Veni vidi…shoot/iStock Editorial via Getty Images

When we last covered Intel Corp. (NASDAQ:INTC), we told you why the dividend was in danger and left with a warning for dip buyers.

This rating signifies a 33-50% probability of a dividend cut in the next 12 months. INTC is not cheap, despite the drop and this is despite our favorite metric dropping near the “buy-range”. The fundamentals here are very poor and the dividend looks unsustainable.

Source: That Dividend Will Have To Go

That article got close to 200 comments with an evenly divided battle between the supporters and detractors. Well, at least on price action, that call appears to be correct, as INTC punished the dip-buyers with a vengeance.

Returns Since Last Article

What we want to focus on today is how our call is shaping up from a fundamental perspective and what will need to happen to make Intel a worthy investment.

The Core Thesis

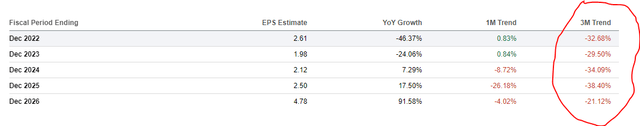

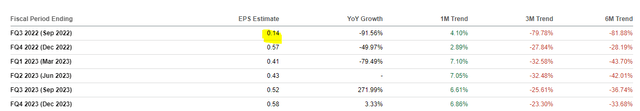

At turns, the analyst community tends to lag fundamentals. It takes a lot of effort to move a tanker and it takes even more to get perennially bullish analyst community to move to neutral or even turn bearish. This was amply evident when we looked at earnings estimates. We felt that had far further to go and we are seeing them dive down in droves. Earnings estimates have fallen across the board and we are seeing the rare situation where analysts are actually pricing in a decline in year over year earnings.

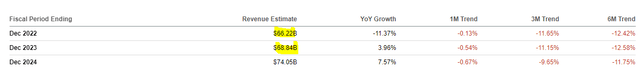

For those that are not aware, this is a big deal. It is rather unfathomable to analysts collectively that earnings could go down year over year and this number shows perhaps reality is sinking in. On the other hand, revenue estimates remain extremely optimistic.

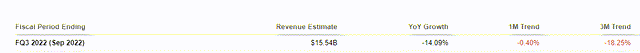

So this is where the rubber meets the road. Q3-2022 estimates, which are most likely accurate at this point, are for $15.54 billion

Earnings estimates are for 14 cents.

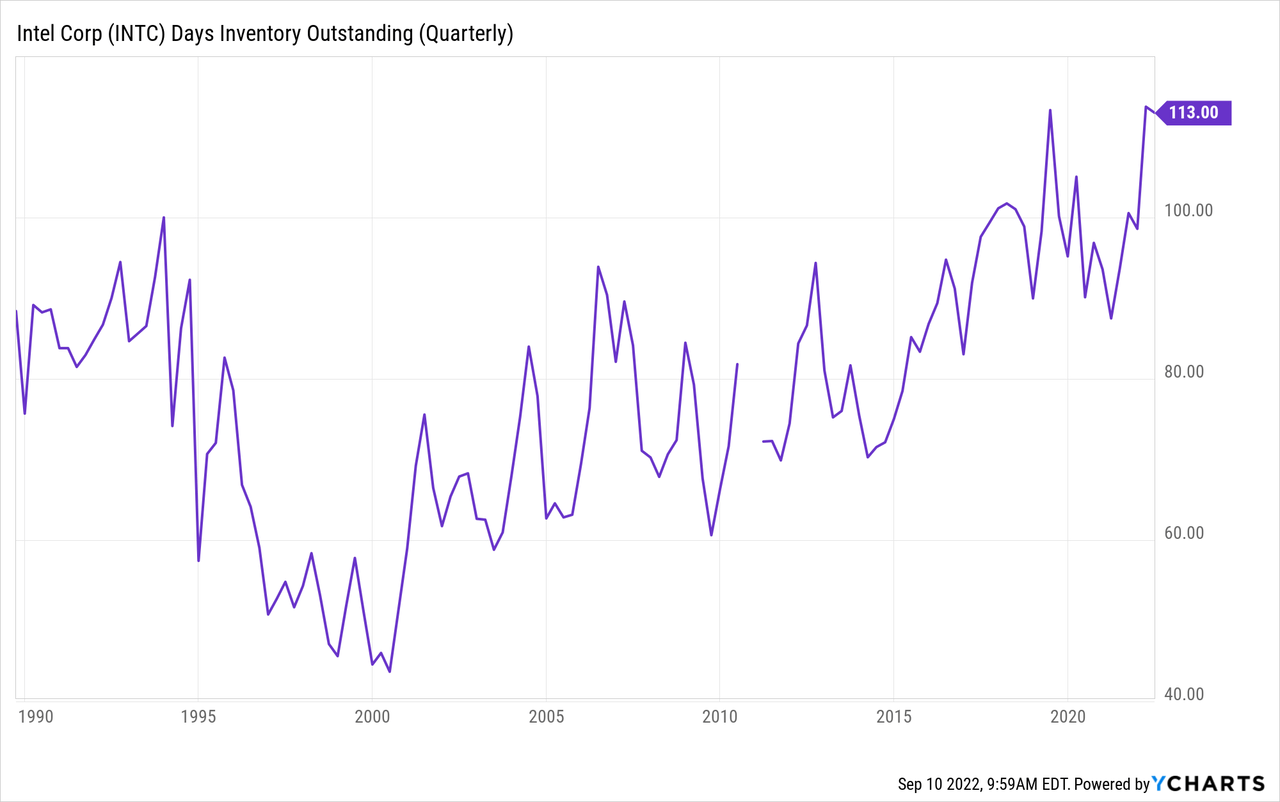

Our base case here, with the economy weakening, the quarterly run rate of Q3-2022 of $15.5 billion is optimistic for 2023. Additionally, with Intel’s bloated inventory levels, margins are also likely to match what we will see in Q3-2022.

