da-kuk

There are times when we can go months not having to rebalance the conservative portfolios we manage, especially when the names in those portfolios maintain their ‘Buy’ ratings and volatility remains low among the portfolio holdings. Lately we have seen a few of our holdings move below previous ratings and as we have evaluated those ‘Holds’ in the portfolio we have found some names that make sense to rotate into at this time. Last week we discussed a trade we did in our income portfolios, which saw us sell a name which had large capital gains in order to rotate into a more attractive dividend with a ‘safer’ valuation.

This week we are highlighting another trade in these same types of portfolios, where we are selling a name which looks a little extended for income portfolios in order to rotate into a name which looks to have a more attractive yield and potentially some upside in the stock.

So What Was The Trade?

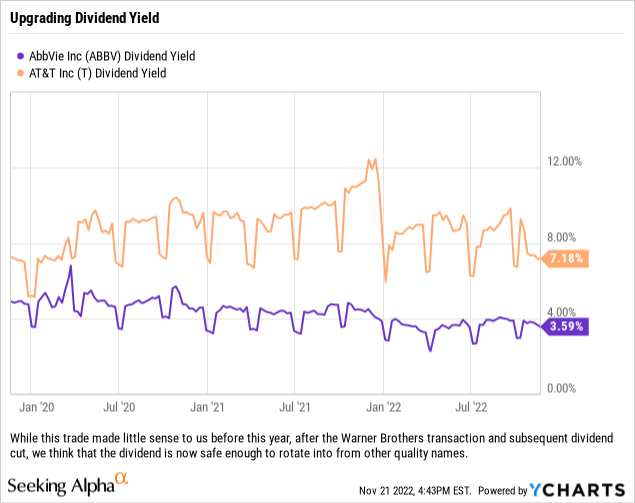

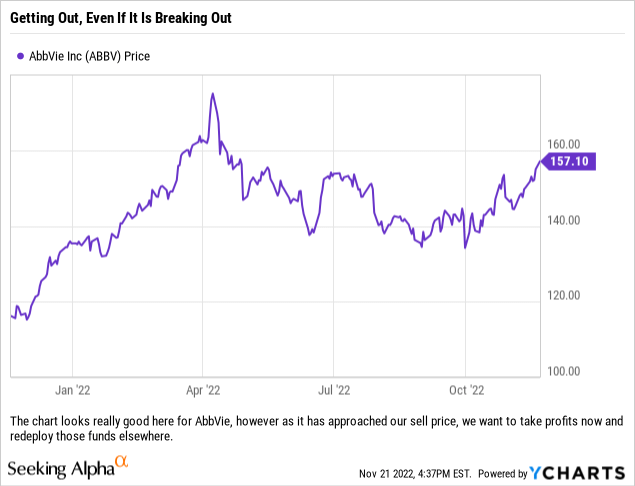

We have had AbbVie (NYSE:ABBV) as a ‘Hold’ for a while now, but due to its dividend and our belief that the stock could rebound in the wake of the baby formula fiasco, we had this stock marked as a ‘Hold’ with a price target of $160/share. With a nice run over the last few weeks, the shares were around 2% away from that price target, so we decided that it was finally time to sell this name and rotate into one of the ‘Buy’ rated names on our list. The dividend yield was still quite respectable, especially among pharma names, at 3.8% but we do see potential issues on the horizon for this name, so we wanted to lock in the roughly 60% gain and redeploy the funds elsewhere.

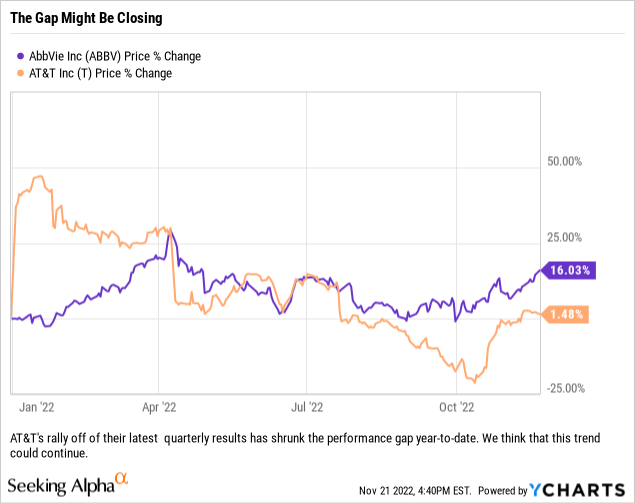

We decided to add exposure to the telecom space (remember we just purchased Verizon last week), by adding to a name which we were under allocated to previously – AT&T (NYSE:T). We had started to build positions in AT&T before the latest earnings release, and published an article on why we thought the dividend was safe. Since the time of publication on that article, shares are up 21.83%, while the S&P 500 is up 6.6%. The gains can be fully attributable to the company meeting its cash flow projections and the market getting more comfortable with the new standalone AT&T.

Why We Like The Trade

Both AbbVie and AT&T have their issues and neither of the companies are perfectly positioned right now to take advantage of opportunities as they present themselves in the coming years. AbbVie faces declining revenues and profits as it has to rebuild its drug portfolio, while AT&T must continue to spend heavily to roll out 5G and fiber offerings. While one could argue that AbbVie’s overall growth runway looks more attractive than AT&T’s, we think that over the next few years AT&T has the potential to deliver more good news via other metrics (such as debt reduction, FCF growth and potentially share repurchases). Currently we believe that AT&T’s dividend might actually be a little safer than AbbVie’s while their stock might also have less downside due to revenues and EPS which should remain relatively stable during a period when AbbVie’s are expected to decline. With the potential to also increase FCF as fiber customers are gained and CapEx spending cools, AT&T certainly appears to be the stock with the wind behind its sails.

While AbbVie revenues are estimated to come in at over $58 billion this year, analysts believe that they will fall next FY to around $54 billion and remain roughly flat the next FY as well until resuming growth in FY 2025. Earnings will look similar, with declines through FY 2024 before increasing in FY 2025. While AT&T is low-growth, and will have revenue declines through FY 2023, the company returns to growth in 2024, and EPS follow the same path…which is not sexy but in the current economic situation looks like a decent way to try and minimize downside risk in this conservative portfolio.

With the latest quarterly results, our estimate is that AT&T has downside risk of just over 10% from current levels and potentially up to 30% gains if everything goes well over the next year. We can see scenarios where AbbVie has 20% downside from current levels, and looking at a chart of AbbVie worries us – especially in the $150/share to $160/share level where AbbVie shares have, on numerous occasions, run into headwinds. Breaking through $157/share, and then $160/share, could certainly lead to another pop higher, but we are not here to speculate and are happy to manage our downside risk and cash flows with this trade.

Drawbacks To The Trade

We will point out that one of the big drawbacks to this trade for readers is that AbbVie, as we just stated above, could be in the process of breaking higher. In that case, the capital gains from current levels to where the shares end up might cover the difference in dividend payments between AbbVie shares and AT&T’s for a few years. So leaving money on the table here might be unattractive for some readers and we absolutely understand that.

AbbVie was our last pharma name in the income portfolio, so from a diversification standpoint we are now under-allocated to the industry as a whole; having previously sold Pfizer (PFE) and Johnson & Johnson (JNJ). While this does throw us out of balance from market weightings, we have carried allocations of certain industries at zero weightings or near zero weightings in the past – with telecom being a good example. So while we are comfortable with the process that got us here, we are cognizant of the fact that this trade does take us to an extreme positioning as it relates to allocations.

The other point we would make about this trade is that we are trading potential long-term growth away for what we perceive to be a near-term upgrade of the safety of dividend while also insulating the portfolio from downward pressure; meaning we think that AT&T has the potential to decline less than AbbVie.

Our Final Thoughts

All portfolios are different. We like to think of them as living, breathing entities that need to be watched over and at times maintained. While this trade might not be beneficial to everyone who currently holds AbbVie shares, and there is a myriad of reasons why that might be the case, we believe that this trade will pay off for our portfolio over the next few quarters, and possibly years. We may be leaving $10/share, or a little more, on the table in upside for AbbVie shares in the interim, but for this portfolio we believe the tradeoff is worth it as we look to shore up dividend streams and position the portfolio for less downside risk over the next 12-24 months. The portfolio has admittedly gotten more ‘boring’ but the trade has allowed us to exit a position that has consistently provided us with headaches (from the baby formula issues to patent issues) over the years, and for that we are thankful.

Be the first to comment