Luis Echeverri Urrea/iStock via Getty Images

Ingredion Incorporated (NYSE:INGR) is a defensive consumer staples name that screens attractive on valuation, trading at 12.8x forward P/E. Recent M&A transactions and focus on specialty ingredients appear to have reinvigorated topline revenue growth, but this is not yet reflected in the valuation. As management executes its plan, there is 45%+ upside to the valuation.

Background

Ingredion Incorporated is a leading global producer of sweeteners, starches, and specialty ingredients. Ingredion’s starch-based products include food-grade and industrial starches and is the largest business segment, representing 45% of sales in 2021. Sweeteners comprise 33% of 2021 sales and include products such as glucose syrups, high fructose corn syrup, high maltose syrup, dextrose, and other sweeteners. Finally, Co-products such as refined corn oil and corn meal make up 22% of 2021 sales.

The company was formerly known as Corn Products International (“CPI”) and began business by producing laundry cornstarch (protects against stains and ‘stiffens’ shirts) and Mazola corn oil. The company renamed itself “Ingredion” in 2012 to diversify away from corn-based sweeteners and starches.

Ingredion competes in the starches and sweeteners markets with global agricultural companies such as Cargill, Archer-Daniels-Midland Company (ADM) and Tate & Lyle Plc (OTCQX:TATYF) as well as many local competitors such as Rogers Sugar Inc. (OTCPK:RSGUF) in Canada and ALMEX in Mexico.

Revenues Stagnant Due To HFCS

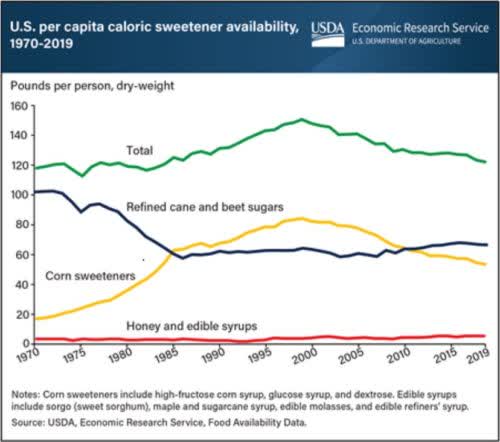

Ingredion’s business grew rapidly in the ’90s and early 2000s, partly on the back of the adoption of High Fructose Corn Syrup (“HFCS”) in American diets (Figure 1). Top line revenues compounded at an 11% CAGR between 1997 to 2012 as a result of M&A and organic growth.

However, as HFCS was identified as being associated with a host of health issues such as obesity and diabetes, its per capita consumption has declined steadily since the early 2000s, leading to a stagnation in Ingredion’s revenue growth.

Figure 1 – US per capital sweetener availability (USDA)

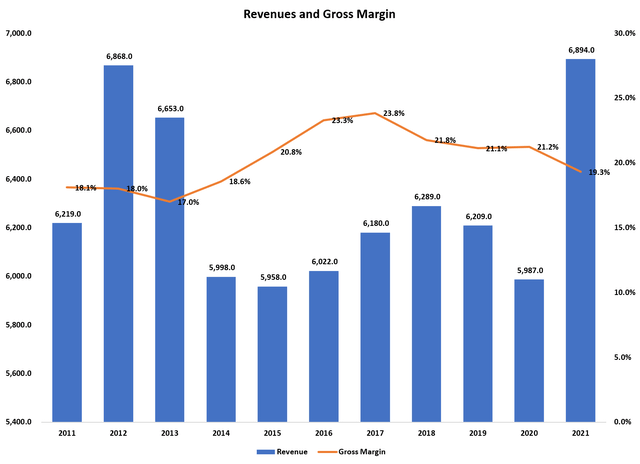

INGR’s top line revenues peaked in 2012 at $6.9 billion, and has declined at a 1.7% CAGR from 2012 to 2020, while gross margins have been relatively stable. 2021 saw a strong 15% YoY rebound in revenues on the back of price increases and the inclusion of acquisitions made in 2020 (Figure 2)

Figure 2 – INGR revenues and gross margins (Author created with data from roic.ai)

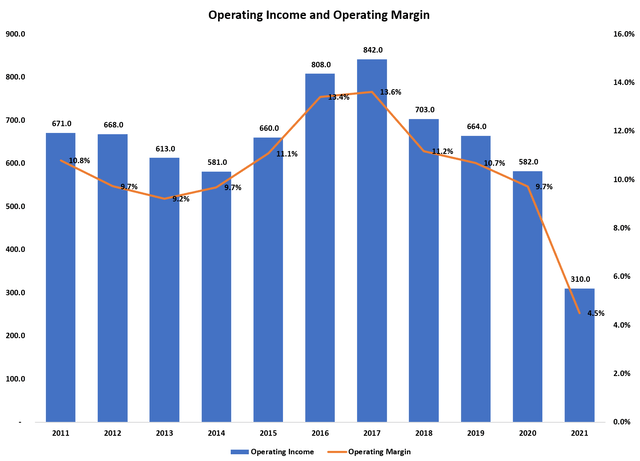

Operating margins have generally been strong, at between 9 to 13%, although they came in at 4.5% in 2021. This was mostly the result of $387 million in restructuring charges related to its Argentina business that was recognized in 2021. Adjusting for this charge would have produced a 10.1% operating margin, inline with historical performance (Figure 3).

Figure 3 – INGR Operating income and margin (Author created with data from roic.ai)

Specialty Ingredients Reignite Growth

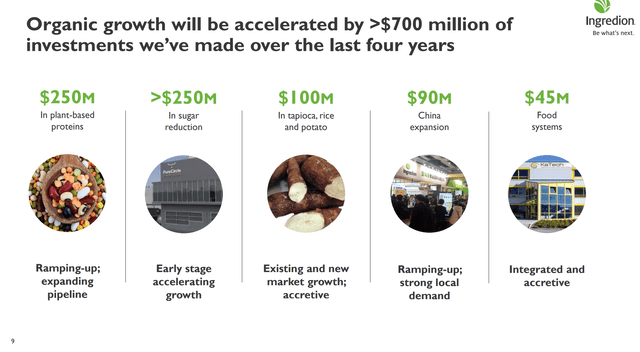

To reignite growth, Ingredion have been investing heavily in ‘specialty ingredients’ in the past few years (Figure 4). For example, in 2020, Ingredion acquired Purecircle, a stevia sweetener maker, as well as invested in Amyris, a Brazilian Reb-M sweetener manufacturer. It also invested $250 million in ramping up plant-based protein manufacturing as well as expanding production of non corn-based starches.

Figure 4 – Investments made to reignite organic growth (INGR investor presentation)

In total, Ingredion considers these investments ‘specialty ingredients’, i.e. they deliver additional functionality than the legacy products and add to customer ‘s value proposition. As defined in the Company’s annual report, specialty ingredients are “aligned with growing market and consumer trends such as health and wellness, clean-label, simple ingredients, affordability, indulgence and sustainability.”

