Ethan Miller/Getty Images News

Given how far Intel (NASDAQ:INTC) has fallen, I again decided to look into whether there was some light at the end of the tunnel. However, having done that, I think there are still reasons to believe Intel’s woes are set to worsen, at least looking forward 1 year.

These reasons are mostly tied to Advanced Micro Devices’ (AMD) Zen 4 cores making it to its laptop and server products. There are other unfavorable factors as well. Let’s see why things are set to become even uglier.

AMD’s Server Room Advantage Is Set To Widen And Laptops Look Ripe For The Taking, Too

To start, Intel is already in a bad place, having delayed its new Sapphire Rapids server CPUs over and over, to the point where when they arrive they’ll already be outdated. These new server CPUs are based on Golden Cove cores from Intel’s 12th generation chips, fabricated on Intel’s 7 process (10nm, but comparable to TSMC’s 7nm). These CPUs are set to be in general availability in early 2023.

Last week, AMD finally unveiled its new desktop CPUs based on its Zen 4 cores. From reviews and benchmarks, we can see that AMD’s new CPUs managed to take the single-core performance crown away from Intel’s 12900K CPUs. At the same time, these new CPUs also built a very large multithreaded performance advantage over those same top-of-the-line Intel CPUs.

AMD achieved this feat by both showing IPC (Instructions Per Cycle) gains (~+13%) and a large jump in operating frequencies. Overall, this led to around 29% gains in single-threaded performance and even more in multithreaded applications.

Now, Intel is set to respond, by launching its Raptor Lake 13th generation CPUs before the end of the year. And actually, Intel will retake the single-threaded performance crown from AMD, while probably matching AMD’s top offerings on multithreaded performance. Intel will manage to so respond due to some IPC gains, together with an also-large frequency jump and 8 additional efficiency cores on its top offering (bringing core count to 24). However, for servers, this gain will likely be highly illusive.

Why so? Because unlike desktops, server CPUs live on a rather meager power budget. That is, server CPUs run many more cores than desktop CPUs, and so the power each core can burn is a lot lower than what’s available on the desktop. As a result, just feeding power and frequency isn’t enough to provide a large performance gain. Moreover, of course, we already know Sapphire Rapids will top out at 60 cores.

It so happens, that Intel’s next-generation server CPUs, Sapphire Rapids, will remain on the same manufacturing process as Intel’s 13th generation desktop CPUs (Intel 7). This is broadly equivalent to TSMC’s 7nm processes. However, Zen 4-based CPUs, for the desktop, laptop and server room, are already using TSMC’s 5nm process. Hence, they’ll have at least a 1 generation advantage.

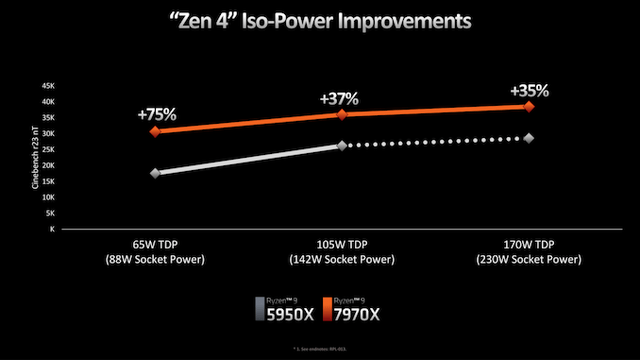

Now, in some benchmarks, we’ve seen that AMD’s new desktop CPUs (for instance the Ryzen 7950X) have used this process advantage (along with other architectural improvements) in two ways. They used it to enable much higher boost frequencies. However, when not operating at these boost frequencies, the benefit from the process advantage has also showed up in terms of a very large improvement in efficiency! Therein lies the problem for Intel’s server offerings. Notice the following chart:

This chart shows that at 65W, the 7950X Ryzen shows a 75% improvement in performance over the previous Ryzen 5950X. This is a 16-Core part. Roughly, a 65W power budget for 16 cores is likely to translate well into the 300-400W power budgets which will be available in the server room for 64-96 core CPUs.

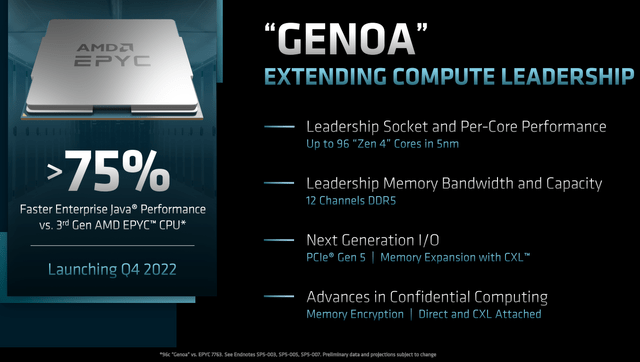

Hence, Intel is likely to soon face server-room parts which will show a much larger than expected performance, even compared to the already very competitive Milan parts. There was already a hint of this on AMD’s server roadmap:

(Notice that the 75% improvement, likely single-threaded, and it’s comparing a 64-core CPU to a 96-core CPU…)

Indeed, it’s now likely that Sapphire Rapids-CPUs will be fighting for the server room using just 60 cores, versus AMD’s Zen 4 parts at 96-128 cores (using 4c cores) which, on top of the massive core count advantage, will now also carry an additional massive efficiency advantage, leading to a massive performance advantage on the same power budget. This looks very bad for Intel over the next year, at least until Meteor Lake server parts start showing up (and possibly even beyond).

The same problem applies to laptops. These, too, are power constrained. It seems likely that this large efficiency gain is also going to translate either into a large efficiency advantage for AMD in the laptop, or a large performance advantage. Or, indeed, both.

Laptops, of course, are the main CPU segment for Intel, alongside servers. Indeed, AMD expects its Zen 4 chips to already be built on TSMC 4nm process, providing yet another further advantage on top. These chips are set for an early 2013 arrival.

ARM Will Make The Pie Smaller

As I’ve been discussing over time, there are many indications that ARM-powered solutions are taking some market share, both in laptops and in servers. Non-exhaustively, we can count:

- Apple (AAPL) dropping Intel x86 solutions for its desktop and laptop range, in favor of its own ARM-based CPU designs.

- Amazon.com (AMZN) iterating on its Graviton CPUs (now in their 3rd generation) for its cloud customers, thus stealing server workload share.

- NVIDIA (NVDA) also replacing x86-based CPUs in favor of an ARM-based design

- Others (Alibaba, Altera, soon Microsoft, Google, etc) also exploring the usage of ARM-based designs in their server rooms.

All of these developments will make the server and laptop pie become somewhat smaller for x86 solutions.

However, while AMD seems set to take share away from Intel fast enough to not shrink due to the shrunken pie, the case for Intel seems much different. Intel starts from very high market share, and hence anything reducing the pie is going to hit it disproportionately.

The Economic Cycle Isn’t Very Positive

Finally, the economy is cooling rapidly all around the world:

- Europe faces an energy crisis and extremely high energy prices which are set to throw the local economy into a recession.

- The US faces higher interest rates and also the absence of large sums of stimulus which affected the past, thus a rapid slowdown in also happening.

- China, for its part, has been shooting itself on its feet with its aggressive COVID-zero policies.

In general, semiconductors are cyclical. Hence, large impacts on the economy typically translate into lower demand for semiconductors including CPUs.

On top of the above, the crazy tech valuations which existed one year ago are now imploding. This will mean a lot less cash available for startups and young tech companies to plow into cloud costs. It will also reduce CPU demand.

Conclusion

Intel looks set to see significantly increased competition from AMD, especially when it comes to the server room and laptops. AMD’s Zen 4 cores, alongside a process advantage, have translated into significant efficiency and performance (when combined with efficiency) advantages (on top of AMD’s already existing gap).

It won’t be a significant surprise if Intel’s woes intensify significantly looking forward at least 1 year.

I’m looking at Intel from the perspective that it might turn things around in its struggle with AMD – especially considering Intel’s shrinking valuation. When it comes to manufacturing process, Intel has in the past suffered significant delays, and now it looks set to get a bit closer to TSMC in the future. When it comes to CPUs, there’s some promise for Meteor Lake. However, what we more or less know now, for sure, is that things are set to become uglier in the next year, while the recovery itself is uncertain.

Given the above, looking at Intel from a valuation standpoint is still not warranted. Intel’s fundamentals are still set to worsen further. Indeed, looking at the market consensus, the market is already expecting intel to turn things around in 2023, and to again be back to revenue (if not earnings) growth. This still seems too optimistic. I’d rather wait.

Be the first to comment