DNY59

Co-Produced by Austin Rogers for High Yield Landlord

Here is a riddle for you: When is bad news actually good news?

Surely multiple answers could be given to that question. But for real estate investment trust (“REIT”) (VNQ) investors, one particular answer emerges as particularly relevant at this moment in time.

Bad news is good news when a bad event incidentally brings about a good result as a byproduct. What kind of bad event are we talking about here?

A recession.

Paradoxically, we believe that an average recession could actually be good for REITs, on balance. This would be paradoxical, of course, because recessions are typically like tornadoes, damaging everything in their path, including REITs. Normally during recessions, commercial real estate occupancy declines, corporate bond yields spike, REITs’ interest expenses rise, tenants default or fall behind on rent, and rent rates decline or at least slow their growth.

That is obviously not an ideal backdrop for strong REIT performance.

But the recent environment of rapidly rising interest rates is not necessarily good for REITs either. After decades of compressing cap rates (i.e., “capitalization rates,” or net operating income yields on properties), REITs’ borrowing costs are quickly climbing and compressing the crucial spread between their costs of capital and yields on invested capital.

Moreover, as existing debt is steadily refinanced at higher rates, REITs’ interest expenses will steadily rise, eating into cash flows. So, not only will future investments be less profitable, but the existing portfolio will also deliver less to the bottom line, all else being equal.

On top of that, the 40-year-high inflation we are currently experiencing (9.1% year-over-year in June!) is higher than what would be ideal for REITs, because a large number of lease terms are locked in for multiple years with rent escalations only in the 1-3% per year range.

The bad news of an oncoming recession, which we’ll address below, may actually prove to be very good news for REIT investors, because it will most likely eliminate the two problems of rising interest rates and too-high inflation.

Let’s take a look first at the case for an approaching recession, then discuss how recessions impact inflation and interest rates.

Recessions Vs. Inflation & Interest Rates

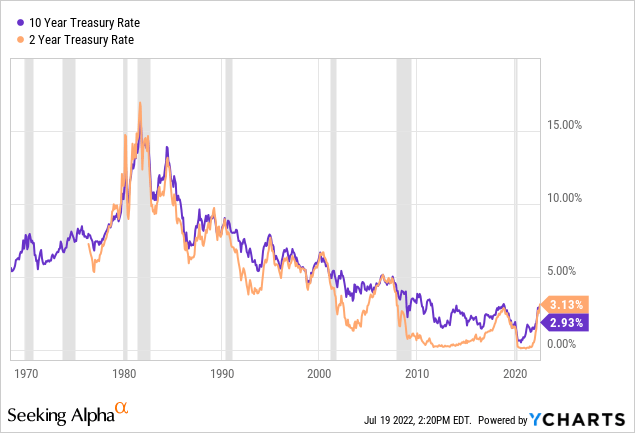

One of the most reliable indicators of an oncoming recession in the near future is the Treasury yield curve.

If the economy never experienced recessions, it would make sense for there to be an upward sloping yield curve for Treasury rates, with the lowest interest rate associated with the shortest-term debt and the highest interest rate associated with the longest-term debt. To tie up one’s money for a longer period requires a greater return (higher interest rate) because of the time value of money.

But when investors bid up Treasury bonds on the long end of the curve to the point where the 10-year yield drops below the 2-year yield, it is a sign that the market thinks that the pressures keeping up the shorter-term yield will soon collapse and rejoin the 10-year yield at a much lower rate.

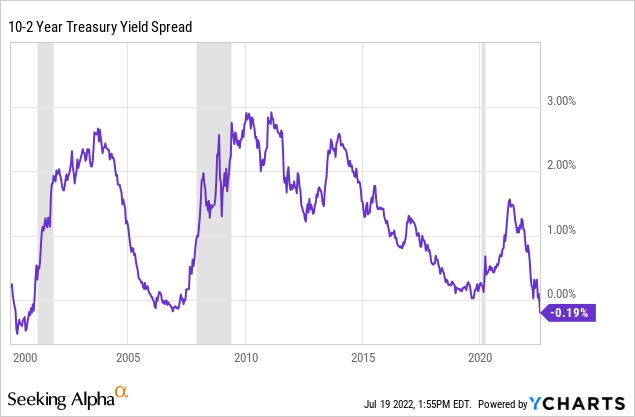

This is why the yield spread between the 10-year and 2-year Treasury rates is so important. When it turns negative, the market is casting a strong signal that economic forces (i.e., a recession) is going to cause short-term rates to drop along with the long-term rates.

Yield curve inversions are one of the most reliable indicators of an oncoming recession in the next 6-18 months.

Right now, the 10-year minus 2-year Treasury yield spread is inverted slightly more than it was prior to the Great Financial Crisis in 2008.

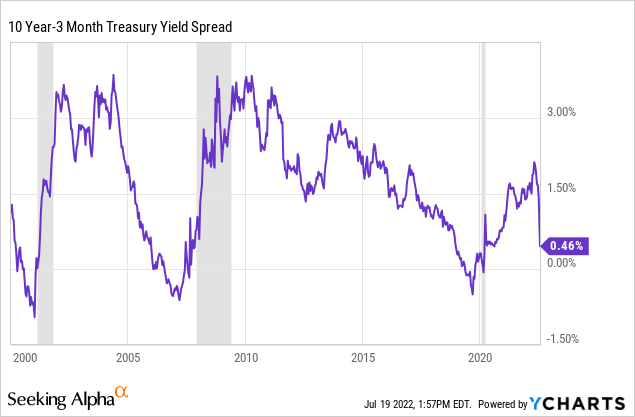

Some forecasters prefer to use the 10-year minus 3-month Treasury yield spread instead, arguing that it is a more reliable indicator. Though that yield spread has not yet inverted, it appears to be well on its way toward inversion.

Is it likely to invert soon? And will the 10-year minus 2-year spread invert further? This does look likely.

As investors begin to take on more fear about a recession, Treasury yields on the longer end (including the 10-year) should remain steady or continue sliding downward.

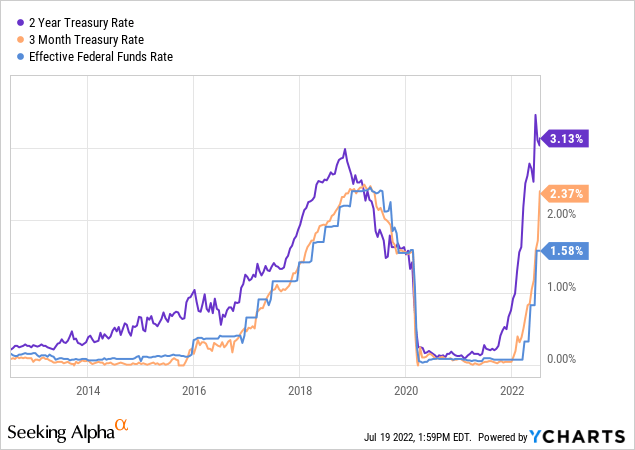

Meanwhile, Treasury rates on the short end are still running higher as a bet that the Federal Reserve will need to push their key Fed Funds rate significantly higher in order to combat 40-year-high inflation.

Notice in the chart above that the Fed Funds rate (blue line) almost always sticks very close to the 3-month Treasury rate. There is also a strong correlation with the movement of the 2-year Treasury rate as well, although there is typically a gap. Typically, the 2-year Treasury rate declines for at least a few months in anticipation of a Fed Funds rate cut.

The point here is that the Fed appears to have a fairly long way to go to catch up with the 3-month and close the gap with the 2-year.

And with inflation as high as it is, the 3-month and 2-year rates will likely continue higher still, further inverting the 10-year minus 2-year spread and eventually inverting the 10-year minus 3-month spread.

Once both of these spreads become inverted, it will be a strong signal that the economy is headed toward a recession.

Many commentators worry that inflation is not going to substantially cool down anytime soon even though the economy is headed toward a recession. In other words, they fear a stagflationary scenario.

In our estimation, this fear is unlikely to manifest. Consider two points.

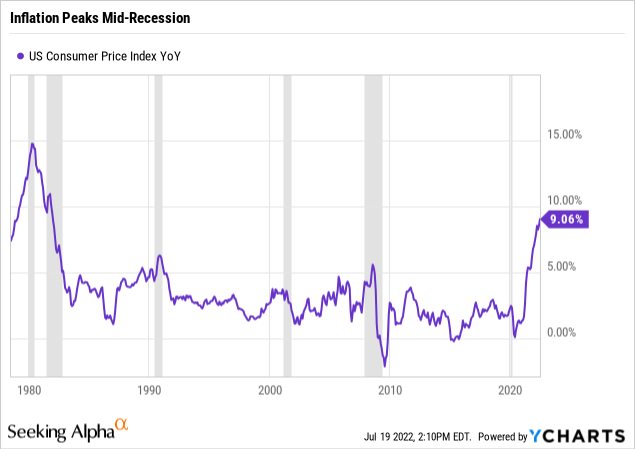

First, as pointed out by macro analyst Eric Basmajian, inflation as measured by the CPI almost always peaks in the middle of recessions, not before they start. This is true of periods wherein inflation is relatively benign such as the 2000s as well as periods in which inflation is running wild, such as the late 1970s and early 1980s.

Second, after every recession over the last century, including ones during which inflation was running hot, the rate of inflation declined. Recessions have an excellent track record of killing inflation, at least temporarily. They diminish demand, allow supply chains time to undo kinks, and give room for inventories to build back up.

If the economy goes into recession in the near future, it is virtually certain that the CPI will come down from its present lofty level. The only questions are (1) how much it will come down and (2) whether it will stay down.

Much the same story could be told about interest rates. After recessions, interest rates decline. There is a very clear track record here.

We go even further back with this chart in order to show that recessions knock interest rates lower in their wake even during secular inflationary periods. From the late 1960s to the early 1980s, inflation was in a secular uptrend. Even during this era, recessions caused Treasury rates to fall.

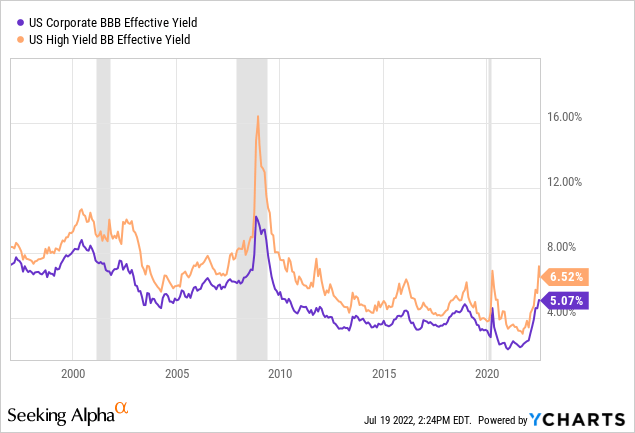

Corporate bond yields act in a similar, though not identical, way. During recessions, when capital markets crash and liquidity dries up, corporate bond yields spike as investors panic-sell for fear of rising defaults. But in the wake of recessions, typically for multiple years afterward, corporate bond yields sink, ending up lower than they were before the recession.

This pattern plays out over and over again. Corporate bond yields spike during (or, in 2000, immediately prior to) the recession, then decline thereafter.

The takeaways from this section, then, are:

- The Treasury yield spread is showing increasing likelihood of an oncoming recession in the near future.

- Recessions have an excellent track record of causing inflation and interest rates to fall in their wake.

- Though corporate bond yields spike during recessions (more specifically, market crashes and panics), they then almost always decline to lower levels than where they were before the recession.

Now, let’s discuss how REITs are well-positioned right now for all of this to be good news.

Rock Solid Balance Sheets To Withstand The Storm

If REITs had weak balance sheets, high debt levels, low interest coverage, short debt maturities, or ample floating rate loans, then the potential for corporate bond yields to spike during a recession could present grave danger.

But that is not the case.

If we are going into a recession, REITs do so with better preparation than they’ve had perhaps ever before in history.

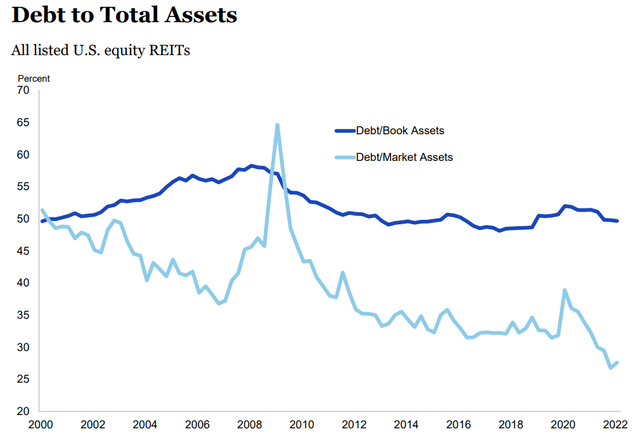

Take a look at REIT debt levels, which sit at or near their lowest levels ever in their history whether using book value or market value of assets.

