset value), and mostly in large- and mega-cap companies (83%). The top 2 sectors are the same as in the S&P 500 (SPY): technology (20.2%) and healthcare (16.6%). However, PFM is less overweight in technology and has a more balanced sector breakdown. Compared to SPY, it significantly overweights consumer staples, financials, industrials and utilities. It underweights technology, communication, consumer discretionary and real estate.

PFM vs SPY sector breakdown (chart: author, data: Invesco, SSGA)

The fund’s aggregate valuation ratios are close to the benchmark (see next table).

|

PFM |

SPY |

|

|

P/E TTM |

19.64 |

20.15 |

|

Price/Book |

3.94 |

3.82 |

|

Price/Sales |

2.09 |

2.4 |

|

Price/Cash Flow |

14.83 |

15.04 |

Data: Fidelity

The top 10 holdings, listed below with some fundamental ratios, represent 25.8% of asset value. The heaviest one weighs 3.69%, so risks related to individual stock are moderate.

|

Ticker |

Name |

Weight% |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

Microsoft Corp. |

3.69 |

3.73 |

27.69 |

27.00 |

1.06 |

|

|

UnitedHealth Group, Inc. |

3.08 |

26.65 |

26.36 |

24.44 |

1.23 |

|

|

Johnson & Johnson |

2.88 |

7.38 |

24.95 |

17.83 |

2.52 |

|

|

Exxon Mobil Corp. |

2.73 |

987.11 |

8.74 |

7.75 |

3.39 |

|

|

Walmart, Inc. |

2.47 |

13.31 |

45.58 |

24.34 |

1.52 |

|

|

JPMorgan Chase & Co. |

2.40 |

-25.07 |

11.32 |

11.63 |

2.98 |

|

|

Procter & Gamble Co. |

2.22 |

5.42 |

26.39 |

26.19 |

2.40 |

|

|

Visa, Inc. |

2.13 |

24.76 |

31.11 |

25.66 |

0.84 |

|

|

Mastercard, Inc. |

2.09 |

23.12 |

35.67 |

33.90 |

0.64 |

|

|

The Home Depot, Inc. |

2.08 |

10.97 |

20.06 |

19.96 |

2.28 |

Performance

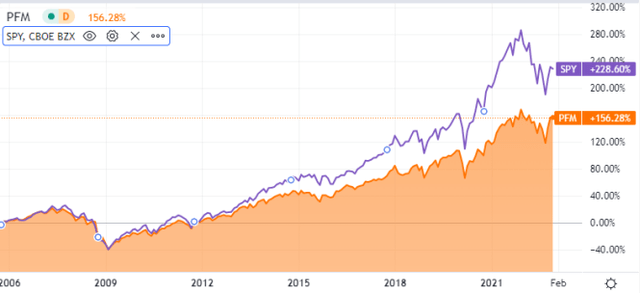

Since inception in September 2005, PFM has lagged the S&P 500 by about 90 percentage points in total return (reinvesting dividends). Despite a lower volatility, it is slightly behind the benchmark in risk-adjusted performance (Sharpe ratio).

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

PFM |

273.60% |

7.95% |

-53.25% |

0.53 |

13.67% |

|

SPY |

363.13% |

9.31% |

-55.42% |

0.57 |

15.55% |

Data calculated with Portfolio123

In share price, PFM has lagged SPY by about 72 percentage points. This represents the difference in assets-per-share growth, without dividends.

