Dilok Klaisataporn

By Claire Yi

Introduction to the E-Commerce Ecosystem

E-commerce is the abbreviation for electronic commerce, which is the purchasing and selling of goods and services, or the transmitting of funds or data, using the internet for the whole or part of a transaction.

Usually, sellers utilize e-market platforms to open online storefronts, and buyers use the platform to shop for specific items. Sellers rely on technology companies to build infrastructures such as websites, analytics tools and cloud services.

They also utilize social media to drive traffic, promote offerings and gain insights. Digital payment solutions enable buyers and sellers to close the transaction without offline interaction. These components together form the e-commerce ecosystem.

The history of e-commerce can be traced back to 1969, when Dr. John R. Goltz and Jeffrey Wilkins established the first e-commerce company, CompuServe.1 In the 1990s, many game-changing events in this industry happened, such as the arrival of the World Wide Web and the launch of online marketplaces like Amazon (AMZN) (1995), eBay (EBAY) (1995) and Alibaba (BABA) (1999).

PayPal rolled out the first e-commerce payment system to process fund transactions in 1998. Meanwhile, search engines such as Yahoo! and Google (GOOG) (GOOGL) were established, which made online searching and marketing easier. Post-2000, e-commerce developed rapidly. UNITAD’s data shows that e-commerce’s share of global retail trade went from almost 0% 20 years ago to about 17% in 2020.2

The COVID-19 pandemic in 2020 forced most consumers to shift from offline to online shopping. However, in the past 18 months, e-commerce companies faced strong headwinds from the reopening of the economy, tightening regulation and lowered valuation under rate hikes.

Index Construction

S&P DJI recently launched the S&P Global E-Commerce Ecosystem Index, which is designed to track the performance of companies that have business exposure to e-commerce.

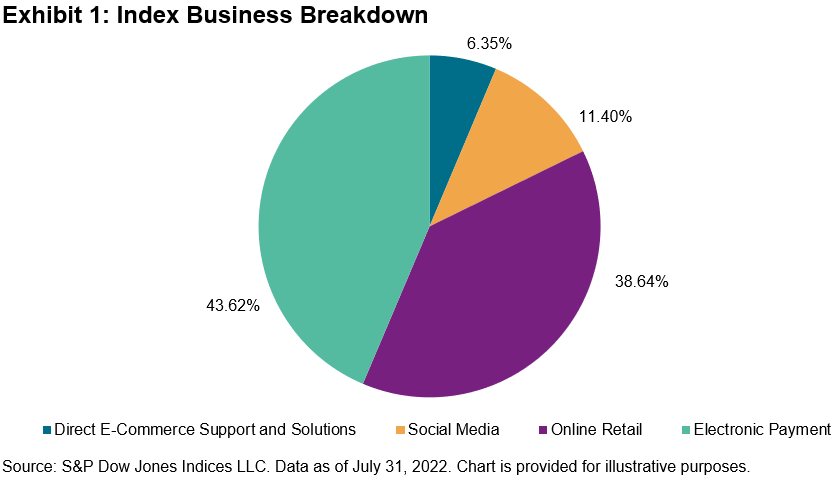

In order to capture the whole value chain, the index identifies four business areas relevant to the ecosystem: online retail, social media, electronic payment and direct e-commerce support and solutions. Exhibit 1 shows the index weight breakdown of business areas.

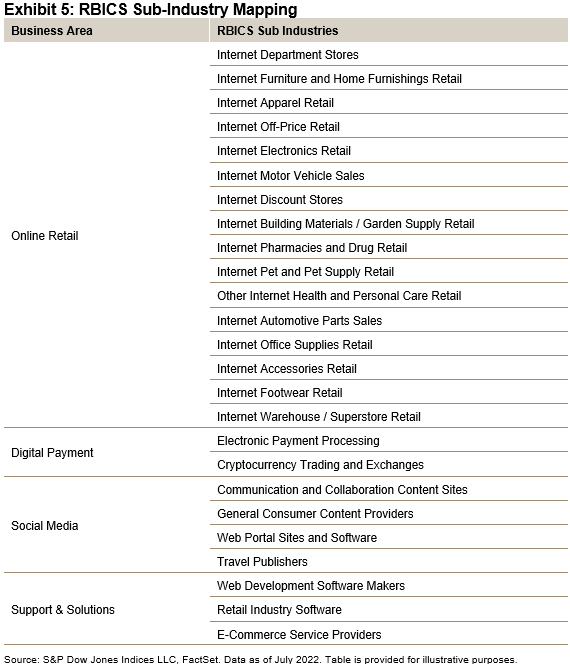

We utilize FactSet’s Revere Business Industry Classification System (RBICS) data to select and assign scores to companies. Companies must generate at least 20% of revenue from e-commerce-related business or have an RBICS focus on any of the determined sub-industries (see details in the methodology).

