ViktorCap/iStock via Getty Images

Investment Thesis

Intuitive Surgical (NASDAQ:ISRG) is a medical device company that is best known for its da Vinci robotic surgical system. It provides minimally invasive care through a comprehensive ecosystem that includes monitoring, imaging, instruments, and control console. Intuitive Surgical is a clear leader in the robotic surgery market with technological superiority and large switching costs. This economic moat will remain in place for the foreseeable future. Since my last article, Intuitive Surgical’s stock price dropped along with the market, and now has fallen below its intrinsic value. It presents a rare opportunity for investors to grab the shares of a leading company in a fast growing market. I believe Intuitive Surgical is an excellent investment opportunity because:

- The revenue and profit growth trajectory returned to normal as hospital resources are freed up from COVID-19. More surgeries are being performed using Intuitive Surgical’s system, and its installed base is growing accordingly.

- As surgery is a major revenue stream for hospitals, surgery-related expenditures will be less affected by a recession or interest rate hikes.

- Recent drop in stock price presents a great opportunity to get shares of a leading company in a fast-growing market.

Resuming Surgical Procedures and Easing Supply Chain Issues

The pandemic brought multiple headwinds to Intuitive Surgical. One of the most obvious was a reduction in surgeries performed in hospitals. Hospitals became congested with COVID patients who were prioritized over non-critical surgeries, and that resulted in fewer Intuitive Surgical units being ordered as well as a drop in service revenue. However, as we leave the pandemic, general surgery in the U.S. has been growing – led by bariatric procedures, cholecystectomy, hernia repair, and rectal surgery. Regional waves of COVID-19 are still affecting staffing and lowering the number of surgeries being performed, but I expect the number of procedures to continue to trend upward.

Also, components, raw material, and logistic delays caused by COVID-19 introduced headwinds as well. Intuitive Surgical’s delivery performance dropped, with on-time delivery to its customers suffering some from supply chain constraints, and the company experienced some delays in fulfilling orders for da Vinci instruments and accessories. Higher cost of logistics and manufacturing inefficiencies impacted the company’s gross margin as well. However, I believe these constraints will be a short-term issue and expect them to be resolved post-pandemic as more people return to the transportation workforce.

Increasing Installed Base

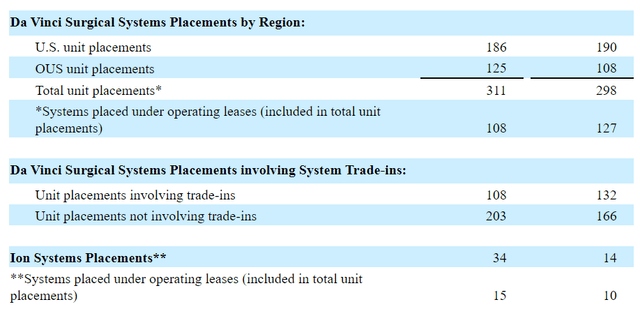

In the most recent quarter, Intuitive Surgical installed 311 more da Vinci systems (compared to 298 last year), and its installed base increased to 6,920. The company’s new lung biopsy system Ion is growing nicely as well. During the last quarter, it installed 34 Ion systems (compared to 14 last year), bringing the installed base of Ion systems to 163. Furthermore, the number of procedures using Ion was 3,900, which was over 4 times higher than the number a year ago.

A larger installed base has a multiplicative benefit for Intuitive Surgical. An expanding base brings increasing service revenue. This service revenue is higher margin and recurring income, so it’s great to see Intuitive Surgical’s service segment growing at a strong clip. Also, a larger installed base means that more clients will request upgrades and trade-ins. Unit placement involving trade-ins are quite a significant chunk of its revenue at this point. As the company releases new generations of upgraded instruments and systems, I expect this portion to become even more important in the future. Additionally, due to the switching cost (e.g. training time and new licenses), a larger installed base represents an improving economic moat as well.

System Placements by Intuitive Surgical (SEC Filings)

Attractive Valuation Due to Market Volatility

The ongoing market volatility has hammered the overall stock market, but has hit growth and tech stocks particularly hard. The overall market turmoil has brought down even a great company like Intuitive Surgical. Its stock dropped from $360 in November 2021 to its current $200 level, which is at the lower end of the intrinsic value calculation from my last article. With increasing revenue growth from both da Vinci and Ion systems after the pandemic, I expect Intuitive Surgical to beat its own guidance. The management already adjusted its growth guidance during the Goldman Sachs Annual Global Healthcare Conference. I expect the positive trend will continue, and its stock price will recover with time.