PFM vs SPY, share price since inception (Trading View on Seeking Alpha)

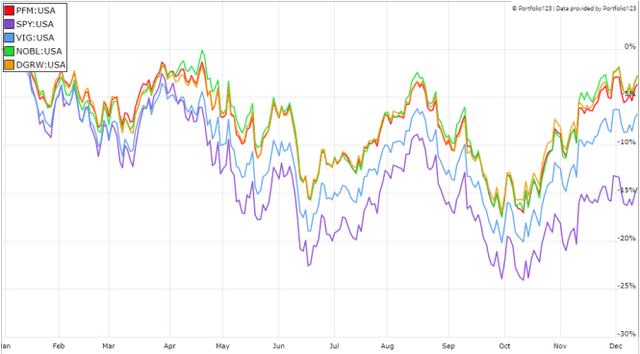

However, PFM beats SPY in 2022 (the next chart includes dividends). Compared to its most popular competitors this year, it also beats the Vanguard Dividend Appreciation Index Fund (VIG) by a few percentage points, and it is almost on par with the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) and the WisdomTree U.S. Quality Dividend Growth Fund (DGRW).

PFM vs competitors and SPY in 2022 (Portfolio123)

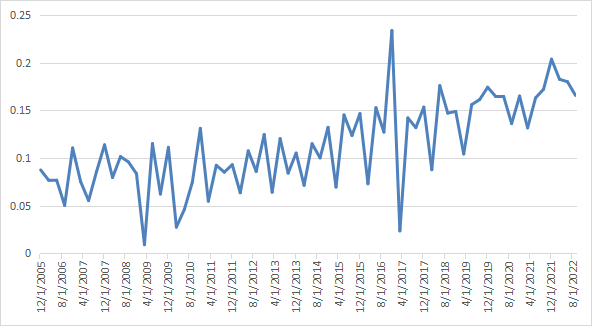

The next chart plots the history of quarterly distributions. The annual sum went from $0.3141 in 2006 to $0.6706 in 2021: it is an increase of 113.5% in 15 years, or 5.2% annualized.

Quarterly distributions per share (Chart: author; data: Invesco)

Comparing PFM with a reference strategy based on dividend and quality

In previous articles, I have shown how three factors may help cut the risk in a dividend portfolio: Return on Assets, Piotroski F-score, and Altman Z-score.

The next table compares PFM since inception with a subset of the S&P 500: stocks with a dividend yield above the average of their respective indexes, an above-average ROA, a good Altman Z-score and a good Piotroski F-score. It is rebalanced annually to make it comparable with a passive index.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

PFM |

273.60% |

7.95% |

-53.25% |

0.53 |

13.67% |

|

Dividend & quality subset |

686.64% |

12.72% |

-41.56% |

0.8 |

15.09% |

Past performance is not a guarantee of future returns. Data Source: Portfolio123

The dividend and quality subset beat PFM by 4.8 percentage points in annualized return and also shows better risk metrics. A note of caution: PFM return is real, whereas the subset performance is hypothetical. My core portfolio holds 14 stocks selected in this subset (more info at the end of this post).

Scanning PFM with quality metrics

Among 372 stocks held by the fund, 30 are risky stocks regarding my metrics. In my ETF reviews, risky stocks are companies with at least 2 red flags: bad Piotroski score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score, excluding financials and real estate where these metrics are less relevant. They weigh only 2.5% of asset value, which is a very good point.

Based on my calculations, PFM is superior to SPY in weighted Altman Z-score, Piotroski F-score and ROA. The return on assets is especially good.

|

Altman Z-score |

Piotroski F-score |

ROA% TTM |

|

|

PFM |

4.19 |

6.08 |

10.43 |

|

SPY |

3.51 |

5.73 |

7.82 |

In summary, PFM is superior to SPY in portfolio quality.

Takeaway

PFM implements a dividend growth strategy with a capped market capitalization weighting. Its aggregate valuation ratios are similar to those of the S&P 500, and quality metrics are better. Moreover, its sector breakdown is more balanced than the benchmark. Distribution history points to a 5.2% annualized growth in dividends since inception. However, past performance in total return is disappointing: the fund has been lagging the S&P 500, although it beats it this year. For transparency, a dividend-oriented part of my equity investments is split between a passive ETF allocation (PFM is not part of it) and my actively managed Stability portfolio (14 stocks), disclosed and updated in Quantitative Risk & Value.

Be the first to comment