alvarez

Background

Imperial Petroleum (NASDAQ:NASDAQ:IMPP) provides international seaborne transportation services to oil producers, refineries, and commodities traders. It owns 10 vessels and is in the business of transporting refined petroleum products such as gasoline, diesel, fuel oil and jet fuel, as well as edible oils and chemicals. IMPP was spun off from StealthGas Inc. in December 2021 as they decided to focus on their LPG carrier business. The company is incorporated in Greece.

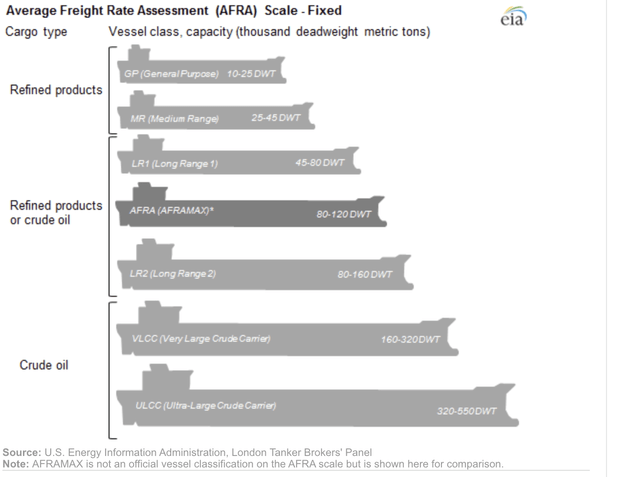

Prior to January 2021 IMPP mostly operated medium range ships (MR) as three of the four ships they owned were such with the Stealth Berana being the only AfraMax ship. The below diagram from the EIA provides a good illustration of the capacities of the various tanker sizes which is important for determining the market rates discussed later.

Oil tanker sizes range from general purpose to ultra-large crude carriers on AFRA scale (EIA)

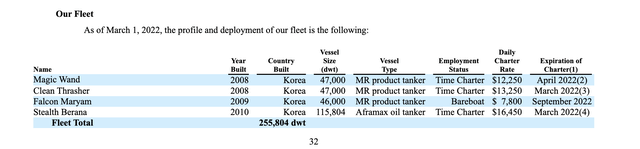

2021 Annual Report (Imperial Petroleum Inc.)

The MR ships have typically been time charter contracts which tends to make revenues fluctuate less. On a time charter, the charterer hires the ship for a stated period of time, for a specified round-trip voyage, or, occasionally, for a stated one-way voyage, the rate of hire being expressed in terms of so much per ton deadweight per month. This contrasts with the most common type of contract which is a voyage charter where the ship is chartered for a one-way voyage between specific ports with a specified cargo at a negotiated rate of freight. On a voyage charter the owner bears all the expenses of the voyage (subject to agreement about costs of loading and discharging), on time charter the charterer bears the cost of bunkers and stores consumed. Finally on the bareboat charter, the owner of the ship delivers it up to the charterer for the agreed period without crew, stores, insurance, or any other provision. Contracts can also be arranged on a lump-sum basis, when an owner agrees to ship a given quantity of a stated cargo from one port to another for a stated sum of money.

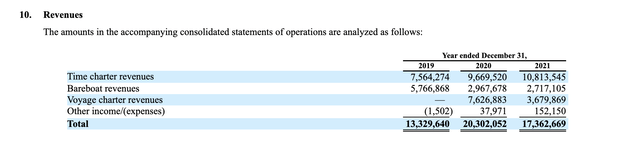

2021 Annual Report (Imperial Petroleum Inc.)

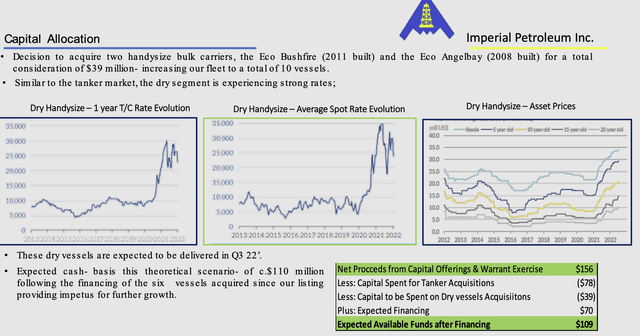

In 2022, IMPP acquired two larger Suezmax tankers for an aggregate purchase price of $46.8MM and two MR product tankers from a related party for an aggregate purchase price of $31.0MM. In July they made a strategic decision to diversify into dry bulk storage by acquiring the Eco Bushfire and the Eco Angelbay containers for a total consideration of $39MM; both vessels are Japanese built with an aggregate capacity of 64,000 dwt.

