Sezeryadigar

Investment Thesis

InMode Ltd. (NASDAQ:INMD) remains well poised for growth, given its stellar margins and excellent mastery of the inflationary issues thus far. Since the company continues its aggressive expansion globally, we expect an upwards re-rating of its revenue and profitability growth, potentially triggering a long-term stock price appreciation.

In the meantime, we expect INMD to expand its medical device offerings as well, with the potential benefit of insurance reimbursement in the future. This move would aid in widespread consumer adoption no matter the inflationary and recession issues, bringing the company further beyond its current aesthetic applications. Thereby, speculatively strengthening INMD’s stock valuations moving forward.

InMode Could Potentially Enter The Insurance Game Ahead

With the recent approval of INMD’s EmpowerRF device for women’s health and wellness by Health Canada in June 2022 and the US FDA in August 2021, the company could be expanding further into medical wellness moving forward, beyond the usual aesthetic applications. The device received regulatory approval to improve urinary incontinence symptoms, along with Genitourinary Syndrome of menopause, chronic pelvic pain, and blood circulation. Though INMD’s device is currently not covered by insurance, there is a real possibility that this technology could be adopted by multiple insurance providers in the future, assuming sufficient demand for said service and the eventual proven results.

For now, ELITONE is the only nonvaginal stimulation device covered by insurance through prescription, which has been proven to successfully treat stress urinary incontinence for females. The treatment method used by ELITONE has a similar outcome to INMD’s EmpowerRF with VTone attachment. Both products rehabilitate pelvic floor muscles to decrease bladder leaks henceforth. Assuming that INMD’s device is eventually approved for insurance reimbursement, we may expect to see a more widespread demand ahead, given that the global urinary incontinence device market is expected to grow from $2.09B in 2020 to $6.17B by 2030, at a CAGR of 11.8%.

The move would eventually boost INMD’s revenue and profitability growth ahead, since it would open more doors into non-invasive medical research/ developments and procedures, instead of elective aesthetics applications. The company’s recent expansion into the women’s health and wellness space is already growing tremendously, with the upgraded guidance of $30M in revenue by the end of FY2022, instead of the original estimation of $20M. It will represent a good 6.9% of its total revenues then, with a high potential for multiple expansions moving forward.

Therefore, it made sense that INMD is also exploring multiple non-invasive pipelines, including medical treatments for gynecology, ophthalmology, ENT issues, and others. This strategy would protect INMD’s profit margins and stock prices during the rising inflationary pressures, due to the eventual therapeutic appeal with little downtime compared to surgeries. Nonetheless, since this is speculative at best, it remains to be seen if the INMD stock is able to sustain its current rally, due to the pessimistic stock market and potential recession. We shall see.

INMD Continues To Report Impressive Margins Despite Temporary Headwinds

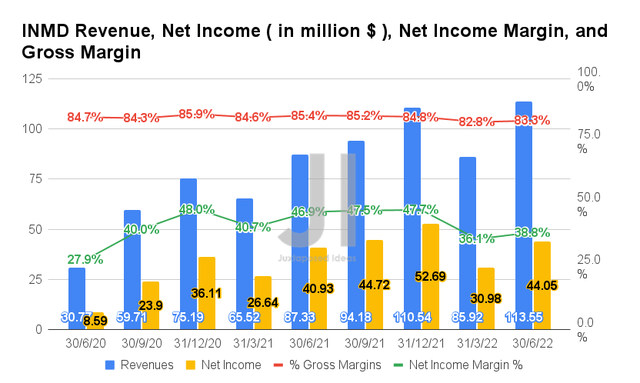

INMD has definitely benefited from the reopening cadence thus far, with the robust pent-up demand for medical and aesthetic procedures. By FQ2’22, the company reported revenues of $113.55M and gross margins of 83.3%, representing an exemplary increase of 30% though a notable decline of 2.1 percentage points YoY, respectively. The revenue comprised 87% of equipment sales and 13% of consumables, the latter representing stellar YoY growth due to the expansion in the installed base.

In the meantime, INMD reported net incomes of $44.05M and net income margins of 38.8% in FQ2’22, representing an increase of 4.7% though another decline of 8.1 percentage points YoY, respectively. The declines in the company’s margins are mainly attributed to rising inflation, which continues to drive up manufacturing, labor, transportation, and logistic costs for most industries. Therefore, its current exemplary margins highlight INMD’s supply chain prowess thus far since the issue naturally affects many global companies.

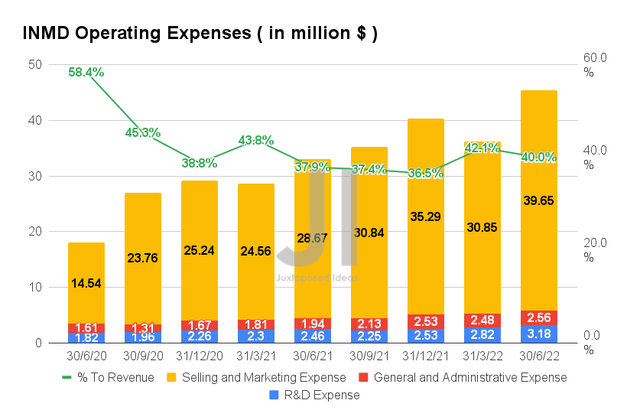

On the other hand, INMD continued to invest in its operations, with total operating expenses of $45.39M in FQ2’22, representing an increase of 25.5% QoQ and 37.2% YoY. Nonetheless, it is essential to note that the ratio to its growing revenues has been stable thus far, accounting for 40% of the company’s revenues in FQ2’22, relatively in line with historical levels.

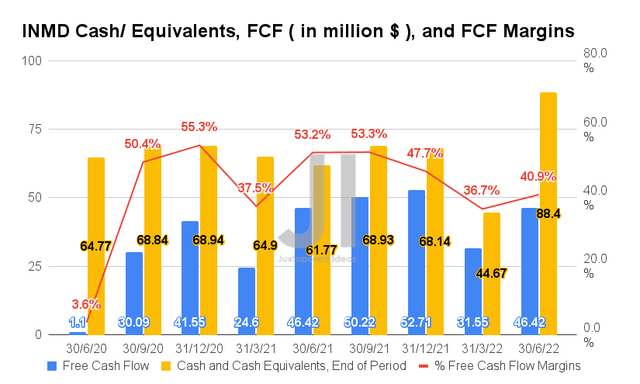

Therefore, given its improved profitability and moderated expenses, we are not surprised by INMD’s robust Free Cash Flow (FCF) generation thus far, with an FCF of $46.42M and an FCF margin of 40.9% in FQ2’22. Though these numbers represent a notable YoY decline in FCF margins, we are not overly concerned since the rising inflation is a temporary headwind at best. Furthermore, INMD continues to report a growing war chest of $88.4M in cash and equivalents on its balance sheet by FQ2’22, despite the massive share repurchase in FQ1’22.

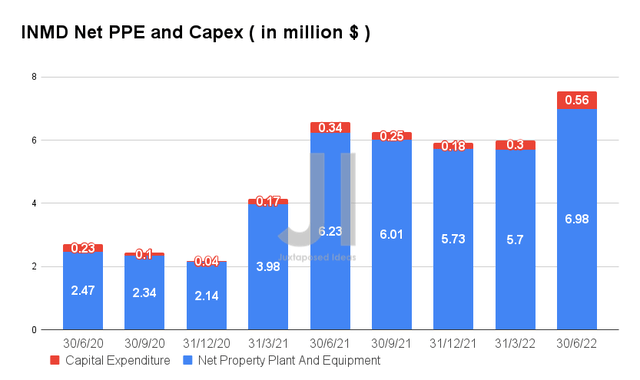

The main reason why INMD continues to command impressive gross, net income, and FCF margins thus far, is that it primarily outsources all of its manufacturing needs while still maintaining necessary quality controls. This allows the company to carry minimal inventory levels without having to incur significant capital expenditures for manufacturing and warehousing needs. Therefore, this strategic plan will enable INMD to report minimal net PPE assets of $6.98M in FQ2’22, representing only 1.3% of the company’s total assets of $523.21M, while reporting capital expenditures of $0.56M at the same time.

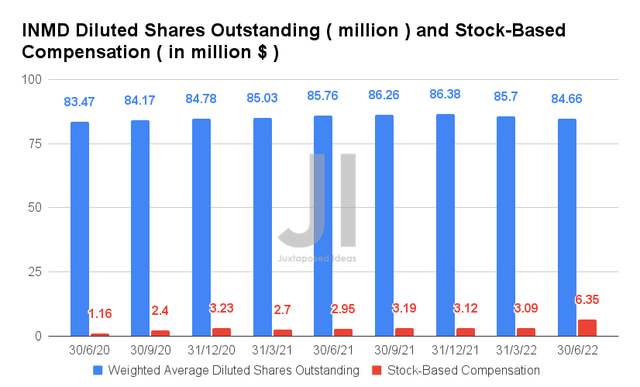

Over time, we have unfortunately observed a notable increase in INMD’s stock-based compensation (SBC) expenses with a total of $6.35M reported by FQ2’22. It represents a sudden increase of 205.5% QoQ and 215.2% YoY. Nonetheless, investors have nothing to worry about, since the company has also kept its stock count relatively stable thus far, with a total of 84.66M reported in FQ2’22. It indicates a minimal share dilution of 11.2% since its IPO in 2019, aided by multiple share repurchase programs thus far. Notably, for 1M shares announced in March 2022, which had reduced its share count by 1.2% by FQ2’22.

We Are Likely To See An Upwards Rerating To Its Future Revenue and Profitability

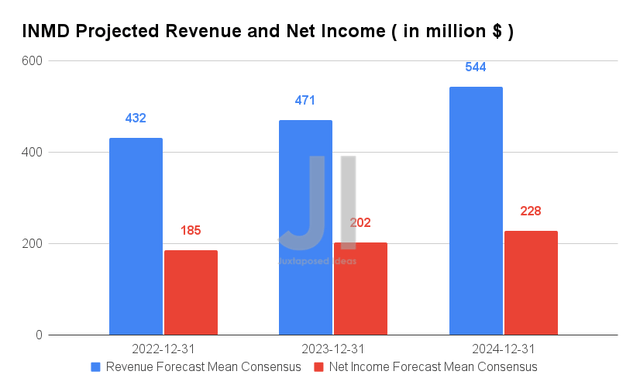

Over the next three years, INMD is expected to report a notable deceleration of revenues and net income growth at a CAGR of 15.01% and 11.39%, respectively, compared to its 5Y historical CAGR of 72.99% and 244.50%. It is evident that the company’s net income margins will also normalize over time, from 46.1% in FY2021 to a projected 41.9% by FY2024. Nonetheless, we are encouraged since it still represents a notable improvement from its previous net income margins of 39.1% in FY2019.

Assuming continued growth in INMD’s international base, we expect to see an upwards re-rating of its revenue and profitability moving ahead. By FQ2’22, the company reports a 33% YoY increase in its global sales (out of the US), accounting for 36% of its revenues. Therefore, assuming successful market penetrations into large cosmetic markets such as China, Korea, and Brazil, a more bullish revenue growth projection of 22% is very likely by FY2024. Therefore, INMD remains well poised for growth post-reopening cadence, since the global non-invasive aesthetic market is expected to grow from $53.8B in 2021 to $190.5B in 2030, at a CAGR of 15.2%.

For FY2022, INMD guided revenues between $425M to $435M and EPS between $2.11 and $2.16, against consensus revenue estimates of $432M and EPS of $2.16. These would represent an excellent YoY growth of 20.96% and 5.2%, respectively. Thereby, potentially pushing for long-term stock price appreciation due to its stellar margins and execution ahead.

So, Is INMD Stock A Buy, Sell, or Hold?

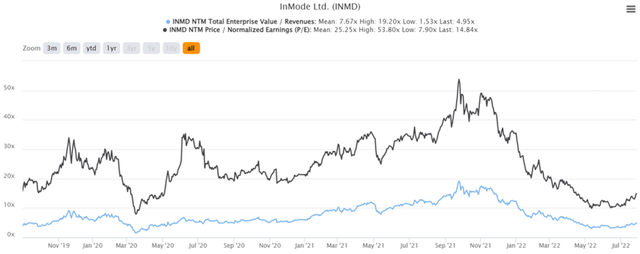

INMD 5Y EV/Revenue and P/E Valuations

INMD is currently trading at an EV/NTM Revenue of 4.95x and NTM P/E of 14.84x, lower than its 5Y mean of 7.67x and 25.25x, respectively. The stock is also trading at $34.33, down 65.4% from its 52 weeks high of $99.27, though at a premium of 66.6% from 52 weeks low of $20.60. It is evident that the stock had recovered by 20% in the past few days, post exemplary FQ2’22 earnings call.

INMD 5Y Stock Price

Therefore, despite consensus revenue estimates of $48 with a 39.82% upside, we prefer to wait a little for the current rally to be digested. Long-term investors considering to add this solid stock may aim for a mid $20s for a better margin of safety, though preferably at the low $20s for maximum gains.

Therefore, we rate INMD stock as a Hold for now.

Be the first to comment