4kodiak

Intel (NASDAQ:INTC) has not improved much of its fundamentals over the past year, but its share price has declined considerably, and I think it now has some upside potential over the next couple of years if it executes well on its restructuring strategy.

Background

As I’ve discussed in previous articles, within the semiconductor industry, I have been more bullish on Advanced Micro Devices (AMD) and Nvidia (NVDA) over the past year, while despite a supportive industry backdrop, I have suggested Intel as being a value trap.

This is justified by Intel’s struggles that aren’t easy to turn around, while its strategy presented during 2021 to grow its business towards the ‘foundry business model’ will take some time to improve the company’s fundamentals, thus Intel is likely to remain an underperformer in the semiconductor industry over the next couple of years.

Indeed, Intel’s financial performance has been quite weak in recent quarters and its stock has underperformed its competitors in recent months, showing that Intel clearly needs improving fundamentals to justify a higher share price, while its current (relative) low valuation is not a reason by itself for investors be positive on the company’s stock.

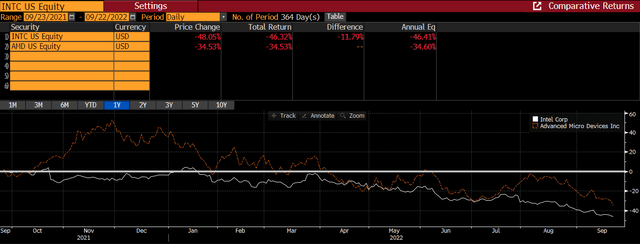

Since my previous article on Intel, its shares have unperformed against the broader market and also compared to its main rival AMD, as shown in the next graph, given that Intel has declined by more than 46% over the past year (white line), while AMD has declined by some 34% (orange line).

Share price performance (Bloomberg)

As I’ve not covered Intel for one year, and considering its weak share price performance during this period, I think it is now a good time to revisit its investment case and look at its most recent earnings, to see if I still think it is a value trap in the semiconductor investment theme, or if its low valuation is now attractive as a recovery play over the next few years.

Intel’s Recent Earnings

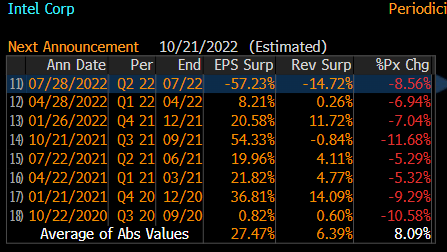

Regarding its most recent financial performance, Intel reported its Q2 2022 results at the end of July, which were quite weak and way below market expectations. Indeed, as can be seen in the next table, while Intel has a good history of beating market expectations in previous quarters, the last quarter was terrible as the company reported revenue 14.7% below estimates and EPS was 57% lower than expected. Not surprisingly, Intel’s shares did not react well to these earnings, dropping by more than 8% on that day.

Earnings surprise (Bloomberg)

While the semiconductor industry has faced a slowdown in the past few months, this weak financial performance was mainly due to Intel’s lack of competitiveness rather than general industry weakness. As I’ve analyzed in a previous article on AMD, Intel had a much weaker financial performance than its main rival AMD in Q2 2022, justified by a weaker PC market and, more importantly, a decreasing market share in the data center segment.

This happens because AMD continues to enjoy technological leadership against Intel, a trend that is not expected to change in the short term as Intel has struggled to improve its manufacturing capabilities in recent years and product delays have led to a weaker product portfolio compared to AMD.

Investors should note that this industry backdrop can’t be separated from the fact that AMD is a fabless company, while Intel has its own factories, and therefore relies heavily on Taiwan Semiconductor Manufacturing Company (TSM) for the manufacturing of its chips. As the Taiwanese company became the world leader in this segment over the past few years, AMD has become much more competitive than Intel compared to some years ago and is now reaping the benefits of technological leadership.

This is a key factor why AMD’s EPYC chips have a better performance and energy efficiency than Intel’s chips for data center customers, which are still in strong demand while chips for consumer products are experiencing some headwinds, being a strong boost to AMD’s revenues and earnings growth.

While AMD has maintained a strong operating momentum in Q2, on the other hand, Intel reported revenue of $15.3 billion, a decline of 17% YoY, which was $2.7 billion below its April outlook. The company attributed this drop to several factors, including a weaker macroeconomic environment, supply disruptions, high inventory, and ultimately competitive pressures.

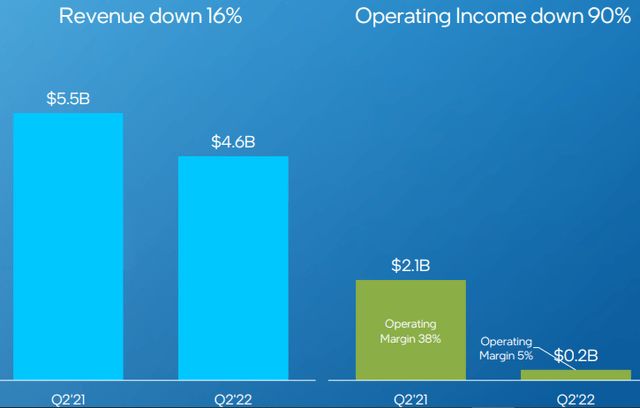

By business unit, the weakest performance was in the Client Computing Group considering that revenue was down by 25% YoY to $7.7 billion due to lower revenue in the PC segment as demand softened from the pandemic boost during 2020-21, while in the Datacenter and AI segment the company’s revenue declined by 16% YoY. This is quite worrisome because, theoretically, datacenter is a growth area for Intel and, beyond lower revenue, the profitability of this unit also collapsed during the past quarter. Indeed, datacenter’s operating income was only $200 million in Q2, a decline of 90% YoY, as the company had to lower prices to remain somewhat competitive in the market and incurred in higher charges related to new products.

On the other hand, Intel was able to report growth in smaller segments, namely Network and Edge Group (revenue of $2.3 billion in the quarter, up by 11% YoY) and Mobileye (revenue of $460 million, up by 41% YoY).

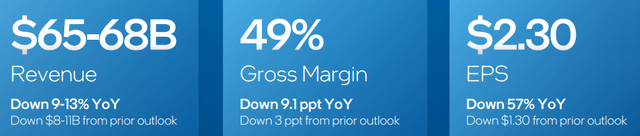

However, these segments are not large enough to offset weakness in Intel’s two largest operating segments, and prospects for the remaining of the year are not particularly positive. Indeed, the company lowered its guidance for the full year, and now expects to report revenue between $65-68 billion, down $8-11 billion from what it expected previously. This is a very strong downgrade, showing that operating momentum in the past quarter was not a one-time issue and operating trends are expected to remain muted in the next two quarters.

