JasonDoiy

Intel (NASDAQ:INTC) continued to lose ground after its nightmarish earnings sheet for the second-quarter: year to date, shares of Intel have lost a staggering 42% of their value. The driving force behind the revaluation was Intel’s poor Q2 earnings sheet, especially in the Client Computing Group which is responsible for a 50% revenue share. With PC shipments likely set to decline further in the second half of the year due to ongoing demand softness and high inflation, I am cautioning against buying Intel’s weakness right now!

Intel may be set for further declines

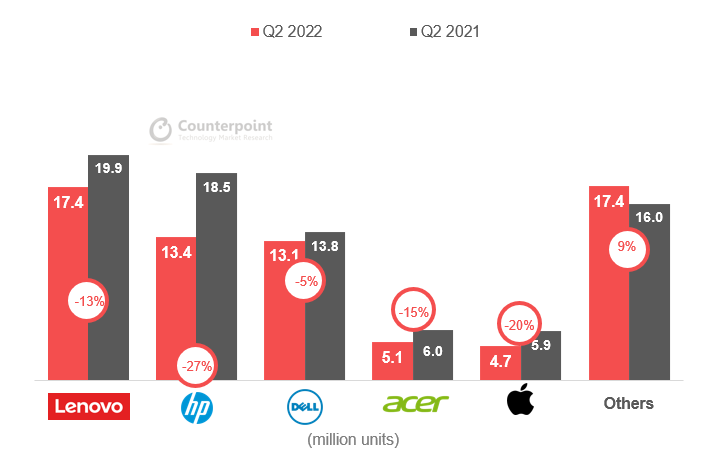

Intel’s fortunes as a chip maker are directly related to the state of the PC market. Weak shipments of PCs and tablets in the second-quarter were the main reason behind Intel reporting terrible Q2’22 results. PC shipments, according to consulting firm Gartner, declined 12.6% in the second-quarter with all major vendors seeing a significant contraction in their shipment volumes compared to the year-earlier period. Apple, HP, Lenovo, and Acer have seen double-digit declines in shipments in Q2’22. HP saw the largest drop in PC shipments in Q2’22 with a massive decline of 27% year over year.

Counterpoint Research: Q2’22 Vendor Sales

The weakness in PC shipments has its roots in the COVID-19 pandemic of 2020 which caused a surge in PC, laptop, and tablet sales for purposes of remote working and studying. Since a lot of companies and consumers already updated their equipment to the latest standard during the pandemic, sales and shipments of new PCs have seen a steep drop-off in 2022, creating a crisis for equipment and chip makers alike.

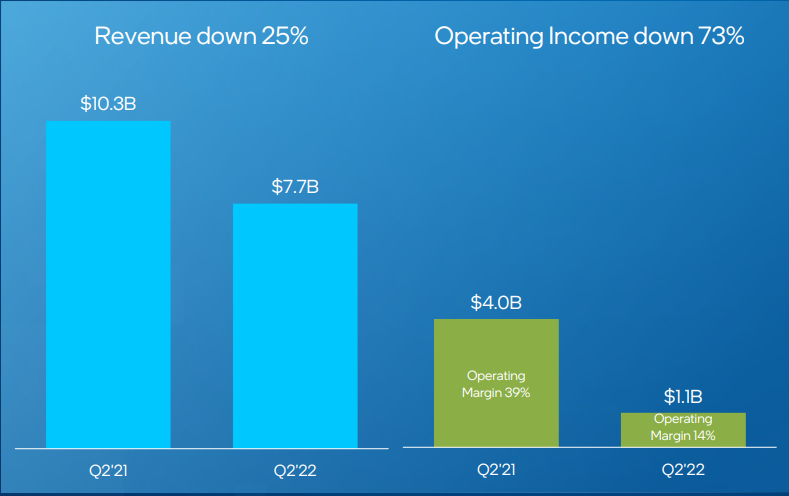

For those reasons, Intel’s Client Computing Group saw a 25% drop in revenues in the second-quarter. The Client Computing Group has a revenue share of 50% and is Intel’s largest revenue-producing segment… so any weakness in PC shipments is going to have an outsized influence on Intel’s commercial performance.

