Joesboy/iStock via Getty Images

Earlier this year, I advised investors to steer clear of small oil tanker operator Imperial Petroleum (NASDAQ:IMPP, NASDAQ:IMPPP) after its recent spin-off from StealthGas (GASS) given the company’s stated intent to grow the fleet to the detriment of common equity holders.

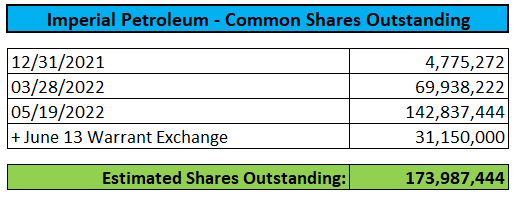

Over the past couple of months, the company has continued to dilute relentlessly, raising approximately $135 million in new capital and causing outstanding shares to increase by more than 3,500% (!):

Company SEC-Filings

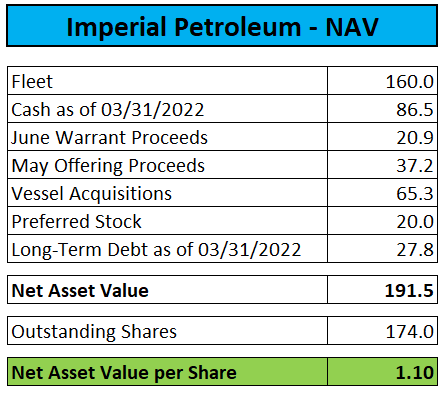

As a result, net asset value (“NAV”) per share has decreased from an initial $4.57 following the spin-off seven months ago to an estimated $1.10 today:

Company SEC-Filings / Compass Maritime

Assuming full exercise of outstanding in-the-money warrants, net asset value per share would be further reduced to approximately $0.88.

Clearly, the company is following the successful playbook of fellow junior shipper Castor Maritime (CTRM) which has managed to accumulate a fleet of 20 dry bulk carriers and 9 tankers over the past couple of years by relentlessly diluting common shareholders.

Very similar to Imperial Petroleum, the company raised hundreds of millions of dollars in a series of offerings of common shares and warrant sweeteners between 2020 and 2021 after momentum traders discovered the stock thus causing daily trading volume to explode.

In fact, Castor Maritime’s expansion was well-timed as dry bulk charter rates have been strong for much of the past two years and tanker rates recently recovered from multi-year lows due to dislocations caused by the Russian assault on Ukraine.

Consequently, the company has seen the value of its fleet increase substantially in recent quarters. In addition, Castor Maritime is generating meaningful amounts of cash from operations.

While the company has abstained from further diluting common shareholders in recent quarters, investors appear to remain wary of potential, additional equity offerings going forward as evidenced by the shares changing hands at a more than 70% discount to net asset value.

Imperial Petroleum’s peer Performance Shipping (PSHG) also has a long history of shareholder dilution and just recently raised new capital at an eye-catching 95% discount to net asset value per share.

Small dry bulk shippers Globus Maritime (GLBS) and OceanPal (OP) have also utilized similar capital raising schemes in recent quarters.

On Monday, Imperial Petroleum used some renewed momentum to raise an additional $20.9 million by reducing the exercise price of 31.15 million Class B warrant sweeteners issued in the March offering from $1.60 to $0.70.

As shares have traded well above $0.70 on outsized volume on both June 9 and June 10, I would assume that warrant holders hedged their gains by shorting the shares in advance.

But that’s not all (emphasis added by author):

In consideration for the immediate exercise of the Existing Warrants for cash, the Exercising Holders will receive new Class D warrants to purchase up to an aggregate of 31,150,000 shares of Common Stock (the “Class D Warrants”) in a private placement pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). Each Class D Warrant is immediately exercisable for one share of common stock at an exercise price of $0.80 per share and will expire five years from issuance. The form of Class D Warrant is filed as an exhibit to this report and is incorporated herein by reference.

In fact, there’s nothing that would prevent the company from reducing the exercise price for the newly issued 31.15 million Series D Warrants from $0.80 to whatever management deems appropriate to incentivize warrant holders to exercise as soon as possible.

Since February, Imperial Petroleum has raised approximately $135 million in new capital but despite the company being a favorite of the momentum crowd, the stock price has succumbed to the seemingly never-ending wave of new shares hitting the market on an almost monthly basis.

At Tuesday’s close, shares were down 76% since the beginning of the year and 93% from the $9.70 momentum high marked in early March.

The company has lost no time putting the new funds to work. In March, Imperial Petroleum announced the acquisition of two MR product tankers from Brave Maritime, a related party, for an aggregate $31 million.

Two weeks ago, the company agreed to acquire two Suezmax tankers for an aggregate purchase price of $46.8 million.

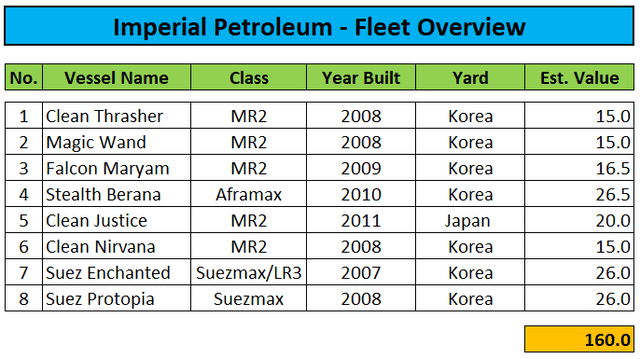

Accordingly, Imperial Petroleum’s fleet now consists of five MR tankers, two Suezmax tankers and one Aframax tanker:

Company SEC-Filings, Compass Maritime

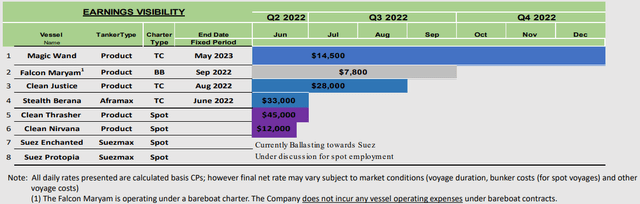

While tanker charter rates and second hand vessel values have increased materially in recent months, Q2 results will be impacted by a number of unfavorable legacy charter contracts and the fact that three of the recently acquired vessels have been delivered to the company rather late in the quarter.

For example, the MR tanker “Magic Wand” will be operating under a time charter contract at a rate of just $14,500 per day until May 2023, well below the average spot rate of $36,000 per day recorded last month.

The MR tanker “Falcon Maryam” will be operating under a bareboat charter agreement until the end of Q3 at a rate of $7,800. While the company does not incur any vessel operating expenses under bareboat contracts, the vessel would generate cash of up to $30,000 per day in the spot market right now.

The MR tanker “Clean Trasher” has been operating under a time charter contract at a rate of $14,500 per day until the end of May.

Lastly, the company’s recently acquired Suezmax tankers have not yet contributed to earnings as the “Suez Enchanted” is “currently ballasting towards Suez” and the “Suez Protopia” remains “under discussion for spot employment” according to the company’s updated fleet employment status:

Given these issues, cash generation in Q2 will remain somewhat limited but assuming the current rate environment to remain stable, Q3 should show more meaningful improvement with all recently acquired vessels available for employment.

Unfortunately, crude tanker rates have reversed course in recent weeks which doesn’t bode well for the new Suezmaxes and the Stealth Berana. That said, the Suez Enchanted appears to be a rare, coated Suezmax tanker (or “LR3”) also suitable for clean petroleum products.

On Tuesday, Imperial Petroleum reported anticipated, weak first quarter results. Subsequently, management conducted a memorable conference call with CEO Harry Vafias openly showing his total disregard for common shareholders by booting participants from the call and telling unhappy investors that they “are not obliged to keep the stock“.

Plenty of retail investors attended the call with one of them outright demanding the CEO “to hang up the phone the next time Maxim calls” and to “buy some more boats with some money from a bank and not me“.

In addition, management made quite clear that more equity will be issued to accomplish the company’s aggressive fleet expansion targets:

Unidentified Analyst

(…) Also, how do you plan on paying, look to expand to 18 ships? How do you look to do that in the foreseeable future through more equity raises?

Harry Vafias

Equity raises and through the profits generated by the current ships plus the debt raised on the current ships.

One caller outright linked the company’s course of action to close peer Performance Shipping, another serious diluter which I have covered for a number of years already.

Another caller complained about Monday’s warrant exchange as the company entered into warrant exercise inducement offer letters only with some large, accredited investors while holders of the remaining, approximately 11.8 million Series B Warrants were left holding the bag.

I would urge readers to take the time and go over the question-and-answer part of the transcript to get an impression of the astonishing back and forth between the CEO and a number of upset retail investors.

Please keep in mind that following the massive dilution, Mr. Vafias is no longer a significant common shareholder albeit he continues to own approximately 21.6% of the company’s 8.75% Series A Cumulative Redeemable Perpetual Preferred Shares (“the Series A Preferred Shares”).

On the flip side, the Vafias family extracts fees from Imperial Petroleum for providing basically all management services to the company, quite substantial in my opinion (emphasis added by author):

17. Management Fee

17.01 In consideration of the obligations undertaken by Managers under this Agreement, Owner shall pay to the Managers a commission fee equal to one and a quarter of one per cent (1.25%) calculated on the gross freight, demurrage and charter hire obtained for the employment of the Vessels on contracts or charter parties entered into by Managers during the term of this Agreement, payable to Managers on the dates when such freight demurrage of charter-hire, as the case may be, is paid or otherwise collected.

17.02 In addition to the commission fee due to Managers under Clause 17.01 above and, for as long as this Agreement is in effect, the Owner shall also pay to the Managers a Management Fee of US$ 440.- per day payable monthly in advance, for vessels operating in the spot market or on a time charter. For Vessels operating on bareboat charter, the Owner shall pay to the Managers a management fee of US $ 125.- per day per vessel.

17.03 In addition to the commission fee due to Managers under Clause 17.01 above Owner shall pay to the Managers a commission fee equal to one per cent (1.00%) calculated on the MOA price for the Vessels being bought or sold for and on behalf of the Owner.

Among other things, the Vafias family is pocketing a 1% commission fee for each vessel being bought or sold.

Suffice to say, management’s interests do not appear to be aligned with common shareholders at this point. In fact, there’s potentially a huge incentive for the Vafias family to grow the fleet as quickly as possible to maximize fees and commissions.

That said, the ongoing dilution has resulted in the company’s 8.75% Series A Preferred Shares (IMPPP) looking increasingly attractive as there’s virtually no near- and medium-term risk to the dividend payments anymore. At the current price, the shares are providing investors with a rather safe 11% annual yield.

In addition, there’s a chance for some decent near-term capital gains as the company might use some of the recently raised funds to reduce its borrowing costs and redeem the Series A Preferred Shares on or after June 30 as stated in the company’s F-1 (page 82):

We may redeem, at our option, in whole or from time to time in part, the Series A Preferred Stock (i) on or after June 30, 2022 and prior to June 30, 2023, at a price equal to $26.00 per Series A Preferred Stock, (ii) on or after June 30, 2023 and prior to June 30, 2024, at a price equal to $25.75 per Series A Preferred Stock, (iii) on or after June 30, 2024 and prior to June 30, 2025, at a price equal to $25.50 per Series A Preferred Stock, (iv) on or after June 30, 2025 and prior to June 30, 2026, at a price equal to $25.25 per Series A Preferred Stock, and (v) on or after June 30, 2026, at a price equal to $25.00 per Series A Preferred Stock, plus, in each case, an amount equal to all accumulated and unpaid dividends thereon to (but not including) the date of redemption, whether or not declared. Any such optional redemption may be effected only out of funds legally available for such purpose.

Unfortunately, trading volume in the preferred shares continues to be very thin.

Bottom Line

CEO Harry Vafias appears to be following the footsteps of George Economou (DryShips) and Petros Panagiotidis (Castor Maritime) by aggressively growing his company to the detriment of common shareholders.

After Tuesday’s sell-off, the company’s common shares are trading at an approximately 44% discount to estimated NAV but investors should remain wary of the massive warrant overhang. Assuming full exercise of all in-the-money warrants, net asset value would decrease to approximately $0.88 per share.

Also keep in mind that nothing prevents the company from reducing exercise prices of outstanding warrants in a similar way like experienced on Monday and in the words of CEO Harry Vafias on the call “We have the right to do as many offerings as we want“.

With management apparently being incentivized to quickly grow the fleet at virtually any price, common shareholders are likely to suffer further dilution sooner rather than later.

Please also note that shipping companies having utilized similar capital raising schemes like Performance Shipping, Castor Maritime, Globus Maritime and OceanPal trade at substantially higher discounts to NAV.

Given these issues, common equityholders should consider selling their shares into the next momentum rally and moving on.

That said, the company’s strengthened financially profile and potential for some decent, near-term capital gains warrants a closer look at Imperial Petroleum’s Series A Preferred Shares.

Be the first to comment