Infosys U.S. Education Center. Infosys is based in India and is a worldwide IT, AI and Digital Services company. jetcityimage/iStock Editorial via Getty Images

The Magnificent Seven – From humble beginnings to India’s second most valuable brand

In 1981, seven engineers quit Patni Computer Systems in Pune, India and started Infosys (NYSE:INFY) in its first CEO, Narayan Murthy’s home with Rupees 10,000 (about $1,200 at that time) borrowed from the CEO’s wife. It took them two years to get their first computer, a Data General 32-bit MV8000. Legend has it that Murthy and his six other co-founders refused to pay the bribe demanded by a customs officer, who finally relented after getting tired of the founders’ dogged resolve to never do anything unethical. This was important and really a crucial part of the reverence and respect that Infosys garnered through its meteoric growth — as an ethical and completely professional giant organization every computer engineer in India aspired to join. It built a very strong foundation along with two other top notch Indian companies, TCS and Wipro (NYSE:WIT), which put India’s IT Services companies on the world map and made Bengaluru, India a Silicon Valley zip code and the outsourcing capital of the world. It added two important milestones on its way. Infosys became the first IT company from India to be listed on the NASDAQ and its market cap reached US$100 million in 1999, at which time it was among the 20 biggest companies by market capitalization on the NASDAQ.

A Lost Decade

However, some 30 years after its beginnings and rapid growth, between FY 2011 and FY 2018, Infosys went sideways. It grew in single digits, lost market share to TCS and HCL and struggled to live up to its high standards. There was significant internal strife between the founders and the then CEO, with allegations of unethical behavior and profligacy – anathema to the founders and the principles which created Infosys.

Returning Infosys to its Former Glory

In FY 2019, Salil Parikh, a CapGemini veteran of 25 years, was handed over the reins to return Infosys back to its glory days. Parikh went back to the drawing board, reinvigorating the company with four basic strategic concepts:

- Agile Digital Business

- Energizing the Core

- Re-skilling

- Localization

In the course of the last three years, Infosys has gotten back to bagging the large deals the way it used to. Its revenues, which were stuck at a tepid 8% growth for six years from FY March 2014 to FY March 2020, roared back to life with 20% revenue growth in FY22. The upward march continues with the 1st half of FY 2023 having also grown 19% in constant currency terms (Indian Rupees) and 14% as reported in USD. Management has signaled 15-16% revenue growth in USD for FY 2023, and if the 1st half is any indication, they are very likely to achieve it.

Its large deal TCV (Total Contract Value) for the quarter was robust at $2.7Bn, its highest in the last 7 quarters.

Also importantly, digital revenues, which were a paltry 25% in 2018 are now 61% of revenues in a rapidly changing Covid and post-Covid environment with a focused migration to cloud services and renewed emphasis on data analytics and security management. These were not Infosys’ core strengths and pivoting towards these by re-skilling engineers has clearly paid dividends. They’re also seeing success in their cloud based platform services “Cobalt”, which crossed $1Bn in revenues in Q2-FY23.

Infosys also took the more expensive option of providing strategic onsite services, biting the bullet often to create value and playing up to its brand strengths.

The Bull Case

What’s in the secret sauce?

Infosys’ success of providing large scale, comprehensive and expensive enterprise software solutions to Fortune 500 and other big customers lies in its ability to provide expert process implementation, backed by top notch management supervising the best engineering talent for customized client requirements. The key to this process is leveraging a huge offshore support base of high quality engineers. Most of Infosys’s business billing is 70% offshore and 30% onsite. With 345,000 employees and presence in 50 countries, this is the result of more than 30 years of institutionalized technology and process management, nurturing the right talent and keeping a deep bench without compromising on standards and quality, which has gotten them to this pole position. This is a huge competitive advantage. Traditional SaaS enterprise software providers can’t get into this business and do it at the same cost or quality. This is an extremely difficult space to get into – it is the happy hunting ground for the big Indian software firms such as Wipro, Tata Consultancy Services and HCL.

Hence the accolades, of which I’ve highlighted just a few.

- Infosys was recognized as the fastest-growing IT services brand in the world by Brand Finance, the world’s leading brand valuation firm, in its Global 500 2022 report.

- A Global Top Employer in 2022, in countries across APAC, Europe, The Middle East and North America.

- Infosys was recognized as one of the “Most Honored” companies, receiving multiple awards at the 2022 All-Asia Executive Team Rankings from Institutional Investor, a leading provider of independent, qualitative feedback, for the investment community. The rankings are based on the opinions of 4,854 investment professionals.

- It also became the second most valuable Indian brand, as named in the Brand Finance India 100 2022 report.

Sheer Scale and Execution

They have a presence in 9 major business segments with several verticals and in more than 50 countries, which bears testimony to their process strengths to provide a vertical agnostic solution. With about 30 years of tried and tested methods, Infosys has demonstrated that it can do it with the same high level of execution for a manufacturer like Daimler in Europe, a telecom in Norway or a bank’s integration in the US.

Besides providing its own IT services, Infosys also partners with SAP (SAP), Oracle (ORCL) to implement their platforms and products, including onboarding, customization, and client success. It is far more efficient for SAP and Oracle and other platforms to roll out their products with the help of Infosys than to do it on their own.

Expanding in India

The digital penetration of India across government institutions is low and the current government has shown a lot of initiative in digitizing more basic services, like passports, taxes and land records to name a few.

Infosys grew domestic Indian services by 28% last year, its fastest geographic domain, however on a very small base of 2.5%. There is tremendous potential in this market India’s government services digitization, and as the second largest Indian IT company, Infosys is one the few companies who can scale up to such a large size.

Shareholder Friendly

They’re sitting on $4Bn in cash and generate gobs of cash every year; they’ve committed to returning 85% of net operating cash to shareholders each year. Currently the share buyback is for 52Mn shares (about 1.19% of shares outstanding) at a maximum price $23.13 (based on Re 1,850) for a period of six months effectively setting a floor on the price.

From a MoneyControl article, JPMorgan said Infosys is its top pick among IT firms: “We would BUY the stock on weakness for its structural strengths and see limited earnings risk from this level given its guidance track record. It stays the sector bellwether and the best way to play the current tech spending super-cycle, in our view.”

Challenges

Belt Tightening and Waning Demand

The biggest challenge to Infosys is a gloomy business scenario for 2023 with belt tightening from enterprise customers. Several cloud providers such as Amazon (AMZN) and Microsoft (MSFT) have shown signs of waning demand and more recently, Twilio (TWLO) and Atlassian (TEAM), two leading cloud based enterprise SaaS providers also guided lower for the quarter ahead.

86% of CEO’s are expecting a recession in 2023, according to a new KPMG survey.

It must keep getting new clients

Infosys is not a SaaS recurring revenue business. Infosys along with Wipro and TCS have to rely on new clients for digitization, cloud migration and new software or business process implementation. It does not sell licenses where it can count on annual recurring revenues. The new client doesn’t necessarily have to provide subsequent engagements and while “Cobalt” is a cloud offering that has shown success, it is still a small part of their overall business.

Talent Retention and Wage Inflation

With raging wage inflation the world over, Infosys saw operating margins fall to a low 20% as they ramped up hiring from 204,107 in FY19 to 314,015 FY22, an employee CAGR of 11.4%.

JP Morgan also cited concerns about margins, for the current year but were optimistic about FY23-24 margin expectations. To their point, Infosys’ average operating margins were consistently around 24% even in the tumultuous internal strife ridden half decade, and a 200 basis point drop is nothing to sneeze at, but seeing the Q3 operating margins go up to 21.5% in Q2-2023, I think this is short term noise worth ignoring. Infosys has been on a hiring binge and wage inflation has played a role in declining margins but over the course of the next decade this will be less of an issue.

Management expects margins to go back to 21.5% this year with better pricing, more client wins and better retention of employees.

Valuation and Investment Case

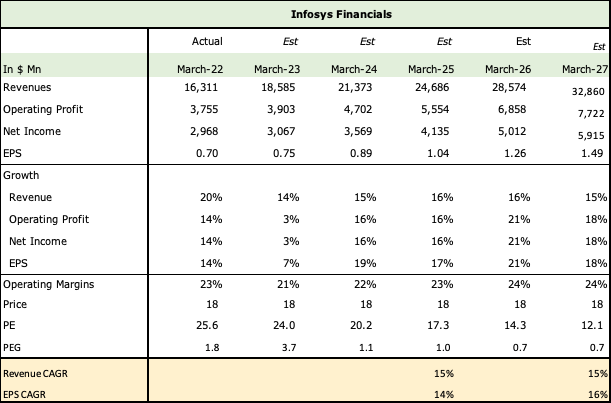

Infosys Financials (Infosys, Seeking Alpha, Fountainhead)

While FY 23 earnings growth is slow at 7% on a higher base and lower margins from FY 22, I expect both revenue and earnings to grow at almost double the pace of the lean single digit years. The three-year expected revenue CAGR is 15% while earnings should grow at 14%. They did add 50% more people in the last 4 years, which took a toll on margins, but will likely bear fruit going into the next 5.

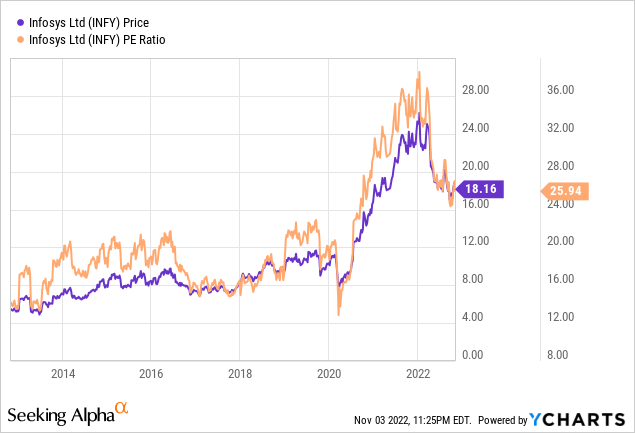

Infosys Stock Price and PE (Seeking Alpha)

I’m recommending buying Infosys for the following reasons:

The valuation is very attractive given Infosys’ brand value and global IT services leadership position.

Importantly, Infosys and its business has several moats and barriers to entry. These are not easily replicated and would cost a ton more than its current market cap of $77Bn and it would take decades…

- To build a scalable operation in Information Technology services with 345,000 highly skilled employees.

- To keep a deep bench to be rolled out for completely different projects in fifty countries across verticals, countries and different databases and architectures.

- To continuously attract, nurture and drive the best software talent over four decades.

The offshore/onsite model just requires enormous scale to achieve quality and cost efficiencies and it can’t be done in too many countries. In India, too this is a consolidated market dominated by entrenched large players.

Most of Infosys’ wounds were self-inflicted, which thankfully have healed. This even suggests a stronger company with fresh blood from a savvy CEO with the backing of its original founders who clearly take a lot of pride in it.

The Magnificent Seven can ride off into the sunset leaving their legacy intact.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment