courtneyk

Inuvo (NYSE:INUV) is the developer of a context-based advertising targeting solution (IntentKey) and a publisher of click-bait websites that serve advertising (ValidClick).

The company has been consistently unprofitable but promotes itself as a growth story because IntentKey is a possible solution to the elimination of third-party cookies (3PC) in digital advertising. IntentKey does not need user info (provided by 3PC) to target ads to specific audiences.

IntentKey has been showing tremendous growth, of almost 300% YoY, but this has not translated into any improvement in profitability for the company. Although this could be part of the company’s strategy to grow the product before milking it, without profitability, funds are disappearing every day.

With a shrinking cash balance, and the delayed phase-out of 3PC, shareholders face the risk of dilution to receive new funding.

On the positive side, I do not believe Inuvo could be severely damaged by a recession or by reduced advertising expenditure, because its costs are mostly variable.

Inuvo’s business thesis and environment

Although the introduction and my previous article on Inuvo may give the idea that I do not like the company, that is not my intention. I actually believe that Inuvo’s product and strategy are interesting, but that they are risky. I also believe that Inuvo is running out of time.

My understanding of what Inuvo’s management expects from the company is the following. 3PCs, used by a substantial portion of digital advertising (all advertising that you see in a website that is not itself a platform like Google or Facebook), are going to be eliminated. Without 3PCs, advertising in regular websites becomes less valuable because companies have no way of telling who they are targeting. A lot of advertising is going to move to first-party platforms (Google, Facebook and the like).

That means 1PC advertising (social media) is going to be more expensive, while 3PC advertising (regular websites) is going to be cheap. However, if someone can find a way to use regular website space but actually target customers, then it can return value to that enormous segment of digital advertising.

Inuvo believes that it has the method to use cheap post-cookies space to provide high-value targeted audiences, and that it has the patent for that method. That method is IntentKey, a series of algorithms that relate ideas or products to websites using only the website’s content, without information from the actual users.

Further, Inuvo believes that once third-party cookies are finally off the table (a process that has been delayed more than three times and is now expected for 2024), a lot of advertising expenditure will be available for new methods like IntentKey.

Before the final phase-out of cookies arrives, Inuvo has to build as much brand as possible, in order to build itself a market. As it was commented in my previous article, other companies are providing similar solutions and will compete for Inuvo’s clients.

For that reason, Inuvo’s management has not privileged profitability but rather growth. Instead of extracting some value from its new customers, it is squeezing gross margins to the maximum.

This strategy makes sense because before cookies are out, IntentKey still does not have a competitive advantage. Clients today can choose 3PC based advertising that is as useful as IntentKey, why would they pay more for IntentKey?

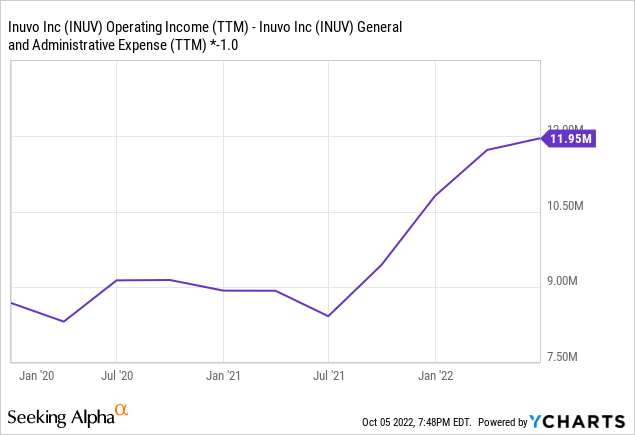

Below is Inuvo’s adjusted gross profit. The company moves part of its CoGS (advertising used to direct traffic to ValidClick sites) to SG&A, so the best way to find the real gross profit is simply to add general and administrative expenses back to operating income. As you can see, gross profits have grown slowly, compared to yearly revenues, which have grown 200% at the company level and 300% at the IntentKey level YoY.

Inuvo’s future

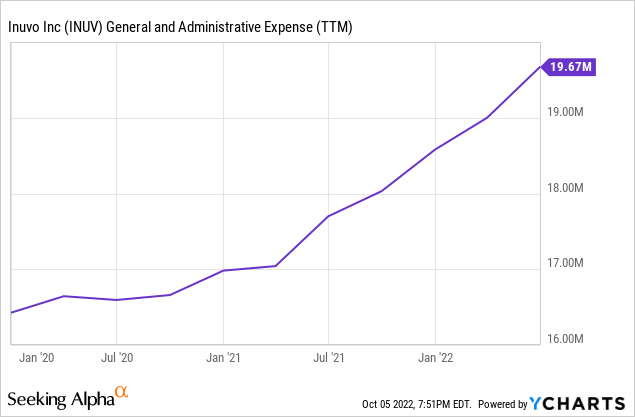

The Achilles heel of management’s strategy is that the company still has to pay for its administrative and sales structure, below, and therefore produces an operating loss.

In my opinion, Inuvo’s management is trying to grow the company as much as possible, while running losses, waiting for the promised end of 3PC to extract value from its newly created market.

But in order to wait for the (continuously delayed) phase-out of 3PC, Inuvo needs funding. As of 2Q22, the company had a cash and securities reserve of $8.5 million. That is more or less the difference between their adjusted gross profit and their G&A expenses. In that context, the company could survive a year more. After that, it should issue shares and further dilute current shareholders.

I can be quite certain that the company will need to issue more shares for a few reasons. First, the current credit market is more difficult for unprofitable growth companies. Second, Google already announced that it has delayed (for the third time) the 3PC phaseout to 2024. That means Inuvo is not going to be able to extract more value from customers because it will have to compete with 3PC based advertising. Third, even growing adjusted gross profits, as Inuvo did, albeit slowly, have not been able to improve profitability because the fixed structure also grows.

On a more positive note, I believe that Inuvo is not going to be affected by a generalized recession or by a localized decrease in advertising expenditure. The reason is that most of Inuvo’s costs are variable. The fixed portion of Inuvo’s cost is G&A, which is already eroding the company’s funds at more or less the same rate independently of the level of business. This does not mean that Inuvo is going to do well in a recession, but rather that it is going to do exactly as bad as in the current or previous context.

Conclusion

Inuvo’s strategy might be correct. In fact, it may be the only possible strategy to grow their business in a context where the company has to compete with a cheaper, albeit death-sentenced alternative.

But the elimination of 3PC has been delayed so much that Inuvo is running into a dead alley. It needs financing to keep the business going until 3PCs disappear, and therefore is in a bad bargaining position.

Given that the business is promising, I speculate that Inuvo is going to find a new investor to inject funds and provide the company with new vitality. But understanding Inuvo’s dire situation, the investor will ask for a significant stake, diluting current shareholders.

After new funds are injected, Inuvo might become an interesting opportunity. Before that, it is a risky proposition with almost certain dilution ahead.

Be the first to comment