francescoch/iStock via Getty Images

I last addressed Intra-Cellular (NASDAQ:ITCI) in 12/2019’s “Intra-Cellular: The Other Side Of The Rainbow” (“Rainbow“). I was positive on the name at the time but have since lost sight of it.

This is my first revisit of the name. I remain positive as I discuss below.

Expect good things from Intra-Cellular’s CAPLYTA

CAPLYTA (lumateperone) was first approved by the FDA in 12/2019 for treatment of adults with schizophrenia. It joined a crowded field of schizophrenia therapies with its Q1, 2020 launch. It generated modest revenues as reflected by its 2021 10-K excerpt (pp. 61-62) below:

Net revenues from product sales consist of sales of CAPLYTA, which was approved by the FDA on December 2019. We initiated the commercial launch of CAPLYTA in late March 2020 and generated approximately $22.5 million in net revenue from product sales for the year ended December 31, 2020. During this product launch year, 2020 net sales increased steadily from approximately $883,000 in the first quarter of 2020 to approximately $12.4 million in the fourth quarter.

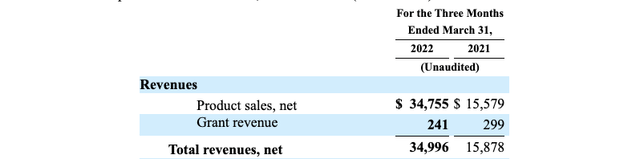

Things got much more interesting with FDA’s 12/2021 approval for CAPLYTA in treatment of bipolar depression in adults. Intra-Cellular promptly launched CAPLYTA in its newly approved indication. Revenues for Q1, 2022 more than doubled compared to its Q1, 2021 as shown by its excerpt from its Q1, 2022 10-Q (p. 16):

Intra-Cellular Q1, 2022 10-Q (excerpt p. 16) (seekingalpha.com)

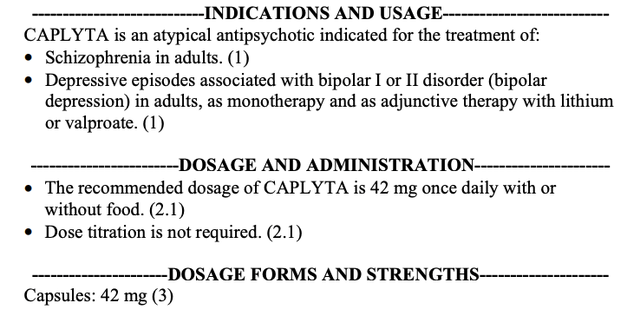

CAPLYTA’s 12/2021 expanded label below added broad coverage for bipolar disorder:

CAPLYTA label excerpt (accessed 06/15/2022) (accessdata.fda.gov)

CAPLYTA has significant competition pretty much throughout its approved indications as illustrated in its 2022 10-K (p. 14) excerpt below:

…CAPLYTA for the treatment of schizophrenia and for the treatment of bipolar depression competes with, among other branded products, Latuda [lurasidone HCl], marketed by Sunovion, Rexulti [brexpiprazole], marketed by Otsuka Pharmaceutical, VRAYLAR [cariprazine], marketed by Allergan, LYBALVI [olanzapine and samidorphan], marketed by Alkermes, and Fanapt [iloperidone], marketed by Vanda Pharmaceuticals. In addition, CAPLYTA competes and our product candidates, if approved, would compete with, among other generic antipsychotic products, aripiprazole, haloperidol, paliperidone, risperidone, quetiapine/XR, olanzapine and clozapine. [material in square brackets added by author]

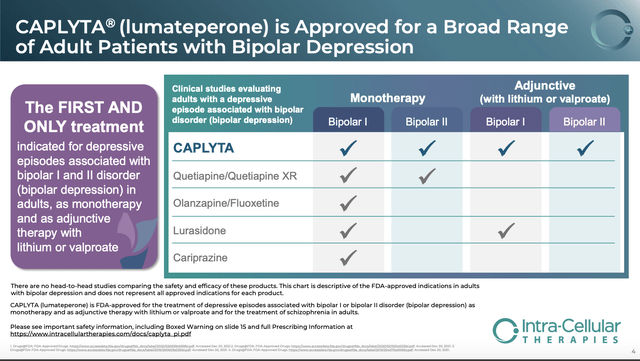

CAPLYTA’s label does however boast areas where it stands alone, or only has limited competition, as reflected by the slide below:

Intra-Cellular 05/2022 corporate presentation (ir.intracellulartherapies.com/)

CAPLYTA is the only approved therapy for bipolar ll with lithium or valproate and SEROQUEL (quetiapine/quetiapine XR) is the only other therapy approved for bipolar ll as a monotherapy.

SEROQUEL is an oldie, launched in 1997; its extended release version was approved in 2009. In 2009 it was AstraZeneca’s (AZN) second leading drug, generating $4.9 billion in worldwide revenues; after giving way to generic competition in 2017, SEROQUEL revenues dropped to $92 million in 2021.

There can be little doubt of CAPLYTA’s potential with its broad label. Intra-Cellular’s 05/2022 presentation (slide 6) pegs bipolar disorder as affecting 11 million patients in the United States. These patients are split roughly 50-50 between bipolar 1 and bipolar ll.

CAPLYTA is the only FDA approved option for these 5.5 million bipolar ll patients other than SEROQUEL. CAPLYTA has other important attributes which distinguish it from much of its competition. Using SEROQUEL as an example, it has different dosing titration requirements which can be off-putting to patients. CAPLYTA has no titration requirements.

With but a single quarter since launch, CAPLYTA is still in show-me mode; progress is good

During Intra-Cellular’s Q1, 2022 earnings call (the “Call“), CCO Neumann pointed to three leading indicators that it uses to assess CAPLYTA’s launch:

- new to brand prescriptions, which really represent the adoption of a new medicine or new indication for that medicine by prescribers, and is really considered to be the key leading indicator of future prescription growth,

- sample demand, and

- feedback that we get from physicians about their current use and their expected future use of CAPLYTA.

He assessed CAPLYTA’s performance as excellent in regard to each of these three. In terms of new to brand prescriptions he characterized the growth at 300%. As for sample demand, since its bipolar launch, he characterized this as quite strong and continuing. He also noted that physician feedback was encouraging in terms of current and expected future use.

When asked to provide color on physician feedback he advised that safety and tolerability with proven efficacy in bipolar were important:

…both weight gain and akathisia are two side effects of great concern to patients with bipolar disorder based on some of the limitations of the existing anti psychotics that they had been using. And in our clinical trial program, changes in weight were similar to placebo with CAPLYTA and akathisia and other EPS measures were also similar to placebo. And physicians are experiencing the same safety and tolerability profile in the bipolar depression patient population as they saw in the schizophrenia population. So that gives them a great deal of confidence that they can prescribe CAPLYTA, they’ll see the efficacy, and they’re sure that there is good and favorable safety and tolerability.

And then in addition to that the dosing a single 42 milligram dose once a day without regard to food, the physician can start the patient on the effective dose without having to titrate over multiple weeks to get to that point and then maintain the patient on that same dose. And that’s being viewed very much as a benefit as well.

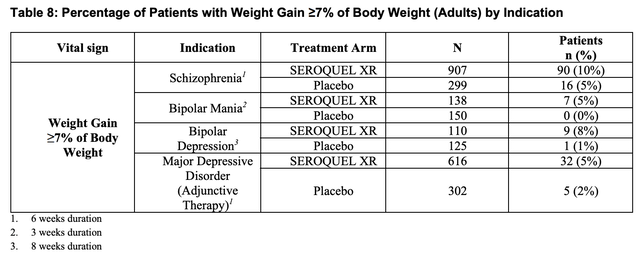

Weight gain is an important attribute to many antipsychotic therapies which can lead to stopping treatment. For example SEROQUEL includes the following table in its label:

SEROQUEL label (accessdata.fda.gov)

CAPLYTA’s label has no analogous weight gain issue. It does cite an incidence of slight weight reduction in schizophrenia patients, with de minimus difference to placebo in bipolar patients.

Intra-Cellular has a strong financial position, but has yet to achieve profitability

CEO Mates closed her opening statement during the Call with this concise overview:

We ended the first quarter with $773.2 million in cash, cash equivalents and investment securities. In January, we received $433.7 million in net proceeds from our public offering of common stock. We have no debt. Across all our efforts, our goal remains the same. We are developing effective, innovative treatments to improve the lives of patients with neuropsychiatric and neurologic disorders. We are very proud of our team and the progress we have made towards our goals. We are encouraged by our performance to start off the year and look forward to bringing CAPLYTA to increasing numbers of patients in the months ahead.

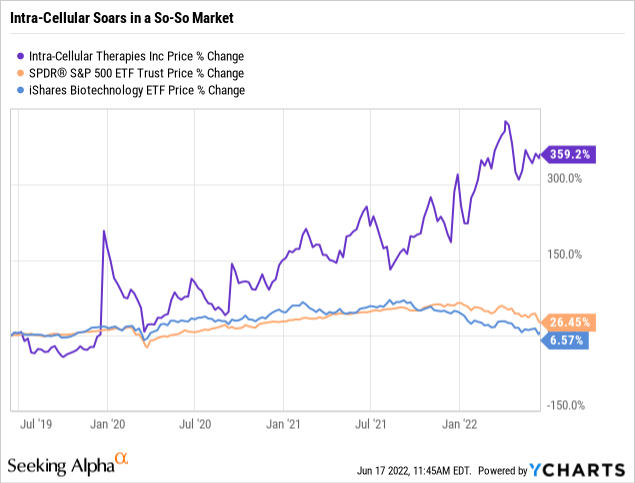

The market seems to like the story. While the rest of the investing world putters, Intra-Cellular is roaring as illustrated by its chart below:

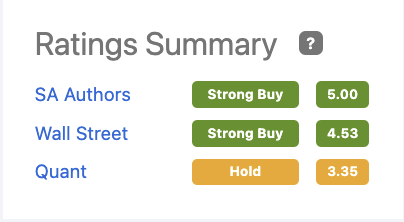

As illustrated by its chart below, both Wall Street Analysts and Seeking Alpha authors are positively besotted by its story.

Intra-Cellular (seekingalpha.com)

Looking beyond the summary shows that this positive view has been wide and deep. There are 20 Seeking Alpha articles with a “buy” rating; six with a “strong buy”, including three of the four most recent. There have been three with a “hold”; three with no rating; none with a “sell” rating out of 32 articles since 2015.

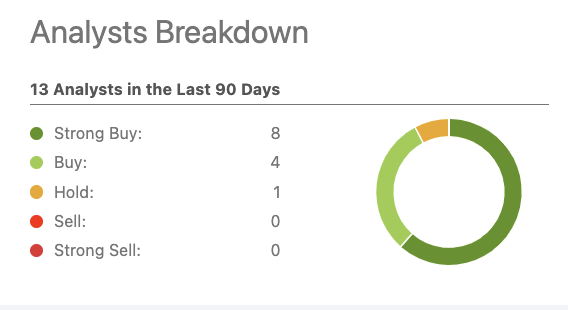

As for Wall Street Analysts, the spread is not dissimilar as reflected by the chart below:

Intra-Cellular (seekingalpha.com)

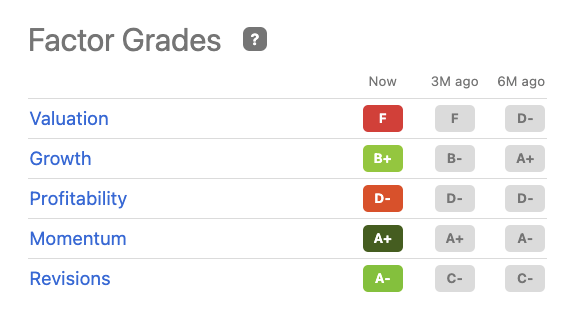

The story is solid, what about the numbers? According to the Ratings Summary chart above Intra-Cellular’s Quant Rating is less ebullient. It rests at a hold, based upon the matrix of Factor Grades below:

Intra-Cellular (seekingalpha.com)

This grouping of grades is distressing for those interested in opening a position in this name in today’s (06/17/2022) fraught market environment. It is growing nicely, but despite its high valuation with a >$5 billion market cap, it has yet to generate earnings.

Conclusion

Yes, Intra-Cellular’s CAPLYTA revenues grew 120% to $35 million during Q1 2022 with its new indication compared to its Q1 2021 revenues. However, SG&A expenses were $75.5 million for the first quarter of 2022 compared to $52.6 million for the same period in 2021.

Intra-Cellular incurred SG&A expense growth of >43% to generate its increased revenues. While CAPLYTA is an exciting product, I cannot endorse Intra-Cellular until it becomes clear that it will be able to generate actual growing earnings, not just growing revenues and expenses.

Be the first to comment