JHVEPhoto/iStock Editorial via Getty Images

Shares of Intel Corporation (NASDAQ:INTC) have been cut in half, as they declined -51.44% YTD. You would need to go back to the spring of 2014 to find the last time shares of INTC traded at this low of a valuation. INTC doesn’t resemble one of the largest companies in the S&P 500 but rather a profitless tech company. Due to many issues, from a softening PC market to supply chain issues, INTC missed the consensus earnings estimates on the top and bottom line in Q2 and guided for lower-than-expected results in Q3, which will be reported next week on 10/27. INTC filed for an IPO of Mobileye several years after it acquired the company and will retain majority ownership after Mobileye goes public. I think shares of INTC are inexpensive and offer an interesting value proposition. INTC remains the largest chip maker in the PC sector, will become one of the largest chip manufacturers by the end of the decade, and if Mobileye lives up to its potential, they could be sitting on tens of billions in value due to its ownership stake. With Q3 earnings on the horizon, INTC could still decline, but with the dividend yield past 5%, I’m continuing to add to my position and believe this is a long-term opportunity many investors will regret passing up on in the future.

The Mobileye IPO and Intel

INTC purchased Mobileye in 2017 for $15.3 billion and has filed to sell Class A shares under the Symbol of (MBLY) on the Nasdaq through an IPO, which is expected in the coming weeks. The IPO’s valuation has been a moving target which has declined from $50 billion to $30 billion, and most recently, it was announced that Mobileye plans to offer 41 million shares at $18-$20, placing the latest valuation at $16 billion.

INTC will retain control of Mobileye through Class B shares which carry 10 votes per share compared to 1 vote per Class A share. INTC will have four board members, including Pat Gelsinger (Intel CEO), who will serve as the chairman of Mobileye’s board. In addition to retaining control of Mobileye, and having a strong presence on the board, INTC will receive a large portion of the proceeds from the IPO. In December 2021, Pat Gelsinger stated INTC would utilize the proceeds to help fund its manufacturing plant initiatives.

Per the SEC filing on page 17, Mobileye issued a dividend note on April 21, 2022, agreeing to pay INTC $3.5 billion. On May 12, 2022, Mobileye paid $336 million to INTC, which still leaves more than $3.16 billion owed to INTC from Mobileye. Mobileye plans to utilize its portion of the proceeds to repay the dividend note to INTC.

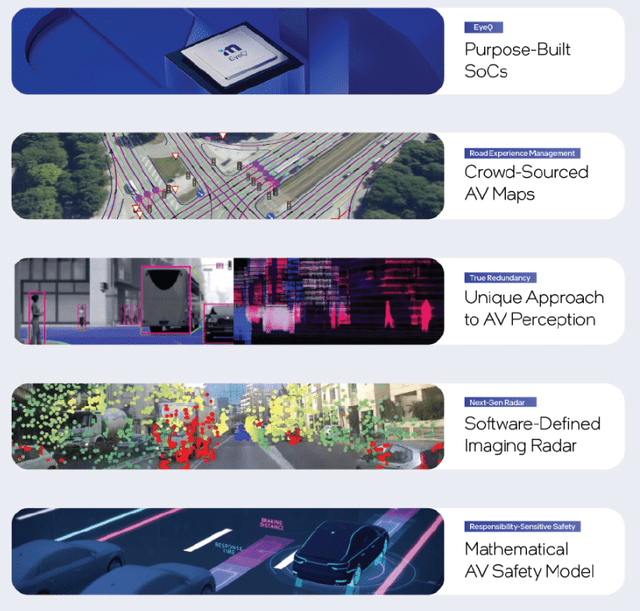

Mobileye was founded in 1999 and builds hardware and software that enables advanced driver-assistance systems in vehicles. They launched its first EyeQ system-on-chip in 2007, which provides processing power that’s optimized for assisted driving systems in vehicles. Outside of the hardware, Mobileye develops a software platform which it envisions as an all-encompassing solution for autonomous driving. The software operation includes a precision mapping system that uses crowd-sourced data in addition to developing a method to aggregate data from sensing systems from cameras and lidar systems to ensure vehicles have an accurate 360 picture. Mobileye’s four main business segments are:

