Torsten Asmus

This article was coproduced with Cappuccino Finance.

As volatility in the market continues, more and more investors are seeking a recession-proof investment option. Wouldn’t it be nice if your investment only grew? There are several typical options falling in those categories.

Government bonds are possibilities, as are blue chip consumer staples like 3M (MMM), Procter & Gamble (PG), and Hormel (HRL). Defense contractors with a nice long order backlog are great options as well.

But, how about places to live?

No matter what the state of the economy is, people still need a place to live, correct? In that regard, I think Apartment REITs should belong to the category of recession-resistant options.

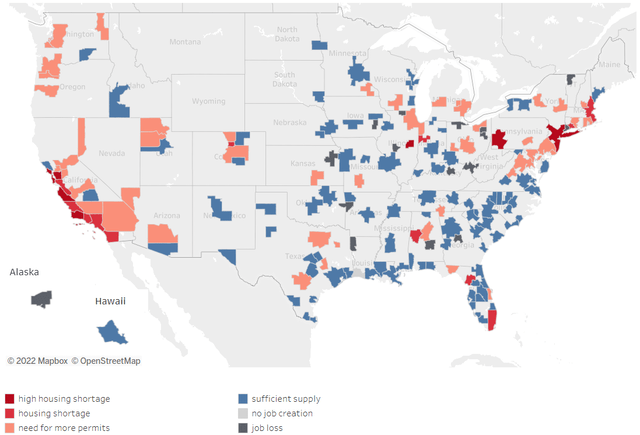

The U.S. has been dealing with housing shortages for years at this point, but it may only be getting worse. Experts believe there’s a nationwide housing shortage of 2 to 6 million newly-built houses. Only a few major cities are issuing building permits at a pace that keeps up with new job creation. As supply gets tighter and tighter and housing prices climb, these people need to live somewhere.

I expect demand for apartments will stay strong for a long time. Therefore, the following Apartment REITs are a great place to stash your money during a downturn (and a boom too!).

AvalonBay Communities (AVB)

AvalonBay Communities is a REIT that develops, acquires, owns, and operates multifamily apartment communities across the U.S. The major markets include New England, New York, Pacific Northwest, and California. They focus on leading metropolitan areas with growing employment in high wage sectors. These also happen to be the regions with the most severe housing shortage.

NAR

AvalonBay has more than 270 apartment communities (more than 80,000 apartment homes) in 12 different states and Washington, D.C., and their apartments are in high demand (96% occupancy rate). Also, their revenue has been growing nicely (12.9% YoY growth last quarter). A major portion of the growth was from the increase in residential lease rates and rent relief.

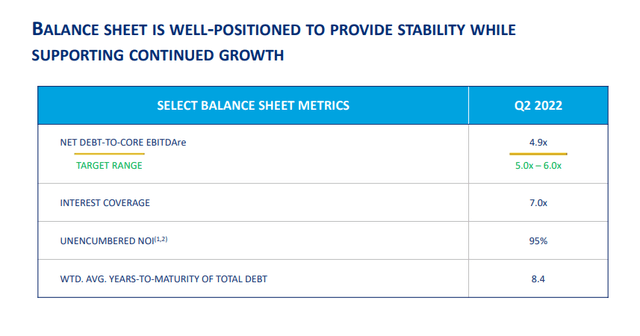

To maintain the growth trajectory, it’s critically important for an Apartment REIT to keep a strong balance sheet. In that regard, AvalonBay is doing an excellent job. Their Net Debt-to-Core EBITDAre is at 4.9x (below their target range of 5.0x-6.0x), and interest coverage is at 7.0x.

AVB Investor Relations

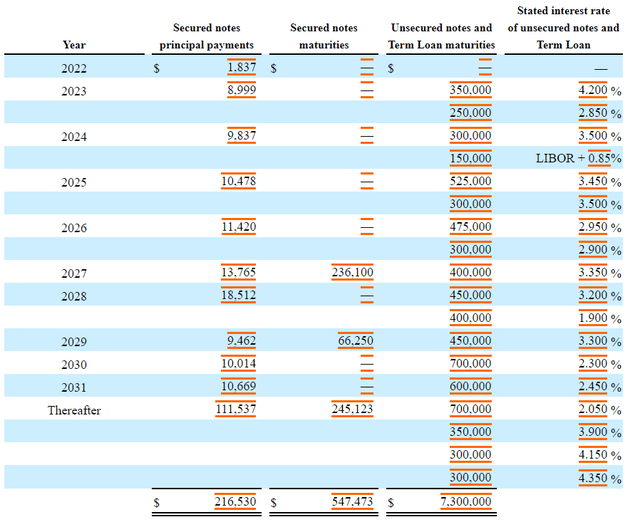

Their debt maturity schedule is very well spread over the next several years, and the weighted average years-to-maturity is 8.4 years.

