svetikd

Investment Summary

We’ve noticed a handful of healthcare stocks have broken out above previous highs in previous weeks, leading us to increase our coverage universe. With greater insight into the space we are confident on finding selective opportunities offering tremendous upside. We recently observed InnovAge Holding Corp. (NASDAQ:INNV) breaking out to new highs; however, the move hasn’t been sustained for too long. Hence, we investigated what could be in store for the company and found there’s a lack of equity premia on offer. Moreover, when we looked at the market data more closely, we found there was a lack of buying support, with accumulation of shares likely to be low in our estimation. In that regard, rate hold.

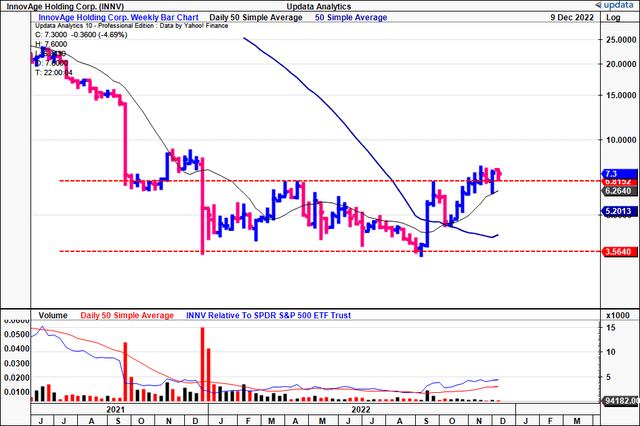

You can see below the latest price action. The relief rally is noted, but it has failed to really break off from the resistance levels.

Exhibit 1. INNV 24-month price evolution.

Note – currently riding 50DMA for support. Break below would be bearish, break away from this point could be bullish in our view.

Data: Updata

INNV: Key Fundamental findings

First, from a top down perspective, we examined the broad market opportunity. Here are our notable findings, which support a hold. It should be known that INNV has unique expertise in the home healthcare market. If we look at the entire market, it was valued at $336Bn in 2021 and is predicted to expand at a compound annual growth rate of 7.93% from 2022 to 2030.

This growth is expected to be driven by a number of factors. However, importantly, each of the sub-components of the market are also set to deliver reasonable growth estimates. Take the Physiotherapy market, for example. It is tipped for a 5.44% CAGR into 2026 and could generate an incremental $6Bn per year. Reports note that the market is fragmented with several players dotting the market, leaving the opportunity for INNV to capture market share in our opinion.

Next, we had a good inspection through the company’s most recent developments. Of note it has attested to the CMS in the California Department of Health Care Services that it is ready to begin the validation audit process. The CMS and DHCS accepted the attestation and management said the CMS validation on began on November 7. In Colorado, each of its six centres were at or above an average accuracy score of 95% in Q3. The CMS accepted this attestation as well and the federal validation audit was expected to begin on December 5. Moving to its operating performance, we note that since January, the company has hired over 250 employees and increased full-time centre-level FTE headcount by ~11%. It has also trimmed critical open positions by ~76%.

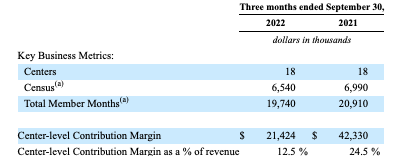

Switching to the quarterly numbers, we noted that INNV clipped revenue of $171.2mm on adjusted EBITDA of negative $3.8mm. This was sequential decline at the top of ~100bps compared to last quarter, the downside driven by census attrition in Colorado and Sacramento. Recall, this, represents ~50% of INNV’s total census. Net-net, it left the quarter serving ~6,540 participants across 18 centres. Compared to the prior year period, this represents an ending census decrease of 6.4%.

Exhibit 2. INNV key operating highlights

Data: INNV 10-Q, pp. 34. See: https://seekingalpha.com/filing/6883335

It’s also worth noting centre-level contribution margin was $21.4mm. As a percentage of turnover, center level contribution margin for the quarter was 12.5% compared to 24.5% last year. As another takeout, it reported roughly 19,740 member months for the quarter, a 5.6% YoY. Again, these aren’t conducive to high growth percentages looking ahead, and support a neutral view.

With respect to industry numbers, the combined capitation rate increase for Medicare and Medicaid was 4.9%. External provider costs were $96.2mm, a 690bps YoY increase. The upside was underscored by the increased cost per participant due to increased housing utilization, leading to higher rates of long-term placement.

Key technical findings

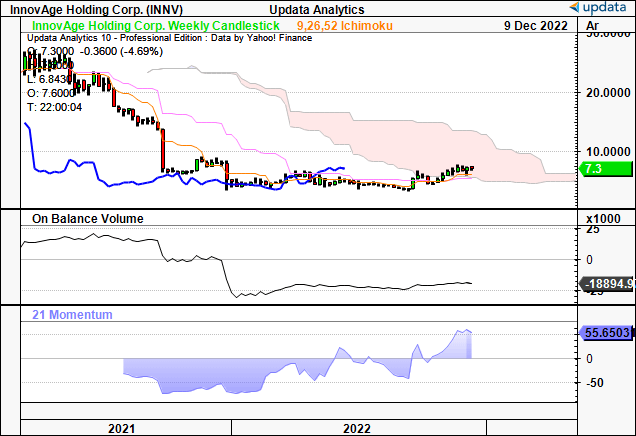

The goal was to examine if the recent breakout can continue. Looking at the cloud chart, it isn’t trading above cloud support. Lag line not even close. On balance volume unsupportive as well. You’d ideally see on balance volume curling up indicating accumulation from larger buyers.

Momentum is also weak suggesting there is lack of buying support with the move.

Exhibit 3. Trading into resistance. There’s not the support from on balance volume or momentum, no accumulation in other words. We would need the order book to be stacked on the buy side to bid the price up.

Data: Updata

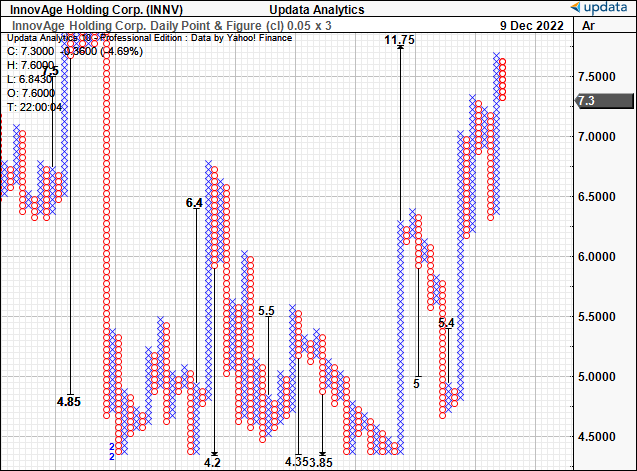

If we look a little deeper at objective measures, removing the noise of time, we see there’s no suggestion shares will continue the latest rally, just yet. We will be keeping a close eye on both charts, but right now we’ve got no volume or trend to work with. This supports a neutral view.

Exhibit 4. No upside targets. Price action is noted, however, as with the above, there acceleration of change is weak.

Data: Updata

Conclusion

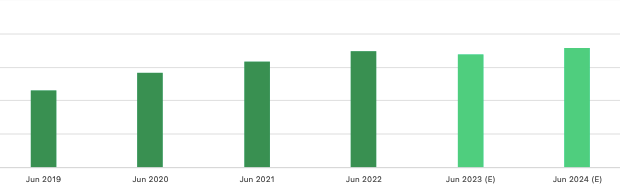

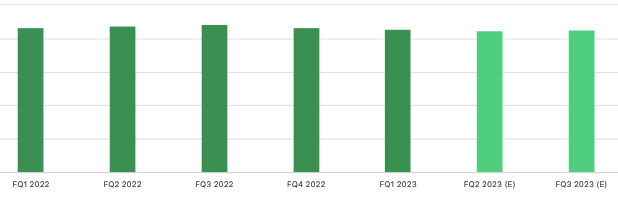

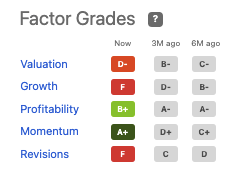

From what we’ve gathered the latest rally for INNV could be short-lived and this means we’d be missing out on more selective opportunities in allocating to the stock. Also, Seeking Alpha’s factor grades, which are also an objective measure of the stock, are pointing it to a hold as well [Exhibit 5]. Furthermore, additional findings demonstrate that top-line growth looks to be weak for the company looking ahead, both on an annual and quarterly basis [Exhibit 4]. This would further corroborate our neutral view. Moreover, it is estimated on a sequential and annual basis looking ahead. With lack of tangible value looking ahead, backed by quantitative data, rate hold.

Exhibit 5. INNV forward revenue estimates

Data: Seeking Alpha

Data: Seeking Alpha

Exhibit 6. Seeking Alpha factor grades, INNV

Data: Seeking Alpha, INNV

Be the first to comment