RomoloTavani

I’m sure you’ve heard the expression “separating the wheat from the chaff” without any real understanding of its meaning (unless you grew up as a farmer). The website wholegrainscouncil.org explains it like this:

“In cereal crops like wheat, rice, barley, oats and others the seed – the grain kernel we eat – grows on the plant with an inedible hull (also sometimes called a husk) surrounding it. Before we can eat the grain kernel, we need to remove that inedible hull…

Traditionally, farmers would toss this kind of grain into the air, from big flat baskets, letting the thin hulls – called chaff in Middle English – blow away in the wind, or fall through the chinks in the basket. This wind-assisted process for separating the wheat from the chaff is called winnowing and the grains with almost no hull are called “naked” grains.”

Now, let be perfectly clear, I’m not here to provide you with a farming lesson, I’ll save that for when I write about Farmland Partners (FPI) or Gladstone Land (LAND). Instead, I’m here to provide you with a much-needed update on the “weed” REIT, Innovative Industrial Properties, Inc. (NYSE:IIPR).

My very first article on Innovative Industrial Properties was back in 2018, in which I explained,

“Cash flow growing so fast it could support some of the fastest long-term dividend growth in all of REITdom, thus potentially generating excellent long-term total returns for risk-tolerant investors.”

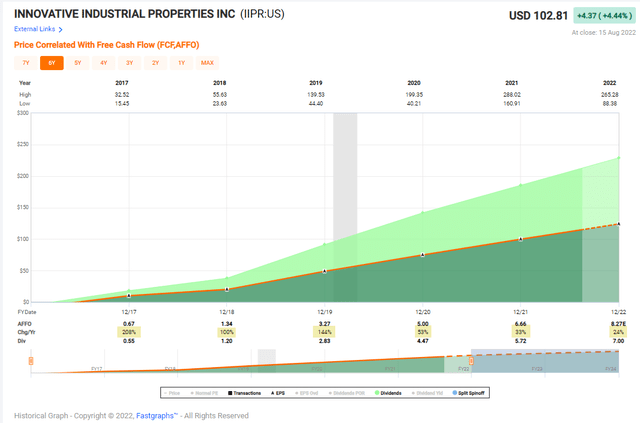

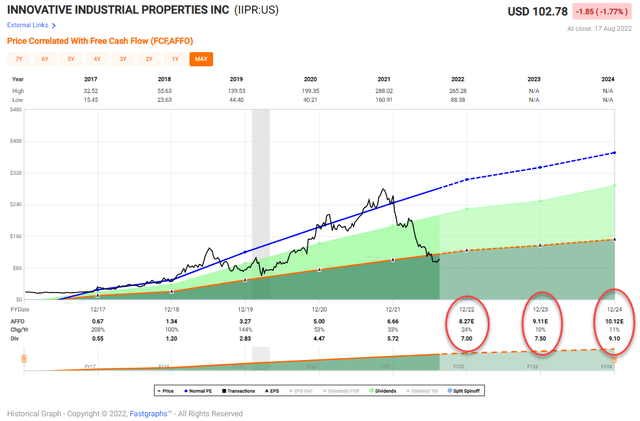

As illustrated below, IIPR has been a “cash cow” over the last three years, generating eye-popping growth (based on AFFO per share) of 100% in 2018, 144% in 2019, 53% in 2020, and 33% in 2021. No other REIT could come close to this type of growth:

Of course, the total returns generated by IIPR during this period was even more impressive:

- 2018: 45%

- 2019: 70%

- 2020: 150%

- 2021: 47%

Are you tracking?

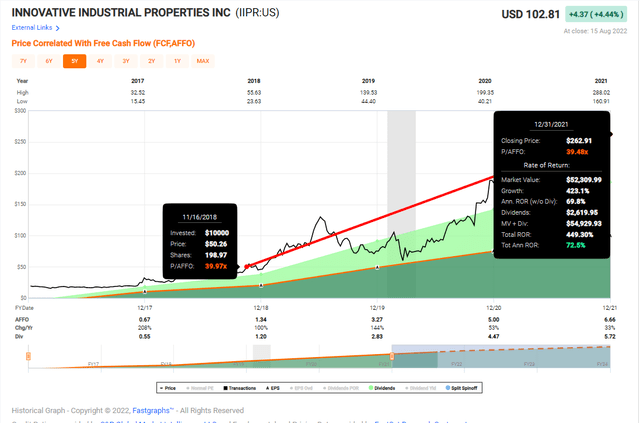

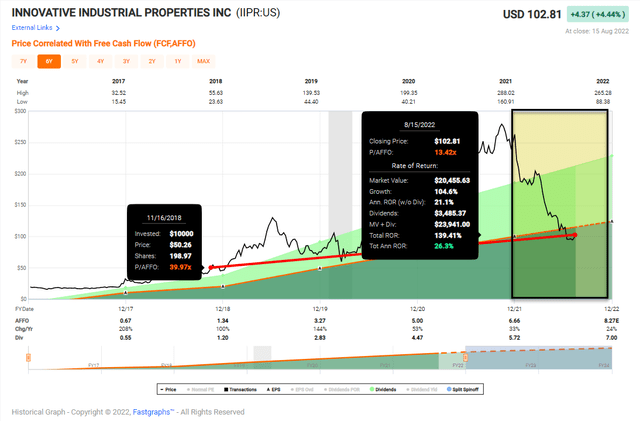

Had you purchased shares in my IIPR article written in November 2018 and sold on December 31, 2021, you would have generated a return of 450% or around 72% annualized:

Only I was so lucky, right?

2022 has been a train wreck for IIPR and the cannabis sector as a whole. To be fair, had someone purchased IIPR in November 2019 and held thru today, your shares would have returned 139% or around 26% annualized…still ahead though!

That’s a big delta…450% versus 139%…

Cleary this means there has been more sellers than buyers…

Which one are you? (respond in the comment section below)

I’m Encouraged (The Bull Case)

A few days ago, I posted on the iREIT on Alpha chat board that IIPR’s chairman, Alan Gold, has become an active buyer of IIPR, as he purchased roughly ~$100,000 on Friday and another ~$100,000 on Monday, bringing his total investment in the cannabis REIT to ~270,000 shares (.96% outstanding or $28 million in value).

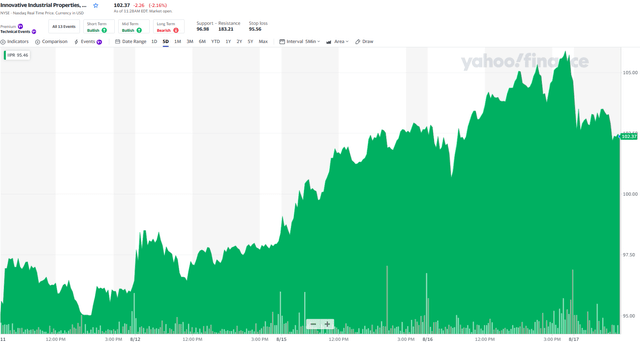

I’m happy to see the Chairman and Founder put some skin in the game. If you didn’t know already, Gold was previously CEO and founder of Life Science REIT, BioMed, that sold to Blackstone (BX) for ~$8 billon in early 2016. As seen below, the market has responded favorably:

Skin in the game is a great catalyst, although I’m hoping to see Gold add a few more chips to the stack.

Other positive news supporting our buy thesis has to do with the rapid growth within the cannabis sector. U.S. regulated cannabis sales were $24 billion in 2020, and are expected to grow to $46 billion by 2026. There are over 428,000 full time U.S. cannabis industry employees in 2021, representing over 30% growth year-over-year.

New Jersey commenced adult-use sales on 4/21/22, and 12 dispensaries sold $1.9 million of recreational cannabis on the first day. These results were in-line with New Mexico’s 4/1/22 adult-use start (also $1.9M), but trailed Illinois’ first day sales of $3.2M (on 1/1/20).

The average “basket size” in NJ of $153/person far exceeded those in IL and NM ($42 and $66/person, respectively), while NJ’s dispensary count (12) is a fraction of that in IL (37 on 1/1/20) and NM (118).

Other states that plan to commence adult-use sales are Connecticut, New York and Virginia (15th largest state), while Maryland (9th largest state) and Pennsylvania (largest state) are expected to legalize in 2023 and 2024, respectively.

Currently, 38 U.S. states and D.C. have legalized cannabis for medical use representing a large majority of where the U.S. population lives.

18 U.S. states have legalized cannabis for adult-use, while 93% of Americans support patient access to medical-use cannabis and 68% of Americans supported full legalization of cannabis (according to a 2019 poll by Quinnipiac University: 2021 poll by Gallup).

Also, according to Arcview Market Research and BDS Analytics, 100% of U.S. states will offer cannabis by 2025 – 100% of U.S. states are forecasted to have medical cannabis by 2025; nearly 50% expected to have adult-use legalization.

Thus, we view the biggest catalyst for cannabis to be the fact that the sector is in its early stages, and REITs like IIPR are well-positioned to capitalize on the continued growth (albeit more modest as I’ll discuss below).

In regard to IIPR, the company has a first-mover advantage in that it is the first and only publicly traded company on the New York Stock Exchange to provide real estate capital to the regulated cannabis industry. This is beneficial in two ways.

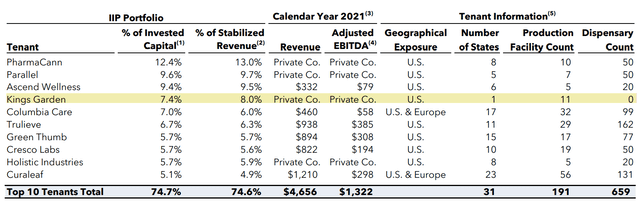

First, IIPR has a portfolio of 109 properties in 19 states, and these Top 10 tenants represent ~75% of the company’s invested capital and stabilized revenue:

Now, I highlighted one of these operators, Kings Garden, because I plan to discuss this in the “Bear” section; however, it’s important to recognize here that most of the leases are master leases and that IIPR’s first-mover position has created a competitive advantage in terms of deal sourcing and follow-up capital opportunities with existing tenants.

Also, IIPR has always maintained very low leverage, as of Q2-22 the company had approximately $2.5 billion in total gross assets and a total of about $306.5 million in debt, consisting solely of unsecured debt with no maturities in 2022 or 2023 (~$300 million of that debt not maturing until 2026).

IIPR’s debt to total gross assets ratio decreased to 12% at Q2-22 and the company’s total fixed cash interest obligation on an annual basis was $16.7 million, or a little over $4 million per quarter. IIPR maintained its investment grade credit rating with a debt service coverage ratio of 15.7x.

Also, as of Q2-22 the company’s payout ratio (based on AFFO per share) was 82%, within the target range of 75% to 85% of AFFO. I’ll touch on valuation later in this article, but I wanted to point out here that IIPR’s dividend yield is 6.7%. I don’t know of any other REIT with just 12% of debt has a yield that high.

The Bear Case

Clearly there are risks to the cannabis sector, and while I’m encouraged with the growth prospects of the cannabis industry, the biggest overhang for the industry has to do with federal legislation, or the SAFE Banking Act that remains the most potentially viable near-term legislation.

I recently interviewed the management team at Chicago Atlantic (REFI), a newly listed cannabis mREIT. They told me,

“…I think when SAFE Act happens… because we are in the same belief that it’s not an if but when… I think that we’ll be just as full of beneficiaries of the reduction of cost of capital and borrowers, if not more, given the fact of our track record and history.”

In my view, the biggest overhang for the cannabis REIT sector is Federal legislation because it will provide for new funding sources to cannabis operators and the opportunity for interstate commerce.

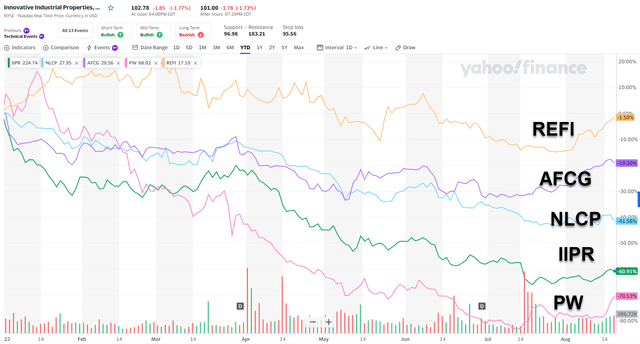

Currently, the cannabis REITs have a unique moat in that they provide much-needed capital for the growing cannabis operators. We now have five cannabis REITs in our coverage spectrum:

- Innovative Industrial: $2.9 Billion Market Cap

- NewLake Capital (OTCQX:NLCP): $372 million Market Cap

- AFC Gamma (AFCG): $370 million Market Cap

- Chicago Atlantic: $287 million Market Cap

- Power REIT (PW): $63 million Market Cap

Keep in mind, the market cap of NLCP, IIPR, and PW would be almost double today had in not been for the selloff in the sector YTD:

Now, one of the reasons that I favor IIPR is because of the company’s scale advantage, and of course the company’s management team is now being tested with its first large tenant default.

