crstrbrt

Thesis

If you are an Intel (NASDAQ:INTC) or Nvidia (NASDAQ:NVDA) investor and you follow the news, you must lately be bombarded with torrents of headlines. The goal of this article is to provide an analysis beyond the ongoing fluctuations and bloodbaths in their share prices. Actually, a bear market offers the best opportunities for investors to buy stocks with bright long-term prospects. It just does not feel that way at the moment.

To me, out of all the ongoing news and excitement surrounding these two stocks, two things are of fundamental importance in the longer term (say the next five to 10 years): The recently passed CHIPS act and the debate that they’re having about the future of the Moore’s Law. And in the remainder of this article, you will see why:

- For the next 10 years at least, I agree with Intel CEO Pat Gelsinger’s comments that Moore’s Law is still “alive and well” and disagrees with Nvidia CEO Jensen Huang’s comments that Moore’s Law has ended.

- More importantly, the comments from CEOs should be used as a window to interpret their long-term business strategies. More often than not, where you sit determines how you think. And I’m more optimistic about INTC’s strategy to build both chip design and foundry capacities. Even though NVDA’s algorithm-oriented strategy has its merits too.

- Finally, I see the recently-passed CHIPS act intertwined with the CEOs’ interpretation of the law. I see the act as more aligned with INTC’s interpretation of the law, and hence provides a stronger catalyst for INTC’s fab+design model than for NVDA’s algorithm-oriented model. And I further see such catalyzing effects to last years or even decades considering the timeframe our chips would hit the law’s limits.

Moore’s law and INTC and NVDA’s divergence

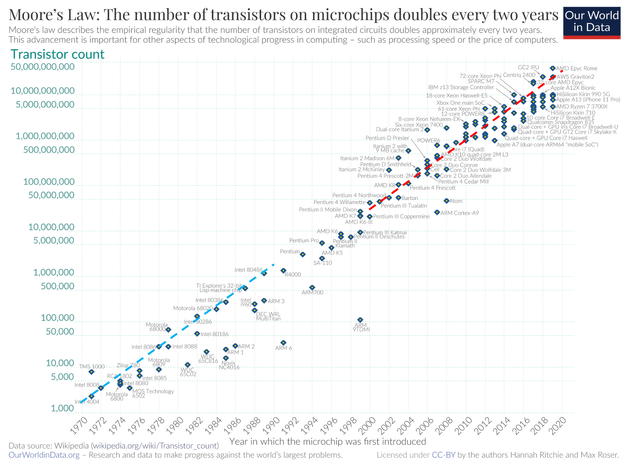

Moore’s Law was proposed by Intel co-founder Gordon Moore in the 1960s. It’s quite simple, it predicts the number of transistors on a dense integrated circuit (“IC”) would double about every two years. Even though it is named a “law,” it’s an empirical observation, not a physical law. Nonetheless, the law has worked so well in the past five decades since the birth of modern ICs’ as you can see from the chart below. The blue line represents my fitting according to the law between 1970 and 1990, and the red line is my fitting between 2000 and 2020. According to the law, transistors density would increase about 1,000 times every 20 years (2^10 equals 1024, quite to 1,000). And as you can see in both periods of 20 years, the actual data points follow the fitting very closely and there have been no signs of the slowing down of the destiny increasing. As a result, even though it’s “nothing more than” an empirical observation, the industry has been relying on the law as a guide for the development of chips.

