mi-viri

Shares of ImmunityBio (NASDAQ:IBRX) have lost nearly 90% of their value since March 9th completion of 100% stock-for-stock merger with NantKwest last year. For year-to-date 2022, shares have lost one-third of their value despite recent FDA acceptance of BLA filing for IL-15 superagonist N-803 for the lucrative indication of BCG-unresponsive non-muscle-invasive bladder cancer carcinoma in situ (CIS) with or without Ta or T1 disease.

The company certainly has its share of warts (I’m not a fan of the “Nant” companies and am undecided on ties to biotech billionaire Patrick Soon-Shiong, though I have to admit he’s done well for himself with 2010 buyout of Abraxis BioScience by Pfizer for $2.8B). The balance sheet needs to be boosted in the near term to support commercialization and ongoing research & development expenses (accumulated deficit of over $2 BILLION), but conversely I respect that Dr. Soon-Shiong has committed serious skin in the game including December’s $300M debt financing from NantCapital.

In ROTY, it’s well known to readers that I steer clear of highly binary names, and here we have significant downside cushion via lead product candidate N-803 for initial indication of bladder cancer (81,000 new cases diagnosed each year, patients experience 70% complete response rate on BCG but half or more relapse within the first year or two). I also appreciate that we have optionality via multiple other solid tumors in clinical development and advantages are clear versus other treatment options such as Keytruda (more on this below).

Consequently, I look forward to digging deeper into this highly intriguing yet speculative name to determine whether this could be an ideal setup for us into the 2023 to 2025 timeframe (establish beachhead in bladder cancer, then expand into pancreatic and other indications).

Chart

Figure 1: IBRX weekly chart (Source: Finviz)

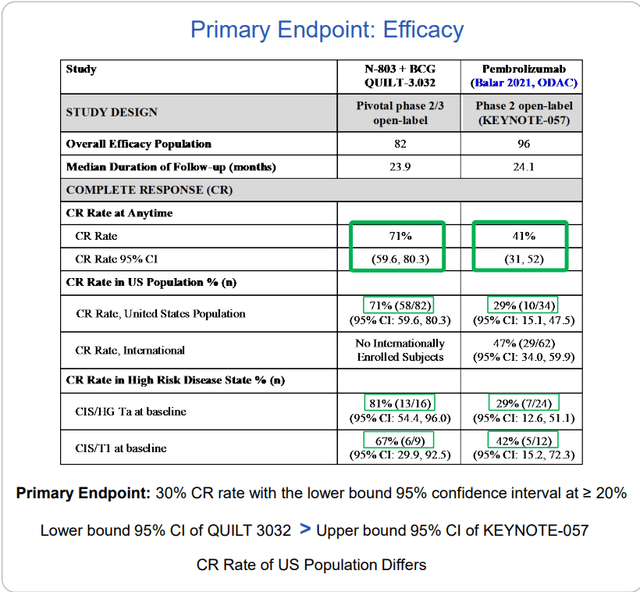

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares trade at the top end of their range after the merger took place with NantKwest last year. Shares also hit a high of $8 at the beginning of this year after positive data was released from the company’s late stage bladder cancer trial showing 71% complete response rate (well above the 41% benchmark established by Keytruda). From there, shares have drifted downward due to lack of news flow as well as the obvious financial overhang that management needs to take care of. My initial take is that readers who like this name could do well to establish a pilot position in the near term, then wait for shoring up of the balance sheet to take place before adding more exposure after the overhang is cleared.

Overview

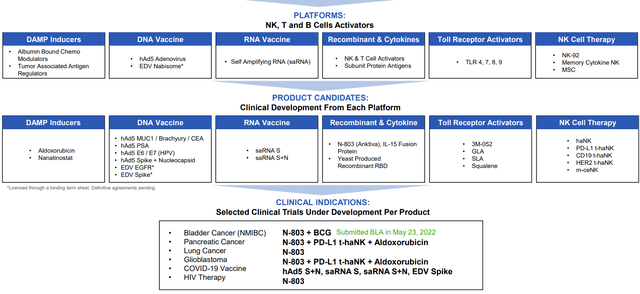

ImmunityBio can be thought of as a multi-platform company whose goal is to achieve long term, durable remissions in cancer as well as infectious disease indications. These include various activators of NK, T and B cells including various types of vaccines and cell therapies.

However, being a rather simplistic investor who appreciates a basic thesis, my reason for owning the name (and thus the focus of this article) is on their IL-15 superagonist N-803, which both proliferates and activates NK & T cells thus providing a secondary stimulus (boost) to trained innate immune memory of another agent such as BCG (the prime).

Figure 2: Pipeline (Source: corporate presentation)

N-803 binds only to beta gamma receptors in NK and T cells, with no alpha receptor binding (which causes those harsh adverse events due to T-reg stimulation and cytokine release). This high specificity is very important, and the end result shows a 4-fold increase in CD8+ T cells, 8-fold increase in NK cells and again no increase in T-regs. This is very different from the traditional IL-2 agent where the goal is to “bring everything up”.

I think of N-803 as a pipeline-in-a-product, with clinical validation taking place in other indications of high unmet need including pancreatic cancer (doubled the historical median overall survival for 3rd line) and lung cancer post progression on checkpoint inhibitor (achieved median overall survival of 14 months versus 6 months for additional comparator therapy).

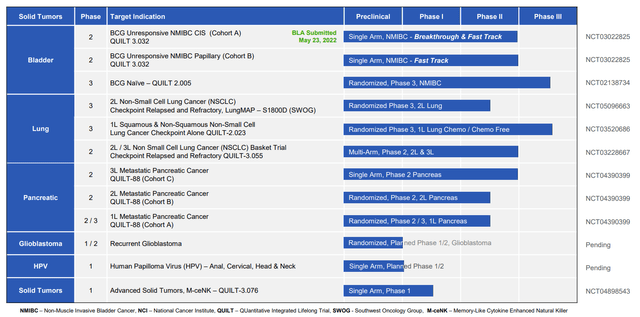

Figure 3: Select active trials in oncology (Source: corporate presentation)

Focusing on the lead indication of bladder cancer, I’d venture to call the data observed to date nothing short of phenomenal. A phase 1 trial showed 9 of 9 patients with durable complete remission (1st line, had not seen BCG). Normally, we’d expect 5 of 9 patients to respond and ultimately relapse, so this result along with the very limited toxicity (cytokine release syndrome was actually blunted) was quite promising. In essence, this is a rare case where a combo treatment adds only to efficacy and not to adverse events.

New data from ASCO this year came from the pivotal phase 2 study in BCG-unresponsive non-muscle invasive bladder cancer (NMIBC). FDA guidance suggested that a single arm trial would prove adequate for eventual approval. 58 of 82 patients had a complete response, meaning no evidence of disease with multiple biopsies.

Figure 4: Efficacy comparison versus Keytruda (Source: corporate presentation)

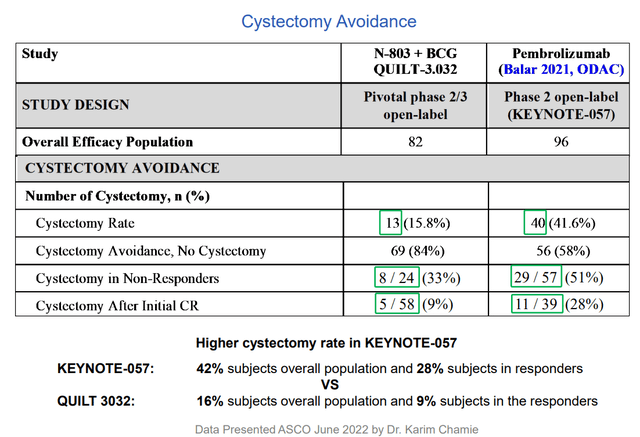

Importantly, there was durability with 26.6 months median duration of response (historically nothing else goes beyond 1.5 years in response). When patients run out of options, the alternative is to lose their bladder (surgery) resulting in a high morbidity, high mortality situation. On the trial, they were able to reduce the cystectomy rate to under 10% (over 84% of patients avoided cystectomy). Again, B-803 BCG combo showed little in the way of additive adverse effects (just the known toxicity profile of BCG, which was lessened a bit). Logic would dictate that when you add a 2nd drug, incidence of adverse events would go up, not down.

Over 1/3rd of patients currently on study continue in ongoing response, so that median duration data could get extended even further. As for benchmarks, Merck’s pembrolizumab is approved in this indication (41% CR rate) as is valrubicin (19% CR rate).

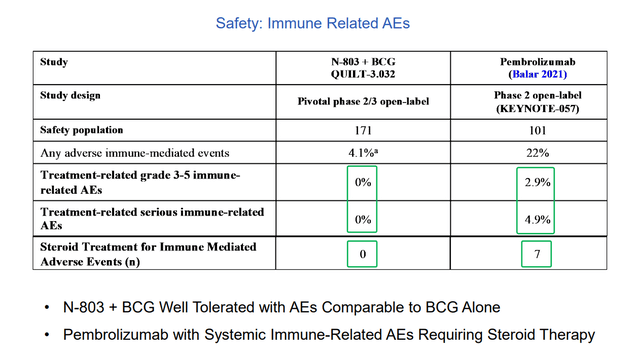

Figure 5: QUILT 3032 compared to KEYNOTE-057 in NMIBC BCG unresponsive CIS disease (Source: corporate presentation)

Additionally, study drug showed retention of CR rates in high-risk disease such as papillary and other subgroups whereas pembro lost benefit in these. From a patient point of view (more important to me personally), their primary concern from quality-of-life perspective is avoiding cystectomy. Ultimately, very few people are dying from this disease because they can be salvaged with surgery (but again, imagine the quality of your life WITHOUT a bladder). Additionally, this surgery has a 5% to 6% mortality rate associated with it, so multiply that by thousands of patients per year with disease. From the perspective of healthcare costs for the system, consider that bladder cancer is the most expensive of cancers as these patients don’t die. Going back to treatment with Keytruda, KEYNOTE-057 study showed very good safety profile except for immune-related AEs – 0.5% rate of serious immune-related toxicity or death, so imagine a fatal case of pneumonitis or colitis occurs in every 200 patients or so. This is a significant issue for doctors in terms of cost/benefit ratio (not like treating a fatal cancer such as melanoma). Treating with Keytruda or other drugs is resorting to a systemic therapy with systemic toxicity effects that could be fatal, and this is in fact a local disease that can be cured with surgical intervention or other therapy.

Figure 6: Comparison of immune-related AEs N-803 vs Keytruda (Source: corporate presentation)

From a commercialization standpoint, I think uptake will be swift here as the drug is given into the bladder (intravesical therapy administered by the urologist in their office in the same way and schedule they’ve been giving BCG for the past 50 years!). Again, very simple and literally no difference between exactly how the disease is treated presently (docs are slow to change, so this is good). PK data confirms there is no systemic absorption which explains why we are not seeing systemic toxicity.

While there is data for other indications, I’ll focus here on pancreatic cancer where expected survival is 12 weeks in 3rd line. ASCO data in 3rd line and beyond (no approved therapies here, standard of care is hospice) showed a doubling of historical overall survival for 3rd to 6th line disease. To be fair, this was an unproven combo with Nant cancer vaccine, essentially a blood transfusion, but AE profile was nice as well with just one case of mild cytokine release and no CAR tox. Currently a randomized phase 2 study in 2nd line disease is underway and being compared to standard of care.

Select Recent Developments

On May 4th of last year, the company announced launch of preclinical development of its liquid tumor pipeline with publication of results from phase 1 study of Anktiva (N-803) in combination with Rituxan in patients with indolent non-Hodgkin lymphoma (INHL) who had relapsed or were refractory after two lines of therapy. The combo was well tolerated with a single Grade 3 adverse event and no Grade 5 AEs. For patients with anti-CD20 mAb sensitive disease, overall response rate (ORR) was 78% (7 of 9). 100% of these responses were complete remissions. Importantly, prolonged stable disease and conversion of SD to response with prolonged duration without progression were observed (8 of 12 patients without progression at 18 to 24 months). For the 5 patients with anti-CD20 mAb refractory disease, ORR was 40% (2 of 5).

Moving onto lung cancer data later that same month, results were shared for chemotherapy free regimen including Anktiva in patients with multiple tumor types who failed checkpoint inhibitor therapy (an area of high unmet need). 140 patients were accrued across lung cancer, melanoma, urothelial, head & neck, gastric and cervical cancer. 68% of evaluable patients demonstrated durable disease control following Anktiva CPI (checkpoint inhibitor) therapy. Adverse event rates of this chemo-free combo were better than historical standard of care alternative of chemo combination. On the con side, it seems that actual RECIST responses were observed only “occasionally”.

In June the FDA gave the ok to initiate a phase 1/2 study evaluating Anktiva and PD-L1 t-haNK combo with antibody-drug conjugate Trodelvy and low-dose chemotherapy in patients with advanced triple-negative breast cancer (TNBC) after prior therapy. I would think Gilead (GILD) would be interested here if the results were good, considering the $21 billion they wasted on the Immunomedics buyout and desire to have something to show for their business development efforts. As for historical bar to surpass, FDA approved Trodelvy for TNBC in 2020 with ORR of 33%, median duration of response of 7.7 months and only 16% of patients maintaining response for 12 or more months. Precedent has been set here with phase 1 data from haNK cells combined with Anktiva and low dose chemo in refractory TNBC (achieved disease control rate of 78% and overall response rate of 67%). Much like the bladder cancer combo, I’m a big fan of these types of studies where companies are not trying to supplant standard of care (a VERY difficult task) but instead looking to add to it (much more feasible especially from a commercial standpoint).

