Khanchit Khirisutchalual

Who knows what investors have been eating over the past year or so? Whatever it was, it certainly seemed to make them believe that the inflation battle was not going to be a big one and that they could continue to invest in stocks, much as they had in the past.

Last fall, as the Federal Reserve talked up the need for tightening up monetary policy because of the looming clouds of inflation, the word got around in many circles that there was not a lot to worry about because any inflation on the horizon was just temporary.

Inflation, the word was, was only going to be temporary because the underlying cause of the bump in inflation was due to supply chain problems.

The supply-chain problems resulted from the conditions created by the spread of Covid-19 and, therefore, as the pandemic resided, inflation would reside.

Finally, by the end of the year, the Federal Reserve convinced people…investors…that inflation was a real problem and monetary tightening was indeed in store.

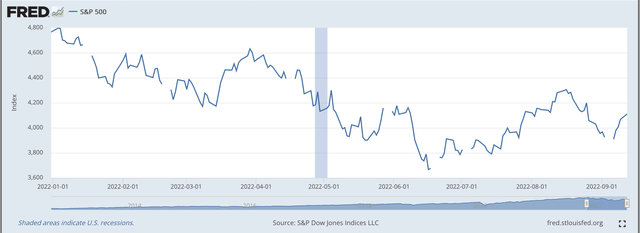

The S&P 500 stock index hit its last, new, historical high on January 3, 2022, and then began to decline.

Standard & Poor’s 500 Stock Index (Federal Reserve)

The stock market declined fairly regularly until the middle of June, when other ideas began to creep into the minds of investors.

The Federal Reserve began to reduce the size of its securities portfolio in June, but the investment community began to wonder whether the quantitative tightening program the Fed has initiated would do the job and bring the inflation rate down to 2.00 percent, the Fed’s goal.

As can be seen, the S&P 500 rose from June into August.

Jerome Powell, the Chairman of the Board of Governors of the Federal Reserve System, decided he had to do something. The place he “did something” was in Jackson Hole, Wyoming, the site of a conference put on by the Kansas City Federal Reserve Bank.

Mr. Powell stated very strongly that the Fed was going to do what it had to do to bring inflation down to its 2.00 percent target.

The S&P 500 nose-dived. On Wednesday, September 7, the S&P 500 turned around and stock prices rose, on Wednesday, on Thursday, and on Friday.

It rose again on Monday.

Then came the news on inflation.

Consumer prices rose in August, year-over-year, by 8.3 percent. This was down from the 8.5 percent rate posted in July.

We hear from The Wall Street Journal that even the doves were crying.

The rate of inflation dropped, but it did not drop by very much. Expectations were for the CPI to rise, year-over-year, by only 8.1 percent, or less.

There was not as much moderation as was expected.

As reported, there were higher than expected results in rent, health care, restaurant meals, and goods such as furniture. These offset the decline that took place in gas prices.

The core price index, the index without gas prices and food prices, accelerated by more than experts expected, in August.

Conclusion: the Federal Reserve was going to have to keep its foot on the pedal and keep a tight hold on monetary policy.

Stock Market Collapse

The result: the stock market dropped.

The S&P 500 stock index was down by more than 115 points by 1:30 PM on Tuesday.

The Dow Jones Industrial Index was down by more than 800 points at that time.

And, the NASDAQ was off by almost 450.

Investor expectations had to be reviewed.

Just how “temporary” were the inflationary pressures and what more could be expected in the future?

This was going to depend upon how long inflation was going to be around and how much the Federal Reserve would have to do to reduce the size of its portfolio so that we could think about getting inflation back down near the Fed’s target of 2.00 percent.

And, from what I can tell, more and more people are starting to ask questions like this.

Inflation And The Fed

The Federal Reserve reacted to the spread of the Covid-19 pandemic in the right way.

When you get a massive threat to the economy like the one presented by the oncoming Covid-19 disaster, a central bank should take a position that it should err on the side of monetary ease if it is to successfully combat the dangers of economic collapse.

And, this is exactly what the Federal Reserve did.

Since the Fed seems to have been successful in preventing a major disruption of the economy, they should be congratulated.

However, there is the other side to the picture.

What happens when the major threat goes away and the central bank needs to “clean up” and remove from the financial system all the “excess” liquidity it injected into the economy?

Well, let’s take a quick look at some of the figures.

On December 25, 2019, the Federal Reserve held roughly $3.751 trillion in securities held outright in its portfolio.

On December 31, 2020, the Fed held $6.730 trillion in securities held outright in its portfolio. This represented an increase of almost $3.000 trillion from the year before.

On December 30, 2021, the Fed held $8.270 trillion in securities held outright in its portfolio. This is about $1.500 trillion from the year before and about $4.500 trillion from two years before.

On December 30, 2021, the Fed’s securities portfolio was almost seven times the size it was at the end of the Great Recession in June 2009.

The current Federal Reserve plan to reduce the size of the Fed’s securities portfolio is to allow somewhere around $95.0 billion in securities to mature off from the portfolio every month.

The initial objective is to reduce the portfolio by around $2.4 billion, so the quantitative tightening will not be over until the fall of 2024.

So, we have a long time to wait before the Fed hits its target.

But, wait. What about the other roughly $2.0 trillion the Fed has injected into the financial system as a part of its fight against the spread of Covid-19?

Is the Fed just going to let this $2.0 trillion float around in the financial system?

Could these funds be the source of future inflation?

It seems as if financial analysts are starting to pose this question.

And, if the threat of inflation is really worse than the Fed would like us to think that it is, doesn’t that mean that the Fed’s job will be just that much harder?

Doesn’t that mean that the Fed’s tightening will ultimately have to take into consideration all $4.5 trillion that the Fed injected into the banking system in 2020 and 2021?

Maybe this is why even the doves were crying.

Be the first to comment