This article was first published to members of Trade With Beta on October 12, 2022.

marchmeena29/iStock via Getty Images

In all our future articles we will have a small intro presenting the yields of various asset classes so that the reader gets an idea of what is normal in the current environment. This includes the treasury yield curve, mortgage rates, corporate bonds, fixed-rate preferred stocks, and a number of instruments we find interesting and representative at the moment. We call this “the big picture”. After the big picture, we present our income idea in the shortest way possible hopefully without any fluff.

The Big Picture

US Treasury

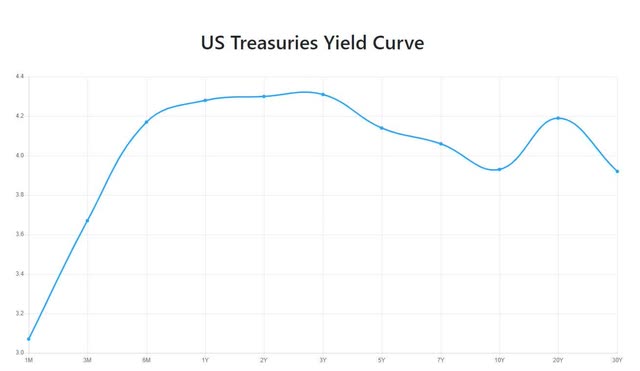

As we all know in the last weeks the US Treasury yields jumped to their highest levels in the last decade and the curve is now inverted:

US Treasury (Investing.com) US Yield Curve (Fed Data)

Fed Funds Rate

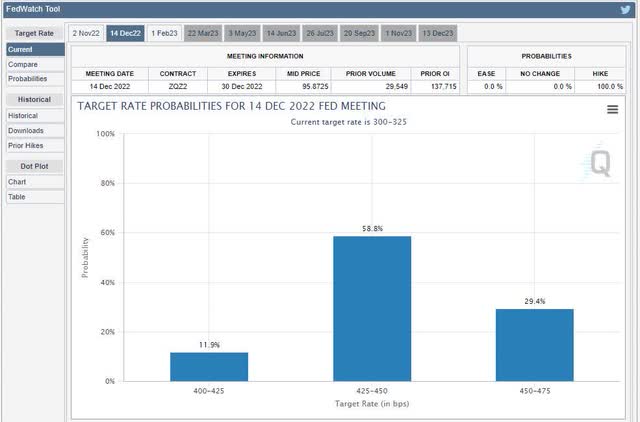

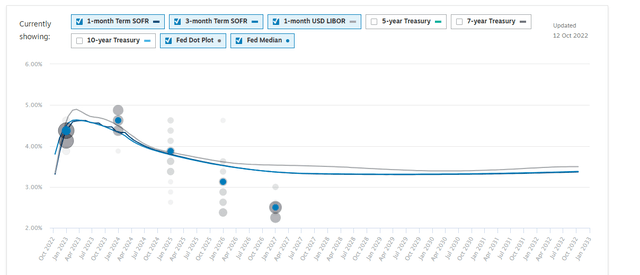

The federal funds rate is currently 3.25%. Fed officials have signaled their intention to keep increasing interest rates as much as needed to fight inflation. The market expectation can be seen below:

Fed Funds Rate Expectation (Cmegroup.com)

LIBOR

The London Interbank Offered Rate (LIBOR) is a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans. The current 3-month LIBOR Rate is 3.90%, while at the beginning of the year it was at levels around 0.2 – 0.3%. It is highly likely that LIBOR will continue to be higher than Fed Funds as it makes sense.

What will happen to LIBOR

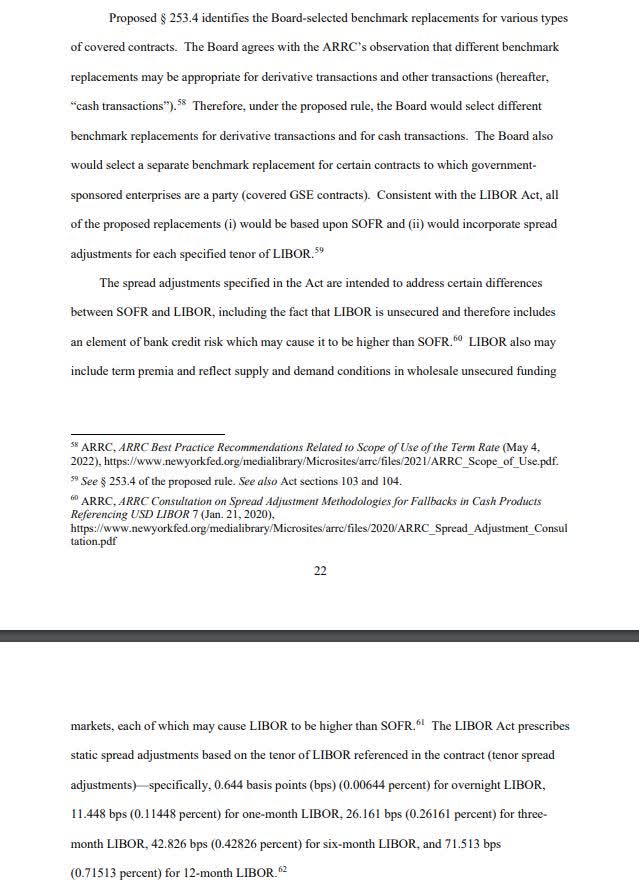

This question is raised after almost any article that includes the good old benchmark. The FED text is as follows:

FED (Federalreserve.gov)

Most likely the 3-month LIBOR will be SOFR +0.26%

Mortgages Rates

The average interest rate on a 30-year fixed mortgage is 7.11%, up from 3.3% at the start of the year. The average rate for a 15-year loan is 6.29% as of the time of writing.

Corporate Bonds

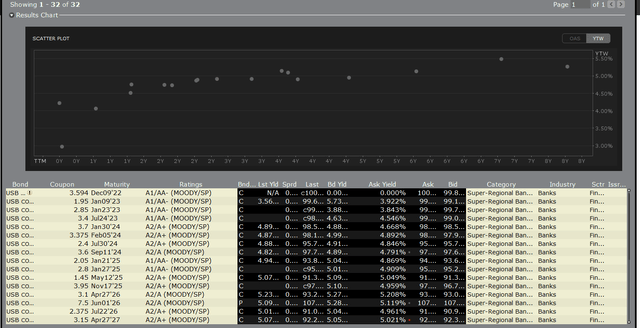

Here we will use the USB corporate bonds yield curve:

USB Yield Curve (Interactive Brokers)

Yields are in the range of 4%-5% depending on the duration and liquidity. USB is as close as possible to the Treasury Yield Curve in the shorter durations