On August 16th, the company announced appointment of Patrick Soon-Shiong, M.D., to the newly created role of Global Chief Scientific and Medical Officer. This was somewhat expected, given that he is the founder of the company and has prior success in entrepreneurial efforts particularly in the oncology arena (Abraxane comes to mind). Playing devil’s advocate, be sure to read this STAT report on him (and the lawsuit that followed). As I recall he also used his fortune to buy the LA Times (billionaires do seem to have a penchant for gaining control of media outlets).

In September, the company took an important step in showing confidence in ultimately obtaining FDA approval by building out its commercial team. Helen Luu is serving as the company’s first Chief Commercial Officer (focusing on beachhead indications of bladder and lung cancer). The company also named Sigrid Schreiner as SVP of Global Market Access (joining from Stemline Therapeutics, a former ROTY holding that was bought out in 2020 by Menarini Group). Interestingly enough, Schreiner also helped with the market launch of Abraxane (would seem this was a Soon Shiong move to bring the team back together, so to speak).

Moving on to December, ImmunityBio gained access to much needed cash via $300M in new debt financing from NantCapital (Soon-Shiong putting more skin in the game). Personally, I prefer pure secondary offerings (equity) as opposed to debt for small cap biotech companies, as the leverage can put them in a precarious situation especially when overcoming the hurdle of launching a new drug (and the cash burn that entails). The PR reminds us that the company has a lot going on under the hood aside from just the lead bladder cancer indication, with 21 active studies of which 13 are in phase 2 or phase 3. Third cohort of the pancreatic cancer study is fully enrolled with 90% of evaluable patients exceeding historical survival rates of 2 months on standard of care chemo. Based on strength of data, the company submitted amendment to FDA to increase enrollment rate (I imagine they could pursue accelerated approval IF data is sufficiently promising). Manufacturing is an often overlooked part of the puzzle and the company as achieved 200-liter scale (single campaign yields 700 billion PD-L1 t-haNK cells, enough for 350 doses). They are advancing to 500-liter capacity in 2022 (could be a competitive advantage if and when they make it to market). Clinical studies in TNBC, pancreatic and H&N cancer utilizing PD-L1 T-haNK continue to make progress. As for Anktiva in lung cancer, the ongoing study is looking to enroll up to 478 second-line patients to be treated with pembrolizumab combo. I’ve skipped over efforts in CD19, COVID-19 and other redundant areas where I doubt the company can make a dent given heavy competition from better funded peers (hope they focus cash resources on optimal opportunities).

On January 18th, the company provided an update on the pancreatic cancer trial, highlighting doubling of median overall survival versus historical OS in patients who had progressed after two lines of therapy (n=30). Interestingly, when patients with even more advanced disease who failed four to six prior lines of therapy are added, the median OS even with such advanced disease (N=63) was 5.8 months. It’ll be important to see how FDA meeting goes to get this therapy expedited to patients (in general pancreatic cancer has been a graveyard for drug development).

Flash forward to April 25th, the company made important progress in NSCLC study with initial patients enrolled. As for market opportunity, consider that in the US nearly 237,000 new cases of lung cancer are diagnosed each year and majority of these patients do not have druggable mutations. When fully enrolled the study will utilize nearly 200 clinical sites and involve up to 478 patients. Rationale behind the Keytruda Anktiva combination is that the latter activates and proliferates NK and memory T cells, while combo with CPI takes the brakes off T cells to result in improved durability.

Lastly, on July 28th, the FDA accepted the company’s BLA filing for lead indication of bladder cancer. Given signs that the FDA is becoming more efficient of late, especially with real time data monitoring in some cases, I would not be surprised if this important combination is approved ahead of schedule (current target action date is May 23 of 2023).

Other Information

For the first quarter of 2022, the company reported cash and equivalents of just ~$190M as compared to operating expenses of $95M. These consisted of research and development expenses totaling $55M (+34% versus same quarter last year) and SG&A of $40M. Additionally, keep in mind the company roughly $300M of promissory notes (liabilities). Thus, a considerable amount of dilution will be necessary, barring other events, to keep the company going until lead indication can generate sufficient cash flow to fund pipeline development. Typically, I prefer companies with 2+ years of operational runway and this one clearly does not fit the bill here.

As for competition in IL-15, this remark from management at Xencor (XNCR) is tangential but nonetheless I found it helpful:

They note that BLA was accepted by the FDA for the bladder cancer program BUT it’s not a systemic therapy (is given in combination with BCG through cystocopy into the bladder). Xencor’s asset XmAb306 is systemic, so they are not direct competition and it’s not apples to apples. 3606 was engineered with dramatically reduced affinity to the signaling receptors and reduced potency to smooth out that activity time curve. So, likewise here we don’t have the big spikes in activity early on that can drive toxicity challenges. Genentech continues to enroll combo study with PD-L1 inhibitor atezolizumab and they are starting the daratumumab combo in myeloma.

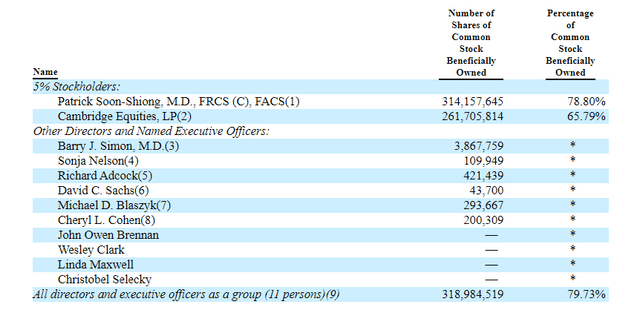

As for key holders of note, it was noted by ShovelStocks on Twitter that Dr. Soon-Shiong owns 80% of the company (and looks committed to help fund future development, at least in some capacity as observed with his involvement in January’s loan).

Figure 7: Beneficial ownership table (Source: proxy filing)

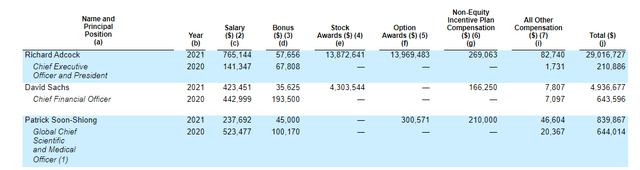

As for executive compensation, it certainly appears in line for a company of this size including the cash component. The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

Figure 8: Executive Compensation Table (Source: proxy filing)

As for useful nuggets of information from the ROTY community, member Prescient.Sage points out that short interest is high at over 22% (perhaps related to balance sheet issues). He also notes that over $450M in debt for a young company is a red flag as is the high outstanding share count (400M). On the other hand, 75%+ insider ownership could be considered a net positive (skin in the game), though it does mean concentrated control.

Key opinion leader video on B-803 data and its relevance was also quite helpful, noting that this particular combination treatment checks the right boxes in terms of tolerability and efficacy.

As for IP, ImmunityBio and its scientists published over twenty scientific papers on the immunotherapy portfolio in 2021 alone and were granted over 750 patents for pipeline technologies. As for IP for bladder cancer indication, patents covering intravesical administration of BCG and Anktiva have already been issued providing term coverage until 2035.

Final Thoughts

To conclude, my feelings are mixed on this one as I appreciate the significance of Anktiva’s pivotal data in bladder cancer where they are seeking to add to standard of care instead of supplanting it (getting the best of both worlds in terms of efficacy and tolerability). Such a treatment, administered in the same manner as BCG (intravesical), would likely see swift uptake as it does not require much in the way of change for doctors. On the other hand, in the past, I’ve learned the hard way that science and solid data alone may not be enough to create value for shareholders, and that is why we all are here. It also takes vision and execution on the part of leadership, and while Soon-Shiong’s previous success at Abraxis is laudable, I need to see the balance sheet shored up and debt load addressed before I can get more comfortable here.

For readers who are interested in the story and have done their due diligence, ImmunityBio is a Speculative Buy (only appropriate for investors with high risk tolerance).

One potential plan for entry would be to establish an initial pilot position, then add incrementally as/if each hurdle is overcome (regulatory approval, funding accessed, positive launch metrics, etc.).

From an ROTY perspective (focus on next 12 months), I am not able to own the stock until balance sheet and funding issues are addressed (particularly the debt load, of which I’m not a fan of small cap companies possessing particularly in the early innings of product launch).

Risks here include dilution in the near term (perhaps secondary offering) and please note that the 10-Q filing states the following:

we believe that substantial doubt exists regarding our ability to continue as a going concern without additional funding or financial support. However, we believe our existing cash, cash equivalents, and investments in marketable securities, together with capital to be raised through equity offerings

There’s also the risk that the company takes on too much for its relatively small resources, spreading itself too thin including working on redundant programs where competition from big pharmaceutical companies is high including in CD19, COVID-19 and HIV. Regulatory risk (FDA not approving Anktiva) and disappointing data for additional indications (i.e. pancreatic and lung cancer) are also risk factors that should be considered.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. Lastly, be aware that most of my articles appear first to members of the ROTY community.

Be the first to comment