AzmanL/E+ via Getty Images

While some of you may eventually get tired of me writing about the same stocks, I don’t get tired of writing about my favorite picks. Part of this is what happens naturally over time running a concentrated portfolio, but I don’t think there are a ton of good options out there to buy right now. After a rough start to 2022, Innovative Industrial Properties (NYSE:IIPR) is worth adding to today or starting a new position.

Investment Thesis

IIPR is the largest REIT focused on cannabis real estate. The shares have had a rough start to 2022 and are down approximately 30% YTD. They continue to grow the portfolio and are well positioned for whatever regulatory changes might be coming in the next couple years. The valuation is very attractive relative to the company’s growth profile. After the recent selloff, shares now yield a juicy 4.1%. When you factor in the dividend growth, investors can expect a large and growing income stream accompanied by share price appreciation. Shares are still a strong buy under $200 and I recently added to my position for the second time in 2022.

An Update based on the 10-K

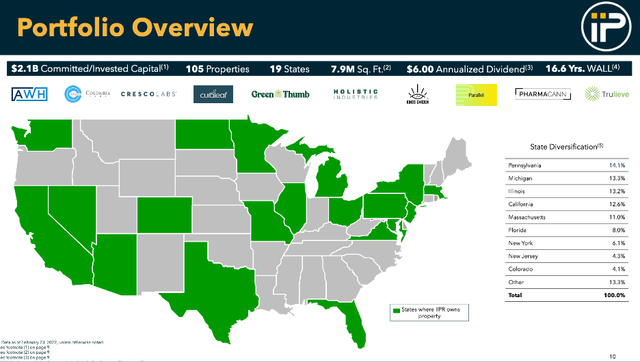

IIPR continues to grow their portfolio at an impressive pace. The slide below shows the year end portfolio, but they have also added 4 properties to the portfolio in 2022, for a total of 108 properties. The company has plenty of dry powder to continue to add new properties. I think they will continue to add states and companies to their rapidly growing real estate portfolio and I’m very bullish on the long-term future of the company.

IIPR was recently in the news for a couple of reasons. The first was for another acquisition, this time in Maryland. The other reason is due to a short report from Blue Orca. Shares were down over 7% on Thursday. The Reader’s Digest version is that Blue Orca views IIPR is a “marijuana bank masquerading as a REIT.” IIPR has always been volatile, but I think it’s a buying opportunity for long term investors. After reading each quarterly SEC filing for the last year and most of the investor presentations, I’m not worried about the long term future of IIPR.

IIPR Portfolio (innovativeindustrialproperties.com)

One of the things I notice every time I look at IIPR and its 10-Qs or 10-Ks is the balance sheet. The company did issue $300M worth of notes (due 2026 with a 5.5% interest rate) in 2021, but they still have plenty of opportunity to lever up in the future. While I don’t want them to get overloaded with debt, future debt financing would provide them with more firepower to go after deals without diluting existing shareholders. Personally, I hope the equity issuances slow down a little bit, but either way, shares are still a no brainer for me at these levels.

Valuation

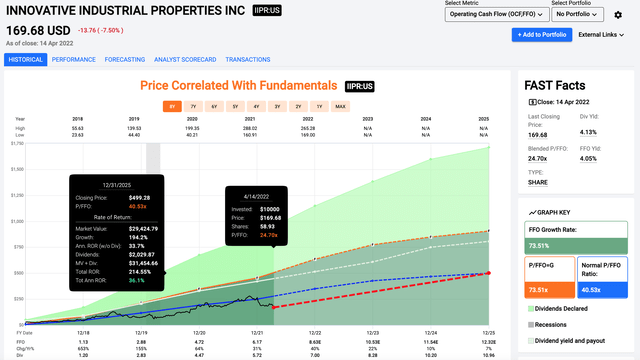

Shares of IIPR have typically traded at a premium valuation since the IPO. This has been more than justified by the growth in FFO/share. Shares currently have a blended price/FFO of 24.7x, which is well below the average multiple of 40.5x. If you choose to isolate projected forward FFO/share, the multiple is somewhere in the low 20x range. IIPR is a timely buy right now and I think shares should at least sit somewhere in the 30x range given the FFO/share and dividend growth.

Price/FFO (fastgraphs.com)

While the valuation is attractive compared to IIPR’s growth prospects, there are some questions about what happens to the company with changes in the regulatory environment. While changes could have an impact on the company, the rewards greatly outweigh the risks in my opinion. On average, they have huge cap rates, significant rent escalators, and long lease terms that should create significant returns for shareholders for the foreseeable future. When add all of this up and throw in an absurd amount of dividend growth, income investors can get excited about what the next 3 to 5 years have in store.

Another Impressive Dividend Hike

For investors that prefer to own securities that pay dividends, IIPR has the best of both worlds. The yield has risen to 4.1% as the price has dropped in 2022. They also recently announced another dividend increase, a 17% hike from $1.50 to $1.75 a quarter. I’m expecting continued double digit dividend growth for at least the next couple years as the company is projected to grow FFO/share at an impressive rate. While we won’t see the company replicate the absurd dividend growth of the last five years, I still think it will be some of the best dividend growth available to investors anywhere on the public markets.

Conclusion

IIPR isn’t your everyday REIT investing in retail or industrial properties. They have found a niche that has proven to be very profitable, and they continue to grow their real estate portfolio at an impressive pace. I will be the first to admit that shares have had a rough start to 2022 after dropping 30%. In my opinion, it’s a great buying opportunity for investors to add to an existing position or start a new one if you don’t own shares already.

Shares are trading at an attractive valuation with a forward price/FFO in the low 20x range. The dividend yield is up to 4.1% after the selloff, and investors can expect continued dividend growth from here. It might be higher risk and higher reward than the typical REIT, but I like my chances when it comes to the long-term future of IIPR. If shares stay this cheap, I will certainly look to add again in the near future.

Be the first to comment