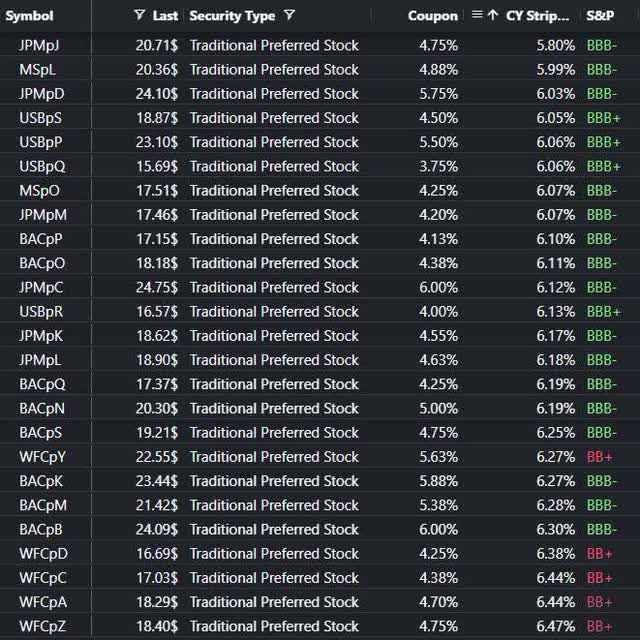

Fixed-Rate Preferred Stocks

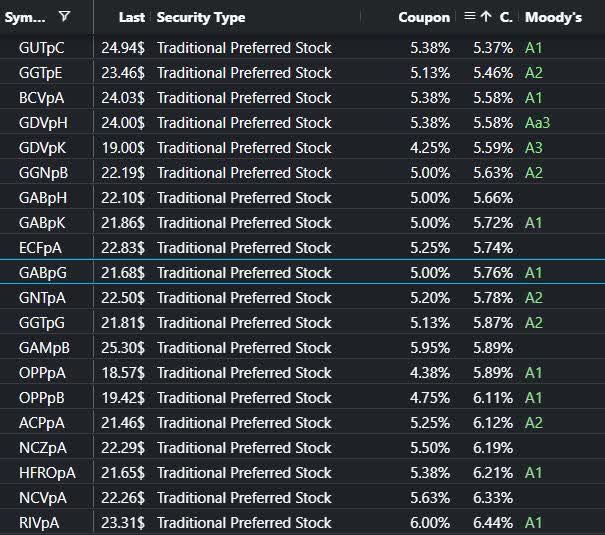

We have over 100 fixed-rate preferred stocks with investment-grade credit ratings by S&P or Moody’s. Some of them are qualified for lower tax rates some are not but in general, their yields are in the range of 5.75% – 7.2% depending on company specifics

Fixed-rate preferred stocks BBB- or higher (Proprietary Software)

CEF’s Preferred Stocks

From a credit perspective, these are the safest preferred stocks on the exchange and their yields are in the range of 5.37% to 6.44% depending on the issuer and some tax differences.

CEF Preferred Stocks A- or higher (Proprietary Software)

Our recent articles and blogs

Today’s Idea

The stock that got our attention is U.S. Bancorp, Fixed/Floating Dep Shares Non-Cumulative Perpetual Preferred Stock, A (NYSE:USB.PA). We believe that this is an income investment that is both suitable from a credit risk perspective and from an interest rate risk perspective. It carries a BBB+ rating by S&P.

Description of USB-A

USB-A is Fixed/Floating Dep Shares Non-Cumulative Perpetual Preferred Stock issued by U.S. Bancorp (NYSE:USB). After his call date of 4/15/2011, this security became floating, and the depositary shares pay at a rate of the greater of 3.50% or the 3-month LIBOR plus 1.02%. Dividends paid by this preferred security are eligible for the preferential income tax rate of 15 % to a maximum of 20% depending on the holder’s tax bracket. At the moment of writing this article USB-A trades at around $740, and it can be redeemed at any time at $1000 plus accumulated dividend. This security is rated BBB+ by S&P and Baa1 by Moody’s.

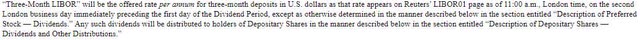

We have to read the USB-A prospectus to understand how the dividend is calculated

That means that we have to take the 3-month LIBOR rate from the second business day after the payment date.

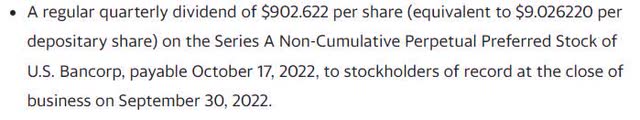

Let’s check the last declared dividend of USB-A:

USB-A Dividend Declaration (Finance.yahoo.com)

When looking at the dividend history of USB-A we can be sure that now it is floating. Since the next payment date is in a few days, we will take the 3-month LIBOR rate from today (3.90 %) to calculate the next dividend. At 4.92% USB-A is supposed to pay $49.2 per year (the rate is adjusted every quarter). At a price of $740, the current yield is supposed to be around 6.64%. It is very important to note that this rate is floating and may fall or rise. Financial markets are so developed that we can even exchange a floating rate for a fixed rate and this can be done using an interest rate swap.

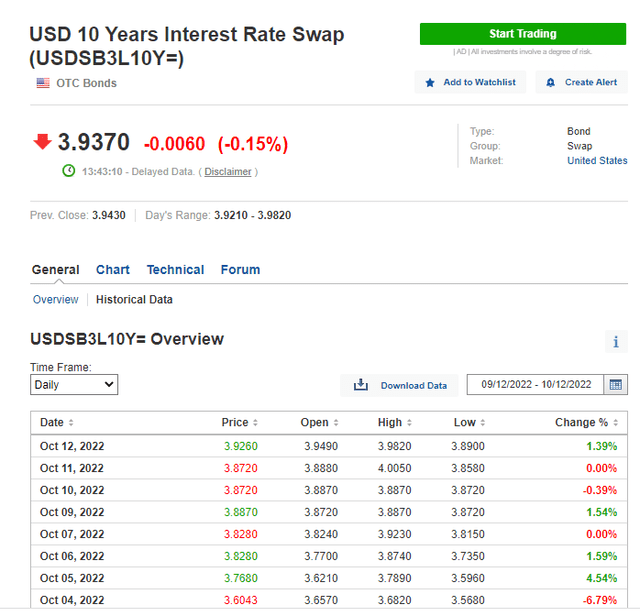

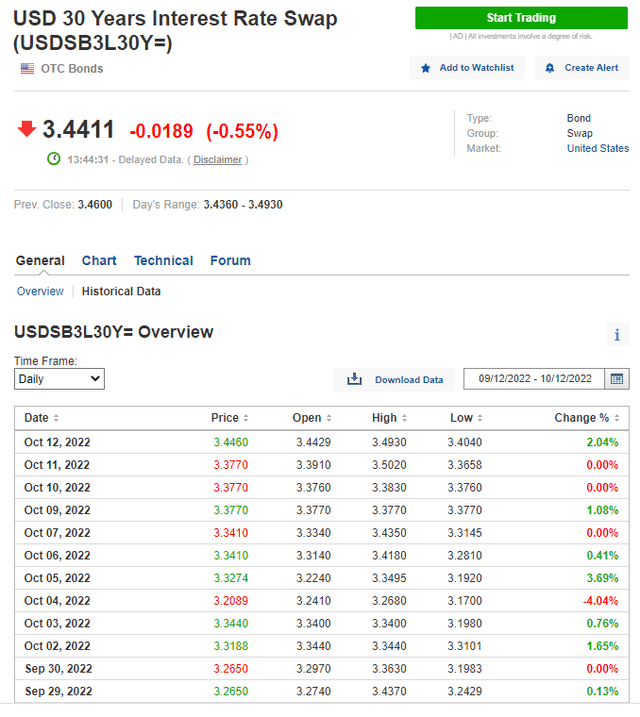

Using an interest rate swap to be able to compare USB-A

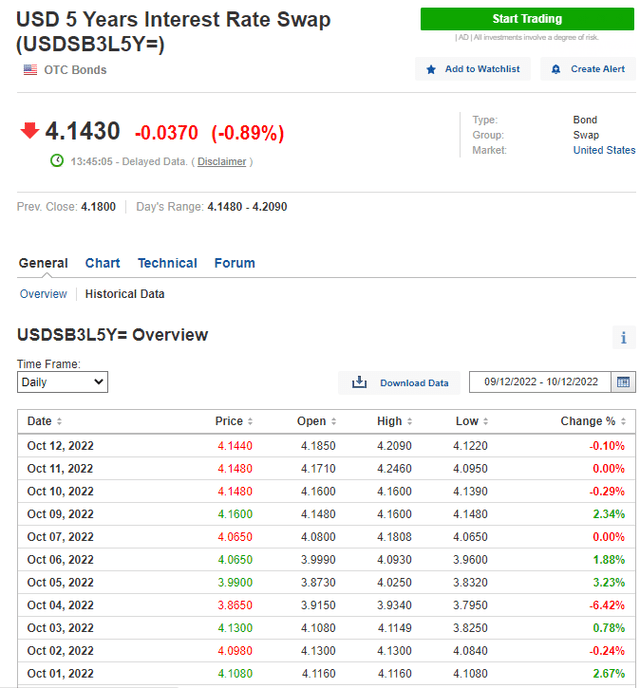

At the time of writing, there is not much data about interest rate swaps. The best source I found for the general public can be seen here:

USD 10 Years Interest Rate Swap (Investing.com) USD 30 Years Interest Rate Swap (Investing.com) USD 5 Years Interest Rate Swap (Investing.com)

Basically, the swap rate is in line with the LIBOR expectation:

Term SOFR and USD LIBOR Curve (Chathamfinancial.com)

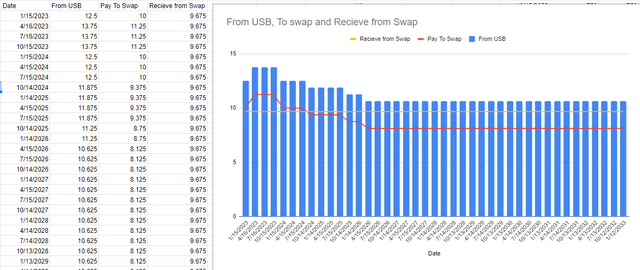

At the time of writing theoretically, one can swap his USB-A LIBOR payment for 10 years and receive a 3.87% fixed instead. If we believe in the LIBOR market consensus at the moment this is what the future holds for our USB-A:

From USB, to swap and receive from swap XIRR Table (Proprietary Software)

Assuming no change in USB-A price in 10 years the no-swap expectation of USB-A is to return 6.17% XIRR. Using a Swap brings the XIRR to around 6.64% with the same assumption. It is very important to note that USB-A is not the typical floating rate instrument because it has a floor rate. A person buying USB-A at a price of $740 is locking a minimum perpetual rate of $35/740 or 4.72%.

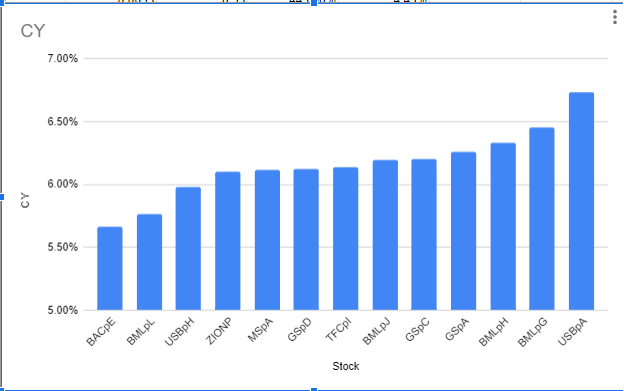

Comparing with fixed-rate bank’s preferred stocks

Let’s take a look at the bank’s fixed-rate preferred stocks below par, we will include the preferred Bank of America (BAC), J.P. Morgan (JPM), Morgan Stanley (MS), U.S. Bancorp (USB) and Wells Fargo (WFC).

Bank’s Fixed-rate Preferred stocks (Proprietary Software)

Their current yields of comparable preferred stocks are at around 6%. This is in line with the 30-year Swap rate of USB-A at a price of $740.(3.4% + 1% =$44/740=6%) The value of the floor rate of USB-A comes as a big benefit even in this comparison. It is also very important to understand that the market concern at the moment is duration risk. USB-A being a floating-rate instrument with a floor has virtually no duration risk and definitely deserves some premium above fixed-rate perpetual cash flows. Of course, if one is certain that the yield curve is soon headed to 0% again USB-A has comparable price appreciation potential to any preferred stock there is. USB-Q was issued at 3.75% which is pretty close to the floor rate of USB-A and as far as upside duration is concerned USB-A has the same capital appreciation potential but without the downside risk.

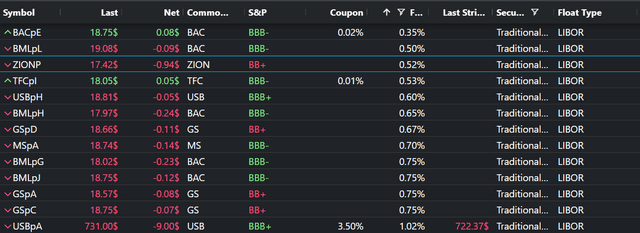

Comparing all floating preferred stocks with a floor

In the graph below we see all floating banks preferred:

All floating preferred stocks (Proprietary Software)

We can see all these securities have a Float rate minimum in the range of 3% to 4%, at current levels of the 3-month LIBOR even the security with the lowest Float Rate of 0.35% (BAC.PE) is a floater. This again is an advantage for our USB-A, because it has the biggest float rate of 1.02%. If you just divide USB-A stock price by 40 you will see that its valuation is comparable to all of the stocks above even though it has the highest LIBOR spread and the highest credit rating. Here we can see the CY of USB-A compared to its cousins of the banking sector assuming LIBOR will not change ( change is the same for all of them):

Floating rate preferred stocks sorted by current yield (Proprietary Software)

This has to be mispricing unless USB is somewhat of a poorer issuer compared to the banks above which we have to check.

USB being the benchmark preferred stock issuer

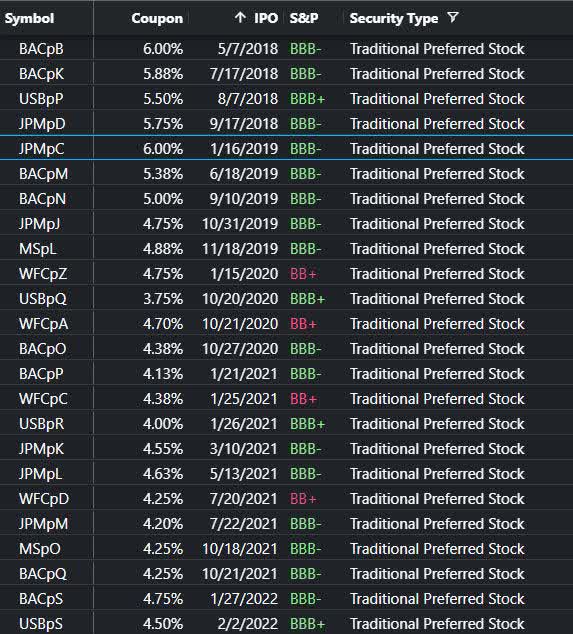

Looking back in time, we can see that USB has always been able to finance at a lower rate compared to other banks:

Bank’s Preferred Stock sorted by IPO date (Proprietary Software)

The spread between the IPO’s nominal yield and 30y Treasury as of the date of the issue looks like that:

Bank’s IPO vs 30y Treasury yield spread (Proprietary Software)

We see that the average spread between USB’s fixed-rate preferred stock and 30y Treasury is 2.28%, and the average spread of the other banks is 2.58%, on average USB has been able to finance 0.30% better.

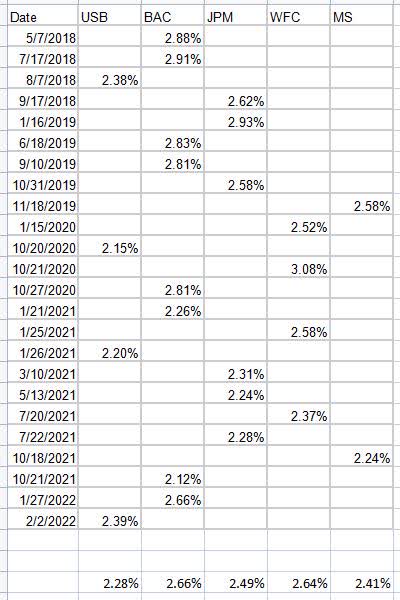

The relative fair value of USB-A

The best way to determine the relative fair value of USB-A is to compare it to its own family:

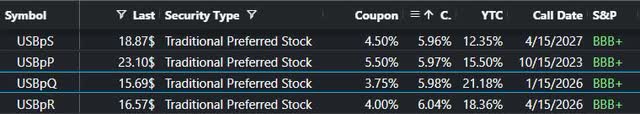

USB Fixed-rate preferred stocks (Proprietary Software)

We can see that all USB fixed-rate preferred stocks trade below par and their current yield is around 6%, they are perfectly priced to each other. If we assume that we prefer the floating rate of USB-A in comparison with the fixed rate of these securities because we are scared of inflation as is the whole world we can simply say that USB-A deserves to trade around $820 just to be equally priced to its fixed-rate brothers. With the next expected dividend of around $12.25, USB-A will have a current yield of around 6% at this price. It is very possible that this calculation is financially not sound because it seems that the yield curve is expected to reverse at some point in the next 2 years and the market is not giving any premium to a floating rate instrument. As a fixed-income investor, I personally prefer the floating rate at the time of writing.

When compared to the bonds of USB:

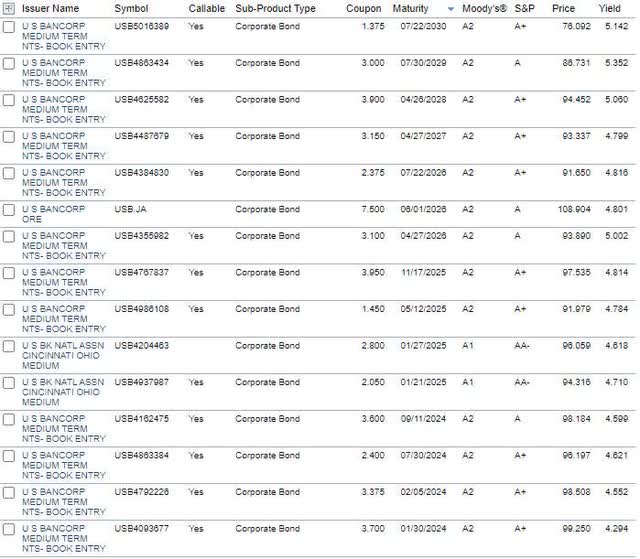

USB Corporate Bonds (Finra Website)

USB-A being a few notches lower from a credit perspective brings some extra qualified yield and duration risk protection. We can not claim with certainty that USB-A is undervalued to the USB bonds above but it is very possible.

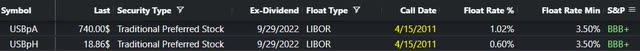

Fortunately, we have exactly the same product as USB-A in the USB family -USB-H.

USB-A vs USB-H (Proprietary Software)

They have one small difference in their float rate, USB-H is 0.60% + the 3-month LIBOR, while USB-A is 1.02% + the 3-month LIBOR. At the moment of writing this article USB-H trades at a price of 18.86 with a par of $25 and USB-A trades at a price of $740 with a par of $1000. When we adjust for the higher LIBOR spread and assume that USB-H is priced correctly, USB-A has to trade close to $880. Here we can claim that USB-A is way superior without a doubt

Conclusion

USB-A is straightforwardly mispriced compared to USB-H and all Floor to Floating preferred stocks on the exchange. There is a serious point to be made that it is a better alternative compared to any investment-grade fixed-rate preferred stock on the exchange with some financial engineering involved. We do believe the market is not fair when evaluating this low-volume forgotten security. Fair price valuation brings USB-A at least 5-10% higher than current prices while providing one of the highest available credit ratings on the exchange for preferred stock with no downside duration risk being a floating rate instrument. It is supposed to be the perfect fit for any fixed-income portfolio at least in theory

Be the first to comment