So would you want to buy this stock with a 14 cent quarterly earnings run-rate? If you use P/E ratios, the answer should be a resounding “no”. Intel would be trading at close 60X earnings and unable to cover even half the current dividend.

Where Is The Turn?

In cyclical stocks earnings tend to be poor indicators as they appear glorious at peaks and awful at bottoms. But our view is that they have still not bottomed and the stock will struggle as our out-of-consensus dividend cut view becomes mainstream. Our rationale comes from the macro indicators we look at and they are looking beyond awful. It is no exaggeration to say that we have not seen anything like this. Here is South Korea’s trade deficit for example, a leading indicator for the semiconductor index (SMH). That trade deficit blowout is far worse than the worst of 2008.

Bloomberg

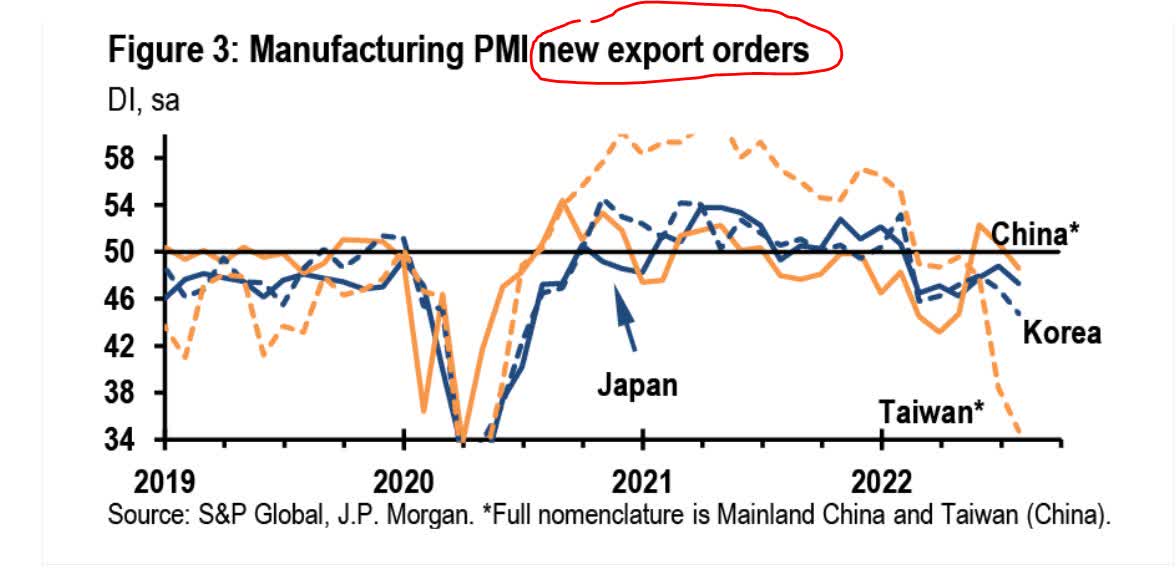

New export orders in Taiwan, another important indicator worth watching, is also doing a swan dive.

S&P Global

These are just a couple of data points but the crux is that we would expect a cyclical bottom at least 12 months after these turn up.

CHIPS Act & Brookfield Asset Management (BAM) Deal

Offsetting what is likely to be a rather brutal 12 months for the semiconductor index is the passing of the CHIPS Act. We see this as a $10-$15 billion net benefit over the next 5 years. Even if we add $5.0 billion worth of this in 2023, we don’t remotely see the dividend covered by free cash flow. That free cash flow is even before capex.

BAM’s deal with a cost of about 8.5% is very credit positive and takes some pressure off the dividend in the very short term.

Under the deal, which company executives described as a first of its kind for the industry, Intel would fund 51% of the cost of building new chip-making facilities in Chandler, Ariz., and will have a controlling stake in the financing vehicle that would own the new factories, Intel Chief Financial Officer David Zinsner said. Brookfield will own the remainder of the equity and the companies will split the revenue that comes out of the factories, he added.

Source: Wall Street Journal

Obviously this was not known at the time of our last article, but deterioration of macro conditions have forced us to keep the same probability of a dividend cut.

Trapping Value

This rating signifies a 33-50% probability of a dividend cut in the next 12 months.

Verdict

It pays to be a contrarian, but it pays more to wait for fundamentals to be better aligned with the contrarian stance. Here, we have rightly stayed out of this name for a long time as we just saw a plethora of risks with poor upside. The lower the price goes, the better, as every dollar down improves your return prospects. We don’t think we are there yet and the analyst community needs to project reality into earnings before we take a dive. For now we stay out and rate Intel as a hold/neutral.

Be the first to comment