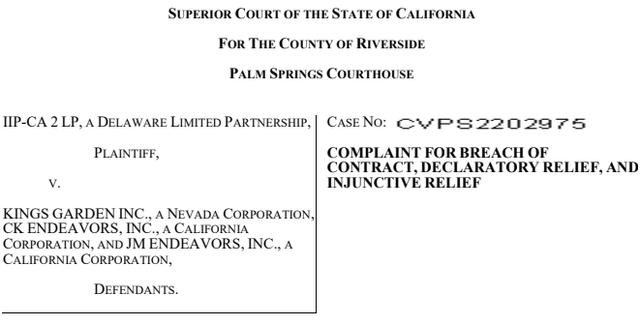

As seen below, on July 25, 2022 IIPR filed a Breach of Contract Complaint versus Kings Garden, Inc., IIPR’s 4th largest tenant:

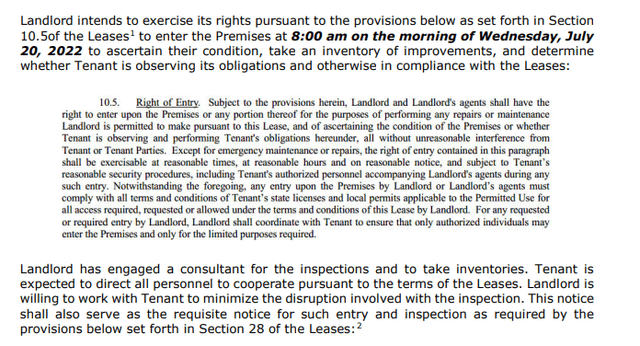

Upon reviewing the Complaint, it appears that IIPR had requested to access one of the Kings Garden buildings on July 20, 2022, to inspect and take inventories:

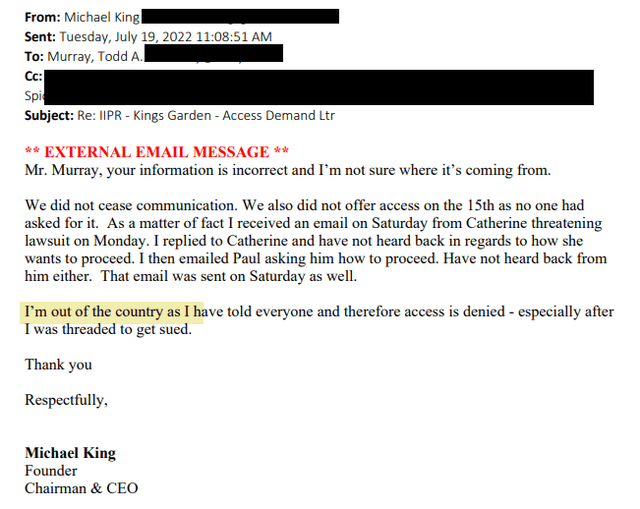

On July 19, 2022, the tenant responded with an email stating the CEO was “out of the country”:

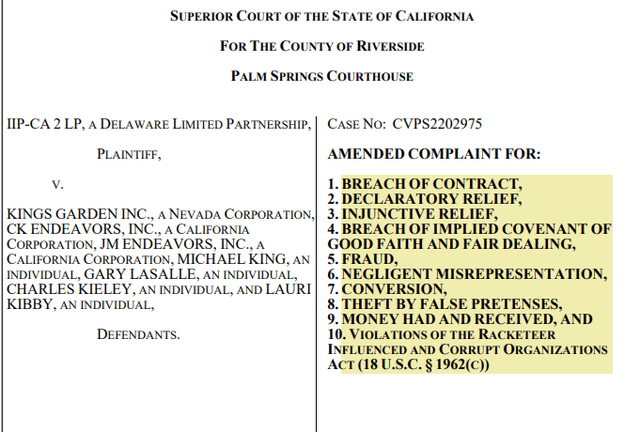

As I said, the lawsuit was then filed on July 25th and then IIPR filed the following Amended Complaint on August 2nd:

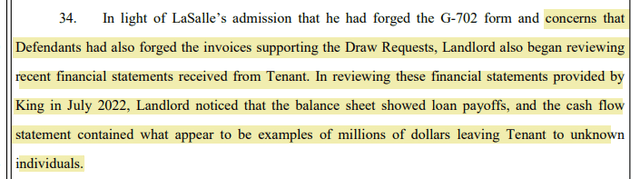

Upon review of the Complaint and Amended Complaint, it’s clear to see that the King’s Garden matter is not as much of a rent default, but more of a breach of contract with violations related to fraud and racketeering.

Furthermore, it appears that IIPR has pursued this matter aggressively, as they should, to enforce its full rights under the lease contract.

I will not provide legal opinions on this lawsuit, other than to state the obvious: IIPR is doing its job to collect monies owed, and the biggest question for investors is how long it will take to get rents flowing again…

On the Q2-22 earnings call, Alan Gold said,

“Now the Kings Garden brand is a high-quality brand and it’s well recognized in the industry as something of — that is of high quality. And others have been certainly envious of their position and their ability to provide product — with their facilities, others know of their brand and of their facilities and where they’re growing, and we have had inquirers.”

Assuming that IIPR does not collect any rent from Kings Garden over the next few months, we will see the payout ratio narrow from 82% to 90%. That’s still means that IIPR has plenty of time to resolve the lawsuit before worrying about a dividend cut.

The Perfect Storm

Year-to-date, IIPR shares are down 56%, which makes this the worst-performing REIT in our coverage spectrum. This company has been victimized by the perfect storm (rising rates, inflation, short, lawsuit, etc..) and now has one the highest dividend yields today (when comparing it with other growth stocks).

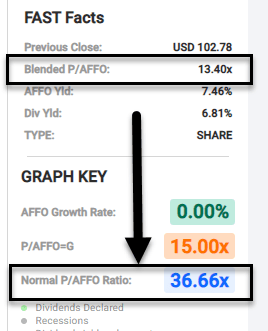

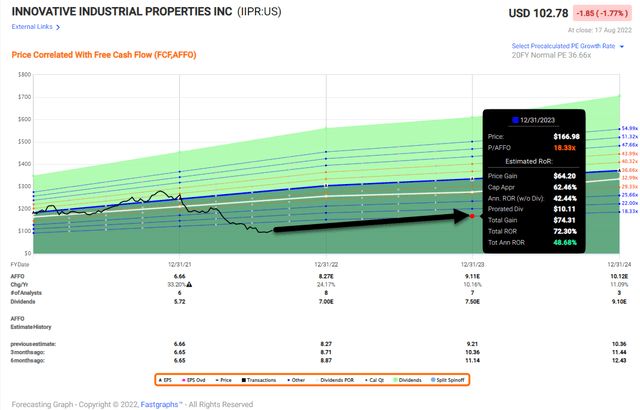

IIPR’s AFFO multiple today as 13.4x, compared with a normal (historical) P/AFFO multiple of 36.7x. The dividend yield is 6.8%.

FAST Graphs

The big question is whether or not IIPR is still a growth stock, and while analysts have estimated growth of 10% in 2013 and 11% in 2024, the growth rate is still higher than most REITs:

So that begs the question, “what is IIPR’s new growth worth?”

For example, Realty Income’s (O) growth rate is ~6% per year and shares trade at 19.5x.

Prologis’ (PLD) growth rate is ~13% (2023 estimates) and shares trade at 34.0x.

American Tower’s (AMT) growth rate is ~9% (2023 estimates) and shares trade at 28.0x.

So, once again, IIPR trades at 13.4x and is expected to grow by low double-digits in 2023.

Conservatively, IIPR could return to a multiple of 18.3x which means shares could return around 50% annualized:

Keep in mind, IIPR management could sit on the beach and do nothing and just work on resolving the Kings Garden matter and the dividend would be fine. There are no near-term debt maturities, and, as mentioned, the company has extremely modest debt on its balance sheet.

Recognizing lower growth prospects ahead and the uncertainty related to Kings Garden, iREIT has lowered its buy-below target. However, we are maintaining a Strong Buy, recognizing that this tenant default is a good test for the management team.

Once again, I was happy to see the founder and Chairman put more skin in the game and also glad to see the company become aggressive in its pursuit of rent collection (reading the lawsuit provides clarity).

Be the first to comment