AsiaVision/E+ via Getty Images

Shares of aspiring autoimmune disease player Immunovant (NASDAQ:IMVT) have lost roughly half their value since coming to the Nasdaq in late 2019 via merger with SPAC Health Sciences Acquisitions Company (sponsored by RTW Investments).

While year to date performance is flat, share price has risen by over 70% during the past month thanks to the announcement of a new anti-FcRn candidate offering best-in-class IgG reduction, simple subcutaneous route of administration and lacking elevated cholesterol/LDL issues of predecessor batoclimab.

As prior NHP (non human primate) results have translated consistently into human data in the clinic, including for former ROTY winner and FcRn leader argenx (ARGX), I look forward to revisiting this one ahead of mid 2023 data update to determine if there’s an opportunity for us to capitalize on.

Chart

FinViz

Figure 1: IMVT weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares rise to a high of $50 as the anti-FcRn on the whole received a lot of attention with the success of frontrunner argenx. However, share price quickly fell to the mid teens and ultimately mid-single digits after a February 2021 announcement of voluntary pause for lead program batoclimab citing elevated total cholesterol and LDL levels in patients treated. This was followed by executive departures, such as the Chief Medical Officer (often a red flag). The program was restarted, but burdensome exclusion criteria in trials coupled with potential co-administration with statins make this drug candidate seem very niche with highly limited market opportunity. Recently, the share price has rebounded back to high teen digits thanks to introduction of follow-up drug candidate IMVT-1402, which offers potentially best-in-class efficacy without the safety/tolerability requirements of its predecessor. My initial take is that investors would do well to buy dips in the near term, as this story is in very early innings (despite management’s tale that batoclimab will continue in the clinic, I think that eventually it will be replaced entirely by IMVT-1402).

Overview

Founded in 2018 with headquarters in New York (124 employees), Immunovant currently sports enterprise value of ~$800M and Q2 cash position of $494M providing them operational runway into 2025.

This does not include the $75M in gross proceeds from recent private placement (with institutional participation from the likes of Logos Capital, Deep Track Capital, Frazier Life Sciences, TCGX, BVF Partners, Commodore Capital and an undisclosed healthcare specialist fund.

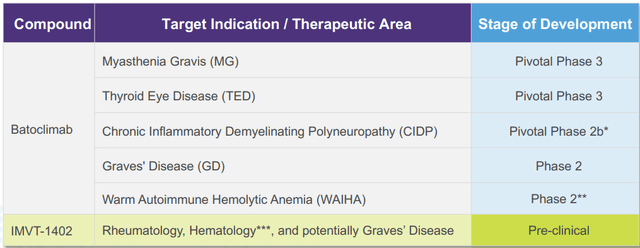

In September’s webcast for Wainwright Investment Conference, the CEO notes that for lead candidate batoclimab they have expanded development to two new indications (CIDP and Graves’ Disease). They view these indications as complementary to lead opportunities in myasthenia gravis (MG) and thyroid eye disease (TED). The company is fully funded into 2025.

Corporate Slides

Figure 2: Pipeline (Source: corporate presentation)

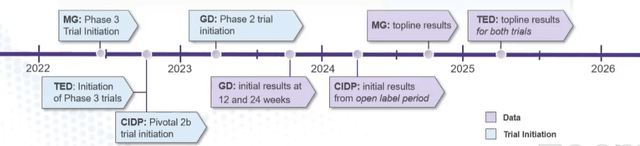

They expect data in 2H 23 and from there at six month intervals across indications (most notable I think will be topline MG results 2H 24 and topline pivotal TED studies 1H 25). However, my caveat is that those are highly competitive indications and I would not be surprised if estimated trial timelines are drawn out even longer (hard time recruiting patients).

Corporate Slides

Figure 3: Cadence of data across all indications (Source: corporate presentation)

As CIDP is a complex condition, trial needs to be well-designed and trials not using enrichment strategy have failed, historically. So, Immunovant is improving on an enrichment strategy introduced by argenx. The way these trials are done is that people who are stable on IVIG or steroids have their standard of care removed, then during washout period only participants who worsen go to the next period where they receive open label therapy and then only those patients who improve go on to period 2. Period 2 is the regulatory period where there is a blinded, placebo-controlled design with withdrawal. Without the washout period, there is a risk that people enrolled are not active and placebo arm doesn’t get worse (trial doesn’t show a difference). Immunovant is adding a third enrichment which is only doing primary analysis on IVIG cohort (group with largest effect size because they can be fully washed out, unlike steroids where it is difficult to fully taper them). Another enhancement is studying two doses in open-label period to better understand relationship between IgG lowering and clinical response.

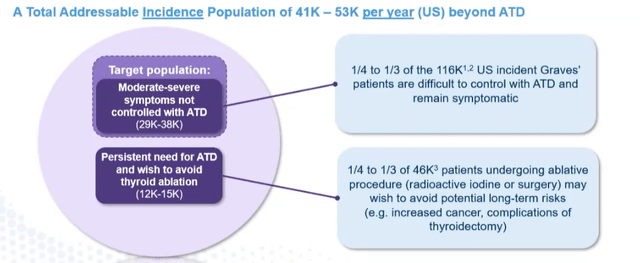

For Graves’ disease, biology is straightforward but size of the population is less appreciated by investors. There has not been a lot of innovation in this area, and there are 116,000 incident patients in the US. What’s less well-described is percentage of people who don’t achieve full efficacy on anti-thyroid drugs (1/3rd to 1/4th of incident patients, symptoms can’t be adequately controlled and abnormally high thyroid hormones are associated with symptoms). The only options for this group are tough it out, get surgery or radio ablation.

Corporate Slides

Figure 4: Total addressable incidence population (Source: corporate presentation)

Both surgery and radio ablation are becoming less popular due to long term problems associated with them, so opportunity here is attractive and there is obvious synergy with the TED indication.

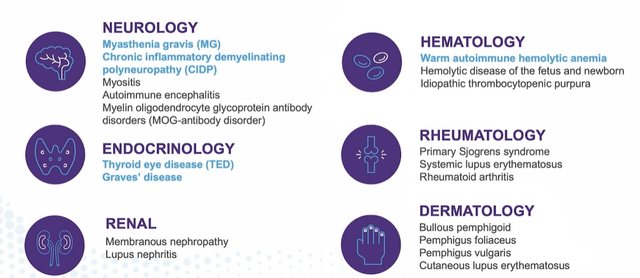

We are reminded that the company is choosing from a broad menu of indications they could address (20+), so to filter down to lead opportunities they focused on likelihood of technical success (how strong the evidence is that an anti-FcRn will work in the condition) and secondly the market opportunity based on degree of unmet need and size of addressable population. CIDP and Graves’ were chosen to follow lead opportunities given overlap (ie. having two indications in neurology).

Endocrinologists are increasingly playing a role in management of TED and are the only physicians relevant in Graves’ disease (the predecessor condition to TED). As for competitive positioning versus Horizon Therapeutics’ (HZNP) Tepezza, slated to do up to $3B or more in peak sales as I recall, CEO notes that if Immunovant has success in both indications clinically they will have a strong foothold in endocrinology.

In CIDP, they are moving directly into a pivotal study yet lack derisking phase 2 data as they possess with TED. CEO states that to move into a pivotal study, they need to be confident in three things (dose, study design and effect size). In MG, CIDP and TED study design was well-understood including copying or building on designs from competitors like Tepezza. Dose was well-characterized and effect size was reasonably estimated whether from own or competitor data. Key challenge for Graves’ disease is trial design from standpoint of anti-thyroid drugs (taking people on them, taper them off in first part) so that’s why they are taking their time instead of rushing into phase 3. CIDP and MG are very related (neuromuscular specialists generally treat both), but they are pretty different from patient standpoint as CIDP opportunity for argenx stemmed from switching people from IVIG to Vyvgart. So, when/if Immunovant launches patients will have been on Vyvgart for a while and differentiation could come from deeper IgG lowering and simple subcutaneous dosing (I remain skeptical that this will be enough differentiation to result in a successful launch). For CIDP, when patients miss their medication they get worse slowly but predictably. For MG it’s different, as patients get a lot worse when they pause indication (worried about a severe flare). In other words, in MG patients are less likely to change drugs if current treatment is working well for them (thus the opportunity comes from people needing a new therapy and not from Vyvgart switches).

CEO indicated that WAIHA program is still in the works but lower priority (sounds to me like they know they won’t be able to catch up with competition). They feel confident in dose and effect size, but want to make sure they have a level of agreement with the FDA on trial design (potential improvements to be made) before moving forward (Rigel trial failed because of high placebo response). Hopefully they get that feedback from the FDA in the latter part of this year. Immunovant’s prior WAIHA study was pretty small with five patients and only three of whom finished (data is suggestive but far from being solid).

Corporate Slides

Figure 5: Broad potential in autoimmune disease for FcRn inhibition (Source: corporate presentation)

As for adding new programs, CEO is forthright in noting that some indications have more technical risk, while others have more commercial risk or competitive pressure. They are pursuing indications that have best combined probability of technical success and commercial potential based on unmet need and addressable population. Batoclimab can deliver deepest IgG reduction with simple subcutaneous device (well-suited to certain diseases versus other indications where they are alone but rationale is modest at best).

As for the LDL signal and tolerability of the drug’s profile, they’ve put in place a simple safety and monitoring program to execute in trials. As for indication selection, CEO states that primary driver of choice of medication will be efficacy (matters more than tolerability or route of administration). On this last point, I do not agree. For TED with fixed duration of therapy, there is less concern in regard to albumin and LDL. For MG with induction and maintenance therapy (higher dose is shorter), that’s a good fit as well (again, highly competitive indication where I’m less inclined to degree).

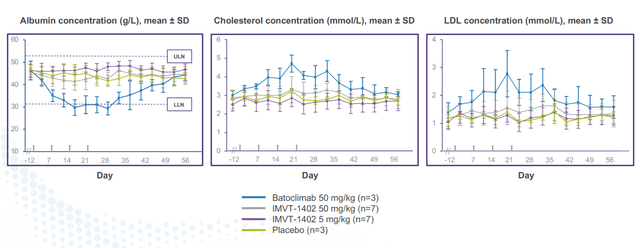

Thesis-Changing News

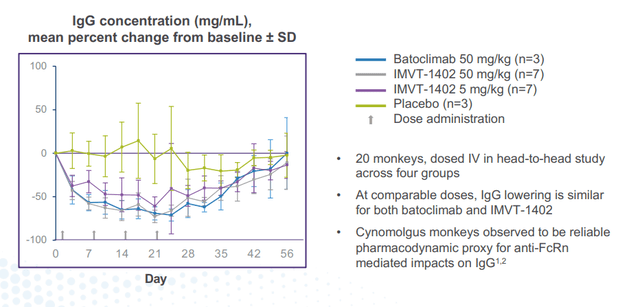

On September 28th, Immunovant announced a novel anti-FcRn candidate, IMVT-1402. At first glance I would have thought share price would take a hit given this could be seen as an admission that lead candidate batoclimab lacks a future or will be a niche product at best. However, share price nearly doubled as the market focused on 1402’s ability to offer best-in-class IgG reduction coupled with subcutaneous administration while lacking the tolerability issues of its predecessor (minimal or no impact on levels of albumin and LDL in animal studies). Management plans to accelerate development of this candidate with phase 1 trial to start in early 2023.

Corporate Slides

Figure 6: 1402 and batoclimab show similar maximal IgG reduction (Source: corporate presentation)

Management spins this as having a combined franchise of drug candidates providing multiple paths to value creation, but again I think the ultimate plan is for 1402 to take over and batoclimab to quietly be swept under the rug at some point. Importantly, the new candidate is expected to have composition of matter protection through at least 2042. I do agree with the case they argue that patient level data from batoclimab could complement the strength of IgG as a biomarker and allow for accelerated development of 1402 directly into pivotal studies after phase 1 results come out. On the other hand, I think it’s a stretch to state that batoclimab will allow for faster cash flow achieved by launch (to my eyes will be a cash burning asset due to tolerability concerns).

corporate slides

Figure 7: 1402 and placebo demonstrated similar albumin and LDL in head-to-head monkey study (Source: corporate presentation)

In the associated investor day presentation from Roivant, management notes that IMVT-1402 can be accelerated into late-stage studies not only on the shoulders of batoclimab data, but also clinical results generated by the rest of the anti-FcRn class. Data timeline (to be reported in mid 2023) assumes FDA gives green light to the IND filing in early 2023 (potential risk factor as this could be pushed back). FcRn class is attractive from a franchise standpoint as IgG reduction is a well-established biomarker with over 10 clinical studies showing correlation between IgG lowering and clinical response. This increases the ability to apply learning across development programs for making decisions such as study design and disease selection. Heterogeneity across conditions treated means that different patients require varying degrees of IgG reduction to affect their disease (indications needing maximal reduction could be most appealing for developing IMVT-1402 in). In some cases a deep IgG reduction (ie 80%+) is needed for only a short period of time (12-week induction therapy or during four weeks of rescue therapy). In other cases, the need for deeper IgG reduction will be longer.

Other Information

For the quarter ended June 30th, the company reported cash and equivalents of $427M (does not include recent $75M financing). Net loss rose by about a third to $40.4M, while research & development expenses rose considerably to $28.4M. G&A costs came in slightly elevated at $11.9M, with management guiding for cash runway into 2025. Accumulated deficit since inception of over $355M seems reasonable based on where the pipeline has progressed to date and being founded four years ago.

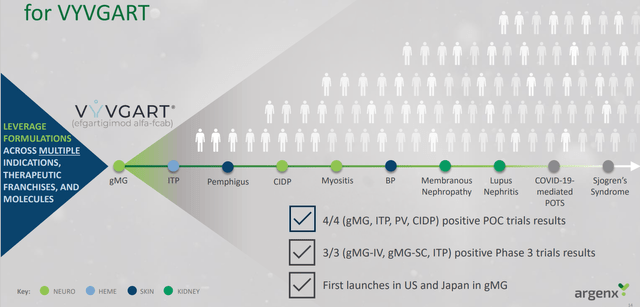

As for competitors in the space, consider that argenx has 15 indications commercially approved or in development for efgartigimod. Q2 sales for Vygart continue to be strong out of the gate at $75M, and three key data sets from pivotal studies are expected in 2023 (ITP, CIDP and PV).

argenx slides

Figure 8: Vygart well in the lead for a broad variety of indications with additional opportunities on deck (Source: argenx slides)

Immunovant bulls argue that the company will have success as a fast follower, while bears/skeptics rightly point out just how far in front argenx is and how hard it could be for the small upstart to catch up to them (or show sufficient clinical differentiation to spur patient switches or change in physician practice for anti-FcRn naive patients). Also, keep in mind Johnson & Johnson (JNJ) continues full steam ahead with nipocalimab (acquired via Momenta Pharmaceuticals buyout with $6.5 billion price tag). On clinical trials gov website, I see seven studies evaluating nipocalimab that are currently recruiting patients across indications such as MG, CIDP, myositis, systemic lupus erythematosus, Sjogren’s syndrome and WAIHA.

On the prior call I touched on above, I liked how the analyst framed the landscape, noting that competitors are “running the table” right now (nice way of saying that Immunovant is way behind). Janssen’s nipocalimab and argenx’ efgartigimod put considerable pressure on Immunovant to catch up, but the CEO stated in higher risk rheumatology indications there can be an advantage to being second (learn from competitor data, what’s working and elements of trial design). For other indications like MG where it’s well established that anti-FcRn is an ideal approach, it’s about getting to market as fast as they can (beachhead indication). Janssen is moving into RA, lupus and Sjogren’s (potentially mediated by auto antibodies and immune complex, new area of biology that could be interesting for anti-FcRn).

As for institutional investors of note, Deep Track Capital owns a 5.8% stake in the company. Previously I noted that in the recent financing, there was substantial participation from funds (Logos Capital, Deep Track Capital, Frazier Life Sciences, TCGX, BVF Partners, Commodore Capital and an undisclosed healthcare specialist fund).

As for insiders, I see a lot of sales over the past year and just a few smaller purchases (not conviction-sized, just for optics it would seem).

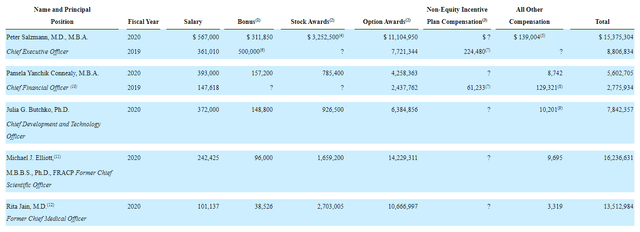

As for relevant leadership experience, CEO Peter Salzmann served prior as Global Development Leader in Immunology at Eli Lilly. CFO Renee Barnett also served prior at Lilly including as CFO of Lilly Austria and Switzerland. Chief Development Officer Julia Butchko served prior as Chief of Staff for the $4 billion Immunology and Neuroscience businesses at Lilly. Other members of management hail from the likes of Janssen, Bristol-Myers Squibb, Amgen and CSL Behring to name a few (I appreciate the depth of leadership team, which I consider a green flag).

Moving on to executive compensation, the cash portion of salaries seems reasonable on the whole, though the total for CEO (including bonus) appears excessive to my eyes at nearly $900k. In certain cases below stock and especially option awards appear on the high side as well.

Proxy filing

Figure 9: Executive compensation table (Source:Compensation table)

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), the development timeline of RSL/HanAll agreement is interesting. Immunovant entered into the license in December 2017 for batoclimab and next-generation antibodies. In May 2019 they achieved first development milestone ($10M payment) and Immunovant remains on the hook for up to $442M in milestone events and is obligated to pay HanAll tiered royalties ranging from the mid-single digits to mid-teens percentage of net sales of licensed products.

Final Thoughts

To conclude, previously I was not interested in this name due to what I perceived as insufficient clinical differentiation for batoclimab along with tolerability challenges that would relegate it to being a niche product at best. On the other hand, argenx was a prior ROTY winner that I wish I’d shown more patience with and the anti-FcRn place appears poised to address a wide variety of diseases and indications (room for multiple players to do well). With the introduction of IMVT-1402, it appears that Immunovant could achieve the best of both worlds in terms of deepest IgG reductions and clean safety profile (absence of cholesterol/LDL effect). Assuming clinical timelines remain on track, I would think mid 2023 data would be an important derisking event for the company and from there accelerate into mid and late-stage studies for a variety of indications (with batoclimab likely to be discontinued at some point).

Playing devil’s advocate, it could be tough to make inroads in indications where Vyvgart is already approved (patient switching unlikely, more about competing for those who are naive to anti-FcRn). To management’s credit, I did appreciate how the CEO was upfront in noting that some indications have more technical risk, while others have more commercial risk or competitive pressure.

For readers who are interested in the story and have done their due diligence, IMVT is a Buy and I suggest initiating a pilot position in the near term. An optimal strategy could be to wait for IMVT-1402 to get the regulatory green light for IND and make progress in phase 1 before adding more exposure.

From an ROTY perspective (focus on next 12 months), I will remain on the sidelines and wait for IMVT-1402 to enter phase 1 study. I could see myself entering the stock perhaps a quarter or two after that event, giving the drug candidate enough time to make some progress in the clinic.

As for key risks, given the aggressive development program in the works I think cash runway to 2025 is optimistic (bet we see another dilutive financing in the second half of 2023). If there is any delay in the clinic or FDA does not give timely green light to IND filing that would weigh on shares as well. High competition in the anti-FcRn space is also a cause for concern, as argenx is far in the lead and Johnson & Johnson has marketing muscle and resources that should not be underestimated (hard for a smaller company like Immunovant to compete against these titans, management really needs to carefully choose which indications & opportunities to prioritize).

I would be remiss if I did not point out that well-respected biotech investor ONeil Trader had a timely and profitable entry into this name in his service and the associated article is certainly worth checking out.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment