Images By Tang Ming Tung/DigitalVision via Getty Images

It has been a long time since our latest article on our favorite Italian bank Intesa Sanpaolo (OTCPK:ISNPY). Before commenting on Intesa and its Russian exposure, we would like to note that in a few weeks it will be the tenth anniversary of the fateful 29 June 2012, the day on which Europe decided to start the banking union.

So, we are asking once again, how healthy is the Italian banking system? And secondly, due to the fact that the economic cycle is changing, rates and spreads are rising while the economy is slowing down and Italian banks are overloaded with government bonds, so are banks vulnerable to these developments? Is the Italian system prepared?

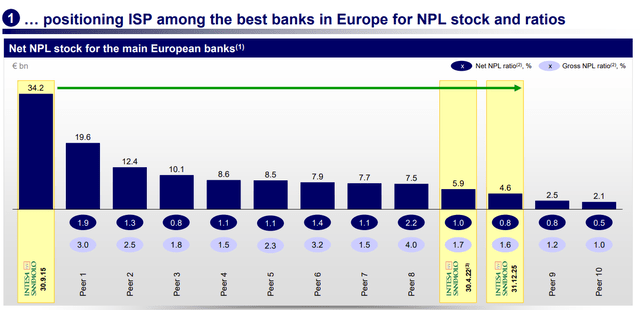

The past decade has led to a strengthening of the Italian system as a whole. Capitalization, liquidity and balance sheet quality have improved in the years following the financial crisis. However, at this time, the half-full glass that hasn’t been filled looks more and more half-empty. Banks identified as problematic ten years ago are still there, with the same problems. The recapitalization stopped a few years ago. Non-performing loans are still higher than the European average, as they were in the years preceding the major crises. A picture, that is seen as a whole, connotes a recovery well-underway yet not fully completed.

Looking at the system, we may note the following three elements.

- Dimensionally speaking, there is a galaxy of local, agricultural, and non-agricultural banking realities, suitable for supporting the micro-economy in the area. As a comparison, Crédit Agricole comes to mind, with its thousands of branches that cover even the most remote areas of France. On that basis, the French giant has built its strength and presence even beyond the border (including the soft steps it is now taking in the Italian market). Italy has taken the first step in this direction with the cooperative credit reform. A strategy that needs to be continued.

- Another element that the system needs is one or more (but few) large banks capable of offering the full range of financial products they need to the rich and diverse domestic clientele. Intesa satisfies this need well.

- The element that is totally lacking is a subject with a European vocation and dimension. Given the characteristics of the continental market today, this entity can only be a wide-ranging universal bank, with a strong presence in all relevant sectors: from classic brokerage to insurance, from payments to savings management, and from consulting to finance. Diversified size and operating lines guarantee income stability and scale advantages.

The first two Italian banks are in the seventh and ninth place in the European Union ranking by the size of their balance sheet. Behind them there is emptiness. This is not enough for what it is, and we hope will remain the third-largest economy in the Union.

Q1 Results And Russian Exposure

In Russia, Intesa Sanpaolo is present with a local bank with 28 branches and 976 employees and is also the only Italian bank in Ukraine with Pravex Bank with 45 branches and 780 employees. To sum up, Intesa Sanpaolo has approximately €4 billion of exposure and recorded €800 million of asset-related write-downs in Q1. The bank shows that all cross-border loans to Russia are performing and are classified as Stage 2. Together with Unicredit, Intesa is studying the possibility of exiting its activities.

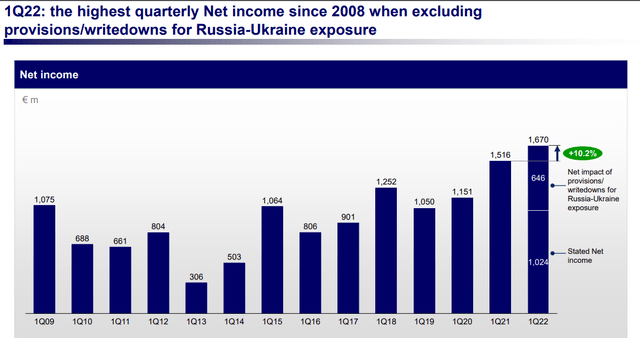

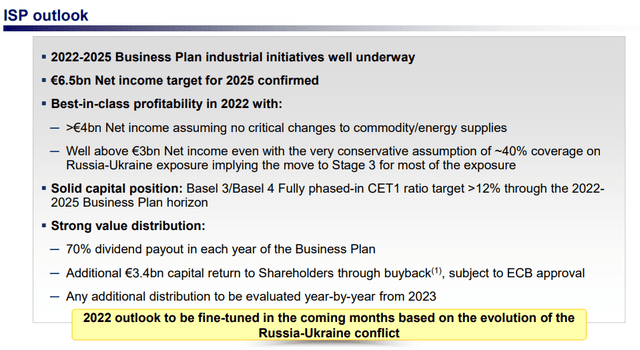

Intesa Sanpaolo ended the first quarter of 2022 with a net profit of €1.67 billion euros, excluding €0.8 billion of value adjustments for Russia and Ukraine, fully in line with the target of over €5 billion for the current year. The operating result was equal to €2.91 billion, up 0.2% compared to the first quarter of 2021. The cost/income ratio stood at 46.3%. At the end of March 2022, deducting from the capital of €717 million of dividends accrued in the first quarter of 2022, the Common Equity Tier 1 ratio was equal to 13.8% (14.5% at the end of 2021). The total of impaired loans (non-performing, unlikely to pay, and overdue), net of value adjustments, amounts to €6.79 billion, a decrease of 4.1% compared to December.

Conclusion

We arrive at a €2.4 stock price valuation based on a sum-of-the parts valuation and incorporating a €3 billion asset write-down due to the Russian exposure. We also assume a sustainable Return on Tangible Equity of more than 13% with a long-term growth rate of 0.5%. We rate the shares a buy. Aside from the Q1 company’s presentation, you can check out the latest strategic plan here.

Be the first to comment