- EyeQ – purpose-built system-on-chip

- RoadExperience Management – autonomous vehicle mapping

- True Redundancy – AV perception technologies

- Next-Gen Radar – Software-defined imaging radar

Mobileye is partnered with 50 companies, including Audi, BMW, Volkswagen, GM, and Ford to develop advanced driving and safety features such as driver assist and lane-keeping using Mobileye’s EyeQ camera, chips, and software. Mobileye’s technology can be found throughout 800 different vehicle models across its partners. The recent filing indicates that Mobileye’s revenue has increased from $879 million in 2019 to $1.39 billion in 2021, while its losses have declined from -$328 million to -$75 million. For the first half of 2022, Mobileye has reported $854 million in revenue compared to $704 million in the 2021 period. Mobileye estimates the current potential market for its chips and services to be roughly $16 billion. It predicts that it will grow to $40 billion by 2026 and roughly $480 billion by 2030.

There are definitely risks associated with Mobileye, which extend past the direct competition. Advanced driver systems are a competitive market, and companies such as Nvidia (NVDA), and Qualcomm (QCOM) also are designing similar systems for advanced driver assistance technologies and autonomous vehicles. Tesla (TSLA) and Apple (AAPL) are direct competitors as TSLA is the frontrunner, and it’s no secret that AAPL has been working on self-driving vehicles, and they have an unlimited war chest behind the project. There also are many unknowns, and the largest unknown is regulation, as we have no idea how government policies will impact the automated driving market in the future.

I believe INTC is making the correct move, and while the valuation isn’t what INTC had hoped for, they will retain majority ownership of Mobileye, have a large presence on the board, and receive 22.88% ($3.5 billion) of their acquisition price from the proceeds of the IPO. The $3.5 billion will be allocated toward INTC’s core business and help build out new manufacturing plants in the U.S. While Mobileye’s market cap could decline in the short term, Mobileye could be a long-term winner and a possible takeover candidate in the future. Innovation and evolution never stop, and automation will be the next phase of driving. Automobiles aren’t going to disappear, and by 2030 there’s a good chance that innovation will create a landscape that looks much different than what it looks like today. Mobileye will have the ability to grow in the public markets, which could unlock value for shareholders, and if they become the dominant force in autonomous driving, INTC could be sitting on tens of billions worth of ownership in the future.

Why I’m still buying more Intel as shares continue to decline

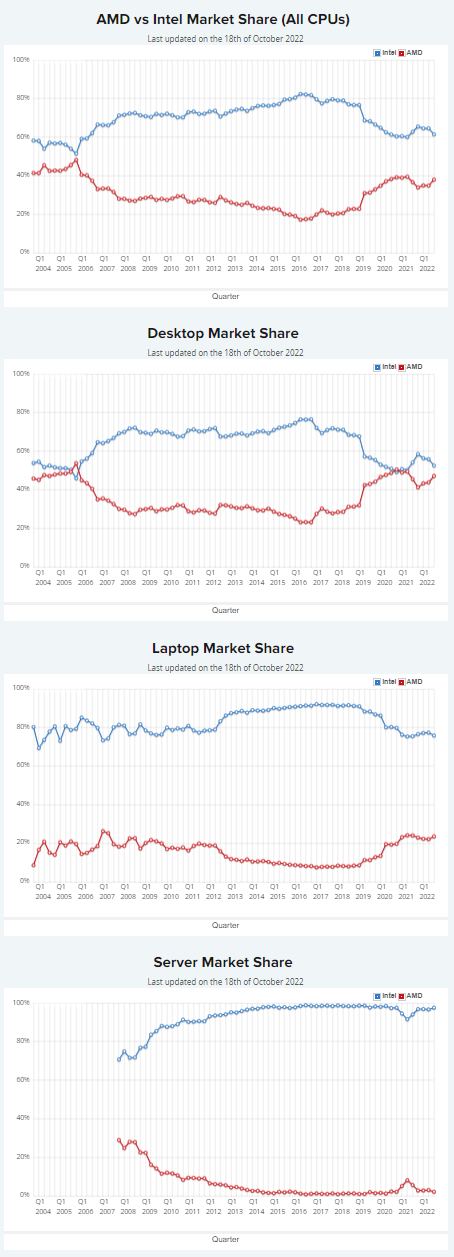

There are only two companies worth discussing when it comes to PC chipsets, and that’s INTC and Advanced Micro Devices (AMD). INTC has roughly 62% of the entire CPU market, with around 55% market share in desktops, 75% in laptops, and 95% in servers.

Passmark

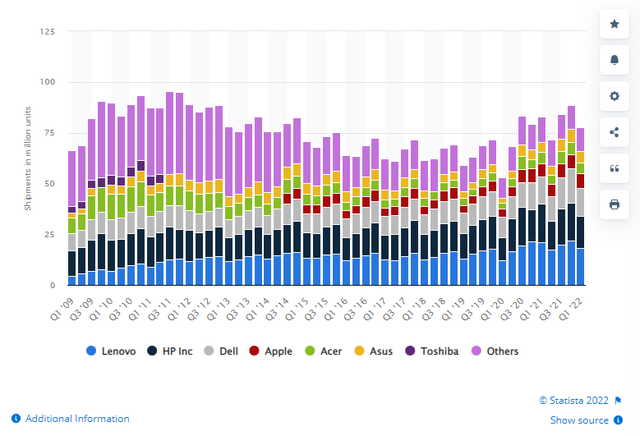

Worldwide PC sales have declined since 2010/2011 but have rebounded since the pandemic, and AAPL remains a small fraction of global sales.

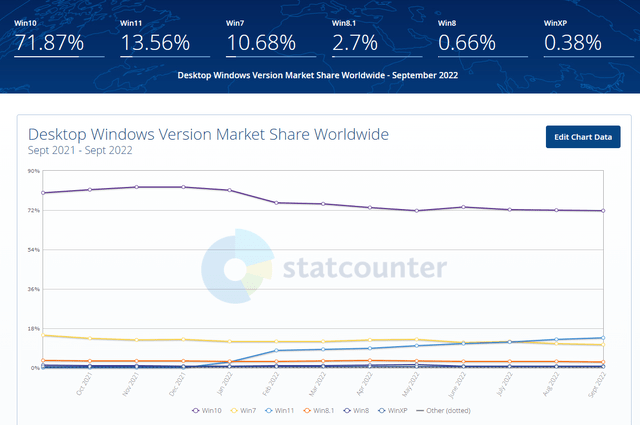

I believe we will see a massive upgrade cycle in PCs over the next several years. Oct. 14, 2025, may seem a long way off, but this is the date when Microsoft (MSFT) will no longer support Windows 10. Once an operating system reaches its end-of-life date, there will be no new security updates, non-security updates, or assisted support. Windows 10 was released on July 29, 2015, and the majority of PCs shipped since then have been loaded with Windows 10. Windows 10 still represents 71.87% of PCs globally, while 10.68% still have Windows 7. Only 13.56% have Windows 11 loaded. Over the next several years, we should see a strong upgrade cycle for PCs and INTC, and AMD should stand to benefit.

Q2 2022 was bad, revenue missed by -$2.63 billion (-17.3%), and EPS missed by -$0.41 as it came in at $0.29. Intel revised 2022 revenue guidance to $65-68 billion from a consensus estimate of $74.35 billion. Management has told us that Q3 is going to be difficult and reduced its expected revenue range to $15B to $16B vs. a consensus of $18.67B and EPS of $0.35 vs. a consensus of $0.66. INTC expects the PC TAM to decline roughly 10% in the calendar year 2022. The Q2 PC unit volume suggests that INTC is shipping below consumption as some of their largest customers are reducing inventory levels. INTC believes that its turnaround is taking place and that Q2 and Q3 will be the financial bottom.

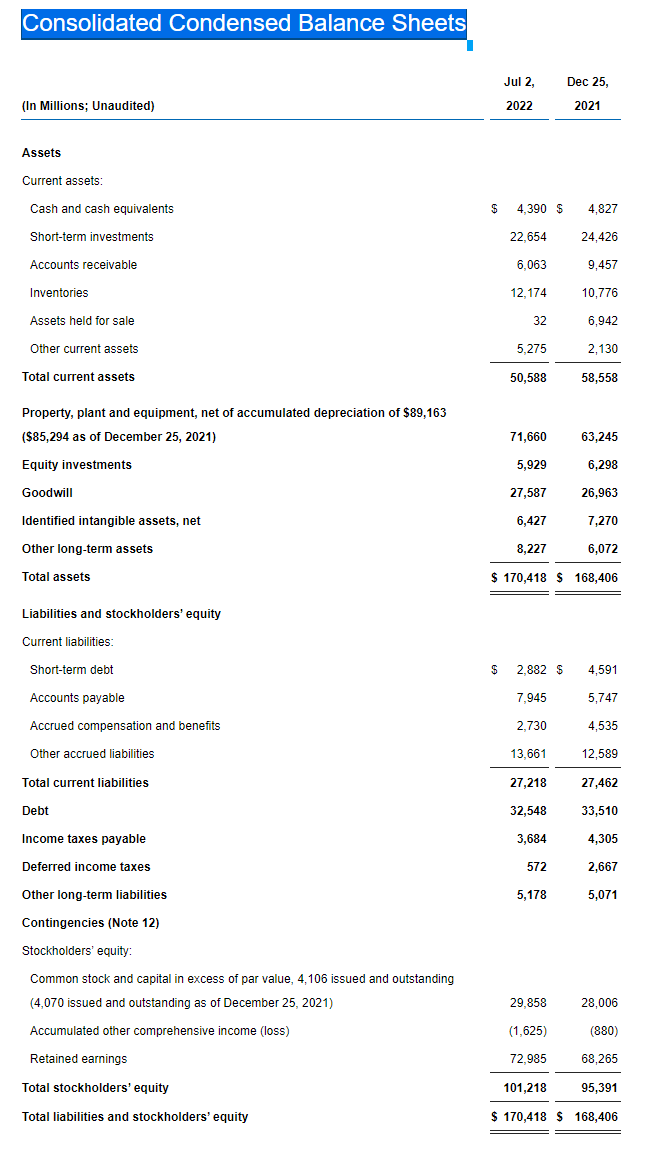

INTC has a strong balance sheet with $4.39 billion in cash and $22.65 billion in short-term investments. Their on-hand liquidity in $27 billion, and INTC has an additional $5.93 billion of equity investments which include marketable equity securities and non-marketable equity securities under its long-term assets. INTC has $2.88 billion in short-term debt and $32.55 billion in long-term debt. With $32.93 billion of liquidity between short-term and long-term cash and investments, INTC has a large enough stockpile to weather the storm.

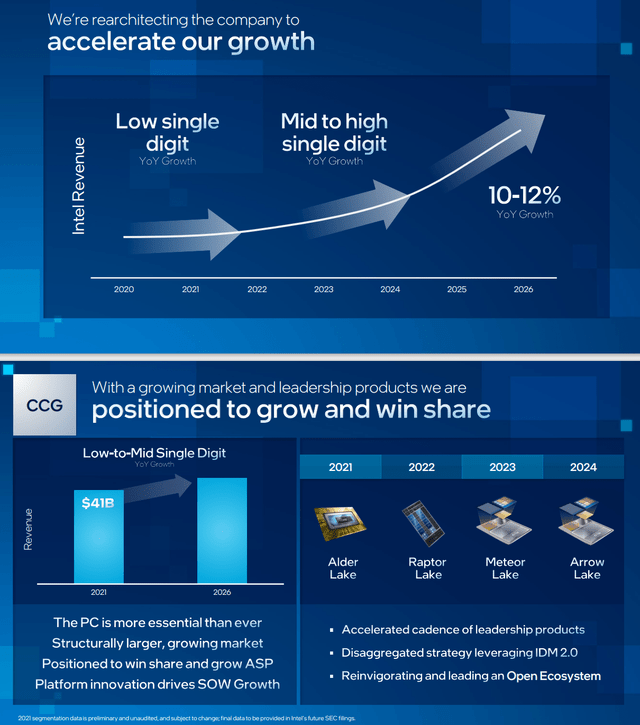

Intel

Over the next decade, INTC is making a tremendous capital investment to build several foundries, which will take considerable market share away from Taiwan Semiconductor Manufacturing (TSM). The new INTC foundry business will provide INTC the ability to make chips for other chip companies such as AMD, NVDA, and AAPL. INTC is making a capital investment of $20 billion to build two new plants in Arizona. INTC is spending roughly $95 billion over the next decade building two new foundries in Europe. INTC also is investing in related manufacturing and research efforts in France, Ireland, Italy, Poland, Belgium, and Spain as part of its EU spending allocation. Pat Gelsinger, INTC CEO, believes the automobile TAM (Total Addressable Market) for semiconductors will rise from $50 billion today to $115 billion by 2030.

I don’t know where the bottom for INTC is, and I’m shocked it’s fallen this much. I’m looking at INTC as a long-term investment, and I believe their new chip manufacturing plants will add tremendous amounts of value in the future. INTC is still the largest chip brand when it comes to PC’s, and soon enough, they will be an alternative to TSM for manufacturing. INTC will diversify its revenue streams, and the combination of a Windows upgrade cycle, and manufacturing should be enough for INTC to deliver on its turnaround plan. I believe INTC has earned the right to be taken at face value, and I will buy into their future revenue projections.

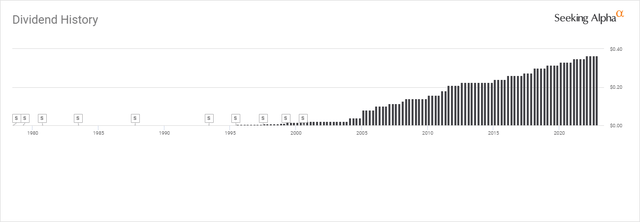

I’m getting paid a lot more to wait now than I was 6 months ago

INTC is yielding 5.65%, and as I buy more shares, I’m getting paid more to wait. I thought INTC was a steal when its yield was between 3% – 3.5%, and now I’m getting paid over 5% to be a shareholder of INTC. This is a long-term investment that has now become an income investment as well. I don’t believe INTC is in long-term danger and that the headwinds they face will be short-lived. My prediction is that several years of weakness in its share price will be a golden opportunity for shareholders such as myself.

Management has said that they’re committed to the dividend, and its dividend track record has been stellar. I plan on buying shares of INTC and reducing my cost basis while reinvesting the dividends. INTC goes ex-dividend on 11/4/22, and the dividend isn’t getting reduced or cut. Prior to the ex-dividend date, I will be purchasing shares, and after the ex-dividend date, I will be purchasing shares.

Conclusion

I think INTC is presenting an opportunity for investors to be greedy while the market is fearful. Shares have dropped more than -50% YTD, but what are the chances that INTC doesn’t execute its turnaround strategy? Computers aren’t going away, and semiconductors are projected to be more critical in the next decade than in the previous decade. I want to be invested in INTC because I see them as remaining the dominant force in the PC chip market and a growing powerhouse on the manufacturing side. I can’t predict the bottom, and shares could slide after the Q3 earnings call, but that’s just looking at the short term. I think INTC presents an opportunity to be invested in one of the world’s most important companies and get paid a large dividend while waiting for its turnaround vision to play out.

Be the first to comment