AVB Investor Relations

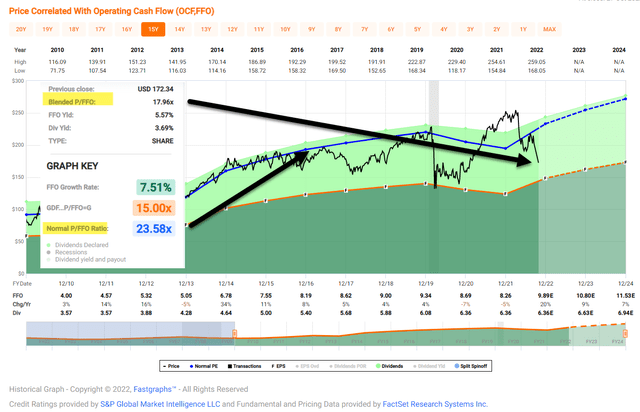

Looking at the current valuation metrics, AvalonBay is undervalued. P/AFFO of 24.7x and P/FFO of 18.12x is 10-15% below their five-year average. A nearly 30% drop in stock price in the past six months has created a great opportunity for REIT investors. Real estate market fears over the rising mortgage rate probably are the main cause of the drop.

While the real estate market slowdown could certainly happen, companies with strong fundamentals like AvalonBay should easily make it to the other side. Therefore, the current valuation is a gift to investors.

AvalonBay’s 3.6% dividend is safe with a cash dividend payout ratio of 70.50%. Also, AFFO payout ratio of 77.24% and FFO payout ratio of 70.51% reiterate the safety of their dividend. Given their growth plan and strong operation, I expect their dividend will stay safe into the future.

FAST Graphs

Camden Property Trust (CPT)

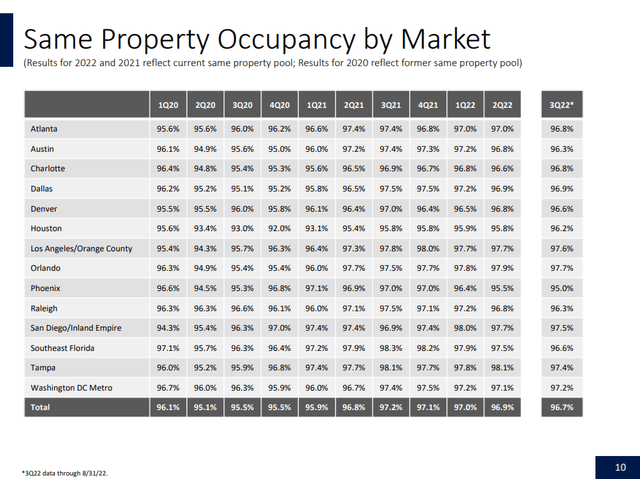

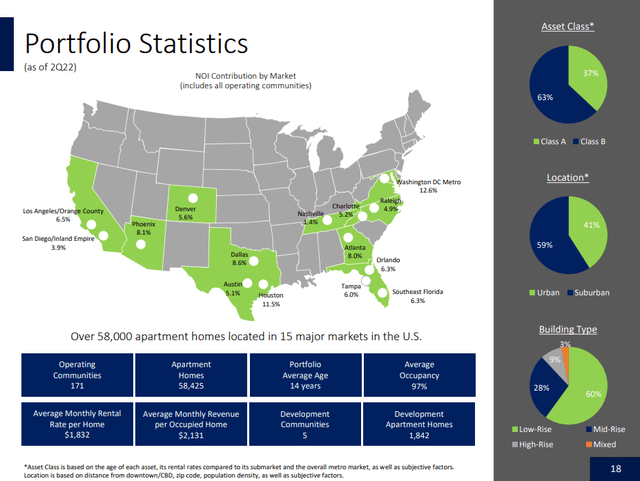

Camden Property Trust is a REIT that develops, repositions, acquires, and manages multifamily apartment communities. Their assets are spread across the U.S., and they have over 170 communities of multifamily housing with over 58,000 units. The demand for their properties is very strong, demonstrated by a high occupancy rate (97%).

