Evgeny Gromov/iStock via Getty Images

Earnings of Independent Bank Corporation (NASDAQ:IBCP) will likely decline this year mostly on the back of lower mortgage banking income. Further, higher provisioning due to higher interest rates will drag the bottom line. On the other hand, decent loan growth will likely support earnings. Meanwhile, the margin will be barely affected by interest rate hikes. Overall, I’m expecting Independent Bank Corporation to report earnings of $2.48 per share in 2022, down 14% year-over-year. The year-end target price suggests a high upside from the current market price. Based on the total expected return, I’m adopting a buy rating on Independent Bank Corporation.

Plunge in Mortgage Banking Income to Hurt Earnings

One of the major reasons behind the anticipated earnings decline this year is the effect of higher interest rates on gains on sales of mortgage loans. Mortgage refinancing activity, which was heightened in the last two years, will taper off this year because an increase in interest rates will end any benefit of refinancing.

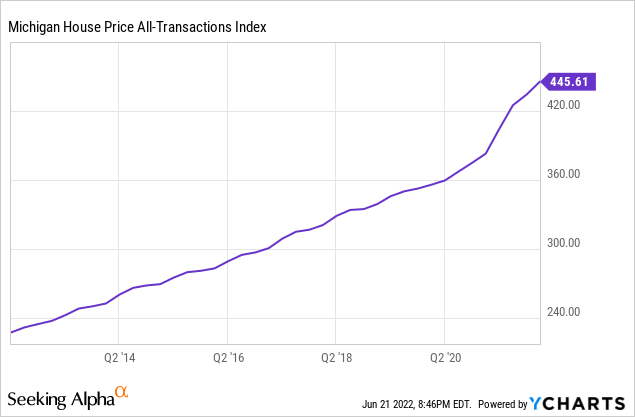

Further, I’m expecting the growth of mortgage purchase volume to get pressurized by the high home prices. Independent Bank operates mostly in Michigan with some presence in Ohio. Michigan’s home price index seems to have recently flattened after a steep increase in the latter part of 2021. Nevertheless, last year’s acceleration can pressurize demand in the year ahead.

The management mentioned in the first quarter’s earnings presentation that it expects the non-interest income to decline by 20% to 25% on a year-over-year basis in 2022. Given the outlook on mortgage banking income and management’s guidance, I’m expecting the total non-interest income to decline by 25% this year relative to last year.

Regional Factors to Help Maintain Loan Growth Momentum

Independent Bank Corporation’s loan portfolio grew by a remarkable 3.5% in the first quarter of 2022, or 14% annualized. The management is targeting full-year loan growth of around 10%, as mentioned in the presentation. Given the first quarter’s performance, the loan-growth target appears achievable. Moreover, the management mentioned in the latest conference call that it had a strong commercial loan pipeline at the time of the conference call, which will drive loan growth in the second quarter of the year.

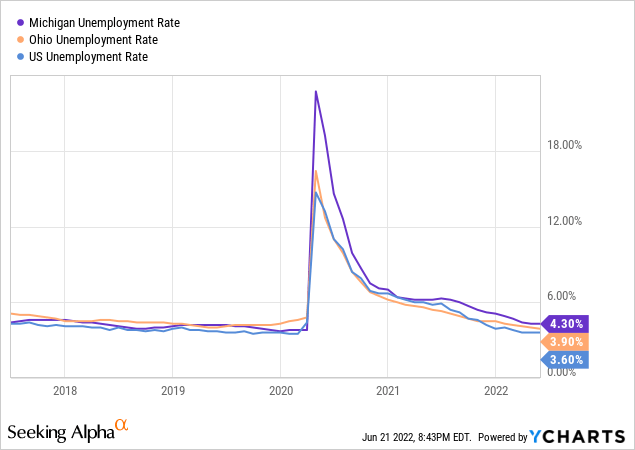

Moreover, regional economic factors will play an important role in loan growth for the year ahead. Although Michigan’s unemployment rate is trailing the national average, it is still much better than in the last two years.

Independent Bank retains a large number of the mortgage loans it originates; therefore, the home price index discussed in the section above will affect the loan portfolio size as well. At the end of March 2022, mortgage loans made up 39% of total loans. Overall, I’m expecting mortgage loans to continue to grow this year, albeit at a slower rate than last year. Moreover, mortgage growth will likely trail commercial loan growth this year.

Overall, I’m expecting the loan portfolio to increase by 10% by the end of 2022 from the end of 2021. Further, I’m expecting deposit growth to match loan growth in the last nine months of 2022. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | ||||||

| Net Loans | 1,996 | 2,558 | 2,699 | 2,698 | 2,858 | 3,147 |

| Growth of Net Loans | 25.7% | 28.1% | 5.5% | (0.0)% | 5.9% | 10.1% |

| Other Earning Assets | 599 | 580 | 600 | 1,246 | 1,580 | 1,556 |

| Deposits | 2,401 | 2,913 | 3,037 | 3,637 | 4,117 | 4,463 |

| Borrowings and Sub-Debt | 90 | 65 | 128 | 109 | 109 | 116 |

| Common equity | 265 | 339 | 350 | 390 | 398 | 376 |

| Book Value Per Share ($) | 12.3 | 14.3 | 15.1 | 17.6 | 18.3 | 17.6 |

| Tangible BVPS ($) | 12.2 | 12.8 | 13.6 | 16.1 | 16.8 | 16.1 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Margin Barely Sensitive to Interest-Rate Changes

Independent Bank’s net interest income is barely sensitive to interest rate changes as the effect of interest rates on the liability side is quite close to the effect of interest rates on the asset side.

On the asset side, a significant portion of the loan portfolio will re-price soon after every rate hike. This is because 53% of the commercial portfolio and 34% of the mortgage portfolio is based on variable or adjustable rates, as mentioned in the presentation. However, the sizable securities portfolio will drag the overall earning-asset yield. Securities made up 31% of total earning assets at the end of March 2022. Most of the securities portfolio will not re-price this year as only around 30% of the securities portfolio carries variable rates. The rest of the securities portfolio will react to interest rates in quite a lagged manner because the portfolio’s duration is 4.66 years.

The liability side is also quite mixed. Savings and interest-bearing checking deposits made up 47% of total deposits at the end of March 2022. These deposits will see pricing pressure as interest rates rise. On the other hand, non-interest-bearing deposits, which made up 31% of total deposits, will weigh down the average deposit cost.

The management’s interest-rate sensitivity analysis given in the presentation shows that a 200-basis points increase in interest rates could lift the net interest income by only 3.51% over twelve months. Considering these factors, I’m expecting the margin to increase by only six basis points in the last three quarters of 2022 from 3.0% in the first quarter of the year.

Provision Expenses to Further Drag Earnings

The management mentioned in the presentation that provision expenses could make up 0.15% to 0.20% of average loans in 2022. This guidance is much higher than the historical average. The provision expense averaged only 0.05% of total loans from 2017 to 2019 and 0.11% in the last five years.

In my opinion, it is reasonable to expect that provisioning might be a bit higher than average this year because of the recent developments. The faster-than-expected monetary tightening can hurt borrowers’ debt-servicing ability. As a result, the management would want to raise its provisioning for expected loan losses. Further, although I believe a recession is unlikely, Independent Bank may want to remain cautious and keep its provisioning high due to the chances of a recession, however slim. Overall, I’m expecting the company to report a net provision expense of 0.17% of total loans in 2022.

Expecting Earnings to Dip to $2.48 per Share

The anticipated drop in mortgage banking income and higher provision expense will likely drag earnings this year. On the other hand, low-double-digit loan growth will likely support the bottom line. Further, Independent Bank plans to close four locations in the second quarter of 2022, which will result in annual cost savings of $1.5 million, as mentioned in the conference call. Overall, I’m expecting the company to report earnings of $2.48 per share in 2022, down 14% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Income Statement | ||||||

| Net interest income | 89 | 113 | 123 | 124 | 130 | 136 |

| Provision for loan losses | 1 | 2 | 1 | 12 | (2) | 5 |

| Non-interest income | 43 | 45 | 48 | 81 | 77 | 57 |

| Non-interest expense | 92 | 107 | 112 | 122 | 131 | 123 |

| Net income – Common Sh. | 20 | 40 | 46 | 56 | 63 | 53 |

| EPS – Diluted ($) | 0.95 | 1.68 | 2.00 | 2.53 | 2.88 | 2.48 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses.

IBCP Trading at a Significant Discount to the Target Price

Independent Bank Corporation is offering a good dividend yield of 4.7% at the current quarterly dividend rate of $0.22 per share. The earnings and dividend estimates suggest a payout ratio of 35.5% for 2022, which is in line with the five-year average of 35.3%. Therefore, the earnings outlook presents no threats to the dividend payout.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Independent Bank. The stock has traded at an average P/TB ratio of 1.35 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 12.8 | 13.6 | 16.1 | 16.8 | ||

| Average Market Price ($) | 23.9 | 21.6 | 15.9 | 15.9 | ||

| Historical P/TB | 1.87x | 1.59x | 0.99x | 0.94x | 1.35x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $16.1 gives a target price of $21.7 for the end of 2022. This price target implies a 15.4% upside from the June 21 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.15x | 1.25x | 1.35x | 1.45x | 1.55x |

| TBVPS – Dec 2022 ($) | 16.1 | 16.1 | 16.1 | 16.1 | 16.1 |

| Target Price ($) | 18.5 | 20.1 | 21.7 | 23.3 | 24.9 |

| Market Price ($) | 18.8 | 18.8 | 18.8 | 18.8 | 18.8 |

| Upside/(Downside) | (1.7)% | 6.9% | 15.4% | 24.0% | 32.6% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 9.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.68 | 2.00 | 2.53 | 2.88 | ||

| Average Market Price ($) | 23.9 | 21.6 | 15.9 | 15.9 | ||

| Historical P/E | 14.2x | 10.8x | 6.3x | 5.5x | 9.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.48 gives a target price of $22.8 for the end of 2022. This price target implies a 21.4% upside from the June 21 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.2x | 8.2x | 9.2x | 10.2x | 11.2x |

| EPS 2022 ($) | 2.48 | 2.48 | 2.48 | 2.48 | 2.48 |

| Target Price ($) | 17.9 | 20.3 | 22.8 | 25.3 | 27.8 |

| Market Price ($) | 18.8 | 18.8 | 18.8 | 18.8 | 18.8 |

| Upside/(Downside) | (5.0)% | 8.2% | 21.4% | 34.6% | 47.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $22.2, which implies an 18.4% upside from the current market price. Adding the forward dividend yield gives a total expected return of 23.1%.

Independent Bank’s stock price has plunged recently partly because of the overall market rout. Further, investors appear to have overreacted to the prospects of an earnings decline. In my opinion, the existing discount on the target price is unjustified. Based on the total expected return, I am adopting a buy rating on Independent Bank Corporation.

Be the first to comment