Although eventually, the law will reach its limit. There are physical laws that can impose hard limits on the size of semiconductor transistors. As the simplest example, the transistor obviously cannot be smaller than the size of atoms, which are about a thousandth of the most advanced 2 nm chip processing technology. But other physical laws are very likely to kick in well before this (one of them is called the Heisenberg uncertainty principle as to be elaborated on in a minute). It’s just neither industry experts nor academic researchers agree (or know) where the limits are. Under this context, there is no wonder why INTC and NVDA are at odds regarding the law. As reported by CNBC, Intel CEO Pat Gelsinger said recently at a company launch event that Moore’s Law is “alive and well,” while NVDA CEO Jensen Huang said at about the same time that Moore’s Law has ended. In contrast to Intel’s approach, Nvidia’s answer to our future computing needs is in Moore’s Law, but in what Huang calls “accelerated computing.” In his vision, computationally intensive applications could run on specific processors that best handle those tasks, such as – and you guessed it – the graphics processor developed by Nvidia.

As we will see next, these above comments provide a window for us to see the long-term business strategies for both INTC and NVDA. And you’ll also see why I’m betting my money (both literally and metaphorically) with INTC’s strategy for the next five to 10 years at least.

The Law’s limit and timeframe

First, timeframe. As a non-expert who knows enough about quantum physics to make an educated guess, I think the so-called Heisenberg uncertainty principle (which is a physical law) would be the first hard limit to Moore’s Law – well before the atomic size scale. And by a simple extrapolating of our current rate of density growth, the limit due to the Heisenberg uncertainty principle would not be reached until 2036, which is a timeframe long enough for my (and I assume most investors’) timeframe already.

Second, the debate is more about their ongoing business strategies than the law itself. More often than not, where you sit determines how you think. And I tend to agree with Gelsinger’s thinking. Their disagreement underscores the difference in strategy between Intel and Nvidia. As we all know, Intel has pledged to expand its production capability, while Nvidia relies largely on third-party foundries outside the United States to make chips. Intel had been a leader in semiconductor manufacturing technology in the past. But in recent years, Intel has been overtaken by TSMC and Samsung, which can currently produce processors containing 5 nm or even 2 nm transistors in the near future, while Intel remains stuck on 10 nm and 7 nm technologies.

After Gelsinger took over, one of Intel’s core strategic goals is to reclaim its manufacturing superiority. And his timing could not have been more fortunate in my view. It has happened at a time when the U.S. and China’s relationship is strained. And the recent passing of the CHIPS act signals that the manufacture of chips has escalated from only being a business issue to becoming a national security issue.

And next, we will see how the act can impact the INTC and NVDA thesis.

The CHIPS act and its impact on projected returns

On Aug. 9, President Biden signed the 2022 CHIPS act into law. The total size of the act is around $280 billion. The largest components include $52 billion for domestic semiconductor fabrication (which will directly and largely benefit INTC). And next major components are $24 billion for a 25% tax credit and $200 billion in grants for research, which would benefit both NVDA and INTC as detailed next.

My view is that INTC will be a major beneficiary of the act. While in contrast, NVDA could benefit too but the benefits would be more limited. At the same time, NVDA also could suffer some headwinds because of the act. For example, its reliance on TSMC could create headwinds as the U.S. emphasize domestic manufacturing, and also it had received notice from the U.S. government to restrict the export of certain chips to China or Russia.

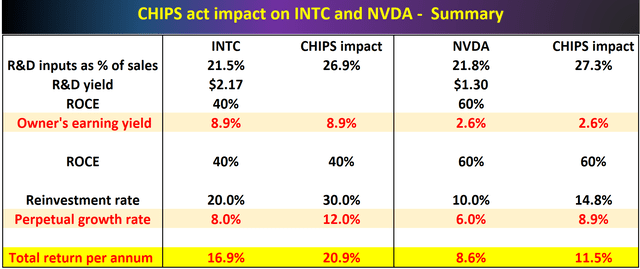

And more specifically, the table below summarizes my projection of the CHIPS act’s impact on INTC and NVDA. It’s expected to boost INTC’s profitability in several directions – expansion of free cash flow, boost of their R&D yield via sponsored research, or boost their reinvestment rates. Note that INTC has already been enjoying a higher R&D yield of $2.17 compared to NVDA’s $1.3 in the past. Here, to avoid double-accounting and also to be consistent, I will lump the benefits into the boost in reinvestment rates for both INTC and NVDA. INTC has been reinvesting at a rate of 20% before the passing of the act with its IFS initiative and NVDA at about 10%. I project the subsidies from the act will boost its reinvestment rates to at least 30%. In contrast, I anticipate the boost for NVDA more restricted and mostly come from the tax credits for R&D-related expenses. To wit, I expect the act to boost NVDA’s reinvestment rates to about 14.8%.

As analyzed in my earlier articles, NVDA enjoys higher profitability than INTC. Measured by ROCE (return on capital employed), NVDA’s average ROCE is 60%, about 50% higher than Intel’s 40% average ROCE. However, the higher reinvestment rate from INTC, especially after the CHIPS act boost, could tilt the growth toward INTC in my projection. As seen, with the boost, INTC’s long-term growth rate is projected to be 12% (40% ROCE * 30% reinvestment rate), compared to NVDA’s 8.9%.

At the same time, INTC also offers a more attractive OEY (owner’s earnings yield) than NVDA given their current valuations. INTC trades at 11.2x FW PE and NVDA still trades at ~37xx FW PE despite recent corrections.

All told, both are projected to provide a total return in the double digits combining the OEY and the growth. However, INTC shareholders are expected to see a more skew return profile, with annual returns projected in the upper-teens to about 20%, consisting of about 8% of OEY and about 12% of growth. In contrast, NVDA is projected to return about 11.5% per year, mostly coming from growth.

Source: Author based on Seeking Alpha data

Risks and final thoughts

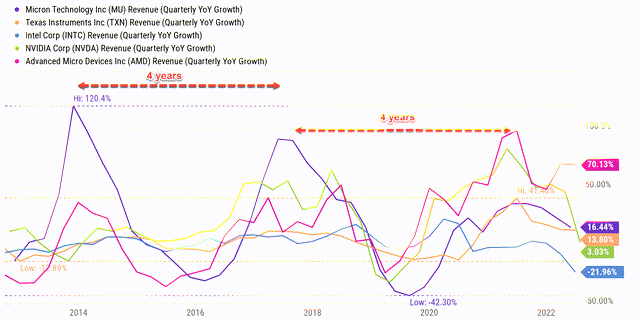

Finally, risks. Both stocks do face some risks too. They first obviously face the same macroeconomic risks including high inflation, global supply chain disruptions, and also the possibility of a recession. Secondly, the impact of the CHIPS act is a scenario analysis, and the actual allocation of the funds in the CHIPS act can deviate from my analysis above. For INTC, it not only has to compete with overseas players such as TSMC it also has to compete with domestic players in both the CHIPS and fab space. For NVDA, its products also have considerable exposure to the cryptocurrency mining business. And its high-end and high-margin products are particularly sensitive to the business cycle and the possibility of a recession. As shown in the chart below (detailed in my earlier article), NVDA has exhibited far deeper cyclicality than INTC even though they both followed a four-year cycle together with the rest of the major chip players.

Source: Author based on Seeking Alpha data

To conclude, a bear market actually offers the best opportunities for long-term investors, particularly for cyclical stocks like INTC and NVDA. These are times when investors should especially look past short-term noises and focus on the long-term fundamentals. And in my mind, out of all the ongoing news and excitement surrounding these two stocks, two things are of fundamental importance for INTC and NVDA in the next few years: The CHIPS act and Moore’s Law. And both factors are intertwined in deeper ways.

NVDA’s algorithm-oriented strategy has its merits. But I’m more optimistic about INTC’s strategy at least in the next 10 years or so. Moore’s law will eventually face hard limits (e.g., from the Heisenberg uncertainty principle). But I do not see that limit approaching anytime soon (the earlier timeframe points to around 2036). And finally, the CHIPS acts as a much stronger catalyst for INTC’s approach much more than NVDA.

Be the first to comment