CPT Investor Relations

Camden is taking advantage of the macrotrend that young adults are more likely to rent instead of buy. Research shows that young adults are marrying and having children later in their lives, delaying homeownership decisions to a later stage of their lives.

Currently, the homeownership rate is significantly lower for young adults (39%), compared to the overall homeownership rate (65%).

Combining a strategic choice of assets and sophisticated property management, Camden is doing a great job at renting their properties to young adults (resident median age is 31 years) with high annual income (~$106k).

CPT Investor Relations

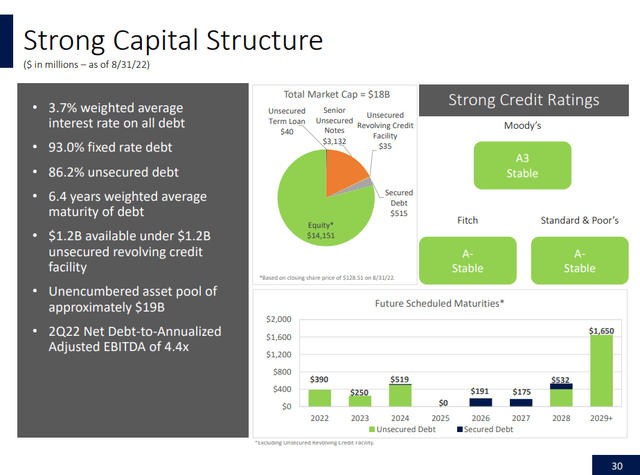

Meanwhile, Camden is maintaining a healthy balance sheet and strong capital structure. The weighted average interest rate on their debt is only at 3.7%, which is very manageable, and 93% of their debt is at a fixed rate, which is great in this environment of increasing interest rates.

Their debt maturity schedule is very well spread over the next several years, and the weighted average maturity of debt is 6.4 years. It’s not surprising to see strong credit ratings of A3 from Moody’s, A- from Fitch, and A- from Standard & Poor’s.

CPT Investor Relations

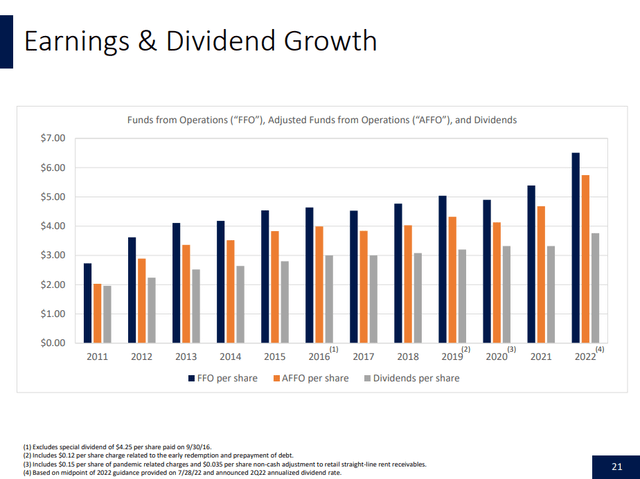

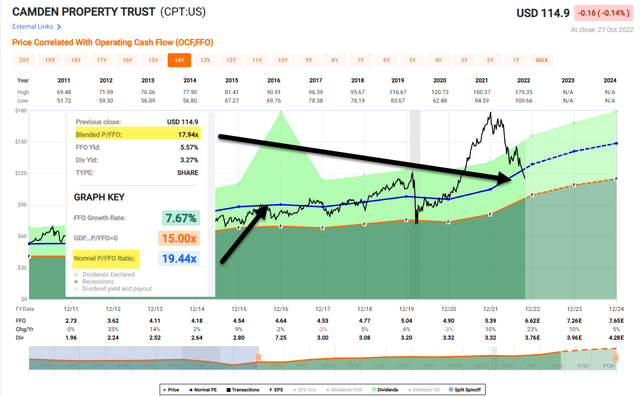

Combining their strategic acquisition of properties and strong operation, Camden has been growing their FFO, AFFO, and dividend nicely over the years.

Their dividend grew 4.0% per year in the past five years, and 4.81% per year in the past three years. Looking at their AFFO and FFO growth trajectories and strong balance sheet, I expect Camden to continue this strong performance in the future.

CPT Investor Relations

Camden’s dividend is very safe at this point. The cash dividend payout ratio is at 55.16%, and AFFO payout ratio is at 69.13%. There’s a substantial cushion between their cash flow and the dividend payout. Also, given their balance sheet and capital structure, I don’t expect Camden to experience financial hardship in the near future.

Looking at their valuation metrics, Camden is undervalued by the market right now. P/AFFO of 25.89x and P/FFO of 17.61x are about 20% lower than their five-year average. Also, iREIT ratings tracker shows that the margin of safety for Camden is at 12%, which also demonstrates that the current stock price is below its fair value.

I expect Camden to continue to perform well in the future and reward shareholders with a 3.3% dividend and stock appreciation.

FAST graphs

Essex Property Trust (ESS)

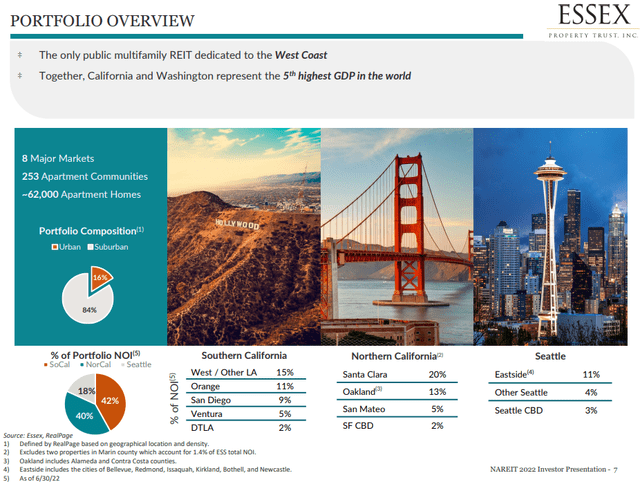

Essex Property Trust is a REIT that owns, operates, manages, and acquires apartment communities along the West Coast of the U.S. They strategically choose the locations that are 1) in a major metropolitan areas with the population of at least one million, 2) constrained supplies due to geographical, political, or development, and 3) high rent rates.

ESS Investor Relations

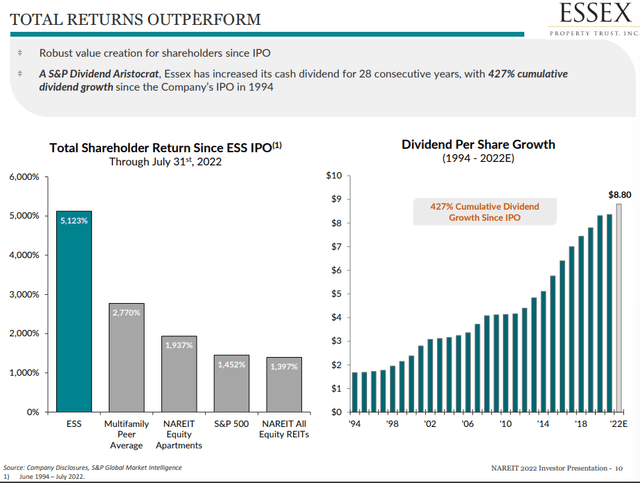

Essex is in eight major markets with more than 250 apartment communities (62,000 apartment homes). They have been growing steadily since the mid-90s, and their dividend growth has been exceptional (427% growth since the IPO). Also, their total shareholder return since their IPO is far superior to their peers.

ESS investor Relations

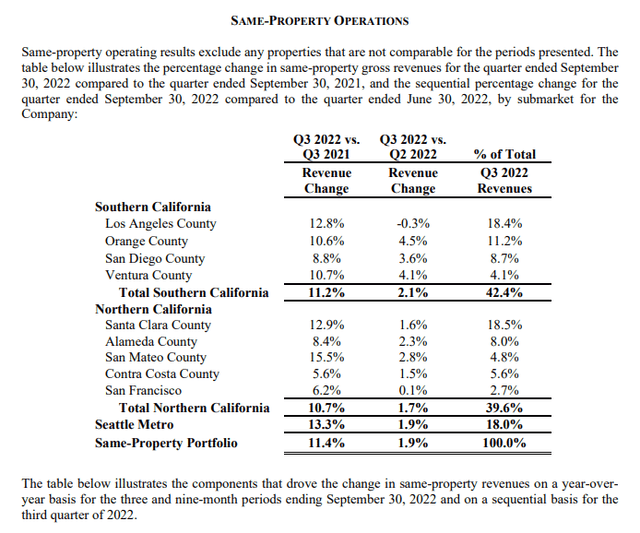

During Q3 2022, Essex continued their excellent performance. Their same property revenue increased by 11.4% YoY, and all three regions (Southern California, Northern California, and Seattle Metro) performed nicely.

Their FFO per share ($3.69) beat estimates by $0.02, and management raised their full-year Core FFO per share guidance by $0.02 ($14.42-$14.52). The outlook represents 15.9% YoY growth.

ESS Investor Relations

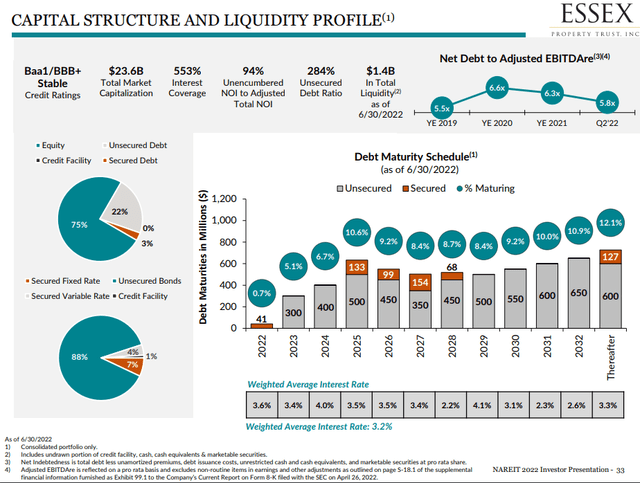

Essex has a very good balance sheet and strong capital structure. The debt maturity schedule is very evenly spread out over the next several years, and the weighted average interest rate is at 3.2%.

Also, Essex has a total of $1.4 B liquidity available. This strong balance sheet and ample liquidity allow them to keep acquiring new properties and redeveloping existing ones to improve the portfolio value.

ESS Investor Relations

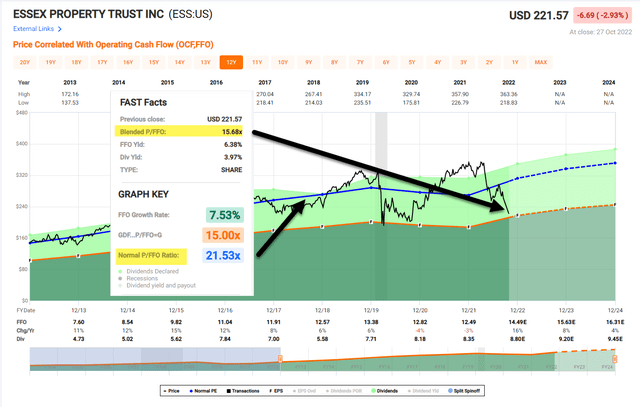

Their dividend payment is safe at this point with 55.95% cash dividend payout ratio. AFFO payout ratio of 73.03% and FFO payout ratio of 64.75% both demonstrate a comfortable cushion between their operating cash flow and the dividend payout.

Additionally, iREIT ratings tracker shows that the margin of safety for Essex is 24%, and their valuation metrics (P/AFFO of 20.45x and P/FFO of 15.84x) demonstrate that they are undervalued at this point.

It’s a good time for investors to add Essex to their portfolio and start collecting the 3.9% dividend.

FAST Graphs

Risk

Mortgage rates have been rising steadily throughout the year, and the rate is now at its highest level since 2008. While I don’t expect the real estate market to crash, a slowdown in price appreciation is almost inevitable at this point.

Especially in coastal markets like California and Seattle.

Therefore, this downturn in the market may interfere with Essex’s divesture plan, and consequently the short-term acquisition plan.

Inflation persists, and the environment could trigger a recession and sour consumer sentiment. The economic slowdown and less real income (inflation adjusted income) could spill over into rental rates, especially of luxury and higher end properties. Therefore, an apartment REIT’s growth could be hurt by these high inflation rates.

Conclusion

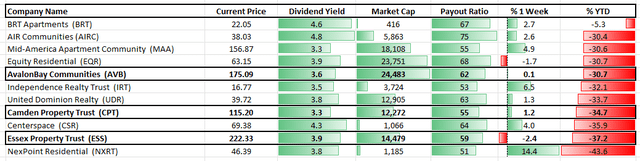

AvalonBay, Camden, and Essex have all been performing great.

Looking at their balance sheet, strategy, and operational performance, I expect their solid performance will continue.

An environment of high inflation and high mortgage rates may negatively impact their growth plan in the short term, but their long-term growth trajectory should remain solid.

These REITs are great places to invest your hard-earned money during volatile times like now.

iREIT on Alpha

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment