Prostock-Studio/iStock via Getty Images

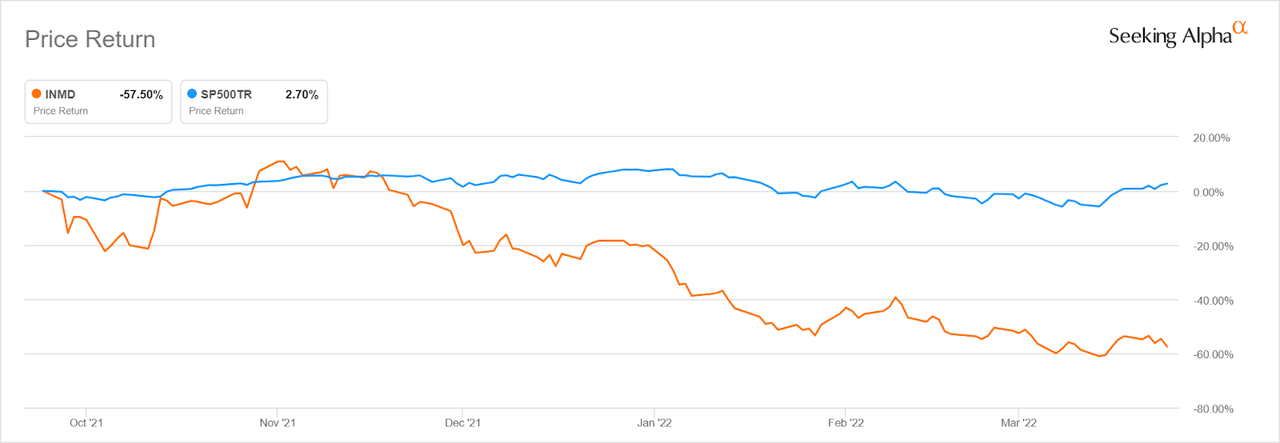

If you are one of those investors who decide whether or not to invest in a stock based primarily on stock charts, InMode (NASDAQ:INMD) is certainly not a stock you would consider buying.

Going long to the tune of $10K in shares of the Israel-based medical devices company three to six months ago would have resulted in a loss of at least $5K –extrapolate that to the size of your position and you’ll immediately conclude INMD’s recent performance has been an unmitigated disaster for any recent investor. However, these losses would just be paper losses unless you sold. There has, in our opinion, been no valid reason to sell (unless, of course, it was a financial emergency or you were trading for the short-term, which is also an acceptable albeit more difficult way to make money in stocks).

INMD 6 month performance vs S&P 500 (Seeking Alpha)

In our view, the steep decline in INMD, which started in November 2021 after the stock peaked at a record market cap of around $7.4 billion, has been a great opportunity for investors with a longer time horizon to increase their potential returns by systematically adding to their positions or initiating a new position.

For long-term investors, a severe pullback can be the buying opportunity of a lifetime if the underlying business has great fundamentals and is operating in an industry experiencing sustained growth. While nothing in investing is ever certain, consistently investing in such high quality companies that are growing profitably and producing significant cash flow greatly increases the odds of outperformance compared to short-term betting on charts. In our view, INMD’s underlying business fits the description of a high quality business worth investing in for the long haul.

The current disconnect between the business and the stock creates a great buying opportunity for risk tolerant investors. Buying a stock in a downtrend is not for the faint-hearted and has historically claimed many victims. That said, there are 4 key considerations that inform our opinion that a huge reversal is in the cards for INMD, making it a compelling buy despite the ugly chart and scary technicals at the moment.

Based on these 4 considerations, we believe the stock will not only reclaim its 2021 highs in the next 12 to 24 months, but surpass it, creating potential rewards of at least 150% + for investors who take advantage of current prices in the market.

However, before going into the details, a brief primer on the business would be timely and beneficial for those reading about INMD for the first time (feel free to skip to our thesis if you are already familiar with the company and its historical financial and operational performance).

Primer: Some useful facts about INMD

-

INMD is an Israel-based medical devices company that designs, develops, manufactures and commercializes minimally invasive and non-invasive surgery products mainly used in aesthetic treatment (it recently launched products for necessary treatments).

-

Non-invasive and minimally invasive aesthetic treatments like fat reduction, skin contouring and muscle tightening rely on the use of medical devices powered by energy-based technologies like laser and radio frequency to achieve results without surgery.

-

INMD produces and sells these products directly to plastic and facial surgeons, aesthetic surgeons, dermatologists and OB/GYNs. The products may be used on a variety of body parts including the face, neck, abdomen, upper arms, thighs and intimate feminine regions

-

INMD sells its products in over 70 countries, but the US, where non-invasive and minimally invasive surgery continues to grow in popularity, represents its main market.

-

As at Dec 31, 2021, the company had a globally installed base of approximately 11,600 platforms (its products) across its markets. The cost of installation and initial training (done by INMD’s sales team or an authorized distributor for some markets outside the US) are included in the purchase price of these platforms. These platforms utilize consumables, which are disposable, that are repurchased by the physicians from time to time, representing a recurring source of revenue. Since inception, the company has sold over 910,000 consumables as per its Annual Report for the year ended Dec 31, 2021.

-

Founded in 2008 by Moshe Mizrahy (current CEO) and Dr. Michael Kreindel (current Chief Technology Officer), INMD went public in 2019 and has since its IPO returned 425% (despite the recent 50%+ decline over the past 3 to 6 months).

-

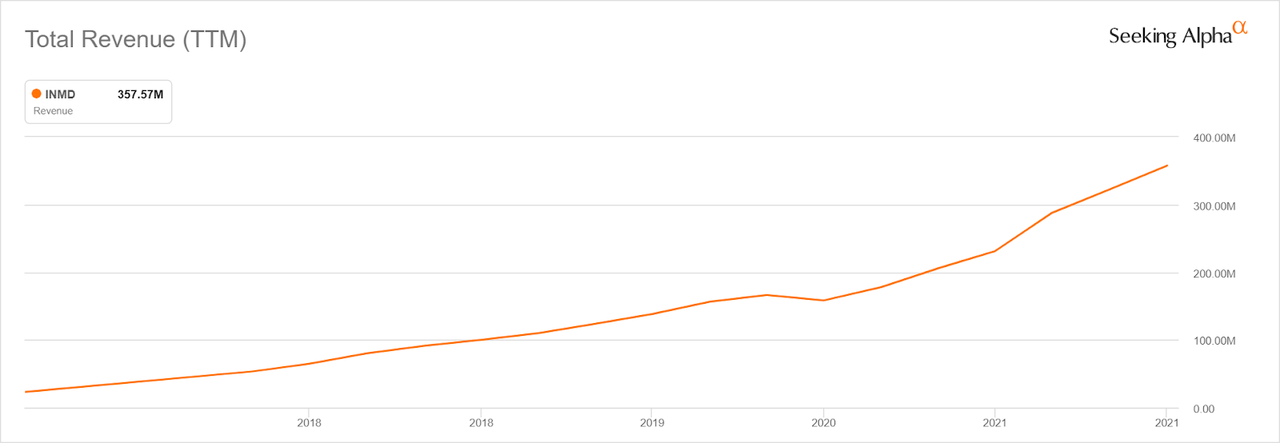

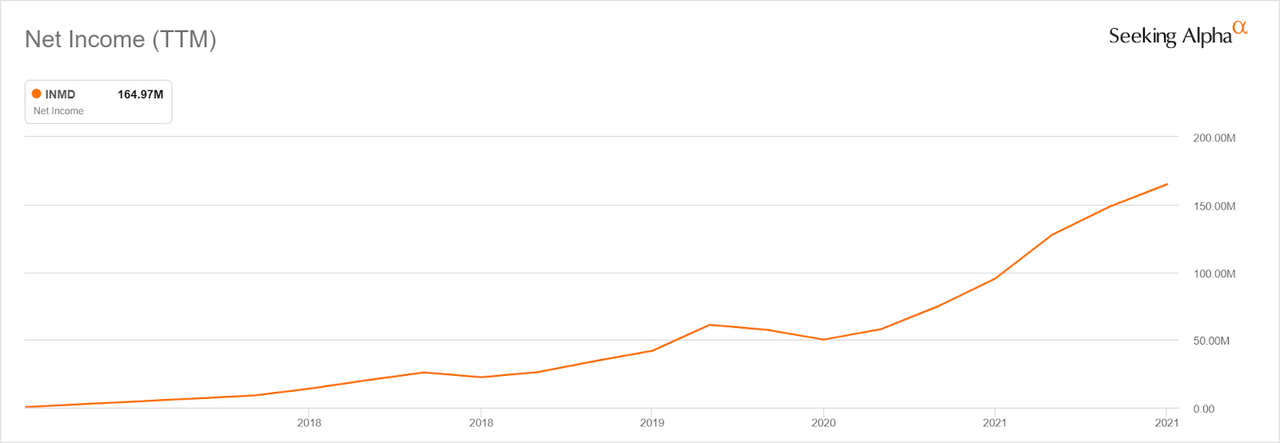

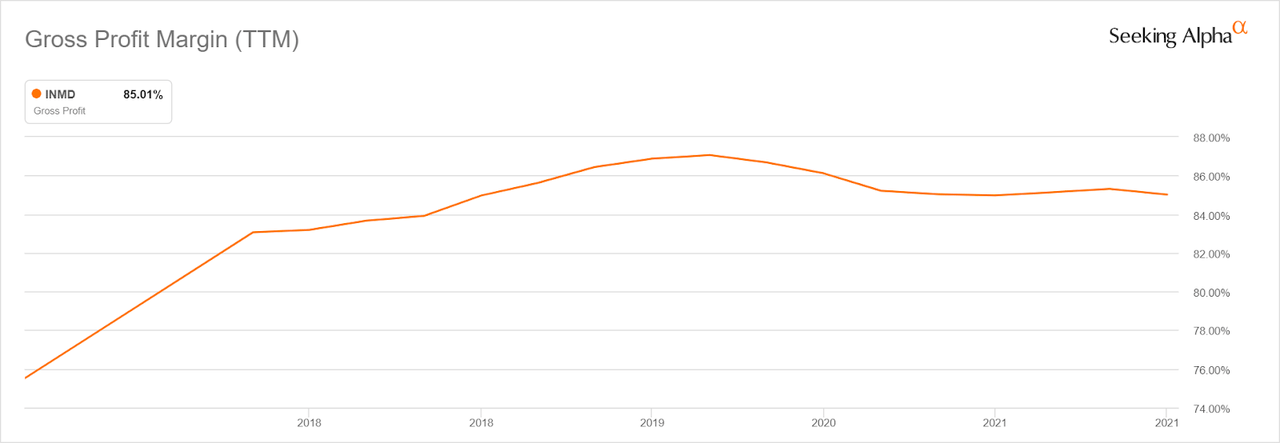

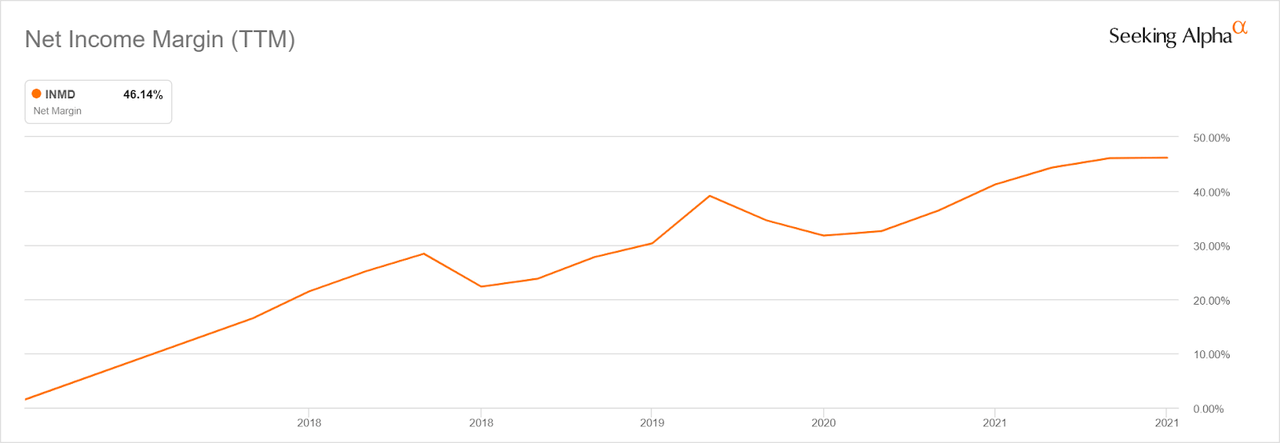

Its financial performance has moved from strength to strength in its three years as a public company, as the snapshots of key operational metrics (top line, net income and margins) below indicate.

INMD Total Revenue, 2018-2021 (Seeking Alpha) INMD Net Income, 2018-2021 (Seeking Alpha) INMD Gross Profit Margin, 2018-2021 (Seeking Alpha) INMD Net Income Margin, 2018-2021 (Seeking Alpha)

-

INMD had a record year in 2021. It posted full year revenues of $357.6 million, an increase of 73% compared to 2020. It also posted record GAAP net income of $165.0 million, compared to $75.0 million in 2020. The company has beaten earnings estimates for the past four quarters.

This may not be an exhaustive summary of INMD but it sufficiently illustrates that the underlying business is not only rock solid but highly promising. With that out of the way, let’s now look at the 4 key considerations that inform our view that a huge reversal is in the cards for INMD.

1. The US, INMD’s main market, continues to grow robustly

INMD raked in revenues of $237.3 million (66% of total revenue) from the US for the year ended December 31, 2021, compared to approximately $149.5 million (73% of total revenue) for the year ended December 31, 2020. This represented a 59% jump.

INMD’s growth in the US mirrors that of the wider aesthetic surgery industry over the same period. Americans are getting more minimally invasive cosmetic surgeries and 2021 was a record year..

Between January 1, 2021-July 1, 2021, Americans spent over $8.7 billion on aesthetic plastic surgery, according to research by the Aesthetic Society, the association for aesthetic surgeons. These half year 2021 numbers are close to equal the full year 2020 numbers when Americans spent over $9 billion (over $6 billion on aesthetic surgical procedures and over $3 billion on nonsurgical aesthetic procedures).

This data (almost 100% year on year growth in industry turnovers) suggests the US is still in the high growth phase as far as aesthetic surgery penetration and non-invasive options are concerned, pointing to continued growth for INMD in this lucrative market.

According to the American Society of Plastic Surgeons, in 2020, 15.5 million cosmetic procedures were performed in the United States, out of which 13.2 million (a staggering 85%) were minimally invasive. INMD, which focuses on minimally invasive surgeries, is on the right side of the trend and has a huge and growing Target Addressable Market in the US that should translate to increased revenue if it sustains and grows its penetration rates among specialists and surgeons.

2. International expansion, investments in sales & marketing and launch of new products

You may have realized that INMD’s US revenues as a percentage of total revenues declined from 73% in 2020 to 66% in 2021, despite a 59% year on year jump in US revenues in 2021. This is because the company’s international revenues are growing at a blistering pace.

INMD has a presence in over 70 countries outside the US. Full year revenue from these international markets reached $120.3 million, a 112% increase compared to 2020. These figures represent 34% of total revenue for 2021, compared with 27% for 2020.

According to Emergen Research, the global minimally invasive surgical systems market size is expected to jump from $21.98 billion in 2020 to $41.16 billion in 2028, representing a revenue CAGR of 8.1% over the period. Global demand for the kind of devices and systems INMD sells is growing and the company’s international expansion couldn’t be timelier. INMD’s international expansion will not only supercharge growth, but also lessen the risk of overdependence on the US.

It’s also worth noting that the company’s salesforce, which interfaces directly with physicians, is the company’s lifeblood. It’s therefore encouraging for us as investors that Sales and Marketing expenses increased 40% in Q4 compared to the fourth quarter of 2020 and 38% for the full year 2021 compared to last year. Overall, the company added 51 employees in 2021, bringing the total to 362 as at Dec 31 2021. This shows the company is allocating capital to growth – i.e. its salesforce.

The launch of new products also represents additional opportunities worth touching on. INMD has historically been very successful in terms of bringing new products to market and commercializing them.

While its past products have been in aesthetics, its new ones are increasingly in necessary treatments, which represents virgin markets in terms of future growth opportunities. The R&D pipeline has about 15 products at different stages of development, with an aim to release at least 2 products annually, according to statements from company executives in its last earnings call. You can read more about the product pipeline in the company’s annual report. However, one key takeaway is that the company will in future focus on products that come with disposables (consumables), which is a recurring source of revenue.

“We will not design additional platforms without any disposables. So in the future, once the install base will get, I would say to 20,000 or 25,000, I assume that the disposable will grow to a neighborhood of I would say 14%-15% of the total revenue,” said CEO Moshe Mizrahy during its last earnings call. Disposables as at full year 2021 represented 11% of total revenue, with the company having 11,600 installed platforms.

3. Ultra-low cost model, high performing teams delivers competitive advantage

An integral part of INMD’s business model is that it outsources almost all of its manufacturing to several subcontractors in Israel (while of course maintaining control over standards and the production process).

Its contracts with these manufacturers do not require it to make minimum purchase requirements, meaning it only purchases products when there is a customer order, removing the cost of holding finished products such as storage.

The cost advantages of outsourcing manufacturing and supply to Israeli subcontractors are immense and represent a unique competitive advantage for INMD. Israel’s government continues to provide generous incentives such as tax breaks and subsidies to grow its science and technology industries, which are considered among the leading globally ( as a coincidence 2022 is going to be the first year that INMD starts paying taxes after a 10 years break)

INMD’s capital expenditures for the years ended December 31, 2021, 2020 and 2019 amounted to approximately $0.9 million, $0.5 million and $0.7 million, respectively. For 2022, the figure is expected to be $1 million.

These factors make the cost of production low and partly explain why INMD has consistently enjoyed an insanely high gross margin of 80%+.

INMD also has high performing teams. A clear pointer to this is that in 2021, despite the widespread supply chain shocks that caused massive delays in shipping, the company still managed to successfully deliver every system within 10 days of receiving an order, according to remarks from its CEO during its last earnings call.

In addition to the supply chain team, the sales team also deserves credit considering the company’s revenue CAGR for the past 3 years stands at an impressive 52.83%. This high performance culture is what you would expect from a successful founder-led company.

4. Strong balance sheet, possibility of M&A and share repurchases

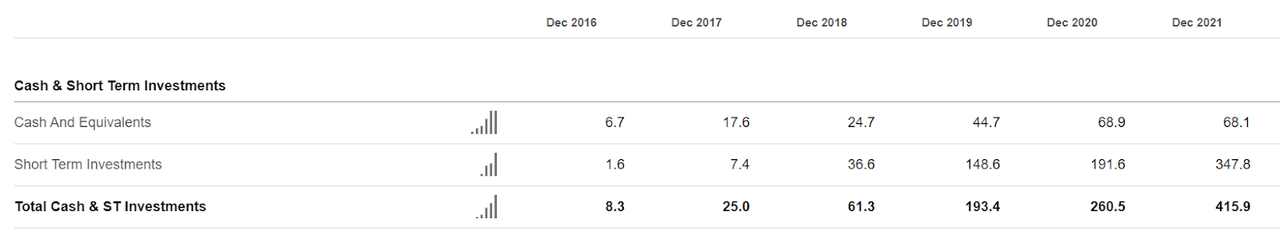

Nothing says “strong balance sheet” as powerfully as fast-growing piles of cash, no debt and no depreciating fixed assets. This is precisely what INMD is.

INMD’s cash pile has grown seven fold since 2018 (Seeking Alpha)

As of December 31 2021. The company had cash and cash equivalents marketable securities and deposits of $415.9 million. Its total liabilities paled in comparison at $62.7 million ($51.9 million of which was current liabilities).

It is impressive that the company’s cash pile has grown close to sevenfold in the past four years with no debt. This gives the company increased flexibility to pursue new growth opportunities, including potential M&As that could not only open up new markets, but also unlock tremendous value for investors.

INMD CEO Moshe Mizrahy in the last earnings call noted the company is exploring some opportunities for M&A, “but we did not find anything that will fit our portfolio yet.” It will be interesting to see how this evolves.

Meanwhile, INMD recently announced a share repurchase program of up to 1 million shares. This may not be substantial in relation to the approximately 83 million shares outstanding or $415 million cash pile, but it is an indication that the company is increasingly going on the offensive in terms of protecting and enhancing shareholder value.