FINANCIAL & OPERATING RESULTS Q2 22’ (Imperial Petroleum Inc. )

Investment Thesis

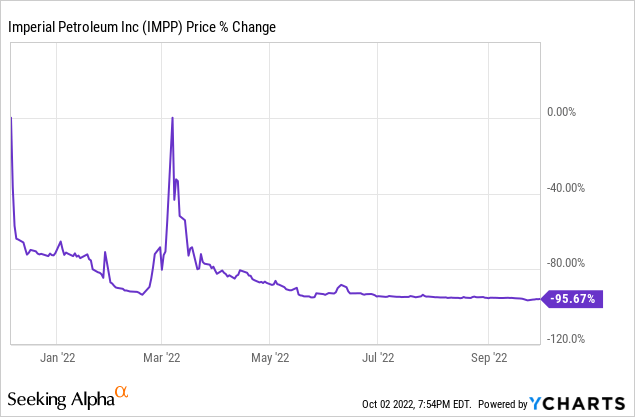

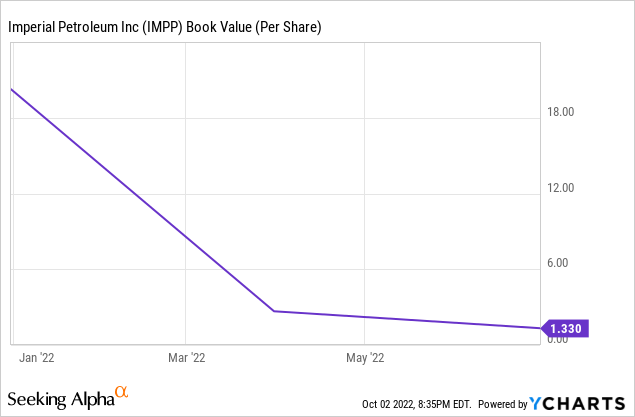

IMPP common stock has taken a drubbing since its spin-off falling 95% since January, with the exception of March 2022 where investors showed some hope. The common stock has fallen to only 22% of its TBV. It may seem like this opportunity is too good to be true and that is because it likely is.

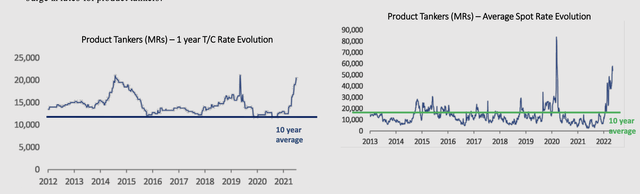

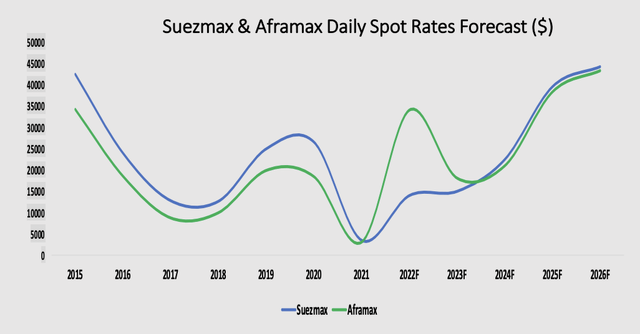

First of all shipping rates have been all over the place the last 10 years with larger containers being the Suezmax and Aframax exhibiting even greater volatility. Thankfully rates are on an uptrend which will allow for excess free cash flows at least in the near term. Four customers account for 60% of revenues and the average age of their fleet is over 13 years which makes it more difficult to compete with more technologically advanced tankers for charters from oil majors and other top-tier charterers which can force them to charter to less creditworthy customers.

FINANCIAL & OPERATING RESULTS Q2 22’ (Imperial Petroleum Inc. )

FINANCIAL & OPERATING RESULTS Q2 22’ (Imperial Petroleum Inc. )

IMPP has a management agreement with Stealth Maritime, pursuant to which Stealth Maritime provides technical, administrative, commercial and certain other services. Stealth Maritime is a leading ship-management company based in Greece, established in 1999 in order to provide shipping companies with a range of services. In relation to the technical services, Stealth Maritime is responsible for arranging for the crewing of the vessels, the day to day operations, inspections and vetting, maintenance, repairs, dry-docking and insurance. Administrative functions include, but are not limited to accounting, back-office, reporting, legal and secretarial services. In addition, Stealth Maritime provides services for the chartering of vessels and monitoring thereof, freight collection, and sale and purchase. The initial term of the management agreement with Stealth Maritime will expire on December 31, 2025. The loss of Stealth Maritime’s services or its failure to perform its obligations properly for financial or other reasons could materially and adversely affect their business and the results of operations, including the potential loss of oil major approvals to conduct business and in turn ability to employ our vessels charters with such oil majors.

