bazilfoto/iStock via Getty Images

If you have not noticed the market action lately, long-time blue-chip semiconductor stock Intel Corporation (NASDAQ:INTC) has seen its price be cut in more than half in the last year, and counting. We are a contrarian firm. We find beaten down stocks, and profit from their rebound. Right now, sentiment in the market is as negative as we can remember. It seems as bad as early March 2020, when we all thought society as we knew it was collapsing due to COVID. It is as painful as October 2008, and most of us remember how bad the six-month period following that was.

And yet, here we have Intel. The stock has been left for dead. There are several main reasons for this. First, in general, the market is horrible. Stocks are just down almost across the board. Second, semiconductor stocks as a whole have been absolutely decimated. The fact is that global semiconductor sales continue to fall. This is because demand is slowing, and there is fear that there will be a very slow period for new computer, TV, car, and every other product that uses chips. Third, Intel, at least right now, is seemingly being outcompeted in this market by other companies.

However, the company is doing everything it can to continue operations, cut costs, and continue to pay its dividend to shareholders. We are buyers here because of the high dividend payout and long-term prospects of the company. We believe that under $25, it is time to scale into Intel. The sentiment is so bad, we are being greedy when others are fearful. Let us discuss.

Q2 earnings showed the weakness accelerating

The problems for Intel really started over a year ago, maybe more, as competitors started to demonstrate some real competitive strength. That said, market leaders in sectors tend to change every few years. Intel is not going anywhere. Pay no attention to anyone who says Intel is going bust. Not happening. We will admit, there are other semiconductor stocks which in the near-term, have a leg up on Intel. But with the yield now approaching 6%, we are buyers. However, we are not blind to the fundamental challenges the company faces. That said, we see a lot of this priced in here, though Q2 earnings reflected a growing weakening environment.

David Zinsner, Intel CFO, summed up the situation pretty well in late summer when earnings were announced:

“We are taking necessary actions to manage through the current environment, including accelerating the deployment of our smart capital strategy, while reiterating our prior full-year adjusted free cash flow guidance and returning gross margins to our target range by the fourth quarter. We remain fully committed to our business strategy, the long-term financial model communicated at our investor meeting and a strong and growing dividend.”

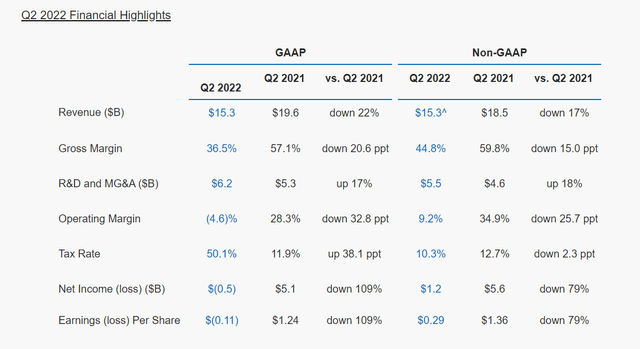

The weakness here was evident. The following summary table shows the pain being experienced quite clearly:

So as you can see, revenue was down 22% from a year ago, 17% when adjusted for currency. Margins were crimped. Research and general expenses were amazingly higher (the company has to stop this). Net income was down 79%, and earnings were just painful, down 79% to $0.29 per share in Q2.

So we know that it was horrible. The question is where are we going from here?

Some keys to Intel’s future near- and long-term

So here is the deal. We are not expecting some magic turnaround here in the next few weeks. If you came here expecting to read about some amazing hidden catalyst, we do not have it for you. This is simply a valuation call, and a call on the dividend. Yes, growth has stalled. Is the business dying? No, but it has come to a grinding halt. The company is not losing money here. Though, if it does not get spending under control, it may.

The company is taking steps to rein in costs, however. On Tuesday, Bloomberg had reported that big cuts to the nearly 114,000-employee base could be announced in conjunction with Q3 results, which will come out in two weeks on 10/27. These cuts will help save money. It would appear many cuts will be on the marketing side, though some may be on the production side as well.

Another cost-saving move, and one that bodes well for the future, is that Intel will start to implement an internal foundry model for its customers, as well as its own chips.

