Khanchit Khirisutchalual

Article Thesis

Inflation for November came in lower than expected, although the CPI reading was still pretty elevated relative to the Fed’s target. Still, with inflation coming down further from previous highs, the Fed will most likely slow down its rate hikes going forward, with the upcoming rate announcement on December 14 being the first occurrence where rates will be increased by less than 75 base points, I believe.

Markets like the fact that rate increases will slow down, and waning inflationary pressures could also be positive for the profit margins of some businesses, which is why it is not surprising to see the market do well on this news.

Inflation: Still High, But Lower Than Expected

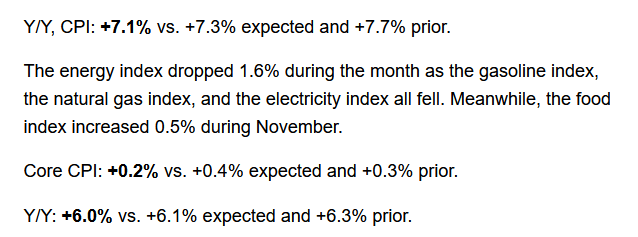

Here’s a snapshot of what was announced in terms of inflation for November:

Seeking Alpha

The year-over-year reading is still pretty high, at more than 7%, although weaker than expected. At the same time, the increase was considerably slower compared to one month earlier, when the year-over-year change was 7.7%.

Energy played a major role in the inflation pullback versus previous months, as prices for crude oil have pulled back substantially in recent weeks, partially due to increasing worries about a recession in 2023 that could hurt oil demand due to less travel, fewer goods being sent over the oceans, and so on.

Core CPI, which excludes energy and food and focuses on less volatile categories, also came in lower than expected, at 6.0% year over year. That’s still pretty high, of course, as the Fed generally wants inflation to be in the 2% range — thus core CPI is still running at around 3x the desired rate. Core CPI is driven by several factors, with shelter being a very important one. Rents and what is called owner’s equivalent rent are driving core CPI readings, due to the massive increase in house prices and rents over the last two years — it takes a while for these to filter through to core CPI, which is why readings are still elevated despite the fact that the housing market is cooling down.

Core CPI is also impacted by other items, of course, such as services. With labor shortages in all kinds of areas, and with workers demanding higher compensation to combat their growing expenses, services are becoming costlier due to higher labor costs. It does not look like a full-blown wage-price spiral, but it seems pretty clear that rising labor costs are resulting in higher costs for all kinds of services, which pushes up core CPI to some degree. With core CPI readings declining to some degree, relative to previous months, it seems unlikely that this will turn into a very long-lasting issue where wages and prices push up each other to higher and higher levels. But it also seems unlikely that core CPI will fall down to 2% very quickly, I thus expect that the trend will be downward but that it will take some time until the Fed’s target is achieved.

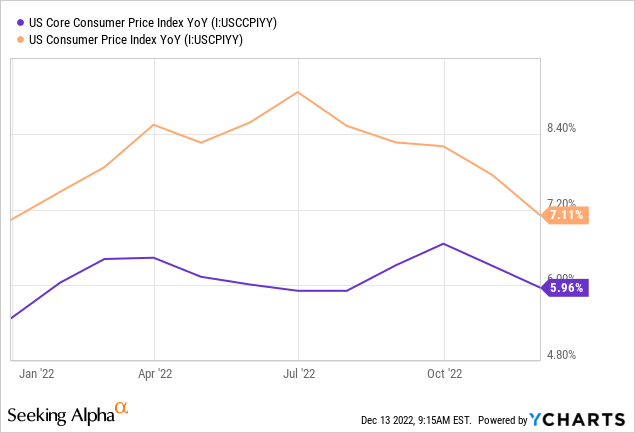

It is relatively clear that the inflation peak has passed in the current cycle:

CPI has dropped for several months in a row, and core CPI is also off its highs. It will nevertheless take some time until inflation levels are at the target area, thus investors should not expect any rate decreases in the near term, I believe.

The Fed Will Likely Slow Down Rate Hikes

That being said, rate decreases are not needed to make markets feel good about future Fed policy. In fact, even when the Fed continues to increase rates in the near term, that could be good for markets, as long as the speed of rate increases isn’t especially high.

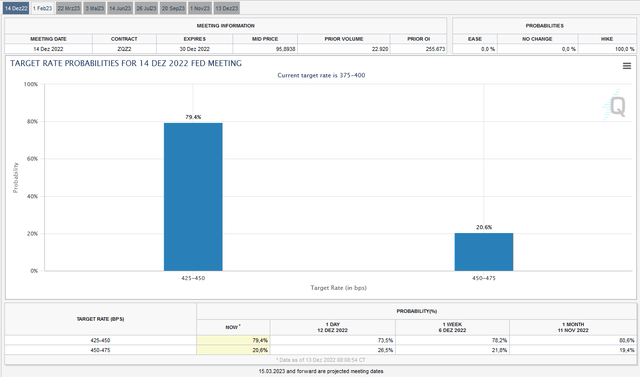

The CME FedWatch Tool shows the following rate hike odds for December:

Markets are now pricing in a high chance that the Fed will increase rates by 50 base points in December, which would be lower than the last couple of rate hikes, which stood at 75 base points each. The market still sees a 20% chance of a 75 base point hike, but I believe that this will not happen. Not only is the recession risk in the U.S. elevated already, but the lower-than-expected inflation reading for November also eases pressures on the Fed to be aggressive with rate hikes.

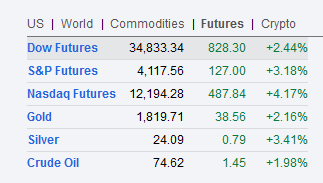

According to the CME FedWatch Tool, the market is also pricing in a 25 base point hike in February and March, which would bring the rate to 475-500 after the March meeting. That’s higher than today, but the rate increases of 50 points, 25 points, and 25 points, would be considerably lower relative to the last couple of Fed decisions. Easing inflationary pressures and lower rate increases in the next couple of months make it likely that rates will top out at some point in 2023, which would then mean that the housing market and the stock market could feel more support from that point. Since markets are always forward-looking, the increasing likelihood of interest rates topping out next year is already having a positive impact on equity markets today, as we can see in the following chart that shows the immediate reaction to the lower-than-expected inflation reading:

Seeking Alpha

The Dow Jones (DJI), the S&P 500 (SPY, SPX), and the Nasdaq index (QQQ) all rallied hard once this news broke, with the long-duration-asset-heavy Nasdaq rallying the most. Not surprisingly, Gold and Silver also rose — a higher likelihood of lower rates in the future, due to easing inflationary pressures, makes precious metals more attractive versus interest-bearing investments, all else equal.

Is The Market A Buy Based On This Inflation News?

With the market jumping upwards on this news, the question is whether investors should chase equities now — and if so, whether a broad market index is the right choice to do so. The increased likelihood that rates will top out at some point in 2023 is good news for equities, and waning inflationary pressures are also positive for some stocks — think retailers such as Target (TGT), for example, that suffered from high inflation which ate into their profit margins.

But at the same time, one can also find arguments against chasing markets today. Rates will not drop in the very near term, instead, they will likely continue to increase for a couple of months. This could easily result in a recession in the US, and some companies could be highly impacted by such an economic downturn. Not all companies will be hit equally, with consumer staple companies such as Altria (MO) likely being less impacted than more cyclical industries such as automobiles or tourism.

Also, the market has already rallied by close to 20% from the recent lows seen in fall 2022, thus we can’t say that investors have the chance to enter equities at bargain prices — that held true in September and October, but stocks have already rallied quite a lot since then.

I thus do not believe that all equities are attractive today, or that investors should chase the S&P 500 or the broad market today, following this news, even though the immediate market reaction was very positive. Instead, investing in select equities could be a better idea. Ideally, those equities would trade at low valuations while also being protected versus an economic downturn in 2023. That does not hold true for companies such as Amazon (AMZN) or Tesla (TSLA), for example.

Instead, companies such as Altria or resilient energy midstream names with strong cash flows in all kinds of economic environments could be more opportune investments. Enterprise Products (EPD) or Energy Transfer (ET) offer high dividend yields, trade at inexpensive valuations, and due to the ongoing energy crisis their pipeline capacity will be needed no matter what the U.S. economy looks like next year.

Takeaway

Markets have been in rally mode for the last two months or so, and the market reacted very positively to the lower-than-expected November CPI reading. While that is a positive item, it is unlikely that rates will fall in the near term — instead, they will likely climb further, although at a slower pace compared to the last half year.

In this situation, even though the market reacted very positively to the CPI news, I do not think that chasing the broad market is the best idea here. I prefer to be more selective with my investments, opting for inexpensive stocks with better downside protection in case we get a recession in 2023.

Be the first to comment