Chip Somodevilla

Thesis

Intel Corporation’s (NASDAQ:INTC) Q2 card gave investors a front-row seat to what worsening macro headwinds, coupled with terrible execution, looked like. As a result, despite the initial euphoria surrounding CEO Pat Gelsinger’s appointment as Intel’s CEO in January 2021, INTC has fallen further to 2017 levels.

Therefore, we believe the market has signaled to Gelsinger & team that it’s not confident of its multi-year, high-risk execution roadmap to regaining process leadership against TSMC (TSM). Coupled with AMD’s (AMD) competitive advantage in data center and the rising influence of the Arm architecture, it has exacerbated the challenges for Intel to overcome.

Notwithstanding, we believe the de-risking of INTC looks nearly complete, and therefore downside could be limited from here. It’s hard to think that Intel could deliver any worse from here, even if macro headwinds intensify.

Management also reiterated its commitment to meeting its long-term financial model at its February 2022 Investor Day. Our valuation analysis suggests that its valuation is attractive if Intel can execute accordingly and fulfill its given guidance over the next four years. We have also used more conservative parameters to account for higher execution risks.

Therefore, we believe Intel investors looking for an attractive entry point after can consider adding exposure. Notwithstanding, we need to remind investors that Intel must execute well on its multi-year roadmap (which is a big if), which remains our thesis’s most critical downside risk.

As such, we revise our rating on INTC from Hold to Speculative Buy.

A Really Stinky Quarter by Intel

Management was astute to allude its horrid Q2 show to macro headwinds on inventory adjustments that seemed “historic” by proportions. Gelsinger emphasized (edited):

Importantly, our Q2 PC unit volumes suggest we are shipping below consumption as some of our largest customers are reducing inventory levels at a rate not seen in the last decade and, along with some pricing actions, should allow for sequential growth into the second half even as some customers manage inventory lower. These are like once in 10-year kind of inventory adjustments because the customers were working through the quarter, catching up to demand that was short for years, right? And all of a sudden, as they saw that shifting, they took quite significant adjustments to their inventory positions. (Intel FQ2’22 earnings call)

And that’s not all. A delay in high-volume production for Sapphire Rapids due to “execution issues” and “underperforming” software release on its discrete GPUs added to Intel’s horror show on display.

The good thing was management was cognizant that it was a terrible quarter, and they needed to set things right. Management’s commentary suggests that investors can look on the brighter side from Q3 as Intel works through the kinks in its execution. CFO David Zinsner also reiterated Intel’s long-term financial model at its February conference. He articulated (edited):

The market turbulence and updated outlook are disappointing. However, we believe our turnaround is clearly taking shape and expect Q2 and Q3 to be the financial bottom for the company. We remain completely committed to the strategy and financial model communicated at Investor Day. The long-term financial opportunity of compelling revenue growth and free cash flow at 20% of revenue remains. (Intel earnings)

Can It Be Worse Than This For Intel?

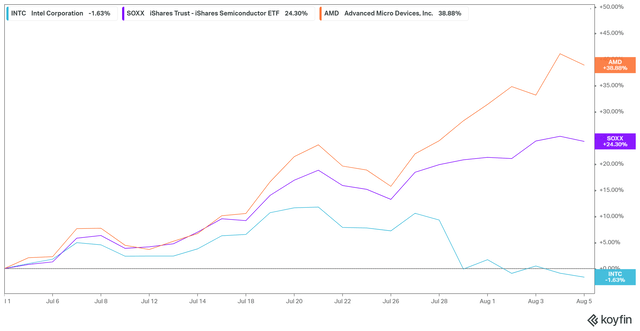

INTC 1M performance % (Koyfin)

Given Intel’s stinky quarter, the market justifiably de-rated it, even as its tech and semi peers bottomed out in June and kept up their upside momentum through August.

Therefore, we believe the market has likely already factored in its near-term headwinds in its current valuation. If management can demonstrate its confidence that Q2/Q3 is its bottom, it could lead to a material re-rating moving ahead.

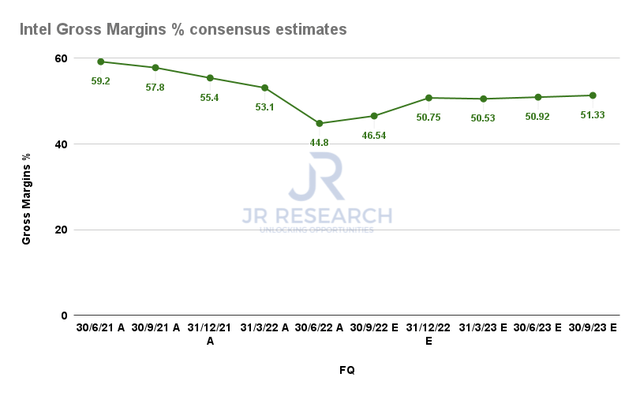

Intel gross margins % consensus estimates (S&P Cap IQ)

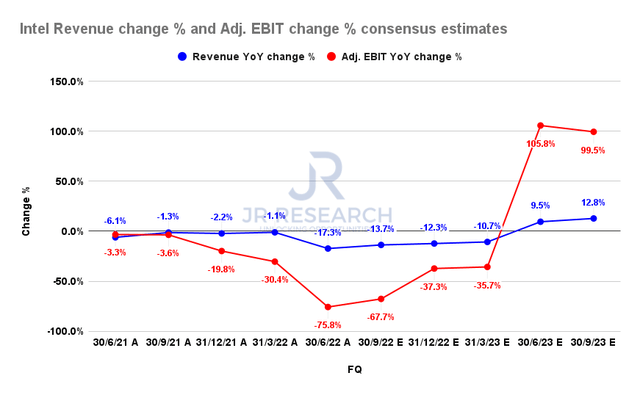

Intel revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (neutral) suggest that Intel’s gross margins could bottom out in FQ2 before recovering above 50% from FQ4. It’s also in line with the company’s revised guidance, suggesting Q2 could likely be Intel’s worst for a while.

However, Intel’s revenue growth could still be in the doldrums before turning positive in FQ2’23. Notwithstanding, the Street also concurs that Intel’s Q2 is likely its nadir for its revenue and operating profitability growth. Therefore, if management executes according to its guidance for H2’22, the potential downside is likely limited from here as the market looks ahead.

Is INTC Stock A Buy, Sell, Or Hold?

| Stock | INTC |

| Current market cap | $145.31B |

| Hurdle rate – including dividends [CAGR] | 11% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 8% |

| Assumed TTM FCF margin in CQ4’26 | 20% |

| Implied TTM revenue by CQ4’26 | $91B |

INTC reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-perform hurdle rate (including dividends) of 11% in our model. We also used a more conservative free cash flow (FCF) yield of 8% (Vs. all-time average of 6.33%) to account for higher execution risks. Applying an FCF margin of 20% according to management’s guidance, we derived a TTM revenue of $91B by CQ4’26, which we believe is achievable.

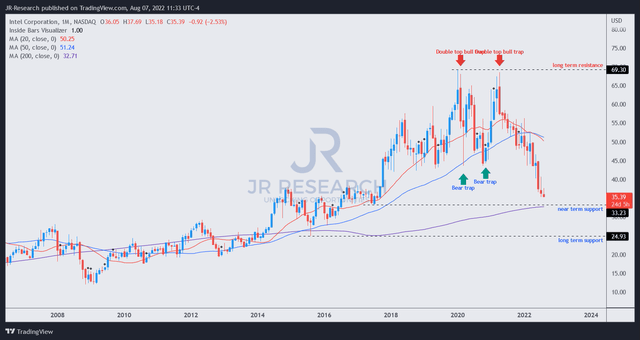

INTC price chart (monthly) (TradingView)

Furthermore, we also observed that INTC is getting closer to its 200-month moving average (purple line), which should serve as a solid long-term support level for INTC.

In addition, it’s also closer to its support zone of $33, which we believe should attract long-term dip buyers if INTC falls to that level. Hence, coupled with INTC’s attractive valuation and improving underlying metrics from Q3, INTC should see limited downside risks at the current levels.

Accordingly, we revise our rating on INTC from Hold to Speculative Buy.

Be the first to comment