Although these factors discussed are major risks, I do not think they fully explain the substantial discount to BV. Let’s discuss how IMPP went from 4 ships to 10.

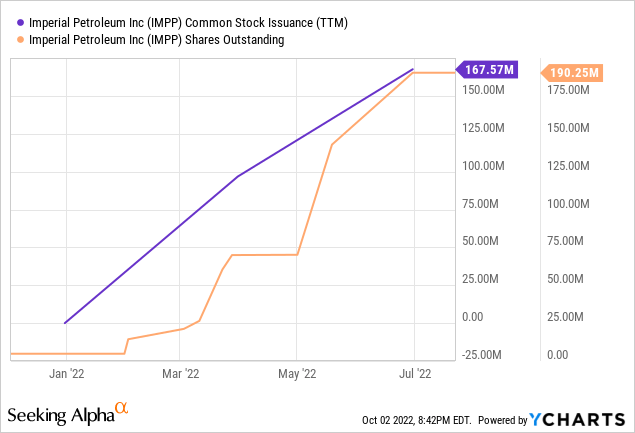

On February 2, 2022, we completed an underwritten public offering of 11,040,000 units for $1.25 per unit, each unit consisting of (i) one Common Share of the Company and ((ii)) one Class A Warrant (a “Class A Warrant”) to purchase one Common Share at an exercise price of $1.25 per Common Share. We also issued 552,000 underwriter warrants to the representative of the underwriters to purchase up to an aggregate of 552,000 Common Shares at an exercise price of $1.375 per share. As of March 28, 2022, an aggregate of 10,997,000 Class A Warrants had been exercised for 10,997,000 of our common shares, resulting in proceeds to us of $13,746,250. A total of 43,000 Class A Warrants, with an exercise price of $1.25 per share, remained outstanding as of March 28, 2022

In March 2022, we completed an underwritten public offering, including the full exercise of the underwriter’s overallotment option, of 43,124,950 units for $1.60 per unit, each unit consisting of (i) one Common Share of the Company (or pre-funded warrants, all of which were subsequently exercised for common shares, in the case of 3,900,000 units) and ((ii)) one Class B Warrant (a “Class B Warrant”) to purchase one Common Share at an exercise price of $1.60 per Common Share. We also issued 1,724,998 underwriter warrants to the representative of the underwriters to purchase up to an aggregate of 1,724,998 Common Shares at an exercise price of $2.00 per share.

-Source: Imperial Petroleum

As the average share price was around $2/share in January so it is perplexing that they would accept $1.20/share in stock and $1.25/share in warrants which is only 8% of its book value. The share price was well above $3/share in March 2022 and yet stock was issued again at $1.60/share and warrants at $2.00/share and the stock was issued at only 26% of its book value which is even more perplexing as price/BV was well over 1:1 at the time. In 2022 IMPP has managed to issue ~185 Million shares which is more than 39x what they began the year with and only raised $167MM in proceeds net of fees which has caused BV/share to decline from $18/share to $1.33/share and would look even worse if the warrants were fully exercised.

If anything at these depressed prices relative to BV a more prudent management team would be initiating a share buyback program rather than issuing more. The only explanation for this is Stealth Maritime provides all management services to IMPFF. IMPP pays Stealth Maritime a fixed management fee of $440 per vessel operating under a voyage or time charter per day on a monthly basis in advance. IMPP also pays a fixed fee of $125 per vessel per day for each vessel operating on bareboat charter. They are also obligated to pay Stealth Maritime a fee equal to 1.25% of the gross freight, demurrage and charter hire collected from the employment of vessels. Stealth Maritime will also earn a fee equal to 1.0% of the contract price of any vessel bought or sold by them on their behalf. These fees are quite hefty at 2-3% of revenue on an annual basis.

Surprise, surprise, as major shareholder of both IMPP and Stealth Maritime is Henry Viafas and therefore is more incentivized to expand the fleet rather than increase returns to shareholders, even if it means issuing shares at nosebleed prices. Investors may find this too callous to believe but remember that $39 Million in proceeds went towards buying two aged containers in dry bulk storage in a market that is running out of steam as both vessels are over 10 years old.

FINANCIAL & OPERATING RESULTS Q2 22’ (Imperial Petroleum Inc. )

The Preferred Shares

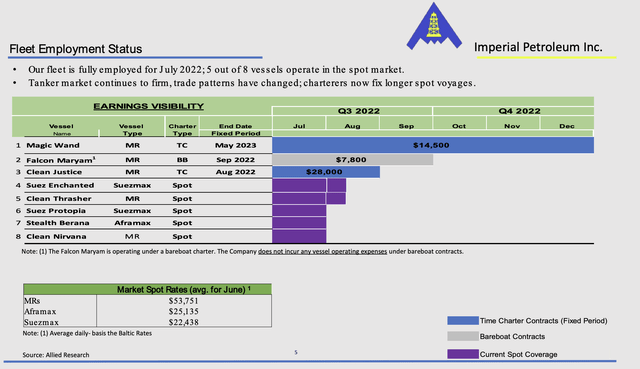

Despite the abysmal management team, the outlook for the product tankers remains bullish. Record high tanker rates appear to be sustainable in the near term as a result of world oil demand expanding at a time when global oil inventories are low as the war In Ukraine has tightened the market even further causing a surge in rates for product tankers. This is combined with a significant amount (11%) of tankers over 20 years of age being sold for scraps in 2022.

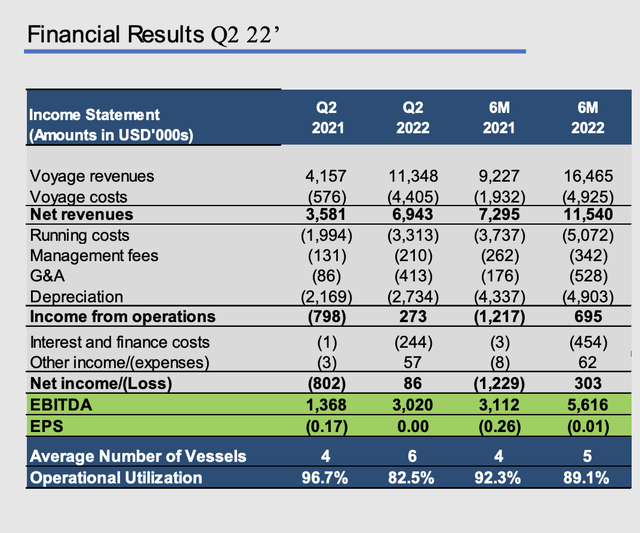

The Magic Wand tanker will be stuck receiving its paltry rate of $14,500/day relative to the spot rate of $53,751 for the remainder of the year. The Falcon Maryam (which is a bareboat anyway) and the Clean Justice vessels have their current contracts expiring before Q3 2022 ends and IMPP should be able to charter at higher rates for Q4. The remainder of the vessels are voyage charters and therefore receive spot rates. Therefore, we should expect EBITDA to come in at, at least $10MM for fiscal 2022 which would be double that realized at 2021 FYE. IMPP has to pay $4MM per year in principal on LTD and $8 Million in 2026 before maturity. The 8.75% Series A Preferred Shares (NASDAQ:NASDAQ:IMPPP) come with $130,000 in annual dividend payments. LTD and preferred share payments are well covered by 2021 YE EBITDA of $5MM when MR rates averaged only $15,000/day and with only four vessels.

FINANCIAL & OPERATING RESULTS Q2 22’ (Imperial Petroleum Inc. )

The Series A shares currently yield ~11% at $19.50/share, a 22% discount to par (liquidation value). The shares are cumulative which means if dividend payments are missed they will have to be paid. The shares are redeemable but at favourable terms above liquidation even:

We may redeem, at our option, in whole or from time to time in part, the Series A Preferred Shares (i) on or after June 30, 2022 and prior to June 30, 2023, at a price equal to $26.00 per Series A Preferred Share, ((ii)) on or after June 30, 2023 and prior to June 30, 2024, at a price equal to $25.75 per Series A Preferred Share, ((iii)) on or after June 30, 2024 and prior to June 30, 2025, at a price equal to $25.50 per Series A Preferred Share, ((iv)) on or after June 30, 2025 and prior to June 30, 2026, at a price equal to $25.25 per Series A Preferred Share, and ((v)) on or after June 30, 2026, at a price equal to $25.00 per Series A Preferred Share, plus, in each case, an amount equal to all accumulated and unpaid dividends thereon to (but not including) the date of redemption, whether or not declared. Any such optional redemption may be effected only out of funds legally available for such purpose.

-Source: Imperial Petroleum

Even if shares are not redeemed before 2026 as I expect management would prefer to use excess free cash flows to expand the fleet in the near term, shareholders will realize an immediate return of 28% while you get an 11% yield to wait.

Concluding remarks

It is possible that the high rates in the market we are seeing today will boost tangible book value per share in the near term and offset the massive dilution that the share issuances have caused. That being said I don’t think the interests of management are aligned with shareholders and continually issuing shares well below book value is the fastest way to the poor house for common shareholder investors. The preferred shares are not impacted by these travesties and lower spot rates will be sufficient to repay debt and preferred share dividends.

Be the first to comment