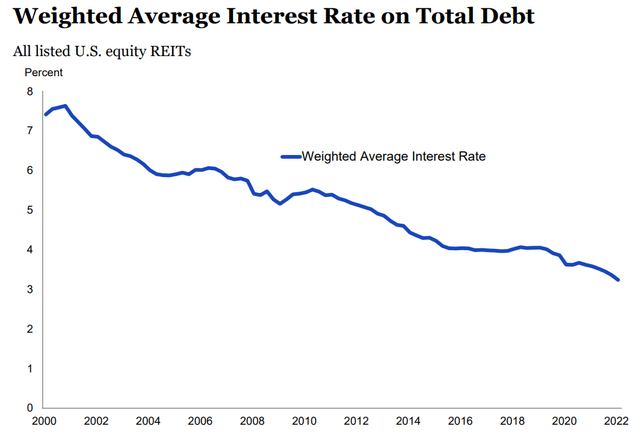

Moreover, REITs’ weighted average interest rate on total debt, including credit facilities and any floating rate debt, has declined steadily for the past two decades to its lowest point during that time.

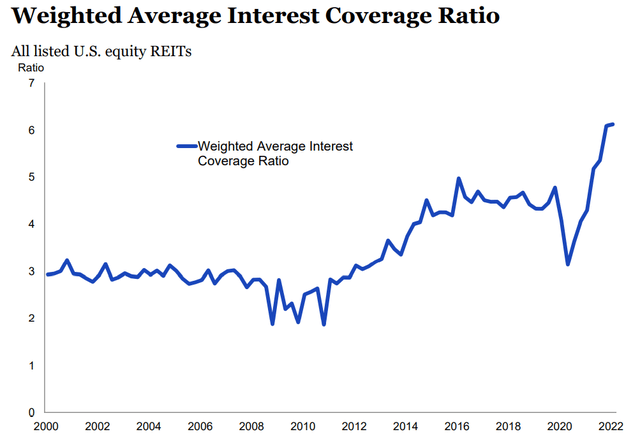

This combination of relatively low leverage and low weighted average interest rates has resulted in the highest interest coverage ratio at any time in the past few decades as well.

This means that REITs currently have an easier time servicing their debt than probably ever before in the history of REITs.

Note that interest coverage is roughly double the level where it stood going into the Great Recession in 2008.

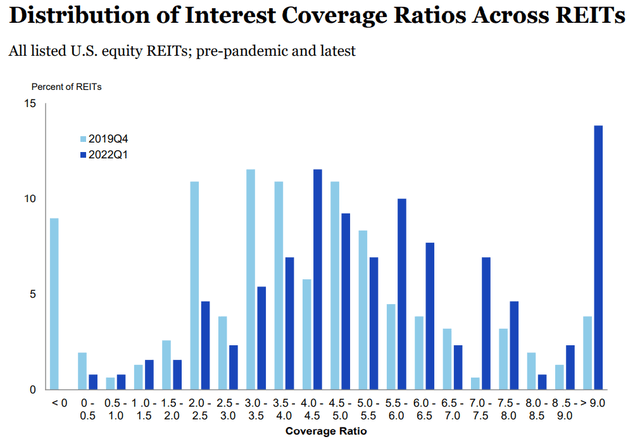

Even over the last few years, interest coverage has significantly improved. Compare the distribution of REITs with various interest coverage ratios in late 2019 to Q1 2022.

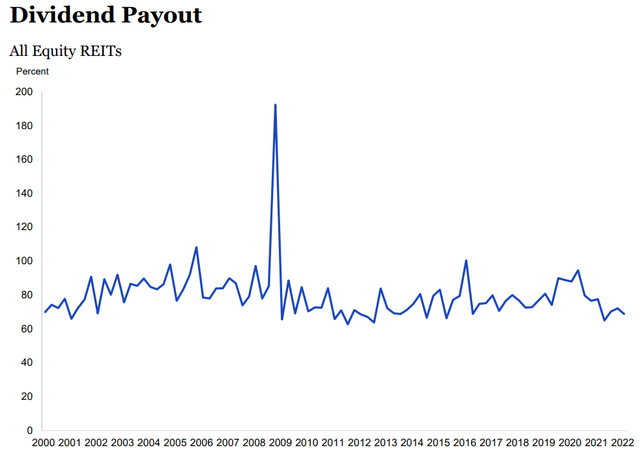

Perhaps best of all, since REITs are primarily income vehicles designed to allow retail investors to tap into cash flowing commercial real estate, the average REIT dividend payout ratio is sitting near its lowest level of any time in the last 22 years at around 70%.

That is a great signal of the safety of REIT dividends as well as their likelihood to continue growing even through a recession.

Putting The Pieces Together

So, when is bad news actually good news for REIT investors?

It’s when an oncoming recession appears likely to push interest rates down and crush problematically high inflation even while REITs are better prepared than ever to endure whatever pain the recession itself throws their way.

The good news is that, overall, REITs are ready to withstand the temporary pain of the recession and poised to benefit when that recession inevitably brings inflation and interest rates back down.

Our Favorite Recession-Ready REITs

At High Yield Landlord, we pride ourselves on creating and maintaining a well-balanced portfolio that performs well through recessions, expansions, high inflation, low inflation, rising interest rates, falling interest rates – almost any economic scenario.

But as we appear to be moving into a recession, two particular REITs stand out right now as good buys:

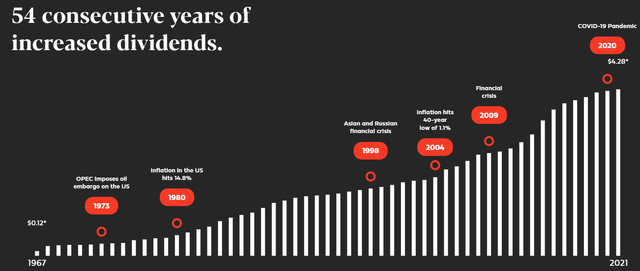

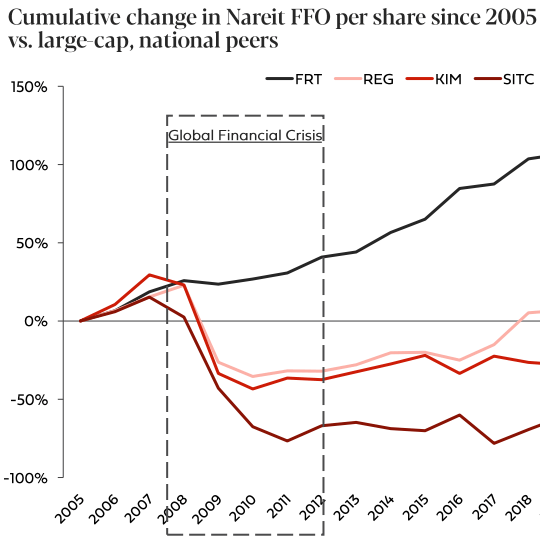

- Federal Realty Trust (FRT): This high-quality coastal shopping center and mixed-use retail REIT has a long track record of steady growth, conservative financial management, and recession-resistance, as exemplified by its 54 years of consecutive dividend growth. The REIT’s A-rated balance sheet and payout ratio in the low 70% range are strong indications of its safety. The 25%+ drop in price YTD presents a solid entry point.

FRT Presentation FRT Presentation

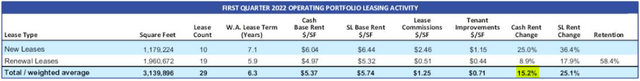

- STAG Industrial (STAG): The market punishes STAG, the value investor in the industrial real estate space with mostly single-tenant properties in secondary and tertiary markets, far too much in our opinion. The REIT is enjoying one of its best years ever in company history, with double-digit cash rent growth, falling leverage, and tenant demand still high. With a monthly dividend and a payout ratio in the high 60% range, STAG’s nearly 5% dividend yield is extremely attractive.

STAG Presentation STAG Presentation

While there are numerous attractive opportunities available to investors right now, we believe these two REITs are some of the finest both for inflation protection and recession resistance.

Be the first to comment