malamus-UK/E+ via Getty Images

Following the Q3 results, today we deep-dive into International Paper’s (NYSE:IP) numbers. Here at the Lab tower, we recently provided a positive overview after FedEx’s (FDX) profit warming, and despite a negative stock price reaction, we believe that IP’s long-term thesis remains intact. Q3 numbers were not positive; however, we used to work in Equity Research and one of the most common errors is following the numbers and not providing a top-down analysis.

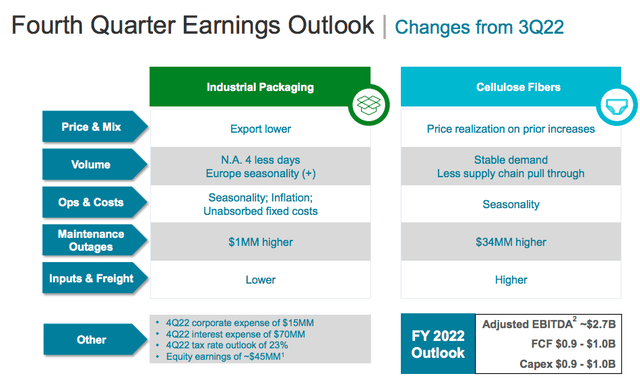

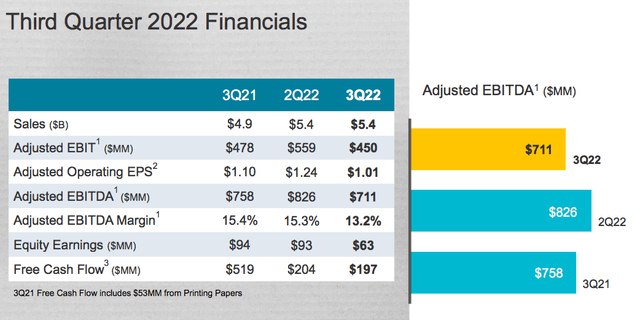

Cross-checking Wall Street analyst consensus, IP reported an adj. EPS of $1.01 against an IBES consensus of $1.22. At the aggregate level, the company’s operating profit reached $450 million, down by 6% on a yearly basis and decelerating from Q2 results. In addition, EBIT was significantly down compared to consensus expectations (by more than 20%). Looking at the company press release, IP was impacted by macroeconomic factors such as 1) lower consumer spending, 2) retail inventory destocking, and also 3) higher logistic and energy costs. Despite the management being more optimistic about packaging demand and input costs, they forecasted higher operating costs in Q4, resulting in an EBITDA cut which is now set at approximately $2.7 billion (14% below the average consensus estimates) and an FCF guidance lowered to $0.9-1.0 billion. As a memo, International Paper was previously estimating a mid-point EBITDA guidance at $3.25 billion with an FCF generation of $1.4 billion.

International Paper Q4 and FY 2022 guidance

Source: International Paper Q3 results presentation

As we also did in Q2, we are now looking at the segment information; here are our main comments:

-

Industrial Packaging’s operating profit was considerably down in Q3 compared to Q2 2022. International Paper increased its turnover thanks to a price effect; however, as happened in Q2, volumes were down by 5.4% on a yearly basis. More importantly, EBIT declined for the cost effect. Raw material inflationary pressure, weaker sales outside the US, and unfavorable one-off costs were coupled with the current macroeconomic challenges. IP’s guidance for Q4 is pretty cautious and to not play any favor to the company, the last quarter will have four days less in delivery.

-

Global Cellulose Fiber’s performance was the positive outlier in Q3, recording an adj. operating profit of $95 million compared to the $76 million achieved in Q3 2021, and up by almost $70 million on a quarterly basis. Higher volumes and incremental pass-through initiatives were offsetting cost pressure. Lower maintenance was also recorded compared to the previous year’s results; however, looking at the segment guidance, management projected higher maintenance in Q4, and this will balance the second-half-year results.

-

Ilim Group reached an equity contribution of $64 million, a lower result compared to the 2022 Q2 of $95 million. This was driven by lower sales prices and higher operating costs. We suggest our readers look at our previous publication on Ilim and its dividend implication on IP numbers. As happened in Q2, the company is actively looking to exit its Russian JV.

International Paper Q3 financial snap

Source: International Paper Q3 results presentation

Conclusion and Valuation

International Paper’s balance sheet looks safe. The company has a fully funded pension plan, and FCF covers the dividend payment. International Paper is also achieving cost-saving initiatives with incremental annual earnings growth projections set for $125/$150 million in 2023 and 2024 respectively. As mentioned in our initial paragraph, we are looking at the long-term horizon; however, looking at the company valuation, we lowered our target price from $55 to $50 per share. In line with our previous valuation methodology and with the latest guidance provided by the management, we derive our target price based on the average between:

- An 8.0x EV/EBITDA on our 12-month forward estimates,

- A DCF analysis in which we assume a 10% cost of equity and a terminal growth rate of 2%.

Mare Evidence Lab’s buy rating is confirmed and a 5.5% dividend cannot go unnoticed.

Be the first to comment