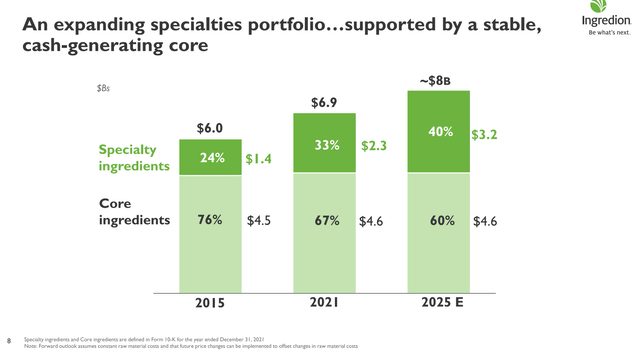

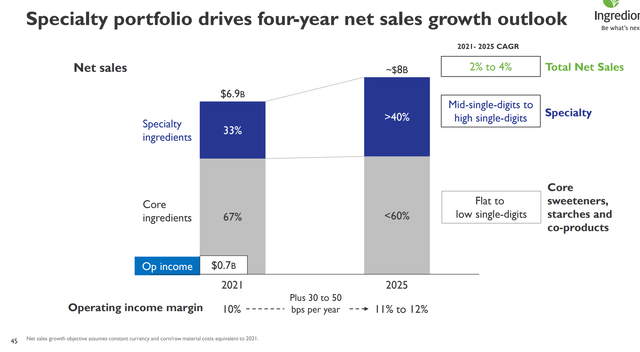

Segmenting revenues using this definition, specialty ingredients comprise 33% of 2021 sales, and has been the primary driver of sales growth over the past few years (Figure 5).

Figure 5 – Specialty ingredients driving sales growth (INGR investor presentation)

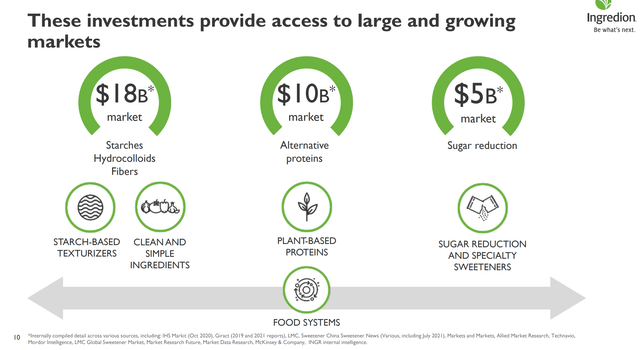

In particular, Ingredion highlights starch-based texturizers, plant-based proteins, and sugar reduction sweeteners as key areas of growth (Figure 6).

Figure 6 – INGR growth markets (INGR investor presentation)

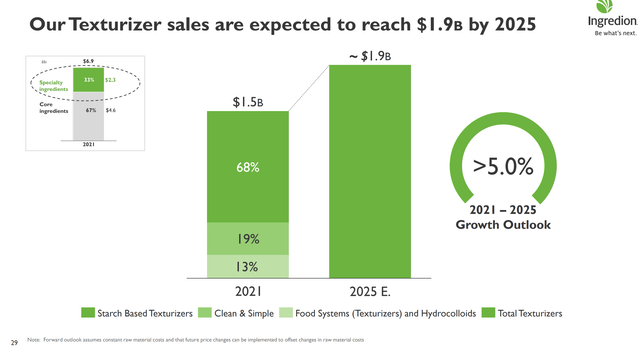

Ingredion is a leading producer of starch based texturizers, with $1.5 billion in 2021 sales that they believe can grow at a 5%+ CAGR (Figure 7). For example, Ingredion has co-created a dairy-free vegan feta-type alternative cheese that uses Faba bean protein and chickpea flour (Ingredion plant-based proteins) combined with tapioca, pea, and modified corn-starches (Ingredion texturizers) that mimic the texture and mouth feel of feta cheese.

Figure 7 – Texturizer expected to grow at 5% CAGR (INGR investor presentation)

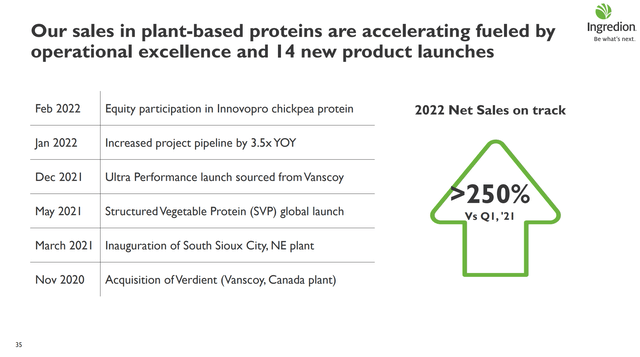

Another key platform for growth is plant-based protein, which INGR believes is a $10 billion market growing at a 7% CAGR. In this market, Ingredion is a relative newcomer, having entered the market via the 2020 acquisition of Verdient (Figure 8). Plant-based protein sales are rapidly growing and Ingredion believes this can become a $150 million business by 2025.

Figure 8 – INGR entry into plant-based proteins (INGR investor presentation)

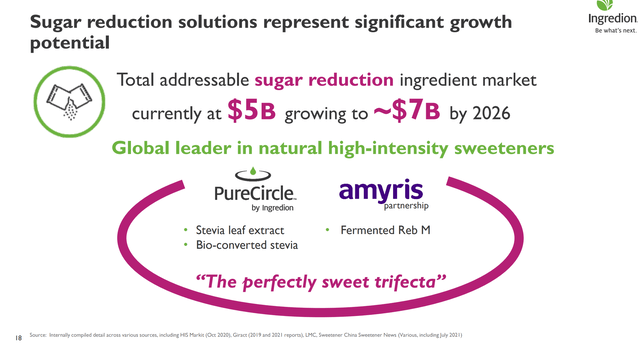

Finally, with the acquisition of Purecircle and Amyris in 2020, Ingredion has products in the $5 billion sugar reduction market that they believe can grow at a high single digit rate (Figure 9).

Figure 9 – Sugar reduction market potential (INGR investor presentation)

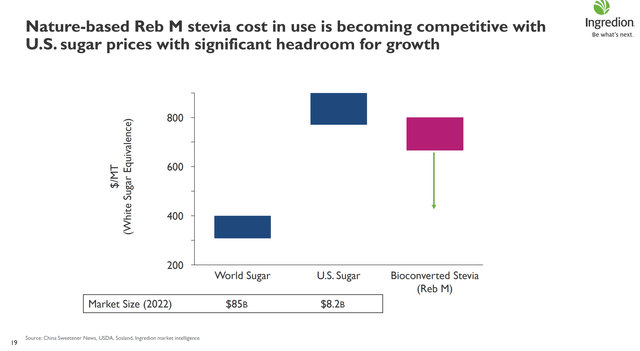

In Ingredion’s view, nature-based stevia is fast becoming cost competitive with white sugar, which should see an inflection in its adoption in processed foods (Figure 10).

Figure 10 – Stevia becoming cost competitive with white sugar (INGR investor presentation)

Altogether, Ingredion expects specialty ingredients to re-ignite topline growth to 2-4%, while also delivering operating margin expansion from 10% in 2021 to 11-12% by 2025 (Figure 11).

Figure 11 – Specialty ingredients reignite growth (INGR investor presentation)

Valuation Is Attractive

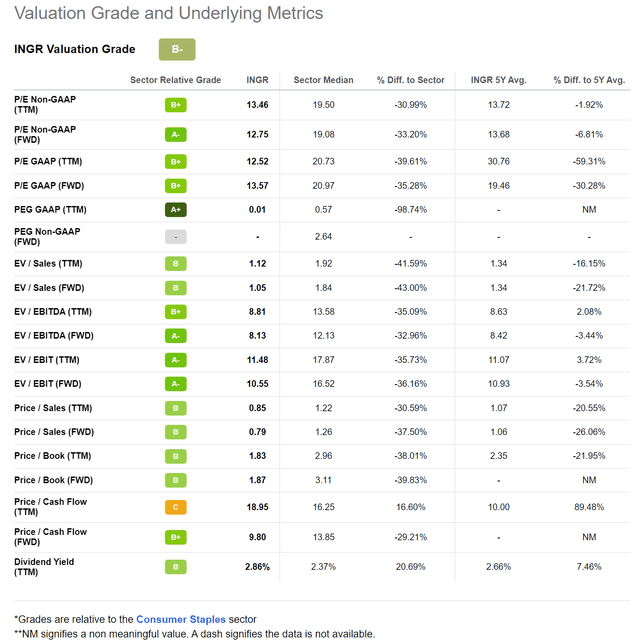

With Ingredion in the early innings of reinvigorated top-line growth, investors have not yet caught on, valuing the company at only 12.8x 2022 P/E, a substantial discount to the Consumer Staples sector average of 19.1x (Figure 12).

Figure 12 – INGR valuation is attractive (Seeking Alpha)

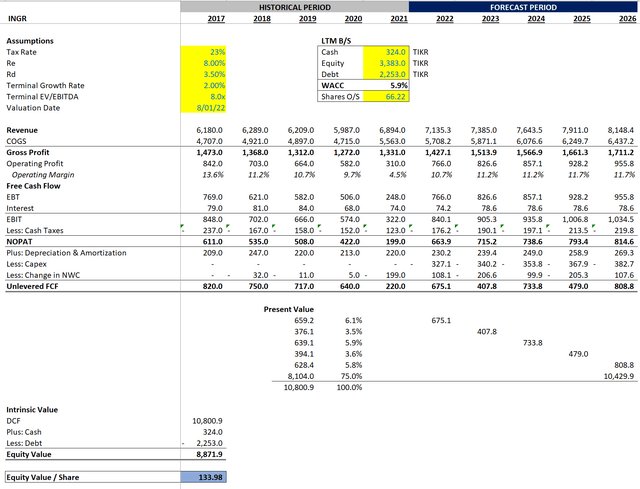

Alternatively, if we model the management’s assumptions from Figure 11 above ($8 billion in revenues by 2025 and 11-12% operating margin), we can derive a DCF valuation of $134 per share, or 45%+ upside (Figure 13).

Figure 13 – DCF valuation on management assumptions (Author created)

Risks To Ingredion

The primary risk to Ingredion is changing consumer tastes. As shown in Figure 1 at the beginning of this article, as consumers shifted away from HFCS, Ingredion’s business stagnated. If this transition away from HFCS were to accelerate, or migrate to other business lines such as corn starches, Ingredion’s core business may deteriorate faster than specialty ingredients can offset.

Another risk to Ingredion is rising raw material prices, particularly corn, as its finished products are made primarily from corn. Although Ingredion hedges a large portion of its corn exposure through futures contracts, if the company cannot pass through price increases to customers, its financial results may suffer.

Finally, Ingredion has incurred substantial amounts of debt, totalling $2.3 billion as of March 31, 2022. High levels of debt may hinder the company’s operations, particularly if the company is not able to or cannot refinance the debt at favourable interest rates at expiration.

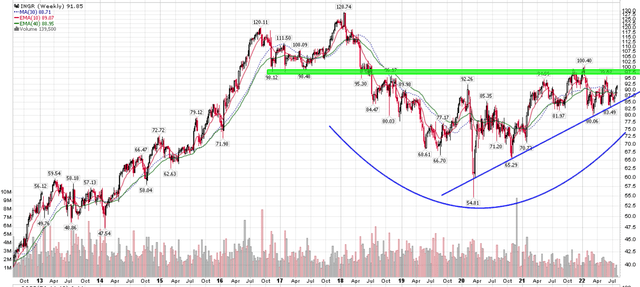

Technicals Shaping Multi-year Base

In terms of technicals, Ingredion is shaping a large multi-year base. Key resistance is $96-100. If Ingredion can take out the resistance level, it should target 2018 highs of $130 (Figure 14).

Figure 14 – Ingredion shaping large base (Author created with price chart from stockcharts.com)

Conclusion

Ingredion is an interesting consumer staples name that screens attractive on valuation due to years of stagnant growth. Recent M&A transactions and focus on specialty ingredients appear to have reinvigorated topline revenue growth, but this is not yet reflected in the valuation. Investors can consider accumulating shares as the core business in sweeteners and starches is highly defensive while reinvigorated topline growth can re-rate the stock much higher.

Be the first to comment