Svetlana Mokrova/iStock via Getty Images

This is my first inquiry into Intercept Pharmaceuticals (NASDAQ:ICPT). It is a commercial stage biotech with one approved therapy and another ready to resubmit an NDA by close of 2022. Beyond these, its pipeline is sparse at best.

In this article, I will review Intercept’s Q3, 2022 results as reported during its earnings call (the “Call“) and Q3, 2022 earnings presentation (the “Presentation“).

OCALIVA is laboring near the stage where it can support Intercept’s ongoing expenses.

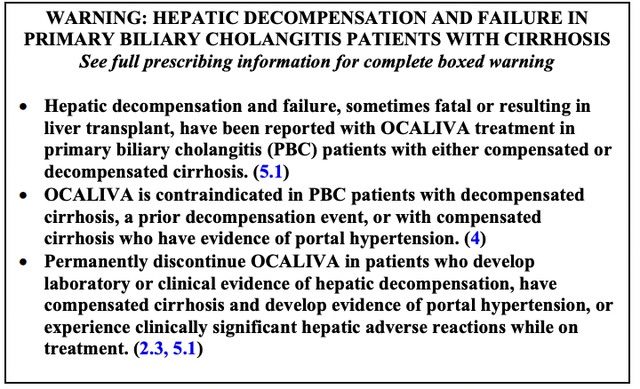

OCALIVA (obeticholic acid, OCA) has an extensive approval timeline with the FDA, going back to its 2016 approval as a second line treatment of primary biliary cholangitis [PBC]. In 2018, it picked up a black box warning for certain patients based upon its post-marketing study. The label was updated again in 2021 as part of an NISS process to contraindicate use for certain patients.

Its 05/2021 revised black box warning reads:

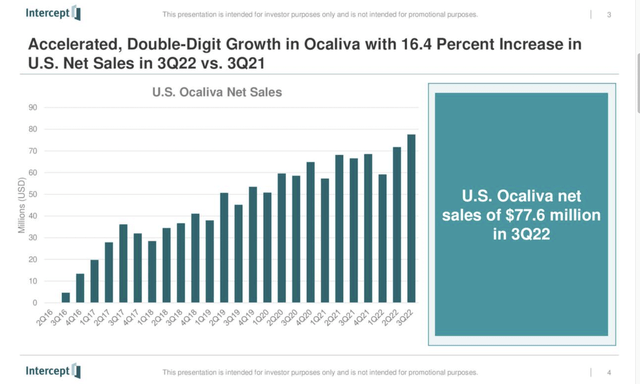

Despite its safety challenges, OCALIVA sales have managed a steady upwards path, quarter after quarter, excepting only brief respites in Q1 performance over the years. Intercept’s Q3, 2022 earnings presentation slide 4 tells the story:

During the call, CMO Berrey emphasized recent published data from a leading Journal of Gastroenterology showing:

…improved transplant-free survival observed for patients administered Ocaliva in a clinical trial compared to natural history data from 2 large patient registries.

In this publication, patients treated with Ocaliva had an approximately 70% lower relative risk of death or liver transplant at any time during follow-up compared to the controlled patients from either patient registry. The consistent effect size across the 2 external control cohorts strengthens our confidence in these observations. This study is the first to demonstrate that Ocaliva treatment is associated with improved transplant-free survival, the ultimate goal of therapy in PBC.

This data is important for Intercept insofar as there are darkening clouds of competition on the not too distant horizon. Two phase 3 trials of note include:

- Genfit’s (GNFT) pivotal phase 3 study in patients with PBC listed in Genfit’s 04/2022 presentation slide 9 as expecting top-line data readout in 2Q 2023; its molecule is in development with Ipsen (OTCPK:IPSEY);

- CymaBay’s (CYMB) phase 3 trial for seladelpar; CymaBay’s slide 3 of its 08/2022 presentation places top priority on this indication; slide 39 lists its timeline as completing enrollment in 2022 with top-line phase 3 PBC data expected in 2023.

Other molecules are in various stages in pursuit of PBC, as listed in Intercept’s 2022 10-K (pp. 16-17).

Intercept also sees its meme of improved transplant free survival as a ticket to help it in its PBC post-marketing presentation to the FDA. Intercept’s 06/2022 press release reports the clinical trials supporting this conclusion.

During the Call, CEO Durso observed that its study generated data will be helpful in:

… the conversation with the FDA with a focus on what we’ve been able to do from a longer-term perspective based on all the experience, as Michelle indicated, the COBALT data set, the real- as well as the post-marketing data with over 20,000 patient years, I think, puts our data set in a unique perspective there.

In terms of patent protection for OCALIVA, Intercept 2022 10-K notes:

…Our primary composition of matter patent for OCA was to expire in 2022. In light of the U.S. marketing approval of Ocaliva for PBC in May 2016, we applied for an extension of the patent term for this patent in the United States into 2027, which extension has been granted (p. 17).

This potential of limited patent protection for PBC after 2027 raises the stakes on its NASH NDA project.

Intercept’s upcoming resubmittal of an NDA for OCALIVA in treatment of NASH has two strikes against it.

Nonalcoholic steatohepatitis [NASH] has been a tough nut to crack. It presents a huge market opportunity, estimated at ~$35 billion back in 2019. It has attracted biotechs like bees to honey. So far, all have failed. Currently, there are no FDA approved therapies for the condition.

Gilead (GILD) took multiple swipes at it that I followed over the years, but failed miserably. After such long laboring, it is still at it, listing one phase 2 trial on its current (11/02/2022) pipeline. All its previous efforts having come to naught, its one current trial is the result of an 03/2021 collaboration with Novo Nordisk (NVO). When at first you don’t succeed, call in reinforcements.

Intercept has been deeply involved in this NASH therapy effort. Back in 11/2019, the FDA accepted its NDA for OCALIVA, seeking accelerated approval for the treatment of fibrosis due to NASH. The FDA granted it priority review, setting a 03/26/2020 PDUFA date.

Not surprisingly, given the challenge of taming NASH, the FDA slapped Intercept with a CRL in 06/2020. Intercept’s initial NASH fibrosis CRL was based on concerns over both efficacy and safety.

Now, with new data in hand, Intercept is anxious to try again. During the call, CEO Durso reported:

…We remain on track to resubmit our NDA for OCA in liver fibrosis due to NASH by the end of this year based on our Positive 3 REGENERATE study. Given the analysis we’ve conducted on REGENERATE to date, we believe in the improved benefit-risk profile of OCA, and its potential role as the first therapy for liver fibrosis due to NASH.

So what are Intercept’s chances of being first in the NASH wars? I might say slim and none, but that would be too pessimistic, albeit some pessimism is warranted. Intercept’s OCALIVA has several strikes against it in its pursuit of NASH:

- Its safety issues that have shown up in connection with its PBC indication;

- Its initial CRL following its first NDA based on both safety and efficacy;

- Its failure to achieve its primary endpoint of a ≥ 1-stage histological improvement in fibrosis with no worsening of NASH following up to 18 months of therapy in its REVERSE study.

During the Call, Intercept was emphatic that this third point was not a problem for its resubmission. CMO Berrey explained:

…our planned NDA resubmission is not impacted by the results of REVERSE. The agency has been very clear that REGENERATE and REVERSE enrolled 2 different patient populations. Nevertheless, should the FDA ask for any safety data from REVERSE, we will be ready to provide it.

REGENERATE (NCT02548351) was Intercept’s Phase 3; it returned positive results. Intercept’s NASH ambitions are exciting. We should know how they turn out in the short term. It plans on resubmitting its NDA in 2022 and is preparing for a 2023 launch in NASH.

Intercept has sufficient liquidity to launch in NASH if it can get FDA approval.

CFO Saik opened his financial presentation during the Call by reminding that Intercept had bolstered its finances with its 07/01/2022 completion of its international divestiture. Its upfront payment of ~$405 million allowed it to repurchase $389 million of its 2026 secured convertible notes.

He later noted:

Further, with approximately $500 million in cash, cash equivalents, restricted cash and investment debt securities available for sale and $336 million in debt, we are now net cash positive for the first time since 2019.

In summary, we have a strong financial position and are comfortable that our current balance sheet gives us financial flexibility to grow our existing business in PBC, support a launch in NASH and progress our pipeline.

On a current operating basis, Intercept is just shy of breakeven. For Q3, 2022 it had $87.7 million in total operating expenses. Its quarterly net sales were $77.6 million, compared to $66.6 million in the prior year quarter.

Conclusion

Intercept is in a complicated situation. On the one hand, it is poised for a possible prize as a first potential therapy in NASH, a condition with a huge unmet need. Aside from NASH, it is just another little biotech, struggling to make a profit.

Interestingly, its Ratings graphic on Seeking Alpha (accessed 11/03/2022) covers the waterfront in an atypical collection of ratings:

seekingalpha.com

In my observations over time, I have noted that Wall Street is overall prone to be more bullish on small biotechs with Quant often more restrained. Here we have an optimistic reading from Quant and a less usual hold from Wall Street.

My own assessment sticks at a tepid hold. I am pessimistic about its chances for an FDA approval in NASH with a clear label. Its prospects as a one therapy, OCALIVA in treatment of PBC, company are unappealing. It has just been straggling along over the years; it faces potential competition in 2024 and patent issues in 2027.

That being said, those who are interested in a high risk lottery ticket with a nice potential payout will find Intercept as just the thing.

Be the first to comment