Another longer-term catalyst is that the United States is battling China over semiconductor production and use. The goal really is to prevent China from using our technology against us militarily, but the secondary goal is to keep China’s technological advances second to the United States, in our opinion. But we know for sure that the United States is looking to build out its domestic semiconductor foundries as an alternate to Asian manufacturers. We know that Intel is the only domestic based supplier that could even get close to that goal in the next few quarters, or even years. So this is a long-term catalyst that simply cannot be ignored.

Another near-term negative catalyst is that pricing of chips has been on the decline. This will weigh when Q3 earnings are reported, but chips, while more secular than in years past, are still quite cyclical. And right now, it’s a downturn on the cycle.

Q3 outlook

As we look ahead to the Q3 report, we want to revisit the guidance that was given for Q3. We think the company is going to miss on these self-guided numbers solely as a result of trends in the semiconductor space. We have seen companies lowering expectations, including Applied Materials (AMAT), which just lowered estimates after hours. While Intel has different customer bases and different lines of business, it is safe to say the neighborhood continues to deteriorate.

That said, the company guided for revenue of $15-$16 billion, on 46.5% margins, looking for EPS of $0.35 in the quarter. Just given the problems in the sector, and trends in pricing, it is going to be a tall order to come in at the high end of this range. We think the revenue number, even though it was a cut at the time, may be too high. We think a range of $14.75-$15.25 billion is more reasonable and attainable.

It is tough to see an upside surprise here. On the earnings front, $0.35 seems lofty given our expectations for revenues, unless there are serious cuts to spending. We do not see the cuts coming until here in Q4, so, we see EPS of $0.12-$0.24 as likely, on the assumption that expenses are commensurate with Q2 spending. With earnings declining so much from a year ago, the concern now is the dividend.

The dividend

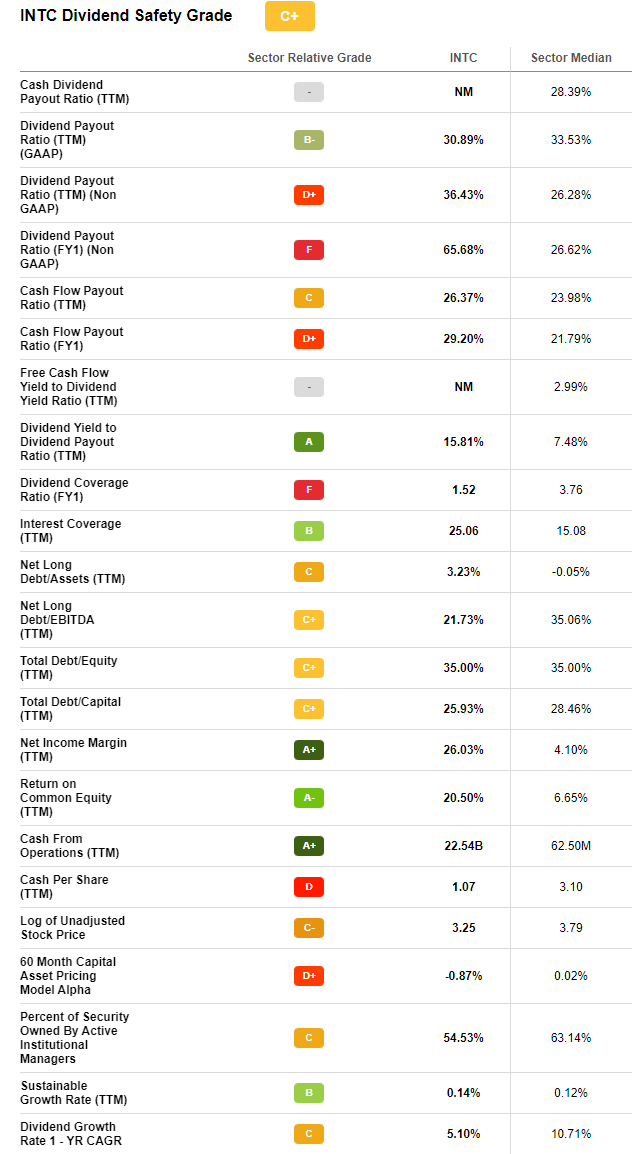

If you think the company is going bust, certainly you do not trust the yield here. But the yield is nearly 6%, and provided this earnings downturn only lasts a couple of quarters, dividend should be secure. Seeking Alpha assigns an average safety rating to the dividend:

Seeking Alpha INTC Dividend Safety Page

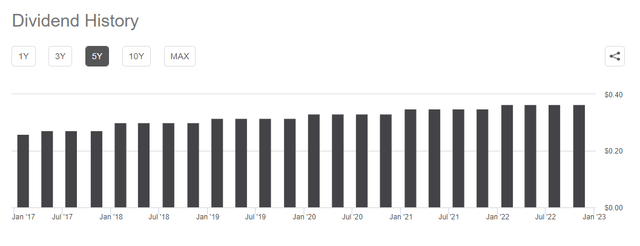

There are some risk signs, like an increasing payout ratio metrics relative to cash flow, and the cash per share on hand. However, the debt/equity and debt/EBITDA remain comfortable, while trailing earnings have been enough to cover the dividend. Right now, the company in the near-term may earn less than it pays out, however. We are happy to start buying under $25 to secure the 6% dividend and wait for the turnaround. The dividend has been consistent, and has been raised time and again as well:

Seeking Alpha INTC 5-year Dividend History

And while the dividend continues to be paid, the valuation has improved as the stock has sold off.

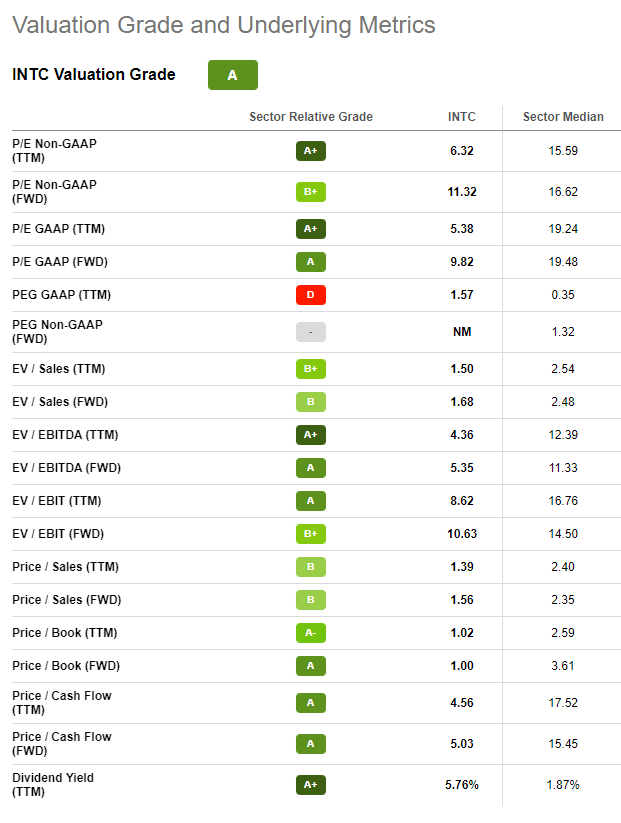

Valuation

We also like the valuation here even though it comes as growth has been collapsing.

Seeking Alpha INTC Valuation Page

The overall rating is an “A,” and this stems from a favorable P/E, PEG, EV/sales, EV/EBITDA, and a price to cash flow. Cheap can certainly get cheaper, but as contrarians, we want to be buying when the sentiment is so negative that investors are capitulating and practically giving their shares away.

Final thoughts

Intel is not going out of business, though it is being priced as if it is in a lot of risk of debt default, bankruptcy, and more. We just do not think this is reality. The company is taking steps to improve its fiscal state, including using a foundry model, and cutting staff.

We want to see the company get serious about its spending, but believe Q3 results will come in below the company’s guidance just given the pain experienced by the sector in Q3. The dividend is secure in our opinion. The sector is cyclical. All the stocks here in the semiconductor space are down. Intel has a lot of near-term and some medium-term problems, but we are comfortable in starting to buy into our long-term dividend growth portfolio as the stock falls under $25. We are being greedy here as others capitulate.

Your voice matters

What do you think about this plan? Are we catching a falling knife? Will the dividend be cut? Will earnings be strong? Is management to blame? Let the community know below.

Be the first to comment