Competitor landscape

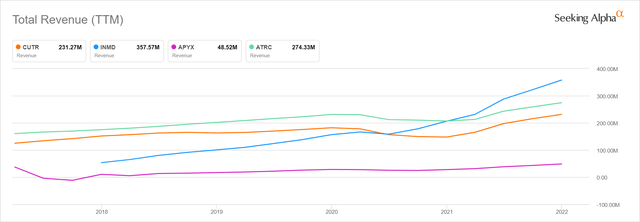

Some of INMD’s competitors include AtriCure (ATRC), NuVasive (NUVA), Apyx Medical Corporation (APYX) and Cutera (CUTR). They all develop and sell medical devices used in different kinds of surgery. NUVA is the largest of these listed competitors with revenues of $1 billion plus. The rest – ATRC, APYX and CUTR – are within the same range in terms of revenue as INMD and also rely heavily on US sales. However, they have trailed INMD in terms of historical revenue growth, as the chart below indicates.

INMD Revenue Growth Vs Peers (Seeking Alpha)

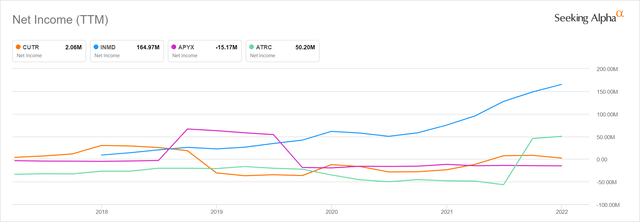

In terms of Gross Profit Margin, INMD leads with its 85%, followed by APYX (69.26%) and lastly CUTR (57.55%). INMD’s leadership is even more pronounced for Net Income, as the chart below demonstrates.

INMD Net Income Vs Peers (Seeking Alpha)

Whether or not INMD has more superior products is debatable. However, what is clear is that its executives are doing a better job relative to peers in terms of operational and financial performance.

Risk factors

While INMD handily outperforms similar sized peers from an operational and financial performance standpoint, the competitive landscape is getting more intense and this could slow growth and share price appreciation, especially if these competitors go public or are already publicly traded. This is a risk factor worth looking into.

A competitor we are closely watching in this regard is Solta Medical Corporation (SLTA), which filed for an initial public offering with the U.S. Securities and Exchange Commission. SLTA is being spun off from Bausch Health Companies (BHC).

SLTA develops and sells medical devices for aesthetic medical procedures in over 50 countries worldwide. The Canada-based company has performed exceptionally well from a financial and operational standpoint. As Seeking Alpha Author Donovan Jones notes in this article on the company, its recent financial results can be summarized as: increasing topline, expanding gross profit and net income margins, increasing cash flow from operations.

SLTA’s revenue for the nine months ending September 30, 2021 came in at $218.74 million, a 32.2% year on year increase. It is also profitable, having booked net income of $72.83 million over the nine month period in review. Its margins are elevated like INMD’s. SLTA had Gross Margins of 73.01% in 2019, 75.11% in 2020 and 77.57% for the first nine months of 2021. Net income margin was 18.7% in 2019, 34.8% in 2020 and 33.3% in the first nine months of 2021.

A formidable competitor like this going public could draw more investor scrutiny into INMD’s performance – or draw some investors away. All this could weigh down on the share price.

Another risk factor worth building into this thesis is INMD’s ambitious product launches. INMD plans to launch at least 2 products a year. While it has historically done well with new products, its imperative to note that the treatments its devices enable are largely not covered by insurance. This means efficacy of new products needs to be very high as no patient is going to pay expensive fees to a surgeon for a procedure that may or may not work. Guaranteeing high levels of efficacy within the ambitious timelines provided could prove difficult, given the sometimes unpredictable nature of medical research and trials.

Valuation

INMD’s recent decline has made its shares relatively cheap. Its Forward PE (non- GAAP )of 17.95x is 36.59% lower than its 5 year forward PE average of 28.31x. Likewise its forward PE (GAAP) of 19.26X is 29.96% lower than the sector median of 27.50x.

INMD has not been this cheap in a long time and we believe it will not stay this cheap, despite the consensus estimates for EPS for all quarters of 2022 indicating EPS is expected to grow year on year in all four quarters.

Conclusion

In view of these factors, and INMD’s historical financial and operational performance, we feel that it is inconceivable that INMD will fail to reclaim its 2021 highs. 2022 has a lot in store for the underlying business and we feel the stock at current levels is one of the easiest opportunities Mr. Market has handed down to us in a long while: hitting our $100 Price Target, which represents more than 150% upside from current prices, is in our view a matter of when, not a question of if. We continue to buy every dip.

Be the first to comment