gorodenkoff/iStock via Getty Images

A Quick Take On Intrinsic Medicine

Intrinsic Medicine (INRX) has filed to raise $47 million in an IPO of its common stock, according to an S-1 registration statement, although the final figure may differ.

The firm is a preclinical stage biopharma developing treatments for irritable bowel syndrome and its variants.

INRX has produced no in-house research to-date and there are selling stockholders in the IPO, unusual characteristics for a life science IPO.

I’ll provide a final opinion when we learn more information about the IPO.

Company & Technology

Seattle, Washington-based Intrinsic was founded to use synthetic human identical milk oligosaccharide molecules to treat irritable bowel syndrome and other inflammatory diseases.

Management is headed by co-founder, Chairman and CEO, Alexander Martinez, who has been with the firm since inception in 2018 and was previously Director, Corporate Development of Ionis, a biopharma company developing RNA-targeted therapeutics.

The firm’s lead candidate, OM002, is expected to begin Phase 2 trials in 1H 2023 in Australia for the treatment of IBS – C (with constipation) and IBS – D (with diarrhea) diseases.

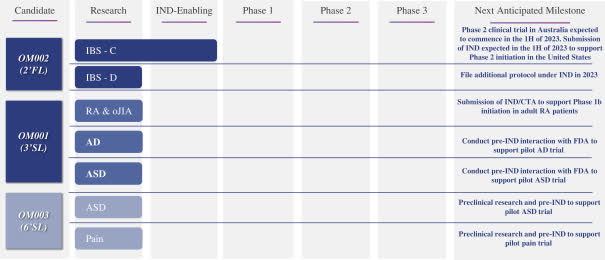

Below is the current status of the company’s drug development pipeline:

Drug Development Pipeline (SEC EDGAR)

Intrinsic has booked a fair market value investment of $12.6 million from various financial instruments as of December 31, 2021 from investors including SOSV.

Intrinsic’s Market & Competition

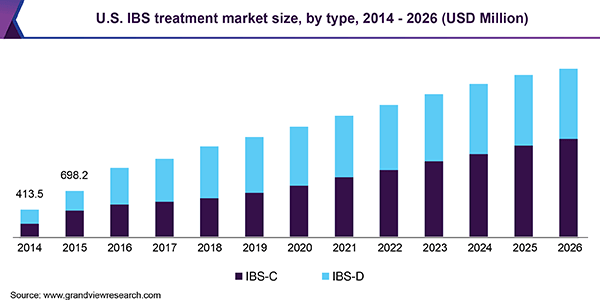

According to a 2019 market research report by Grand View Research, the global market for irritable bowel syndrome treatments was an estimated $1.5 billion in 2018 and is forecast to reach $3.2 billion by 2026.

This represents a forecast CAGR (Compound Annual Growth Rate) of 10.1% from 2019 to 2026.

Key elements driving this expected growth are a growing prevalence of the disease and increasing adoption of drug treatments by patients.

Also, below is a chart showing the historical and projected future growth trajectory of the U.S. IBS treatment market by segment:

U.S. IBS Treatment Market Size (Grand View Research)

Major competitive vendors that provide or are developing related treatments include:

-

Finch Therapeutics Group

-

4D Pharma

-

Seres Therapeutics

-

Synlogic

-

Kaleido Biosciences

-

Evelo Biosciences

-

Ironwood Pharmaceuticals

-

AbbVie

-

Arena Pharmaceuticals

-

Xiling Lab Pharmaceutical Co.

-

Boston Pharmaceuticals

-

Salix Pharmaceuticals

-

Sebella Pharmaceuticals

Intrinsic Medicine’s Financial Status

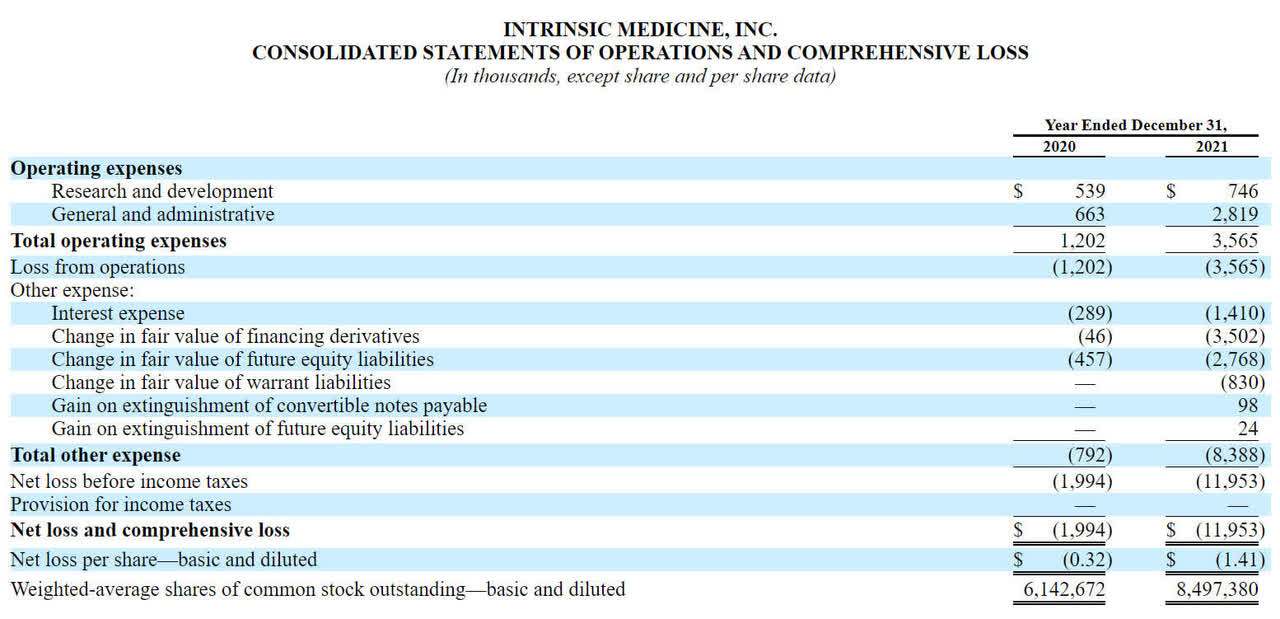

The firm’s recent financial results are mostly typical of a development stage biopharma in that they feature no revenue and growing R&D and G&A expenses associated with its research efforts.

Below are the company’s financial results for the past two calendar years:

Statement of Operations (SEC EDGAR)

As of December 31, 2021, the company had $2.8 million in cash and $17.8 million in total liabilities.

Intrinsic Medicine’s IPO Details

Intrinsic intends to raise investment from an IPO of its common stock.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Notably, it appears there will be selling shareholders, which would be highly unusual in a life science IPO, much less one that is at a preclinical stage of development.

Management has also issued warrants in relation to its previously-issued Bridge Notes. Also, the Bridge Note holders have the option to convert the principal and accrued interest to common shares at any time through December 31, 2023 at a price equal to 65% of the IPO offering price.

Management says it will use the net proceeds from the IPO as follows:

to advance the development of OM002, including initiating our planned Phase 2 clinical trial in patients with IBS-C in Australia and, upon completion of IND-enabling toxicology studies, initiating our planned Phase 2 clinical trial in the United States;

to complete confirmatory IND-enabling toxicology studies to support our IND filing for OM002; and

the remainder for clinical development of our drug candidates and other research and development activities, working capital and other general corporate purposes, including the additional costs associated with being a public company.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, an in-licensed EPO (European Patent Office) patent, which the firm obtained rights through a license agreement with Glycosyn, has been the subject of a post-grant opposition by two firms and subsequent revocation by the EPO. Patentees have initiated an appeal of the revocation and the next hearing is scheduled for July 2022.

Listed bookrunners of the IPO are Spartan Capital Securities and Revere Securities.

Commentary About Intrinsic’s IPO

INRX is seeking public investment to advance its pipeline through and into clinical trials.

The firm’s lead candidate, OM002, is expected to begin Phase 2 trials in 1H 2023 in Australia for the treatment of IBS – C (with constipation) and IBS – D (with diarrhea) diseases.

The market opportunity for treating irritable bowel syndrome variants is moderately large and is expected to grow at a strong rate of growth over the coming years.

Management has disclosed no major pharma firm collaboration relationships.

The company’s investor syndicate does not include any well-known life science venture capital firms or pharmaceutical companies.

Spartan Capital Securities is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (77.3%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

INRX has a number of unusual aspects to its IPO, from selling shareholders to special Bridge Note conversion terms, especially for a preclinical stage biopharma company.

In addition, the firm has conducted none of its own research, instead relying so far on ‘independent, published research to arrive at our development thesis and plan our clinical trial protocol for our drug candidates. As such, we have not generated any data as of the date of this prospectus.’

When we learn more information about the IPO, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment