mysticenergy/E+ via Getty Images

Introduction

International Petroleum is an E&P company with assets in Canada, Malaysia, and France. It is a relatively high-cost producer, but it is also superbly managed, delivering on all fronts from an operational standpoint, returning value relentlessly to shareholders, and with several options for organic and inorganic growth in the coming years. It is quoted on the Stockholm Stock Exchange (IPCO), on the TSX (TSX:IPCO:CA) and on the US OTC market (OTCPK:IPCFF).

Despite repeated statements to the contrary from Western politicians, the world is going to need oil for the foreseeable future. As the world enters the first energy crisis of the modern era and oil is trading at a large discount compared to equivalent carbon-based energy sources, O&G producers are going to be huge beneficiaries over the next few years. While the rest of the economy, especially energy-intensive industries, will see their earnings severely squeezed, energy companies will continue to print massive amounts of free cash flow. On top of a bullish sector outlook, International Petroleum, like many other peers, is currently undervalued. I see this pause, in what I believe will be a multi-year bull market for oil, as a good opportunity to add to my position.

Oil and gas sector is undervalued

I will begin with some general considerations about the energy sector, and the oil price in particular. In the end, this is the most important driver for International Petroleum.

O&G companies are currently misunderstood and, again, undervalued. It is remarkable how the energy sector is the only sector of the S&P 500 to be in positive territory year-to-date. Virtually nothing has been done to solve the ongoing crisis, so I expect the trend to continue into 2022 and 2023. Since energy is the lifeblood of the majority of the economy, the energy sector will “cannibalize” other sectors and continue to massively outperform in relative terms.

This view is quite contrarian; otherwise, the current valuations of O&G companies would make no sense. So, let’s unpack it in more detail.

Energy investors are used to boom and bust cycles. The oil price has risen 36% in the last year, after rising another 60% the year before. All O&G companies are up considerably over this timeframe. International Petroleum itself is up a massive 143% over the last year. Usually, what follows is a rapid increase in supply, which crashes the oil price back down.

This time, it is different. Producers are not ramping up production, but are instead focusing on returning value to shareholders via dividends and buybacks. OPEC has found its balance and seems to be able to maintain market discipline. Or, at least, OPEC is unable at the moment to bring any spare capacity online following years of underinvestment. In any case, the physical market is very tight.

Saudi Arabia itself is stating that the paper market has diverged from the physical market and that it may adopt, with the backing of other OPEC members, drastic measures to bring the two into alignment.

Comments from several producers, including from International Petroleum’s Q2 2022 conference call, confirm this view:

[…] I think it’s important to realize that the physical market, the oil physical market is very tight. That is evidenced by the year-to-date by a $3 premium of the dated Brent compared to the IC to the financial Brent, if you wish. So that is a very clear indication that the physical markets are tight. And we see that as well, Mike mentioned, in Malaysia, we used to enjoy a premium when we were selling our brands or cargoes in Malaysia, we had premiums of single digits. Now for Q3, we’ve been selling already two cargoes between $10 and $20 premium above dated Brent. So indeed, a very tight market.

However, over the last few months, the oil price has relaxed somewhat. This has prompted many to believe that what happened in 2008 is going to happen again. Tightening financial conditions and the energy crisis are going to cause demand destruction, hence oil is ripe for a big correction.

Contrary to this belief, the oil price has proven exceptionally resilient over the recent period, especially in the face of numerous headwinds. Let’s go through them.

First, China‘s appetite has been weak because of Xi’s zero-covid policy. I don’t see this policy as sustainable in the long term. China might re-open after the CCP’s elections in November, which would lead to a significant increase in demand.

Second, the price has declined because Russian volumes are still finding their way to the markets. However, Russian oil production is projected to fall in the coming years, as sanctions against Russian oil from the EU come into effect starting in February 2023. For this reason, Russia is negotiating agreements with China and India to sell its oil at steep discounts.

Third, recession fears have been weighing on sentiment, fuelled by central banks policies and uncertainty about the Chinese property bubble. However, while a recession is in the cards, I don’t see it as an inevitability. Even if there were a recession, demand destruction might be offset by other considerations.

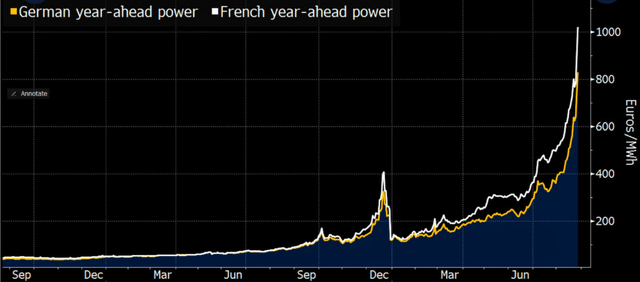

One that I find particularly interesting is that oil is trading at a massive discount to other carbon-based energy sources. Today, German and French one-year-ahead electricity prices broke above €1000/MWh. This corresponds to an oil price of more than $600 per barrel!

German and French year-ahead energy cost (Bloomberg)

On a relative basis, oil is actually very cheap. As the EU enters winter in the midst of a global energy crisis and with energy prices already going through the roof, I would expect electricity producers to convert plants from burning gas to burning oil. This would put a floor under the oil price, even in a recessionary scenario.

O&G companies are even cheaper relative to oil. In fact, if the oil price were to crash back, for instance to $65/bbl, many of them would still be very attractive from a value point of view. Take the case of International Petroleum. With Brent at $65 per barrel, the company would generate in excess of $900 million in FCF over the next 5 years. This corresponds to a 12% FCF yield. Not bad at all.

Why International Petroleum

Being long energy has been the winning trade of 2021. I am convinced it will continue to overperform going forward. This is why I want more energy exposure. International Petroleum checks all my boxes.

The company owns a variety of high-quality assets in different jurisdictions. In terms of barrels of oil equivalent (boe), about 50% of production comes from Canadian oil, 33% from Canadian gas, and the rest from the Malaysian and French assets. Because the Canadian operations are relatively high-cost, International Petroleum is not the cheapest producer out there, but it is a massive cash-flow machine and it is cheap.

International Petroleum is cheap

The market capitalization is around $1.5 billion. The company was in a net cash position of $14 million at the end of June. Over the next five years, it is guiding for OpEx of $15-16/boe and CapEx of $4.65/boe. Production is expected to average around 47 million boe per day.

Under the previous assumptions and taking an average Brent oil price of $95 over the 2022 to 2026 period, International Petroleum would generate more than $1.8 billion in FCF. This would give it an EV/FCF ratio of less than 5.

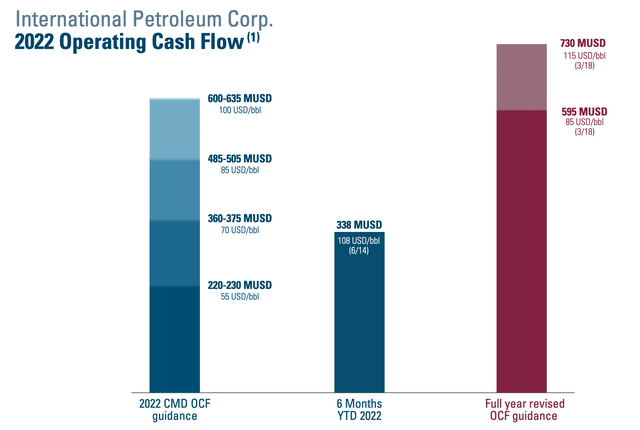

Consider that International Petroleum has already generated FCF of $248 million at an average realized price of $108/bbl in 2022. For the full year, the company is currently guiding for FCF between $395 million (if oil averages $85/bbl) and $530 million ($115/bbl).

FCF for 2022 (Investors Presentation)

International Petroleum is delivering on all fronts operationally

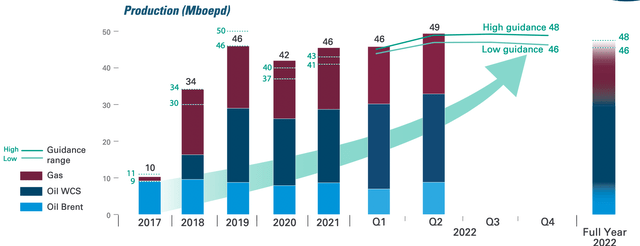

Operationally, the company has a history of beating its own guidance. This year is likely going to be no exception. At the beginning of the year, International Petroleum guided for production of 46-48 thousand boepd. During Q2 2022, it delivered an average of 49.4 thousand boepd, the result of very high uptime in all operating regions.

Production and production guidance (Investors Presentation)

The company is also doing a good job of controlling costs. OpEx per boe amounted to $16.20 for Q2 2022, which is at the low-end of the full-year guidance range of $16-17 per boe.

International Petroleum is superbly managed

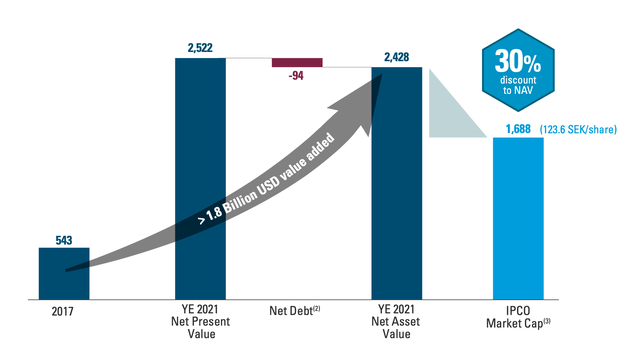

Management is smart. It has a long track record of creating and returning capital to shareholders. This is evidenced, for instance, by the relentless buybacks.

At the company’s inception, there were 114 million shares outstanding, which increased to 190 million after the BlackPearl Resources acquisition in December 2018. Starting in 2019, the company has been buying back shares every single year. Right now, the share count is back to 139 million shares. That is only a 22% dilution to finance a 5x increase in production and a 9x increase in 2P reserves.

The company has generated considerable value for shareholders since inception (Investors Presentation)

More recently, a Substantial Issuer Bid (SIB) for $100 million and 8.3 million shares was completed at the end of June through a Dutch auction. Another 8.3 million shares at an average price of SEK 80 per share were cancelled via an in-progress Normal Course Issuer Bid (NCIB). For the full H1 2022, the company has already returned $165 million to shareholders.

As a matter of fact, why invest in new production when you can buy up oil at a cheaper price by simply retiring your own shares? Given that the market is not recognizing the true potential of the company, I believe buybacks are the best strategy to return capital to shareholders at the moment. I am happy that management concurs.

Another sensitive issue that can often destroy value is the hedging strategy. In the case of International Petroleum, however, it is very sensible. The company has hedged 60% of the WCS – WTI differential at $13 per barrel. A good move, considering that the spread has widened somewhat, and is now around $20 per barrel. There are no hedges on Brent or WTI, while 35% of natural gas production is hedged at $3.60, but only until the end of September.

This quote is taken from the Q2 conference call:

On oil, it’s — you still have a very significant — we are not against hedging philosophically, we are just shocked with the — as I was mentioning, there is a very tight physical market. And so you’re losing almost $10 between now and the end of this year. So the market is in steep backwardation and you lose another $10 per barrel between January and December 2023. So hedging today would mean to accept up to $15 or $20 discount to where oil prices are today, which we’re not willing to accept just right now.

While buying back shares, International Petroleum is also further investing in its many projects, where it makes economic sense. CapEx for the year has been increased from $127 to $170 million on the back of an improved pricing environment. According to management, the purpose is not just to increase production, but to accelerate the development of projects with the highest value and the fastest payback, to take advantage of favorable market conditions. This strategy makes total sense.

Conclusion

International Petroleum is a well-managed E&P company capable of generating significant free cash flow. It has a very clear-cut policy to return value to shareholders, as evidenced by its in-progress buyback program. Since the beginning of the year, it has already retired around 11% of the outstanding shares.

The company is obviously undervalued, as it trades at an EV/FCF multiple of less than 5, under conservative assumptions. I remain bullish on the oil and gas sector, despite some temporary headwinds. International Petroleum gives significant exposure to any further upside in the oil price, with the margin of safety of a cheap valuation.

Be the first to comment