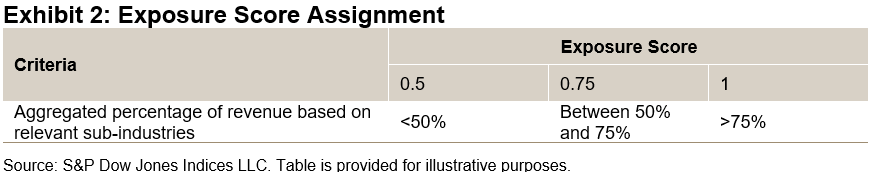

Then, companies will be assigned an exposure score of 1/0.75/0.5, depending on their aggregated percentage of revenue related to e-commerce (see Exhibit 2). Each of the RBICS sub-industries is mapped to one of the four business areas in the ecosystem (see details in Exhibit 5).

The top 50 constituents are selected and weighted based on the product of total market capitalization and exposure score to balance the index capacity and exposure purity.

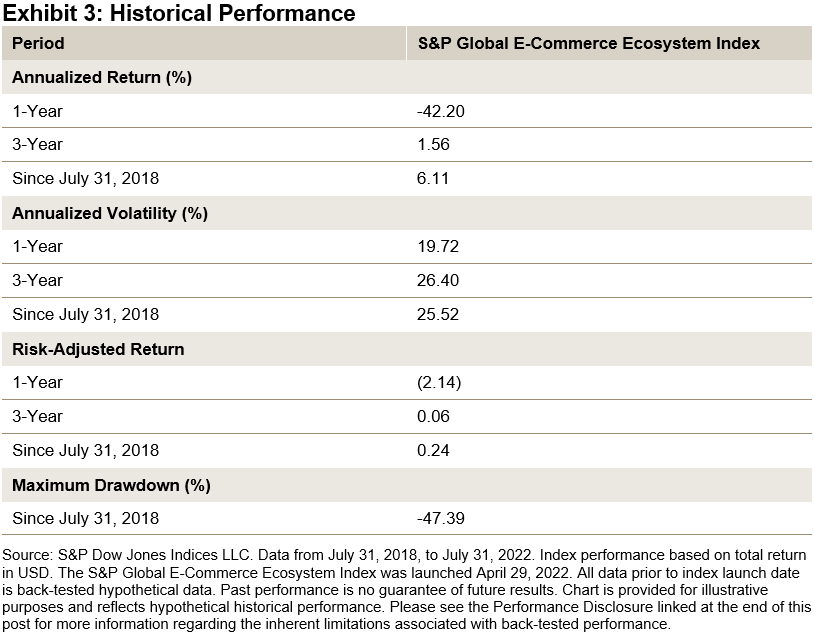

Exhibit 3 shows that e-commerce-related companies have experienced a challenging period since 2021. The index lost over 42% in the 12-month period ending July 31, 2022.

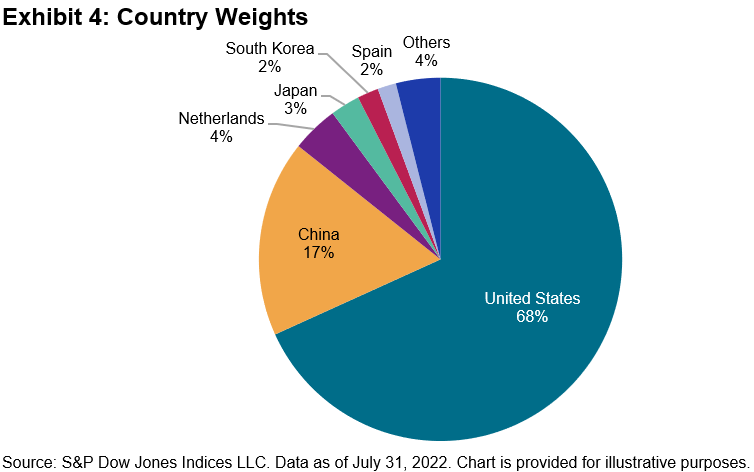

From a country allocation perspective, 68% the index weight was allocated to companies in the U.S., and China had the second-highest weight at 17% (see Exhibit 4).

The recent drawdown was not unique to e-commerce companies; it prevailed in the growth sector. The S&P 500 Growth lost 28% in the first six months of 2022, and the Dow Jones Internet Composite Index lost 44% during the same period.

Despite the performance headwind this year, e-commerce is not leaving our lives. In October 2021, Facebook (META) announced its new endeavor into the Metaverse, which could introduce a new era for how people shop in the virtual world. The S&P Global E-Commerce Ecosystem Index is one possible way to track the evolution of e-commerce businesses in the long run.

1 Shiprocket, The History Of eCommerce & Its Evolution – A Timeline

2 UNITAD, How COVID-19 triggered the digital and e-commerce turning point

Disclosure:This post is an opinion, not advice. Please read our Disclaimers. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment