AsiaVision

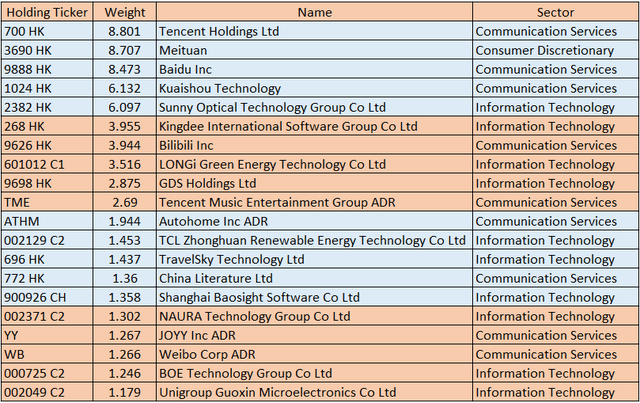

In the trade war with China, the whole purpose of the CHIPS and Science Act is to support the American semiconductor industry and make the country less dependent on imported electronics goods, as well as become more competitive. However, while everyone is focused on supply chains and onshoring of chip production, there are questions about whether there could be unintended effects, namely on the Chinese internet sector. In this case, the Invesco China Technology ETF (NYSEARCA:CQQQ) holds some of China’s biggest tech names, with the first twenty holdings shown in the table below.

CQQQ’s first 20 Holdings as of August 26 (www.invesco.com)

The aim of this thesis is to assess the impact of the CHIPS act on the Chinese tech sector. For this purpose, there is no better way to start than to consider how U.S. sanctions impacted Huawei, a Chinese multinational technology corporation that produces telecommunications equipment, and various smart devices.

Learning from Huawei

Some will remember how the Trump administration blacklisted Huawei and banned U.S. companies from selling sensitive microprocessor technology to the Chinese group which was also cut off from Google’s (NASDAQ:GOOG) Android operating system, which equipped its smartphones. Interestingly, the current U.S. administration has not brought any changes to this policy.

As a result, and after recording a 38% drop in sales in the second quarter of 2021, losing its position as the world’s largest smartphone maker, Huawei’s goal has shifted from growth to survival with U.S. sanctions forcing it to strategically refocus on sectors such as software, enterprise IT or smart vehicles. One of the reasons for this is that Huawei has not been able to procure the leading-edge chips it needs to manufacture mobile phones, because, in addition to barring American companies from exporting sophisticated processor gear to China, the U.S. Commerce Department also worked with allies and partners in Europe, Taiwan, South Korea, and Japan to enforce the sanctions internationally.

For investors, while China is the world’s largest manufacturer of chips, it produces mostly lagging process nodes or older generation processors. It cannot manufacture leading-edge nodes as semiconductor equipment suppliers like ASML (ASML) cannot supply China’s top foundries like Semiconductor Manufacturing International Corporation (OTCQX:SMICY) with EUV systems.

The risks to China’s Tech

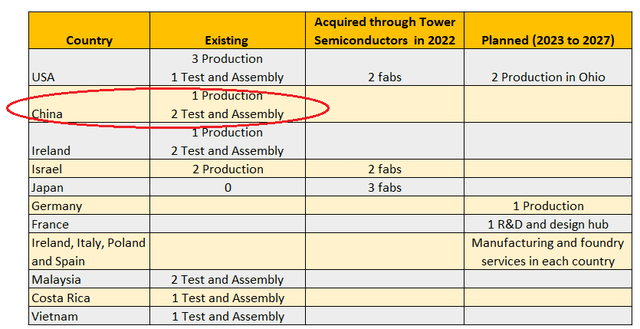

As a result, companies like Tencent (OTCPK:TCEHY), Baidu (BIDU), and others have to rely on sophisticated processors from U.S. companies like Intel (NASDAQ:INTC) for their AI-driven clouds. Now, the U.S. company has an elaborate worldwide presence with production, test, and assembly plants including in China as I highlighted in a previous thesis. This is shown in the table below.

Table built using data from (www.intel.com)

Now, in the eventuality of Intel onshoring its plants (or moving them to the U.S.) or other places of the world like Germany where a production plant is scheduled for the 2023-2027 period, it could scale down its Chinese facilities. This could make it more difficult for Chinese tech companies to obtain the advanced gear they need to operate data centers and maintain their competitive advantage. This can impact profitability in case the chips have come all the way from the U.S.

Exploring further, a reconfiguration of the semiconductor supply chain focused on relocating more foundry activities in the U.S. will also signify that fewer chips are produced in Taiwan and South Korea. For this matter, encouraged by stimulus measures, Taiwan Semiconductor Manufacturing Company (TSM) is building a 5-nanometer fab in Arizona and Samsung Electronics (OTCPK:SSNLF) is expanding production in Texas. This should exacerbate matters for China’s tech as the chip semiconductor supply chain moves further away from the Chinese mainland.

This may be the reason why China has officially opposed the move and sees the support for local production of semiconductors as “disrupting global supply chains and hampering international trade”.

CHIPS Act Not Impactful For Now

However, it is unlikely for Intel to reduce production in China as it obtains a significant portion of its revenues from that country. The same is the case for Qualcomm (NASDAQ:QCOM), which is even more exposed to the world’s second-largest economy.

Moreover, as I mentioned at the beginning, the U.S. authorities seem more concerned about the supply chain than putting sanctions on China. Moreover, now that the CHIPS act has been signed into law, a lot of work remains to be done, namely in terms of execution. For this matter, China remains an important part of the world’s supply chains especially when it comes to assembling various electronic components into circuit boards. Furthermore, there is the cost factor whereby both wage inflation and raw material prices for making chips are more expensive in the U.S. This implies that domestic production of chips may most likely be consumed on American soil itself as an alternative to lengthy and stretched supply chains originating far away in East Asia.

Moreover, given the importance of the Chinese economy, it is likely for Intel and Taiwan Semiconductor to keep some of their manufacturing capacity in China. Continuing on a positive note, CQQQ provides diversification as it is composed of many software applications and social networking companies that are not directly exposed to the eventuality of the semiconductor supply chain becoming more stretched for China.

Strangely, problems for China’s tech seem to be due to the country’s own government, namely the zero-COVID policy which imposes drastic lockdown measures as soon as infection rates have been reported in a region or province. One of CQQQ’s holdings to be impacted was Tencent, the owner of the popular WeChat messaging app and which also makes a lot of money from gaming.

COVID Impact

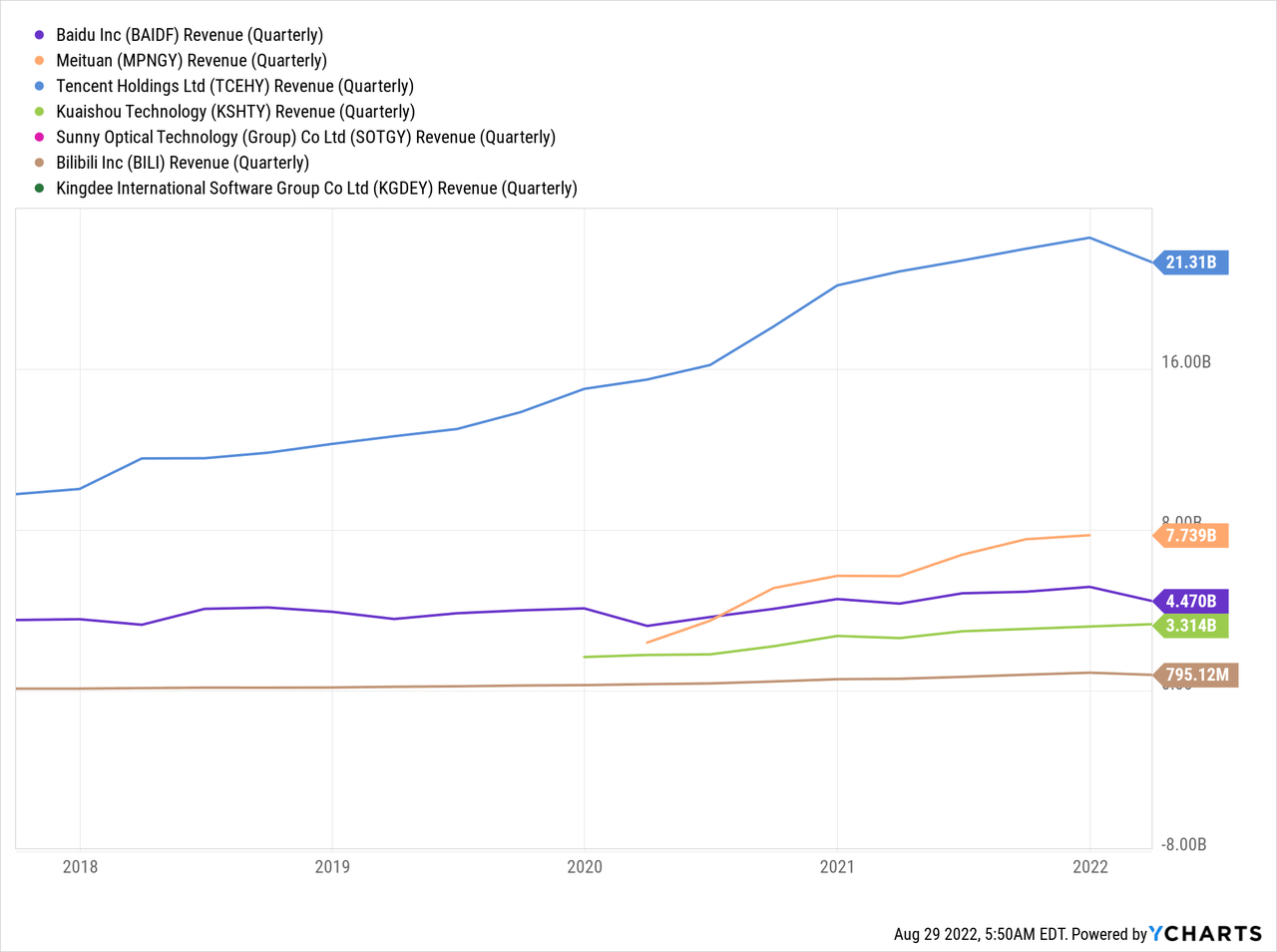

With fewer people risking themselves to venture out of their homes, usage of the WeChat Pay mobile payment app fell compared to previous quarters. Things were worst for Tencent’s online advertising business as corporate customers tightened their budgets. Thus, its revenues fell as shown in the pale blue chart below and this was the case with other CQQQ’s holdings too.

Looking ahead, with COVID still lingering in many parts of the world especially China, and the Chinese Communist Party hosting its party congress in this half of the year, the priority will surely be to contain COVID and avoid widespread infection throughout the country, which if ever it happens could be interpreted as a sign of failure of the country’s leadership. Unfortunately, this will be at the expense of business activities that contribute to tech revenues.

In this case, a better approach than investing in this ETF would be to look into the individual stocks with a view to identifying those which are less impacted by COVID. To this end, the Chinese tech space is synonymous with a high degree of innovation and offers a lot of opportunities for those who are prepared to adopt a long-term view.

Discussion

Coming back to the theme of this thesis, it is unlikely for CQQQ’s holdings to suffer the same fate as Huawei which was seen more as a security threat to the U.S. Moreover, with the center of gravity of the supply chain moving nearer to the U.S. thanks to the CHIPS act, there should be fewer tensions related to semiconductors, which makes it less likely that there will be a ban on the export of chips to China.

Also, it would be counterproductive for the American authorities to block companies like Intel and Qualcomm to ship processors to China’s tech sector as the aim, if carefully scrutinized from 2019-2020, seems to be to exert better control on where advanced chips are shipped. This was precisely done by denying Chinese foundries of the most sophisticated chip-making equipment.

This said things can change completely in case there is any intelligence report that Chinese equipment which includes American-made processors has been used in the Ukrainian conflict. Thus, given the current state of geopolitics, sanctions cannot be completely excluded.

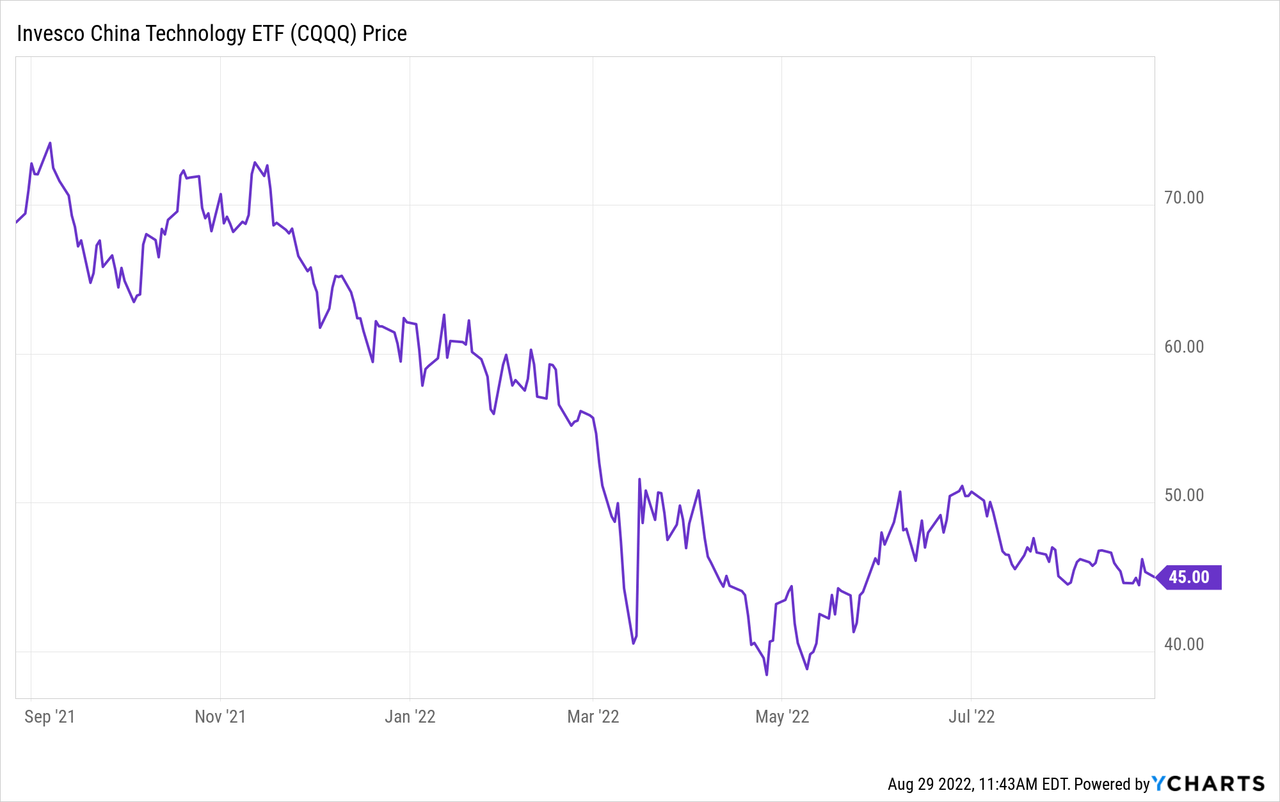

For the time being, the woes of China’s tech sector are more related to COVID, especially the associated lockdown measures. This is the reason why, even after a 34% drop during the last year, it is better to wait at least till the end of 2022 to invest. By that time, there should also be more clarity on the regulatory and COVID fronts.

For this matter, in addition to COVID, the tech sector has suffered from a large degree of volatility after the government put in place a series of regulations including record fines. Tech was also impacted by delisting fears from the U.S. stock exchanges, but for this purpose, as seen in the introductory table, CQQQ’s holdings are mostly based in Hong Kong and Shanghai in addition to the U.S. as the ETF tracks the FTSE China Incl A 25% Technology Capped Index.

Additionally, there have been talks between competent authorities of the two countries in order to avoid the delisting of Chinese companies.

Conclusion

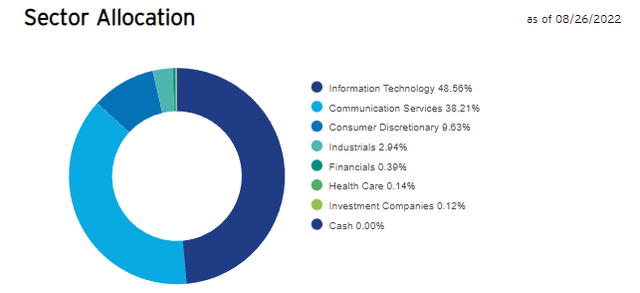

Despite all its woes and for those who do not have the patience to analyze and pick individual stocks, CQQQ which includes a wide tech ecosystem composed of IT, Communications Services, and Consumer Discretionary remains a valid choice, but, not at current times.

Sector Allocation (www.invesco.com)

Finally, China’s tech sector remains resilient as together with a skilled labor force that can do advanced research; the inflation rate is lower than in most other countries in the world. Companies also have access to advanced computing resources, and it is unlikely that the tech sector will be denied these through the CHIPS Act unless there is an escalation of tensions between the world’s two largest economies.

Be the first to comment