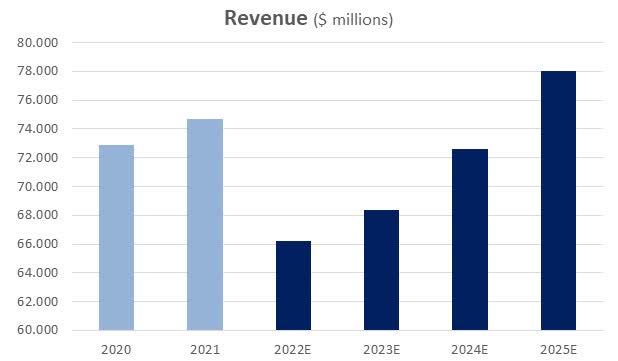

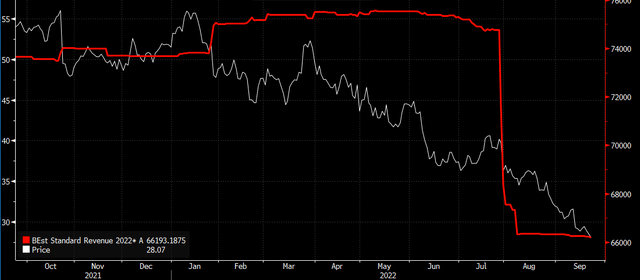

As can be seen in the next graph, this revised guidance was clearly unexpected as the market was expecting 2022 revenue to be about $75 billion before Q2 earnings (red line in the graph), while now it is expecting some $66 billion in revenue, close to the bottom of Intel’s guidance.

Medium-Term Estimates & Valuation

In my previous article on Intel, I was expecting 2022 revenue to be around $73 billion, which was a small decline compared to 2021, but operating momentum has clearly decreased much more than expected and a rebound in the coming quarters doesn’t seem likely.

This expectation is justified by Intel’s struggles in its product roadmap to be more competitive with AMD and Nvidia, plus its growth strategy in the foundry business is not expected to change its fundamentals in a significant way over the next couple of years. While Intel is investing significantly in capital expenditures (capex) to build new factories, this takes some time to build and equip and are only expected to be operational by 2024/2025. This means that revenue growth is likely to remain weak in 2023, while some recovery is possible in 2024.

However, according to analysts’ estimates, Intel’s revenues are expected to be around $68 billion in 2023 (+3% YoY), while for 2024 are expected to increase to some $72.6 billion (+6.2% YoY) and reach $78 billion by 2025 (+7.4% YoY). While this is a better performance compared to what the company has reported recently, it is much lower than my previous estimate of some $85 billion in revenue by 2025, showing that Intel’s fundamentals have deteriorated quite rapidly in recent quarters.

Revenue estimates (Bloomberg)

Regarding its bottom-line and EPS, the trend is also quite negative in the short term, considering that current estimates are for a net income of $10.53 billion in 2022 (-47% YoY), $7.58 billion in 2023 (-28% YoY), while its bottom-line should recover in 2024 and reach about $15 billion, and its EPS is expected to be $3.26, by 2025. Note that previously I was expecting net income to be close to $19 billion by 2025, while current estimates are 21% lower that level, which is a key drag for Intel’s intrinsic value.

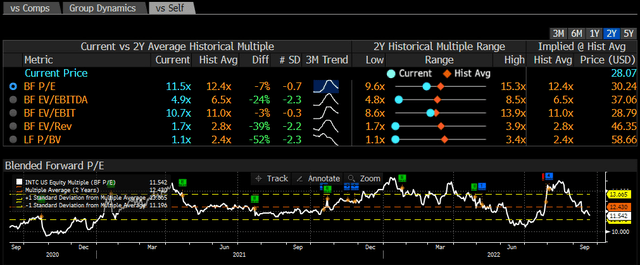

Regarding valuation, my previous price target was around $55 per share by end-2024, but due to downward revised expectations in recent months, this price target is clearly outdated. Indeed, using current 2025 estimates and its current forward valuation of 11.5x next twelve months earnings (as seen in the next graph), my revised price target for Intel is around $37.5 per share by end-2024. This is more than 30% above Intel’s current share price, thus much of Intel’s fundamental issues seems to be already priced-in.

Conclusion

While Intel has struggled recently to improve its fundamentals and a quick turnaround is not likely, its share price weakness in recent months has been quite harsh and Intel is now much more attractively valued than it was one year ago.

This means that for contrarian investors who believe Intel’s growth strategy in the foundry segment will succeed in changing the company’s growth prospects over the medium to long term, Intel seems to offer some value right now. This means that while Intel is no longer a value trap, on the other hand its upside potential is not impressive, thus for me personally I think it makes more sense to remain on the sidelines until the company improves its operating momentum, as further downside in its share price may not be ruled out in the short term.

Be the first to comment