Intel: Q2’22 CCG Performance

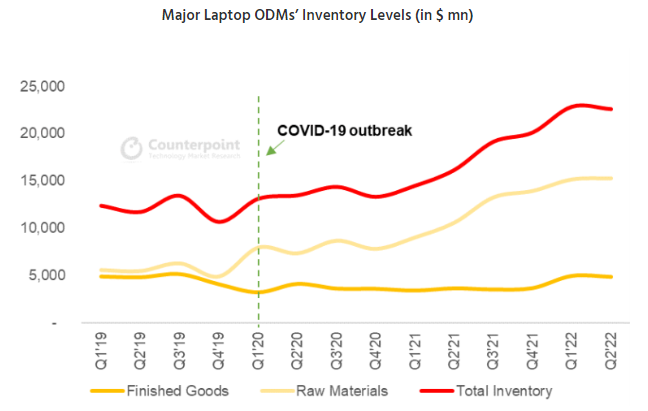

What is concerning about the current situation is that it might get worse before it gets better. The reason: inventory levels have increased significantly in FY 2022 — according to Counterpoint Research — indicating that OEM manufacturers are having trouble offloading their PCs and tablets. For vendors this could create a new headache on top of the significant volume drop in shipments in the second-quarter: product prices may come under increasing pressure and lead to a new round of estimate down-grades for Intel.

Counterpoint Research: Inventory Levels

Intel’s guidance for FY 2022 is at risk

Intel may have to down-grade its guidance for FY 2022 if the slowdown in the PC market accelerates in the third-quarter and there is some evidence that it might be. Intel’s revenues in Q2’22 were $15.3B and the outlook for Q3’22 calls for revenues of $15-16 billion, implying that Intel does not expect a material deterioration in the current demand situation.

However, according to the International Data Corporation/IDC, headwinds for the PC shipment market are indeed growing and soaring inflation as well as expectations of weakening demand for electronic products are cited as reasons for a projected 12.8% decline of global PC shipments in 2022. The forecast is worse than Gartner’s July outlook for the PC market which projected a 9.5% decline in PC shipments this year. The IDC now also projects that the PC and tablet market will decline 2.6% next year before a rebound is expected in 2024. The latest forecast contradicts Intel’s assumption that market conditions are set to stabilize. Therefore, high inventory levels and weakening consumer demand in Q3 pose risks to Intel’s full-year guidance. Intel’s FY 2022 guidance calls for $65-68B in net revenues, implying a 9-13% year over year drop-off in revenues.

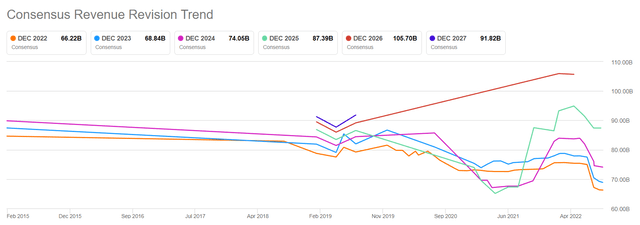

Expect earnings estimates to continue to drop, impact on valuation

Top line estimates for Intel have dropped significantly since the firm submitted its second-quarter earnings sheet and while a consensus has formed around Intel’s new net revenue baseline for FY 2022, I believe there are considerable risks for Intel that may not be fully reflected in current FY 2022 estimates. In the last 90 days there were 29 down-grades of Intel’s forward annual revenue estimates and there were 0 up-grades.

Seeking Alpha: Intel Revenue Estimates

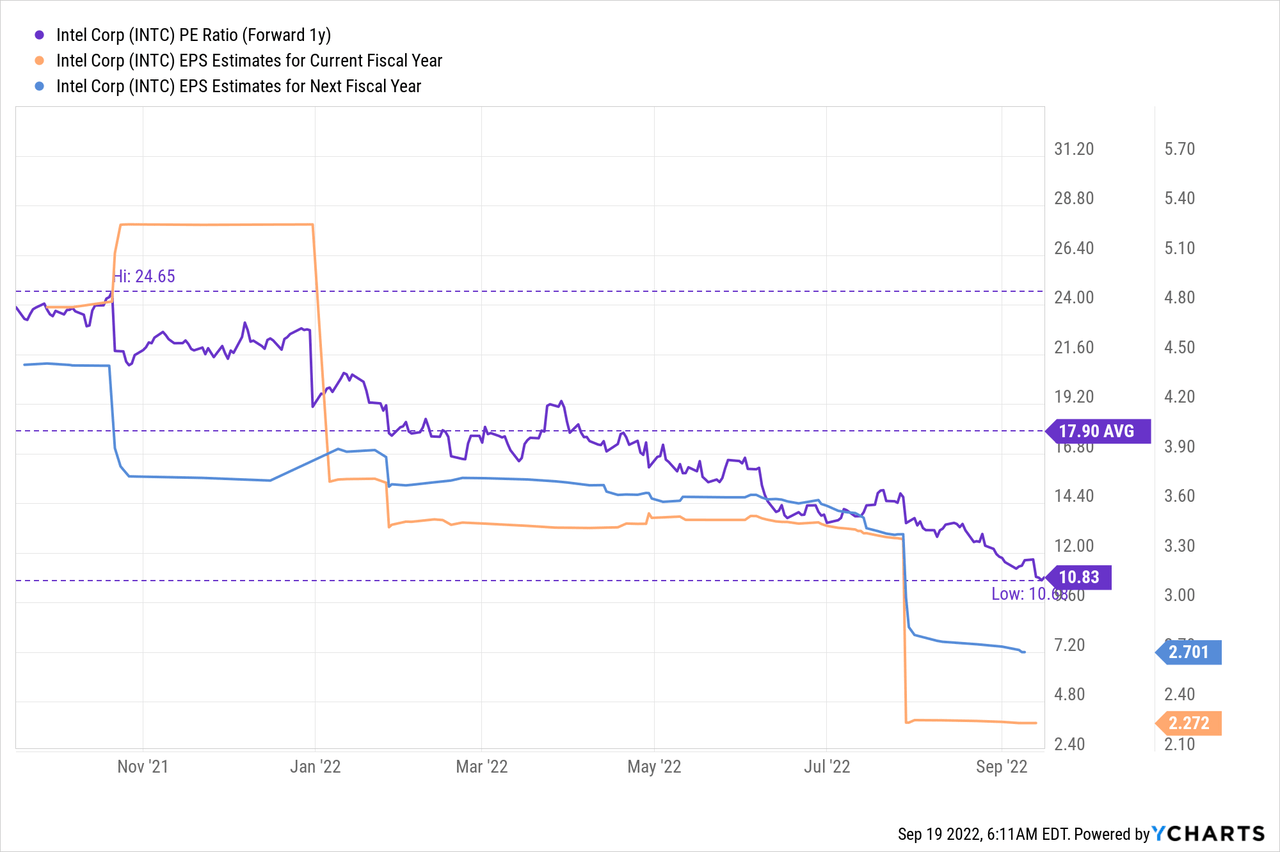

With earnings estimates dropping, shares of Intel are getting more expensive. Currently, Intel is trading has a P-E ratio of 10.8 X which may appear low, but if estimates keep dropping like they did in the last two months, Intel’s shares are set to become more expensive. I really don’t trust Intel’s EPS predictions much here given the uncertainty in the PC shipment market, elevated inventory levels and the growing risk of a global recession. Although Intel is trading significantly below its average P-E ratio in the last year (17.9 X), the stock’s risk profile remains unattractive.

Risks with Intel

If Intel falls short of its Q3’22 revenue estimate due to persistent weakness in the PC shipment market, not only is the stock up for a major revaluation to the down-side, but Intel’s full-year estimates are likely going to be further down-graded as well. This means that Intel has probably higher than acknowledged top line and estimate risks. If Intel under-performs its revenue guidance next month when it presents earnings, the stock may go into another down-leg.

Final thoughts

It may get worse for Intel before it gets better and it seems that this is exactly what Intel’s share price is reflecting. Since the release of Q2’22 results, Intel’s shares have lost 26% of their value, but I can only warn against buying into the chip maker at this time. The market does not have a clear view of the supply-demand situation yet and due to high inventory levels and likely soft Q3 PC shipments, Intel may even be forced to adjust its FY 2022 guidance down-wards. The stock has an unattractive risk profile and should be avoided!

Be the first to comment