Intrinsic Value

I ran a DCF calculation to estimate the intrinsic value of Intuitive Surgical. For the estimation, I utilized EBITDA ($2,131 M) as a cash flow proxy and current WACC of 7.0% as the discount rate. For the base case, I assumed EBITDA growth of 20% for the next 5 years (Seeking Alpha consensus estimate) and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed EBITDA growth of 25% and 30%, respectively, for the next 5 years and zero growth afterwards.

With a market leading position in the fast growing robotic surgery industry and an increasing installed base, I expect Intuitive Surgical to achieve this upside. Also, the growth rate of its new product, the Ion System, is very exciting to watch. The recent drop in stock price has created opportunity for investors.

|

Price Target |

Upside |

|

|

Base Case |

$193.46 |

-4% |

|

Bullish Case |

$227.75 |

11% |

|

Very Bullish Case |

$270.98 |

32% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 7.0%

- EBITDA Growth Rate: 20% (Base Case), 25% (Bullish Case), 30% (Very Bullish Case)

- Current EBITDA: $2,131 M

- Current Stock Price: $205.36 (07/06/2022)

- Tax rate: 20%

Cappuccino Stock Rating

Details of the stock rating can be found in this article.

| Weighting | ISRG | |

| Economic Moat Strength | 30% | 5 |

| Financial Strength | 30% | 5 |

| Growth Rate vs. Sector | 15% | 3 |

| Margin of Safety | 15% | 4 |

| Sector Outlook | 10% | 4 |

| Overall | 4.5 |

Economic Moat Strength (5/5)

Intuitive Surgical is the dominant leader in robotic surgery and has many features to protect its economic moat. It is technologically superior (e.g., less complications after surgery) and has a large installed base (i.e., high switching cost). Companies like Medtronic (MDT) are entering the market and will challenge Intuitive Surgical in the future, but, at this point, Intuitive Surgical is the clear leader.

Financial Strength (5/5)

Intuitive Surgical has been a cash generating machine for the past several years. The company has generated over $1 B in operating cash flow since 2016. It has over $4 B cash on the balance sheet and zero debt. Easy 5 here.

Growth Rate (3/5)

Intuitive Surgical has been a superb growth company in the past. However, it is now maturing, so expected growth will be in a lower range of 20-30% per year. I expect Intuitive Surgical to grow in line with the overall robotic surgery market, leading to very solid but not spectacular growth.

Margin of Safety (4/5)

Recent market volatility dragged down Intuitive Surgical’s stock price by 40%. For the market-leading company in a rapidly growing field, I have little doubt that Intuitive Surgical will recover back to its previous highs. Also, the robotic surgery market is a very lucrative field, and Intuitive Surgical is making tons of cash and has a formidable balance sheet.

Sector Outlook (4/5)

Healthcare and robotic surgery market will grow at a solid pace in the future. Especially, as technology advances and people increasingly become comfortable with more automation, robotic surgery will naturally grow both in depth and breadth.

Risk

The competition within the robotic surgery industry is increasing from both existing competitors and new entrants (e.g., Medtronic, CMR Surgical, and Johnson & Johnson (JNJ)). Especially, competition from Medtronic and Johnson & Johnson is most significant in my opinion. They may not have products that directly challenge Intuitive Surgical yet, but they have the technological and financial resources to do so in the future. Also, they already have a strong relationship with hospitals and a well-established distribution network, so they could grab market share in a hurry.

The da Vinci machine (over $2 M) is very expensive. As a recession might be on the horizon due to the Federal Reserve’s attempts to curb inflation, hospitals may reduce their capital expenditure, especially when interest rates are rising. However, surgery is a huge money maker for hospitals, and they typically prioritize surgery over other items as the procedures are reimbursed at a higher rate than for a typical medical patient. Intuitive Surgical’s management has also expressed a similar view on the matter. Also, I personally believe a potential recession wouldn’t be too deep, but shallow and mild. Therefore, I don’t anticipate a recession would have a material impact on Intuitive Surgical’s growth trajectory.

Conclusion

Intuitive Surgical has been a superb company and investment choice for the past decade. Their cutting edge technology has helped doctors and hospitals to save lives and lowered the rate of complications for surgical patients. The company has been a cash generating machine for several years, and holds a formidable balance sheet. Increasing levels of competition and a potential upcoming recession pose challenges, but I expect the company to continue to grow despite these hurdles.

Marketplace In Preparation

Thank you all for reading my article. I’m in preparation for a Marketplace launch soon. Please get excited! Also, let me know the types of analysis or information you would like to see more of in my articles. I will take that into consideration for the marketplace. Thank you all for your support!

Be the first to comment